Oregon Certificate of Foreign Limited Partnership

Description

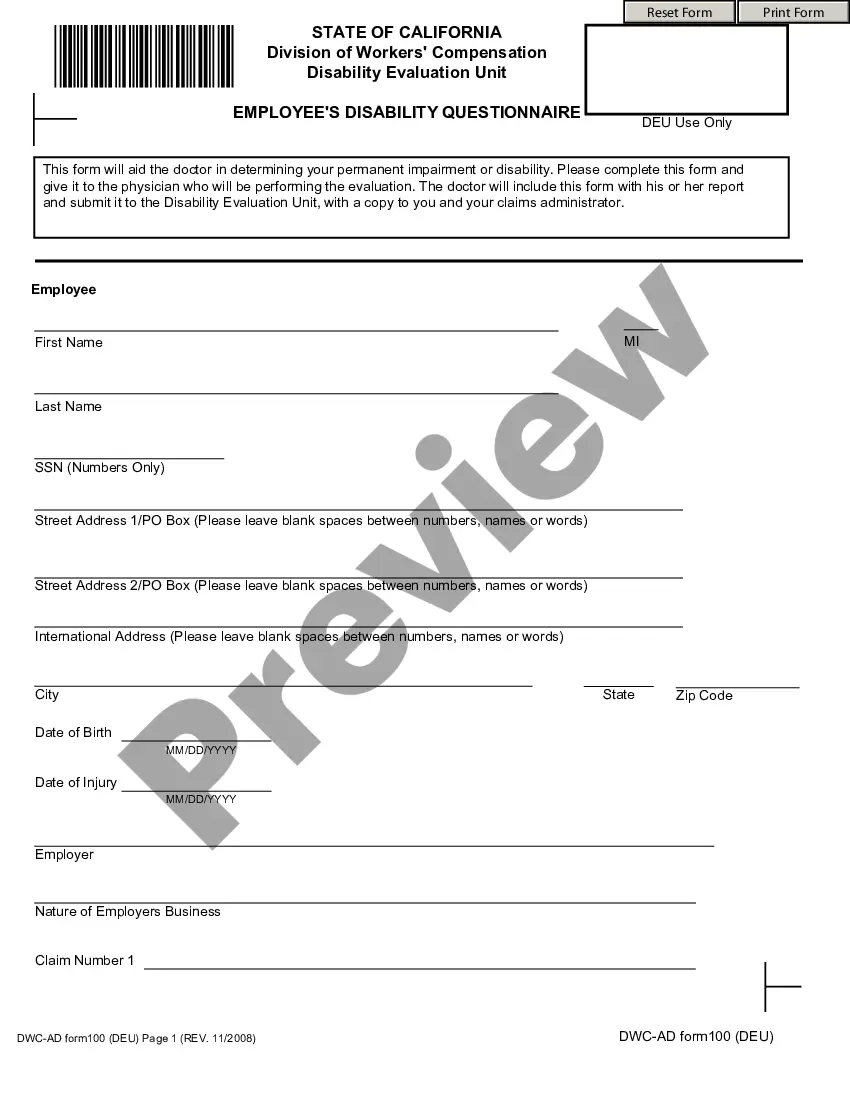

How to fill out Certificate Of Foreign Limited Partnership?

Discovering the right legal file format could be a have a problem. Obviously, there are a variety of themes available on the Internet, but how do you get the legal develop you will need? Take advantage of the US Legal Forms website. The support offers a huge number of themes, like the Oregon Certificate of Foreign Limited Partnership, which can be used for organization and personal needs. All the kinds are checked by professionals and meet up with state and federal requirements.

Should you be already registered, log in to the accounts and click the Download switch to get the Oregon Certificate of Foreign Limited Partnership. Use your accounts to check with the legal kinds you might have ordered in the past. Check out the My Forms tab of your own accounts and acquire one more backup in the file you will need.

Should you be a whole new consumer of US Legal Forms, listed here are straightforward directions for you to stick to:

- Initial, be sure you have chosen the appropriate develop for the area/region. You may look over the form while using Review switch and study the form outline to guarantee this is basically the best for you.

- When the develop fails to meet up with your requirements, utilize the Seach area to get the appropriate develop.

- When you are positive that the form is acceptable, go through the Buy now switch to get the develop.

- Pick the prices strategy you would like and enter the necessary information and facts. Make your accounts and pay for the order making use of your PayPal accounts or bank card.

- Opt for the file formatting and obtain the legal file format to the product.

- Complete, modify and produce and indicator the received Oregon Certificate of Foreign Limited Partnership.

US Legal Forms is definitely the greatest catalogue of legal kinds where you can see numerous file themes. Take advantage of the service to obtain professionally-created papers that stick to express requirements.

Form popularity

FAQ

How Long Does It Take to Form an LLC in Oregon? If you choose to file your articles of organization online using Oregon's online platform, your LLC will be registered in as little as one business day. If you want to mail in a paper form, the projected processing time is about three to four weeks.

To request registration of an Oregon Foreign LLC, you must complete an Application for Authority to Transact Business and pay a processing fee of $275. The state may have additional requirements so contact the Oregon Secretary of State Corporation Division for more information.

To register a foreign corporation in Oregon, you must file an Oregon Application for Authority with the Oregon Secretary of State, Corporation Division. You can submit this document by mail, by fax, or in person. The Application for Authority for a foreign Oregon corporation costs $275 to file.

How much does it cost to file the Application for Authority for foreign LLCs in Oregon? Oregon charges $275 to file the application. You can pay online with a credit or debit card, or by mail with a check.

Oregon LLC Formation Filing Fee: $100 It'll cost you $100 to officially register your Oregon LLC with the state by filing your Oregon Articles of Organization. You can submit your articles by mail, by fax, or online through the Secretary of State's Secure Access System.

A limited liability company or ?LLC? is also a statutory entity. It is similar to a corporation in that it provides limited liability protection for its owners, but it is taxed either as a partnership, sole proprietorship or as an entity, like a corporation, depending upon how it is organized.

A registered agent can be an individual or a legal entity. Limited liability companies organized under Oregon statute are "domestic" limited liability companies. Those formed under the laws of other states, but transacting business in Oregon, are "foreign" limited liability companies.

How to register your non-Oregon business with the State of Oregon Select a business name. ... Fill out an application. ... Pay the filing fee of $275 to the Oregon Secretary of State. Submit your Application for Authority to Transact Business. Wait.