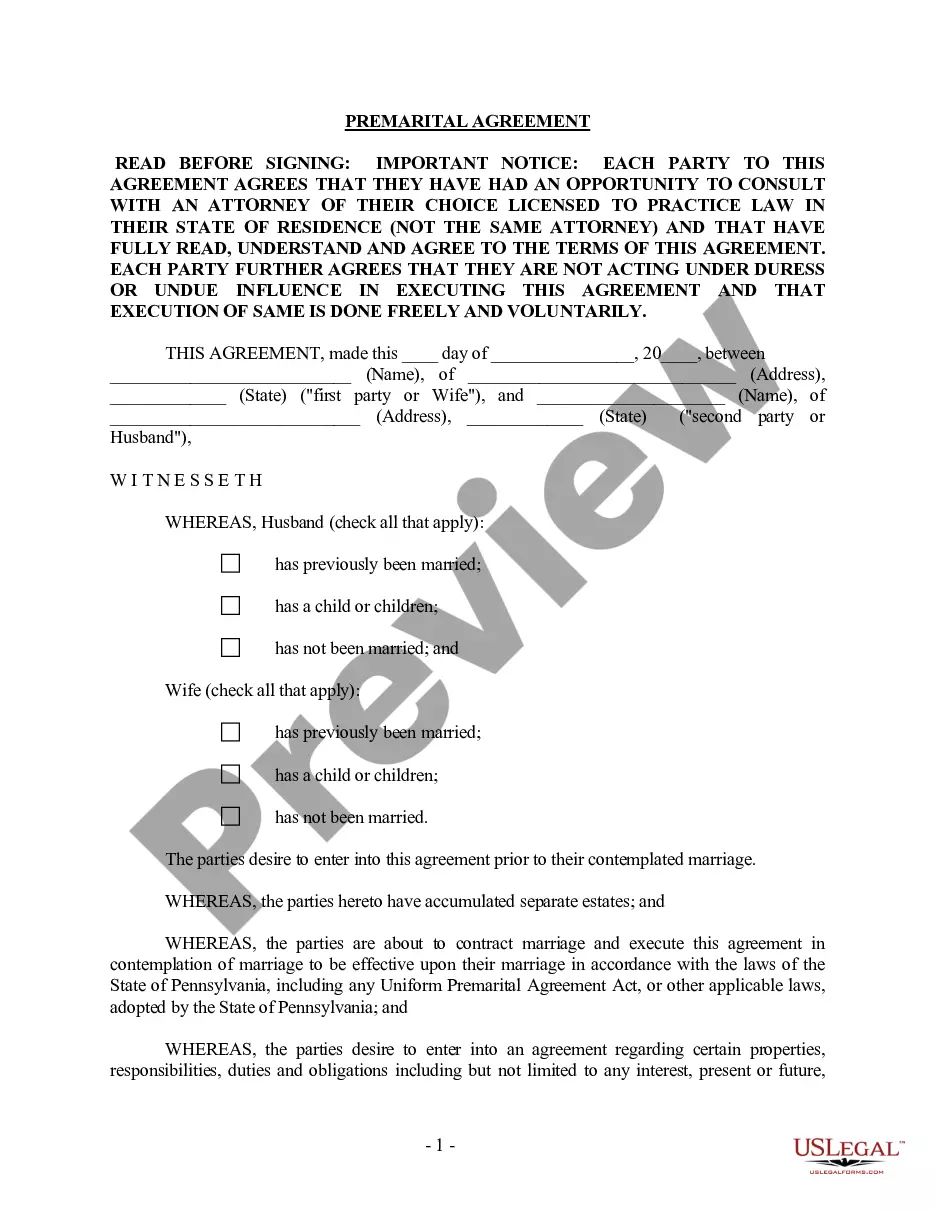

Pennsylvania Prenuptial Premarital Agreement without Financial Statements

Description

How to fill out Pennsylvania Prenuptial Premarital Agreement Without Financial Statements?

The work with papers isn't the most simple task, especially for those who rarely work with legal papers. That's why we advise using correct Pennsylvania Prenuptial Premarital Agreement without Financial Statements templates made by professional lawyers. It gives you the ability to avoid troubles when in court or handling official organizations. Find the documents you need on our website for top-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template page. Right after accessing the sample, it will be stored in the My Forms menu.

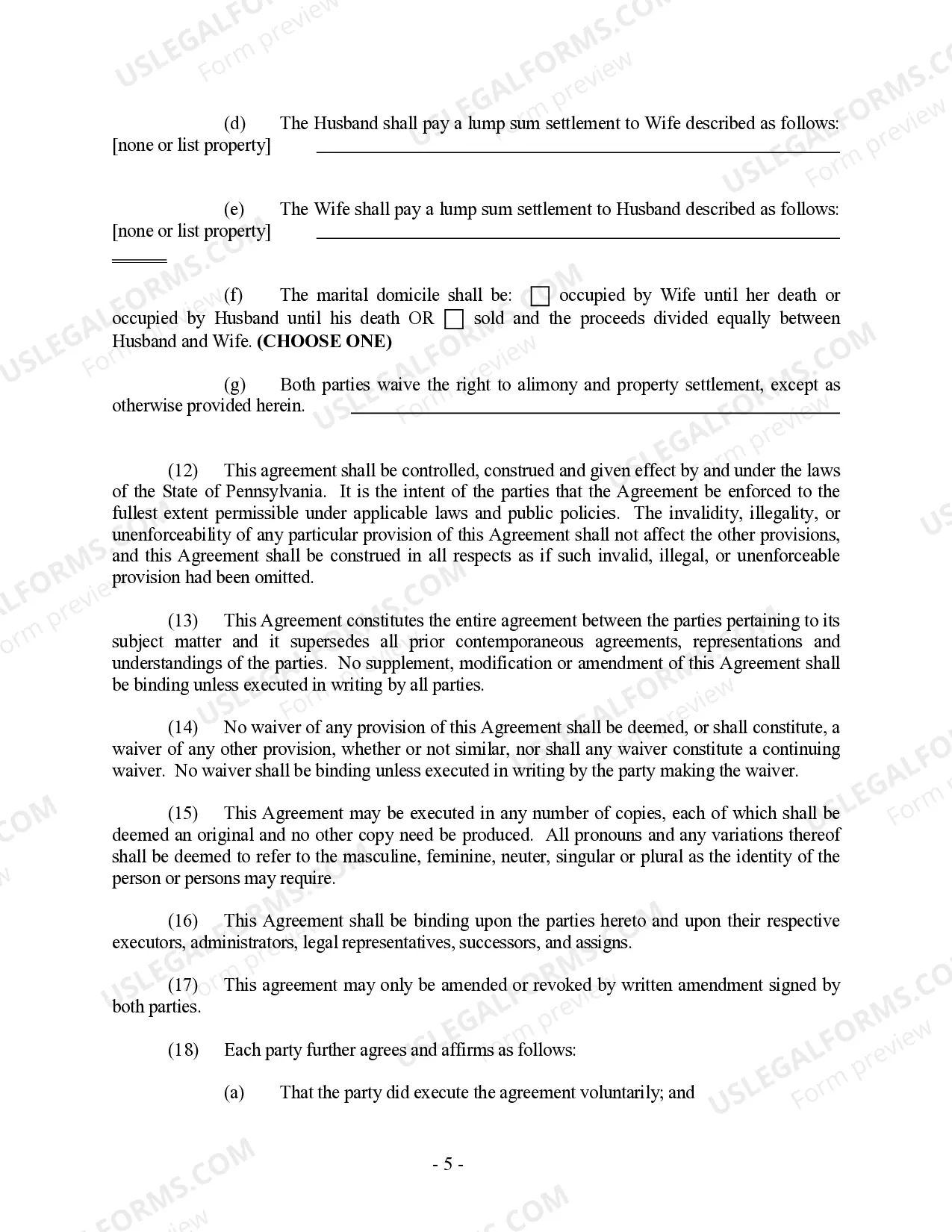

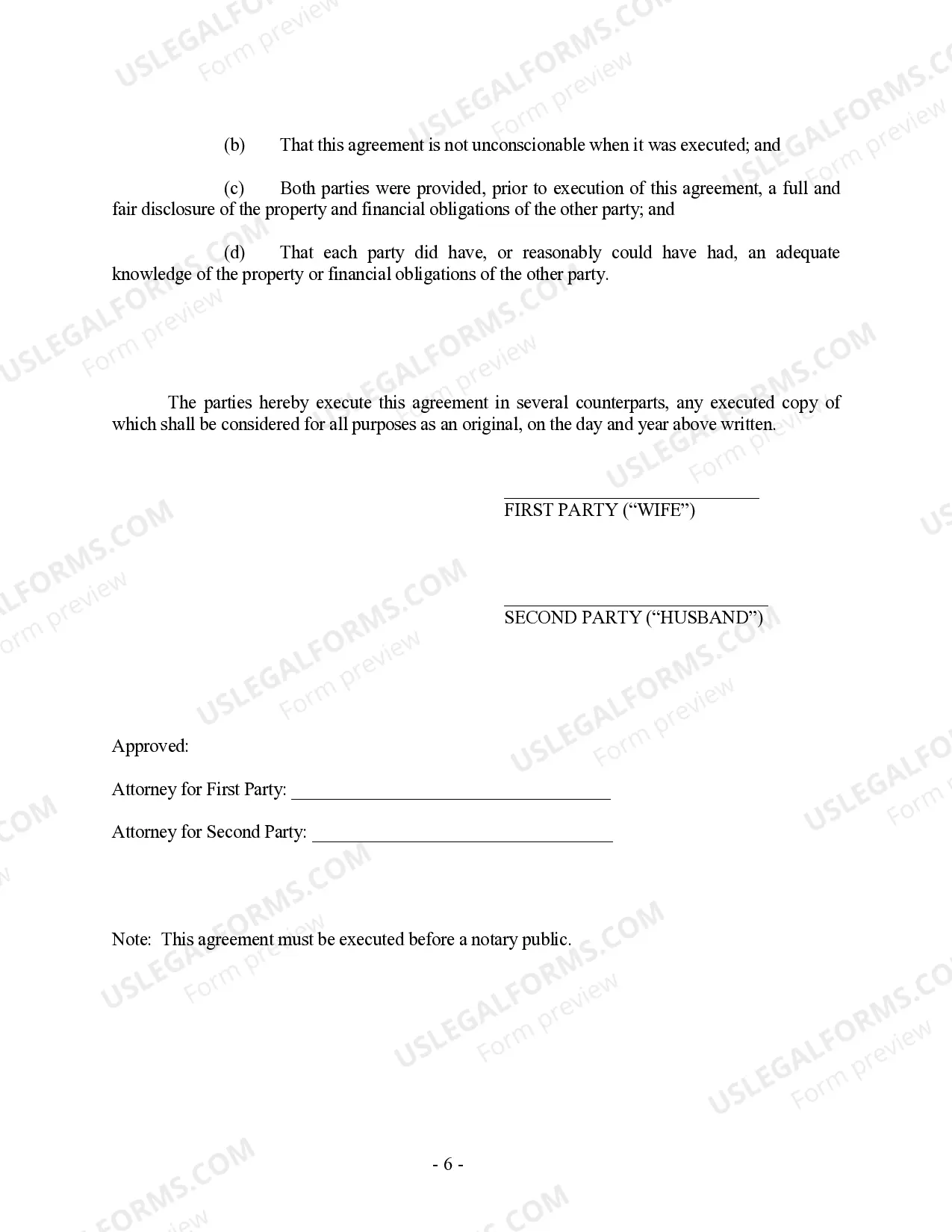

Customers without an active subscription can quickly create an account. Make use of this brief step-by-step help guide to get your Pennsylvania Prenuptial Premarital Agreement without Financial Statements:

- Make sure that the form you found is eligible for use in the state it’s necessary in.

- Verify the file. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this template is what you need or return to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these simple actions, you can fill out the sample in an appropriate editor. Recheck completed data and consider requesting an attorney to examine your Pennsylvania Prenuptial Premarital Agreement without Financial Statements for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

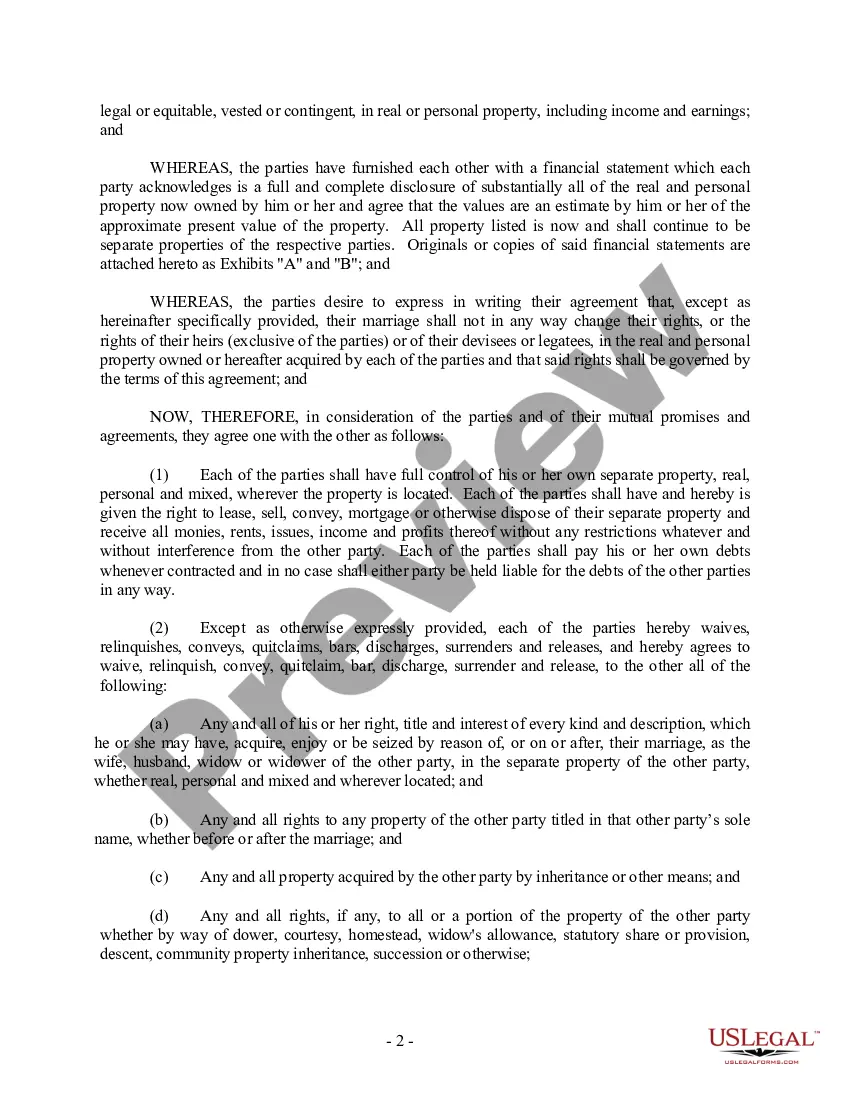

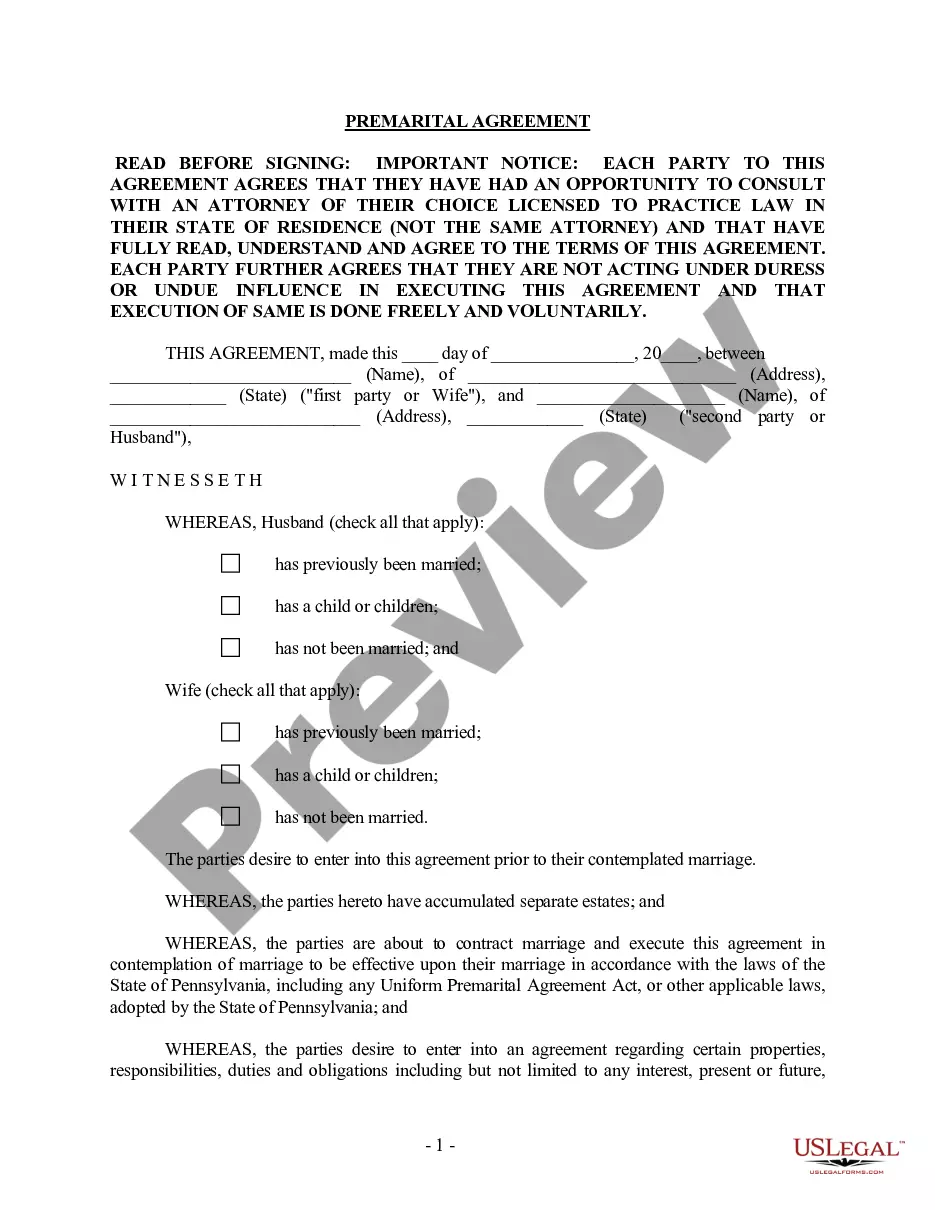

Saving and Spending Strategies A prenuptial agreement should address the couple's future financial plans, including investment and retirement strategies. It should also cover how much income is to be paid into joint and/or separate bank accounts, and whether or not their will be any specific spending allowances.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

In California, individuals can draft their prenups. However, without a legal background, it is easy for the prenuptial agreement to be invalidated.Other requirements include a written contract, legal terms within the prenup and the voluntary signatures of both parties.

As long as both parties are in agreement to the terms of the post nuptial contract, and have the ability to put those terms into a legal document, most states don't make it a legal requirement to have an attorney.

A prenuptial agreement does not have to be notarized to be valid. Often, they are notarized, so there is no question that it was actually signed by the parties. Assuming, that neither of you are contesting the validity of the agreement it should be legally viable.

Putting the Agreement in Writing. Identify the parties and the document. After titling the document something like Premarital Agreement, you want to identify the two parties by full, legal names and state that they are both willingly entering into the agreement. State the intent of marriage.

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

The premarital agreement is not a notarized document, therefore there is no per se obligation to notarize it.For instance, whenever the prenuptial agreement, in dividing assets between the spouses, also refers to a real estate property transfer, having the document notarized is highly recommended.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.