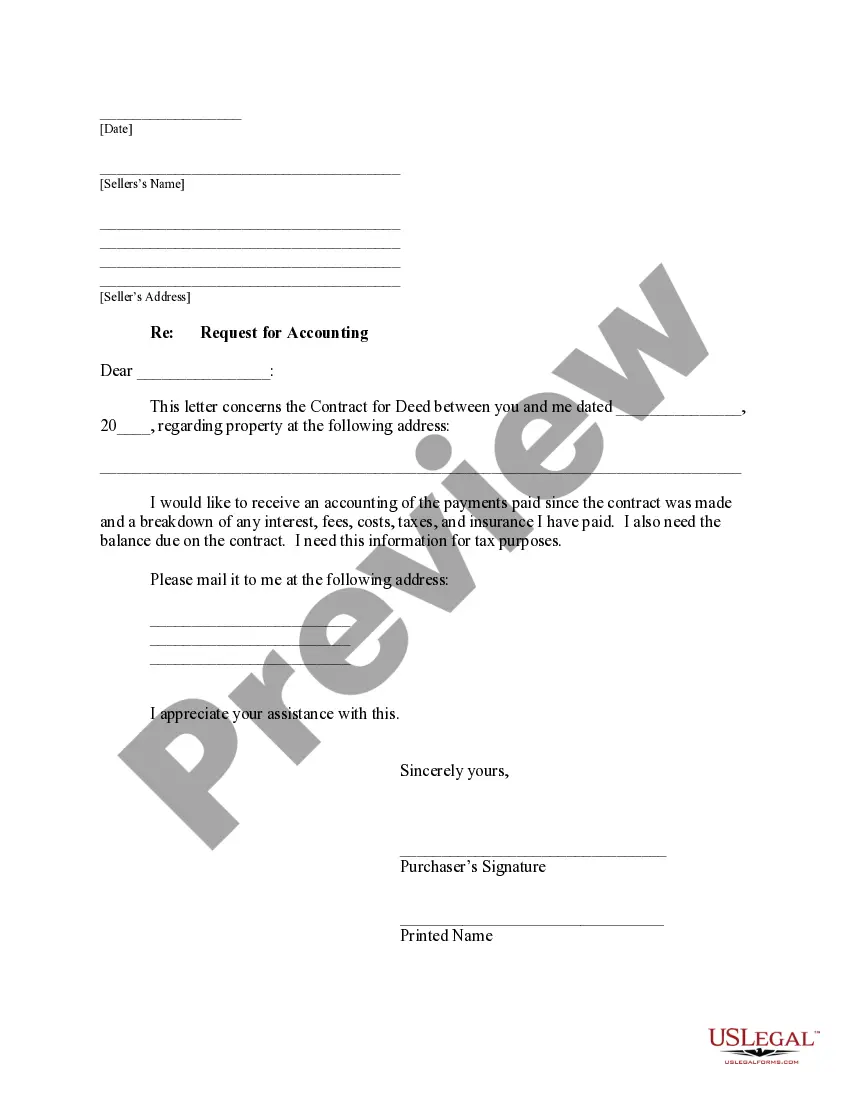

Pennsylvania Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out Pennsylvania Buyer's Request For Accounting From Seller Under Contract For Deed?

Use US Legal Forms to get a printable Pennsylvania Buyer's Request for Accounting from Seller under Contract for Deed. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms catalogue on the web and provides reasonably priced and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Pennsylvania Buyer's Request for Accounting from Seller under Contract for Deed:

- Check out to make sure you get the right template in relation to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Hit Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search field if you need to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Pennsylvania Buyer's Request for Accounting from Seller under Contract for Deed. Over three million users already have utilized our service successfully. Choose your subscription plan and obtain high-quality documents in just a few clicks.

Form popularity

FAQ

A home owner can cancel the home equity or refinancing contract for any reason within three business days after signing the contract. The right of rescission does not apply to contracts pertaining to the sale or purchase or a house.

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.

Act fastthe sooner you back out, the more options you have. If you are having cold feet about buying a home, don't waste too much time before you speak up. See if your contract gives you an out. Be prepared to pay for backing out. Be nice to the sellerand they may return the favor.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

While a buyer can legally back out of a home contract, there can be consequences for doing so. For example, you can lose your earnest money, which could amount to thousands of dollars or more. That is unless your reason for pulling out of the deal is stipulated in your contract.

Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement. The biggest risk when buying a home contract for deed is that you really don?t have a legal claim to the property until you have paid off the entire purchase price.

If you want out of a real estate contract and don't have any contingencies available, you can breach the contract.The seller could also decide to sue you for breach of contract. Some real estate contracts have a liquidated damages clause that states the maximum the seller can keep if the buyers breach the contract.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.