Oregon Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest

Description

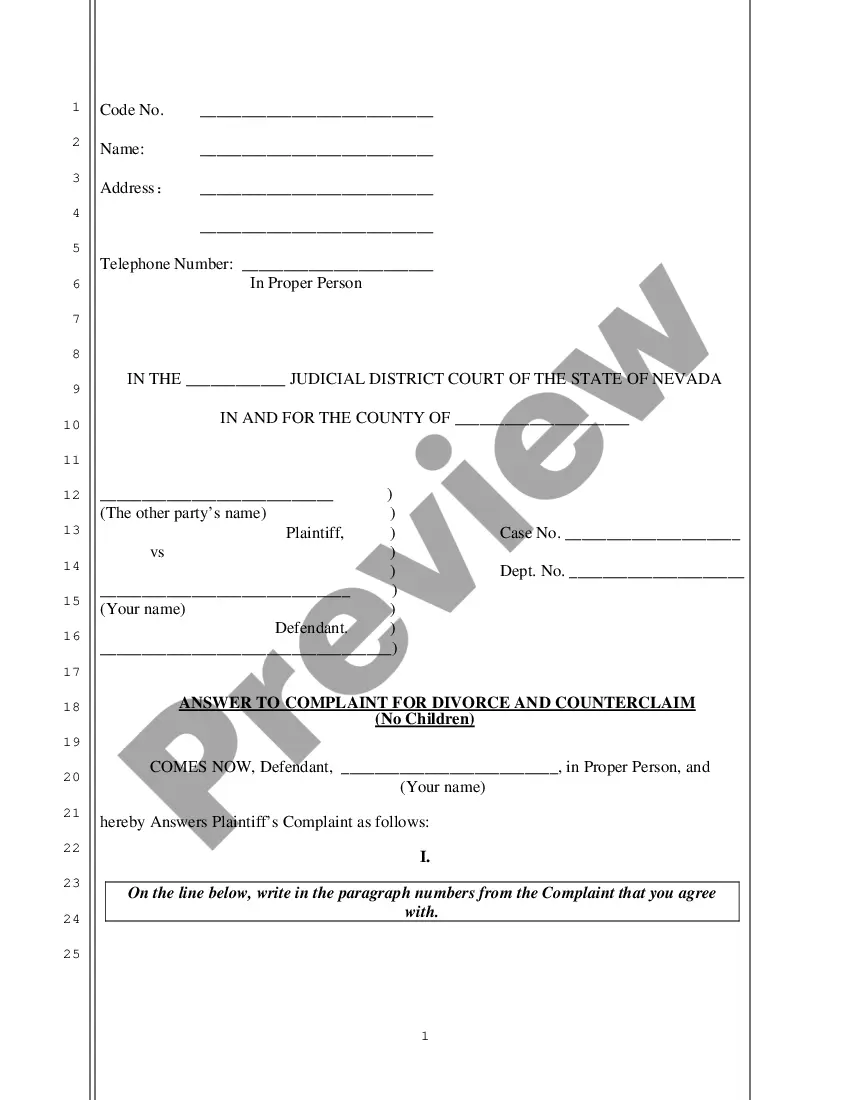

How to fill out Partial Release Of Mortgage / Deed Of Trust On Undivided Leasehold Interest?

Choosing the best legal record template can be a struggle. Naturally, there are plenty of layouts available on the net, but how do you find the legal kind you need? Utilize the US Legal Forms website. The assistance gives thousands of layouts, like the Oregon Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest, which you can use for company and personal demands. Every one of the types are checked by pros and meet up with state and federal requirements.

When you are presently registered, log in to the accounts and click on the Acquire key to get the Oregon Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest. Utilize your accounts to look through the legal types you have acquired previously. Visit the My Forms tab of your accounts and obtain an additional duplicate in the record you need.

When you are a whole new customer of US Legal Forms, listed below are simple recommendations so that you can comply with:

- Very first, make sure you have selected the correct kind to your area/county. You can check out the form making use of the Review key and study the form information to guarantee it will be the best for you.

- When the kind does not meet up with your needs, utilize the Seach area to find the correct kind.

- When you are positive that the form would work, go through the Acquire now key to get the kind.

- Pick the prices plan you need and enter in the necessary information. Build your accounts and pay for the order making use of your PayPal accounts or bank card.

- Opt for the file formatting and down load the legal record template to the product.

- Comprehensive, modify and printing and signal the attained Oregon Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest.

US Legal Forms is definitely the largest catalogue of legal types that you can see different record layouts. Utilize the company to down load appropriately-made files that comply with express requirements.

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

A mortgage involves two parties, while a deed of trust has three, and. mortgages are usually foreclosed judicially, while deeds of trust typically go through a nonjudicial foreclosure process (but not always).

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Can a Promissory Note Be Used Without a Mortgage? Promissory notes are often used for unsecured loans. An unsecured loan isn't backed by collateral, such as real estate. For example, you might use a promissory note if you make an unsecured personal loan to a friend or family member.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.