Oregon Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

US Legal Forms - one of several greatest libraries of authorized forms in America - delivers a wide array of authorized papers web templates you may acquire or produce. Using the internet site, you may get 1000s of forms for business and individual functions, sorted by categories, states, or keywords and phrases.You will find the most up-to-date versions of forms just like the Oregon Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files within minutes.

If you already have a registration, log in and acquire Oregon Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files from the US Legal Forms collection. The Acquire switch can look on every single develop you see. You gain access to all earlier saved forms within the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed here are easy recommendations to help you started:

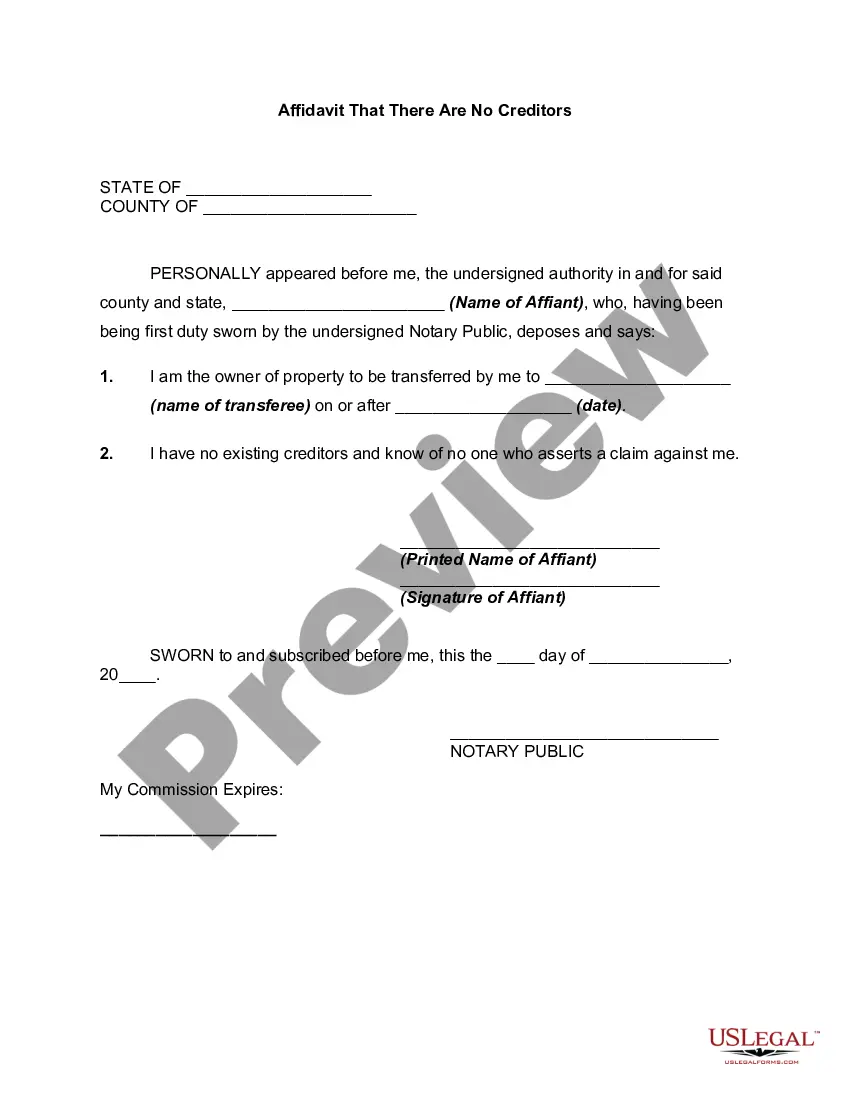

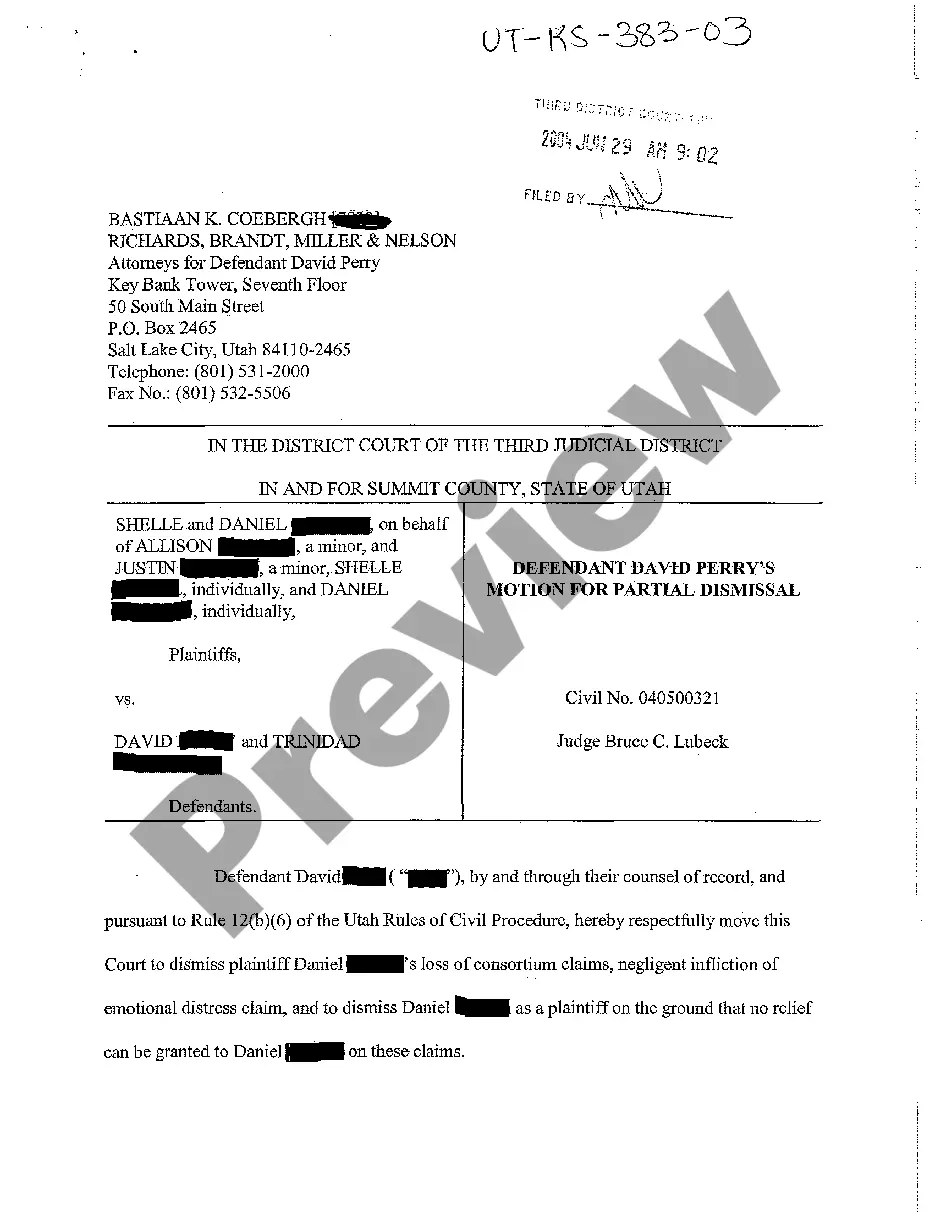

- Make sure you have selected the proper develop for your metropolis/region. Click the Review switch to check the form`s articles. Look at the develop description to ensure that you have chosen the right develop.

- In the event the develop doesn`t satisfy your specifications, use the Look for discipline towards the top of the display screen to get the the one that does.

- Should you be satisfied with the shape, validate your selection by simply clicking the Get now switch. Then, opt for the rates strategy you want and offer your qualifications to sign up for the bank account.

- Approach the purchase. Make use of credit card or PayPal bank account to complete the purchase.

- Pick the format and acquire the shape on the device.

- Make adjustments. Fill up, revise and produce and indicator the saved Oregon Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files.

Each and every template you put into your bank account does not have an expiration day and is your own permanently. So, if you would like acquire or produce one more version, just proceed to the My Forms section and click about the develop you require.

Gain access to the Oregon Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files with US Legal Forms, probably the most considerable collection of authorized papers web templates. Use 1000s of specialist and express-particular web templates that satisfy your business or individual requires and specifications.

Form popularity

FAQ

?UCC? stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

Article 9 of the Uniform Commercial Code (UCC) provides various methods for a secured creditor to repossess collateral after default. The method for obtaining possession depends on the nature of the collateral and, to some extent, how the security interest was perfected.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

There are two basic ways to perform a search with the Oregon UCC office. You can conduct an uncertified search yourself through our site or request our office to perform a certified search for you for a fee.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.

A creditor with a UCC lien against your assets could immediately come after things like: Cash from your bank account. Your vehicle or other personal property. Any other assets mentioned in the UCC-1.

First, the debtor must send an authenticated demand to the secured party. The demand should be sent to the name/address of the secured party as indicated on the financing statement. The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file.

In general, a UCC filing is not bad for your business ? it simply serves as an official notice to other creditors that your lender has a security interest in one or all of your assets. However, UCC filings can impact your business credit, risk your company's assets and/or hinder your ability to get future financing.