Oregon Last Will and Testament with All Property to Trust called a Pour Over Will

Description Last Will And Testament Form Oregon

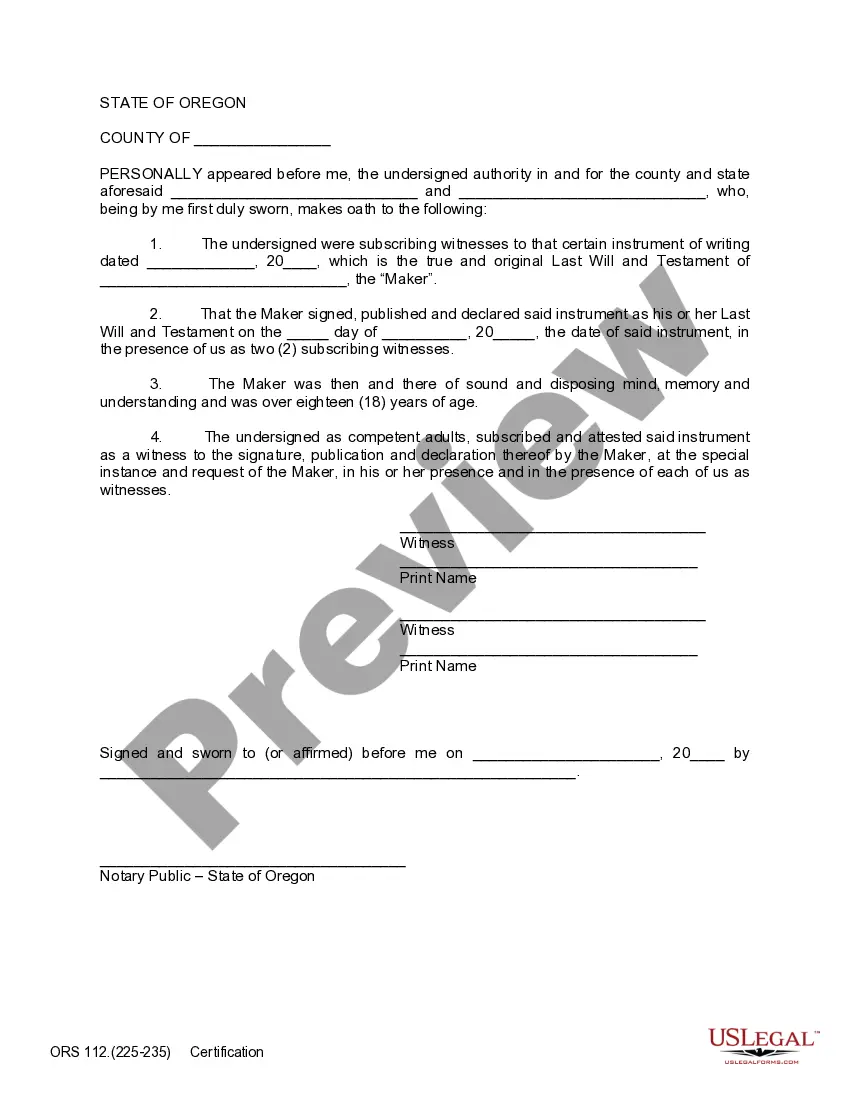

How to fill out Oregon Last Will And Testament With All Property To Trust Called A Pour Over Will?

Creating papers isn't the most uncomplicated process, especially for those who rarely deal with legal paperwork. That's why we advise utilizing correct Oregon Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will templates created by professional attorneys. It allows you to eliminate troubles when in court or working with official institutions. Find the files you want on our website for top-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the template web page. After downloading the sample, it’ll be stored in the My Forms menu.

Customers without a subscription can easily get an account. Use this simple step-by-step guide to get the Oregon Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will:

- Be sure that the sample you found is eligible for use in the state it is required in.

- Confirm the file. Make use of the Preview option or read its description (if available).

- Buy Now if this sample is the thing you need or return to the Search field to find another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these easy steps, you can fill out the form in an appropriate editor. Check the completed data and consider requesting a legal professional to review your Oregon Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Pourover Will Form popularity

Last Will And Testament Vs Living Trust Other Form Names

FAQ

Combining a Will and Trust Together: Should You Use Both? The use of a living trust and a will together as part of your estate planning is acceptable under California law. The benefit of this approach is that you can address separate issues on each document.

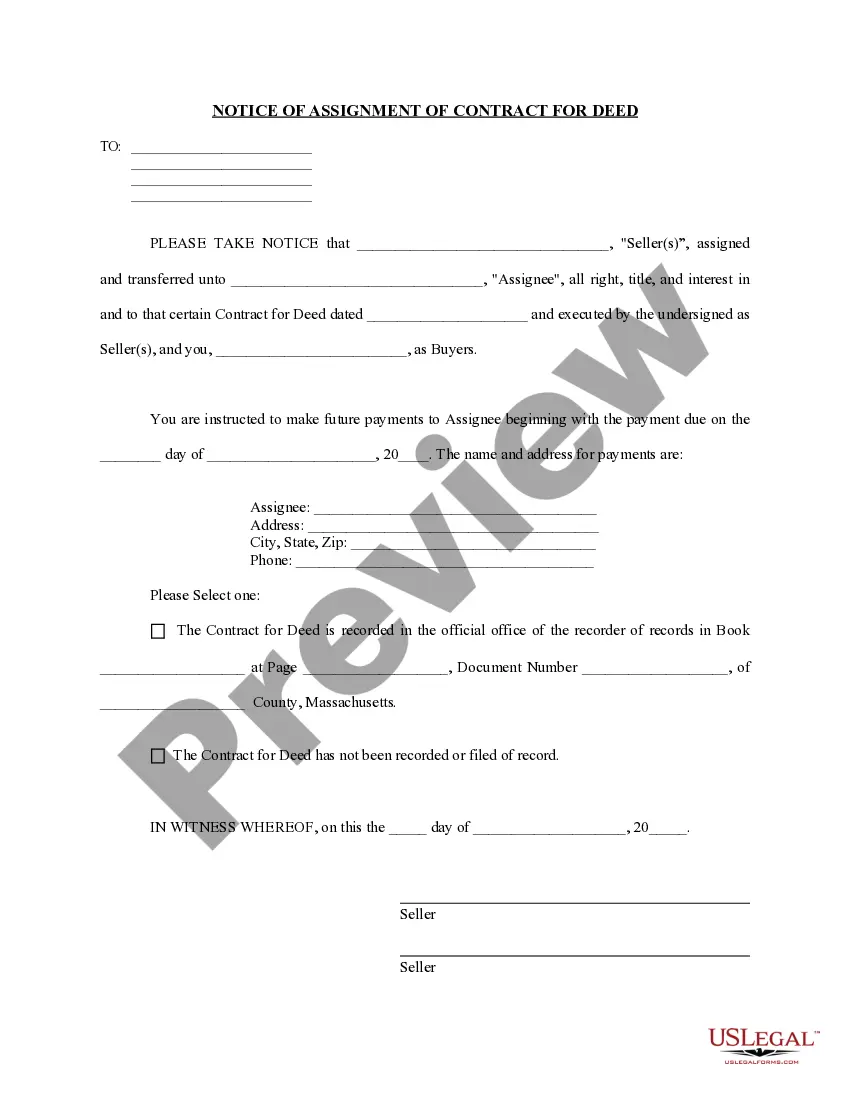

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

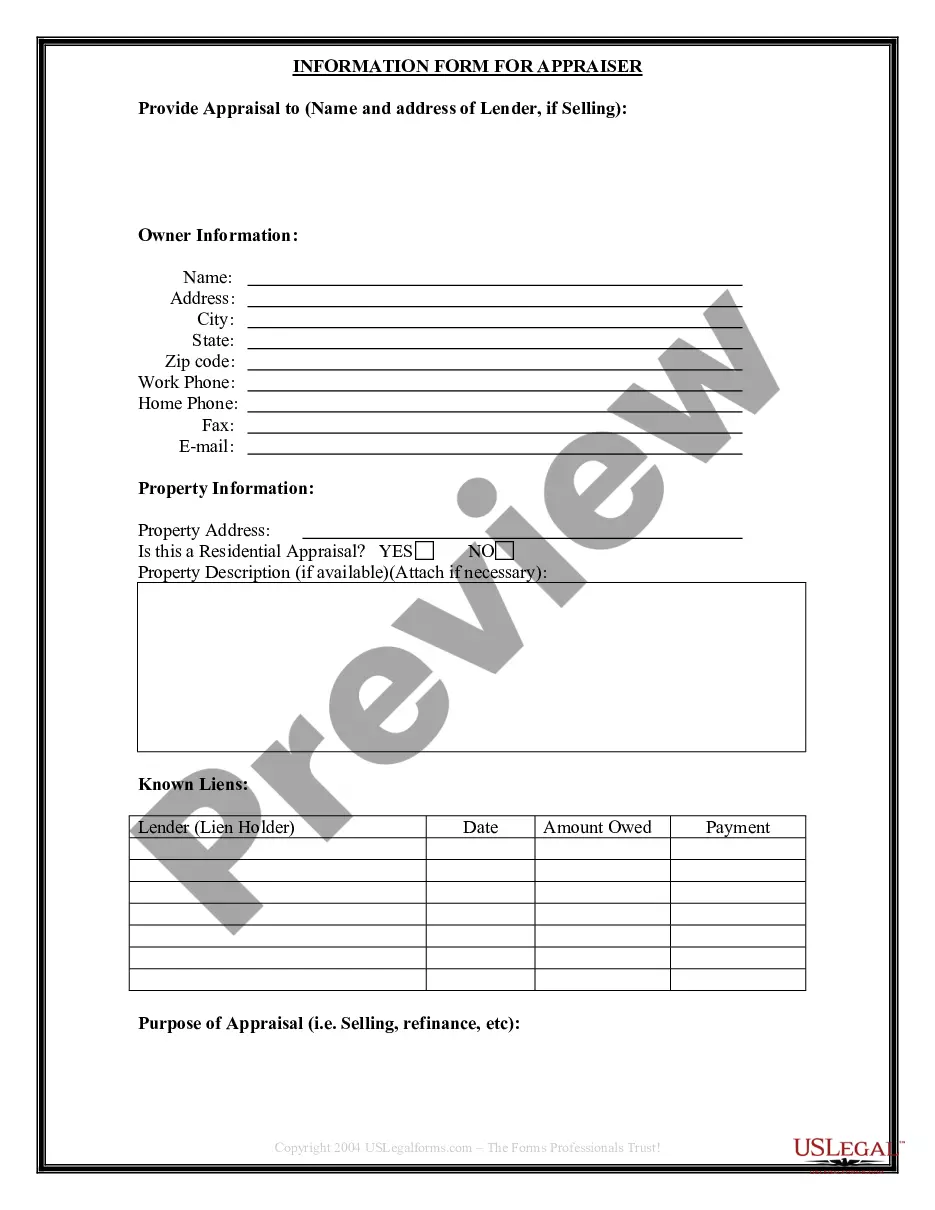

Important: Although a revocable trust supersedes a will, the trust only controls those assets that have been placed into it. Therefore, if a revocable trust is formed, but assets are not moved into it, the trust provisions have no effect on those assets, at the time of the grantor's death.

While a will determines how your assets will be distributed after you die, a trust becomes the legal owner of your assets the moment the trust is created.

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

A revocable trust becomes irrevocable at the death of the person that created the trust.The Trust becomes its own entity and needs a tax identification number for filing of returns. 2. The Grantor (also called the Trustor) of the Trust becomes incapacitated.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

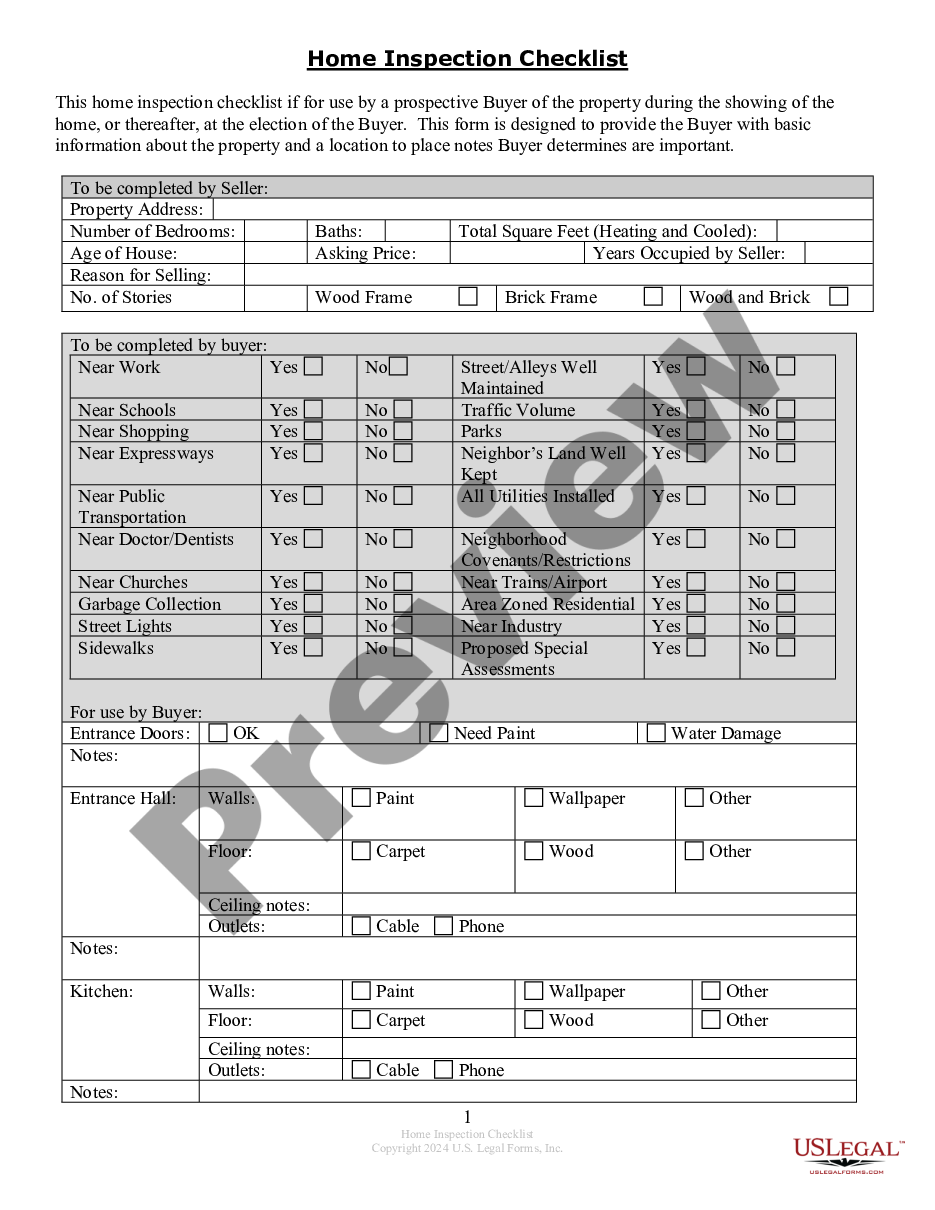

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.