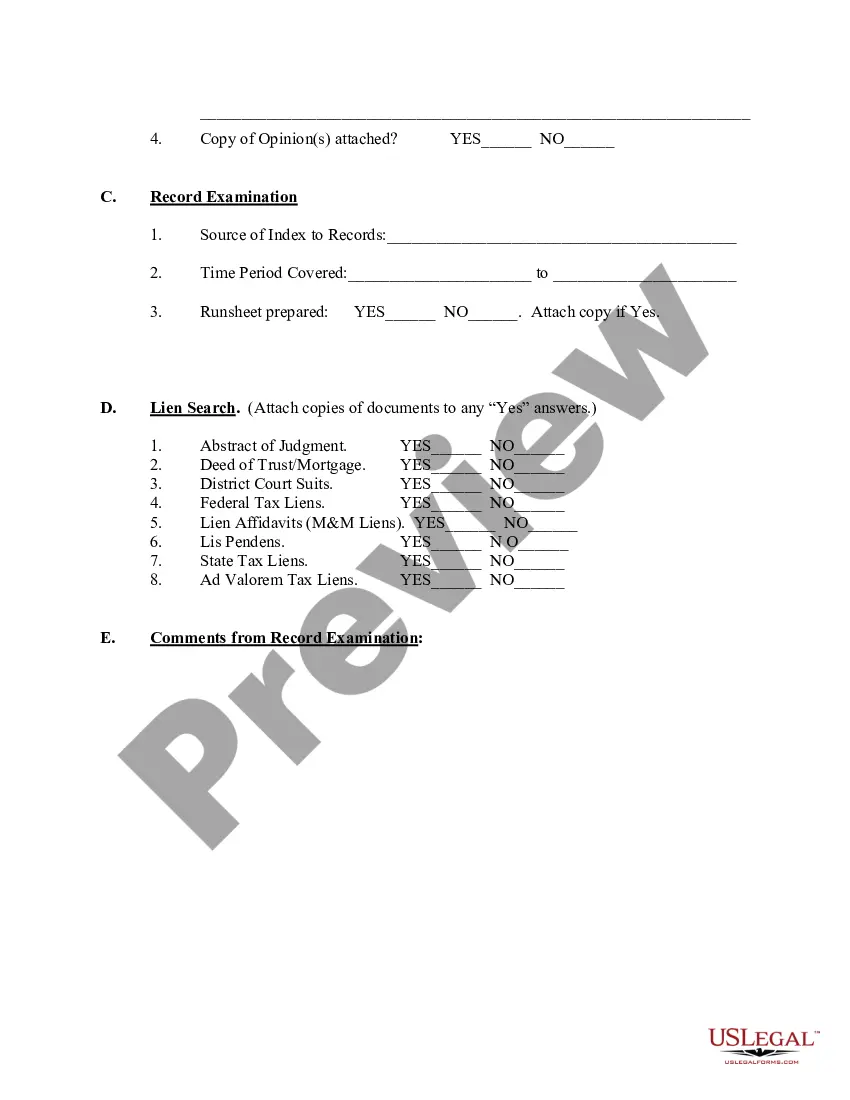

Oregon Due Diligence Field Review and Checklist is a comprehensive process to evaluate the legal, financial, and operational aspects of a property or business before finalizing a transaction. This diligent approach helps potential buyers and investors in Oregon to make informed decisions by thoroughly examining the property or entity in question. The Due Diligence Field Review is conducted by experts who assess every crucial aspect through on-site inspections, document analysis, and interviews with relevant stakeholders. This meticulous evaluation ensures that all potential risks and opportunities associated with the property or business are identified, enabling investors to negotiate better terms or avoid unfavorable circumstances. The Oregon Due Diligence Field Review and Checklist cover various essential considerations that vary depending on the nature of the investment. Some common types of Due Diligence Field Reviews and Checklists in Oregon include: 1. Real Estate Due Diligence: This evaluation focuses on real estate properties, analyzing factors such as property condition, zoning compliance, environmental issues, title searches, and lease agreements (if applicable). 2. Business Due Diligence: This type of review is performed when investing in an existing business in Oregon. It involves examining financial statements, employee contracts, tax records, customer contracts, intellectual property rights, and other critical factors affecting the business's value. 3. Legal Due Diligence: This evaluation concentrates on legal matters associated with a property or business. It involves reviewing contracts, permits, licenses, litigation history, and compliance with local, state, and federal regulations. 4. Financial Due Diligence: This due diligence focuses on analyzing the financial aspects, including cash flow statements, balance sheets, income statements, tax liabilities, debt obligations, and financial projections. It ensures that all financial information is accurate and reliable. 5. Environmental Due Diligence: This evaluation is crucial, especially when dealing with potentially contaminated properties. Experts assess environmental risks, hazardous substances, previous site uses, and compliance with environmental regulations to ascertain any potential liabilities or remediation requirements. 6. Compliance Due Diligence: In certain cases, it is necessary to evaluate the compliance of a property or business with industry-specific regulations, such as healthcare, education, or energy. This type of assessment ensures that all legal requirements and industry standards are met. In conclusion, the Oregon Due Diligence Field Review and Checklist process are vital for investors and buyers to assess the risks, opportunities, and legal compliance associated with a property or business. By incorporating these various types of due diligence, individuals can make informed decisions, negotiate effectively, and safeguard their investments in Oregon.

Oregon Due Diligence Field Review and Checklist

Description

How to fill out Oregon Due Diligence Field Review And Checklist?

Are you presently inside a situation where you need to have paperwork for either organization or individual purposes virtually every day time? There are plenty of lawful record themes available online, but finding types you can trust is not simple. US Legal Forms delivers a large number of type themes, like the Oregon Due Diligence Field Review and Checklist, that are written to fulfill state and federal requirements.

When you are presently informed about US Legal Forms internet site and get your account, merely log in. Following that, you may down load the Oregon Due Diligence Field Review and Checklist web template.

Should you not come with an accounts and wish to begin using US Legal Forms, abide by these steps:

- Obtain the type you will need and make sure it is for that appropriate city/county.

- Make use of the Review option to check the form.

- See the explanation to actually have chosen the correct type.

- In case the type is not what you are looking for, utilize the Research area to obtain the type that meets your needs and requirements.

- Whenever you obtain the appropriate type, click on Purchase now.

- Opt for the prices prepare you would like, complete the desired info to create your bank account, and pay for your order using your PayPal or bank card.

- Pick a handy document format and down load your copy.

Find every one of the record themes you may have purchased in the My Forms food list. You can aquire a further copy of Oregon Due Diligence Field Review and Checklist any time, if required. Just click the required type to down load or print out the record web template.

Use US Legal Forms, one of the most comprehensive collection of lawful varieties, to conserve efforts and stay away from mistakes. The support delivers expertly created lawful record themes that can be used for an array of purposes. Produce your account on US Legal Forms and initiate producing your life easier.