This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Oregon Employee Stock Option Agreement

Description

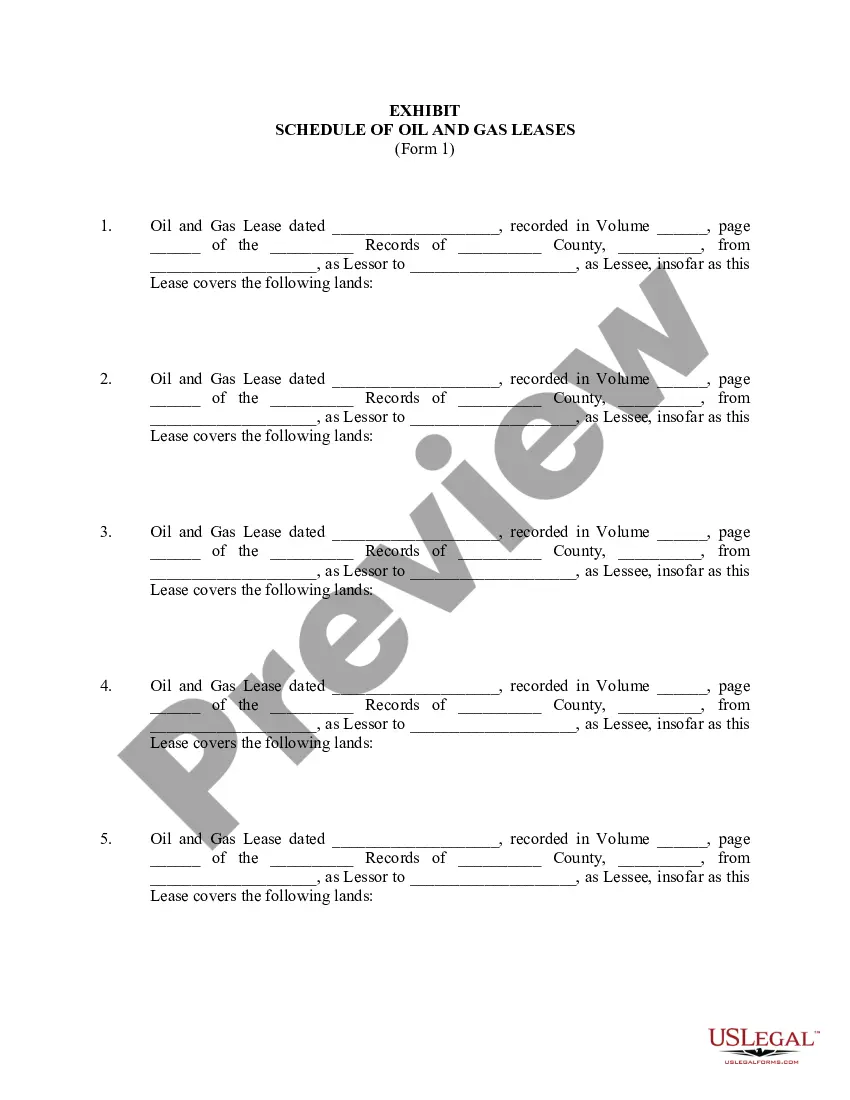

How to fill out Employee Stock Option Agreement?

If you have to total, down load, or produce authorized record web templates, use US Legal Forms, the biggest collection of authorized varieties, which can be found on the Internet. Use the site`s simple and handy lookup to get the files you need. Different web templates for enterprise and person reasons are categorized by classes and states, or key phrases. Use US Legal Forms to get the Oregon Employee Stock Option Agreement in a handful of clicks.

Should you be currently a US Legal Forms client, log in for your profile and click on the Down load key to obtain the Oregon Employee Stock Option Agreement. You can even access varieties you formerly acquired within the My Forms tab of your own profile.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate city/country.

- Step 2. Take advantage of the Preview method to look over the form`s content. Do not neglect to learn the outline.

- Step 3. Should you be not satisfied with the type, take advantage of the Research area towards the top of the monitor to get other types of your authorized type template.

- Step 4. Upon having found the shape you need, click on the Acquire now key. Select the costs strategy you prefer and add your accreditations to register for an profile.

- Step 5. Procedure the purchase. You should use your charge card or PayPal profile to finish the purchase.

- Step 6. Find the structure of your authorized type and down load it on your product.

- Step 7. Full, edit and produce or indicator the Oregon Employee Stock Option Agreement.

Each and every authorized record template you buy is yours eternally. You have acces to every single type you acquired inside your acccount. Click the My Forms segment and select a type to produce or down load yet again.

Remain competitive and down load, and produce the Oregon Employee Stock Option Agreement with US Legal Forms. There are many professional and express-certain varieties you may use for your personal enterprise or person requirements.

Form popularity

FAQ

Stock options are only for people While it's usually fine to grant stock options to an individual consultant under the option plan, grants generally can't be made to an entity. If you want to grant options to non-individuals, consult your attorney.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

A transfer of employee stock options out of the employee's estate (i.e., to a family member or to a family trust) offers two main estate planning benefits: first, the employee is able to remove a potentially high growth asset from his or her estate; second, a lifetime transfer may also save estate taxes by removing ...

You can offer two kinds of stock options to employees: incentive stock options (ISOs) and non-qualified stock options (NSOs). The largest difference between these two categories of stock options is their tax qualification and eligibility requirements.

Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Companies often offer stock options as part of your compensation package so you can share in the company's success.

If you are an employee of a private company, part of your compensation may be paid in stock, restricted stock units, stock options, or other company securities.

As far back as 1955, California courts considered with how to deal with incentive compensation, such as employee stock awards. Since then, courts consistently hold that agreements to provide stock options, restricted stock units (RSUs), or other ownership rights count as wages under the California Labor Code.

The term employee stock option (ESO) refers to a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead.