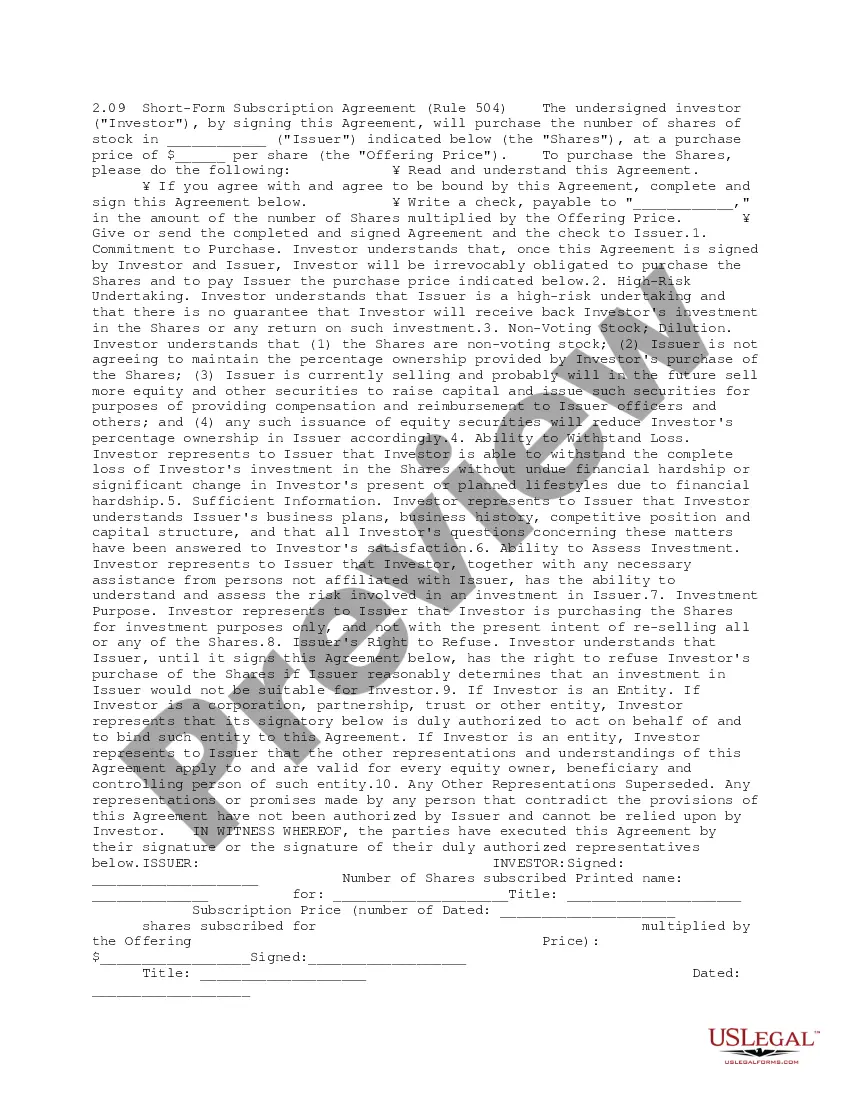

This is a Short-Form Subscription agreement. The investor agrees to buy a certain number of shares at a specified price from the issuer. The completed form is accompanied by a check to facilitate the purchase of the shares of stock.

The Oregon Short-Form Subscription Agreement is a legal document used in the state of Oregon to formalize the process of offering and selling securities to investors in a private placement. This agreement is commonly used by companies looking to raise capital for various purposes, such as expansion, research and development, or product development. The purpose of the Oregon Short-Form Subscription Agreement is to establish the terms and conditions under which an investor can purchase securities issued by the company. It outlines the rights and obligations of both the company and the investor, providing a clear framework for their relationship. Some key elements typically included in the Oregon Short-Form Subscription Agreement are: 1. Identification of the parties: This section provides the legal names and addresses of the company issuing the securities and the investor purchasing them. 2. Subscription details: It specifies the type and class of securities being offered, including common stock, preferred stock, or debt securities. The agreement also outlines the number of shares or units being purchased, along with the purchase price per share or unit. 3. Representations and warranties: The company and the investor make certain representations and warranties to each other, ensuring that the information provided is accurate and complete. These may include the company's authority to issue the securities and the investor's eligibility to purchase them. 4. Risk factors: This section discloses any potential risks associated with the investment, informing the investor about the uncertainties and challenges the company may face in its operations. 5. Transfer restrictions: The agreement may include provisions that restrict the transfer or resale of the securities, ensuring compliance with relevant securities laws. 6. Governing law and dispute resolution: It specifies that the agreement is governed by the laws of the state of Oregon and outlines the procedures for resolving any disputes that may arise between the parties. Different types of Oregon Short-Form Subscription Agreements may vary based on the specific terms and conditions offered by the company. For example, there may be variations in the type of securities being offered (e.g., preferred stock versus common stock) or the rights and privileges associated with those securities. Overall, the Oregon Short-Form Subscription Agreement serves as a vital legal document that protects both the company and the investor by establishing clear guidelines for their relationship while facilitating the process of raising capital. It offers transparency and clarity, reducing the potential for misunderstandings or disputes down the line.