Pennsylvania Registration of Foreign Corporation

Description Pennsylvania Foreign Llc Registration

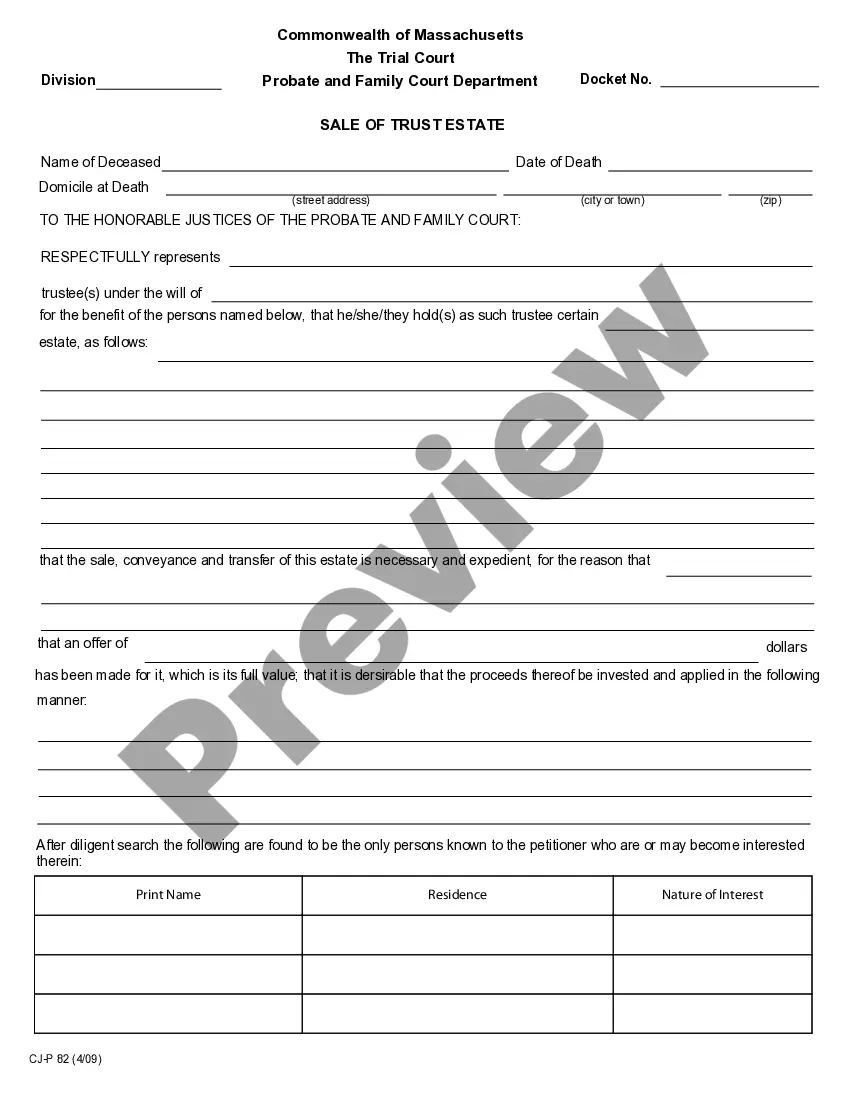

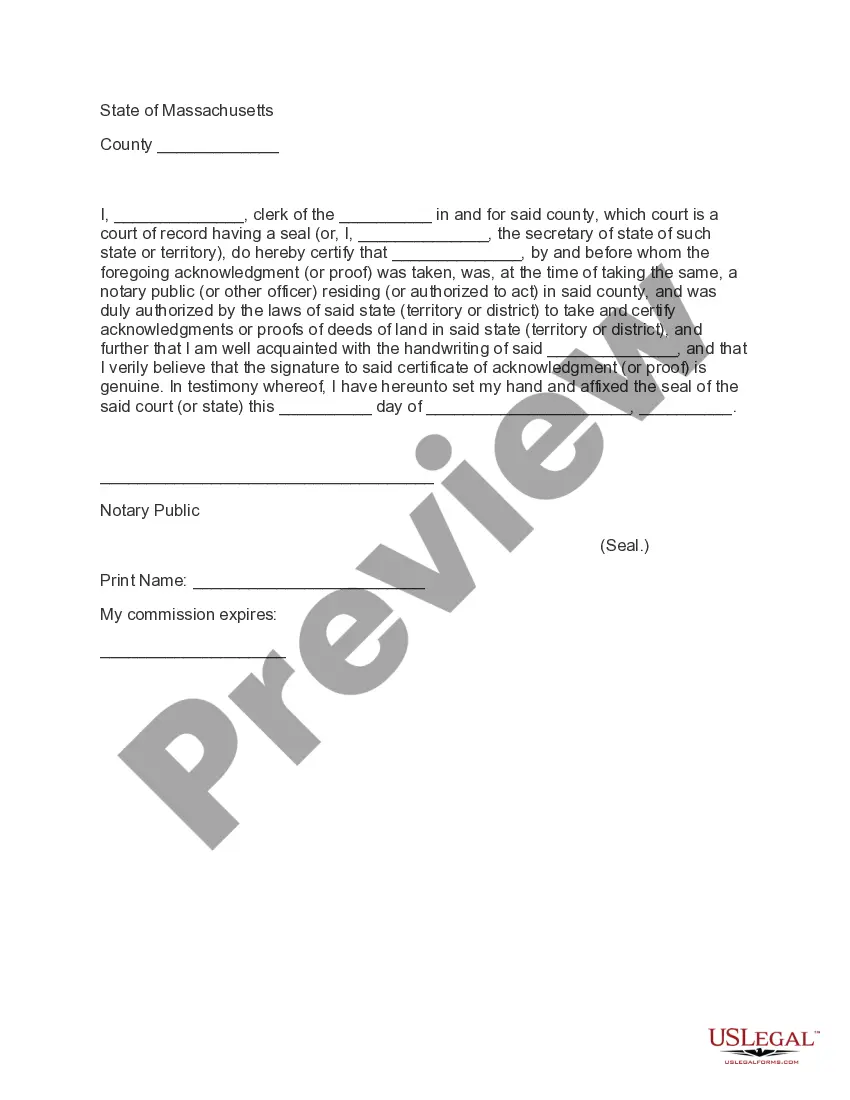

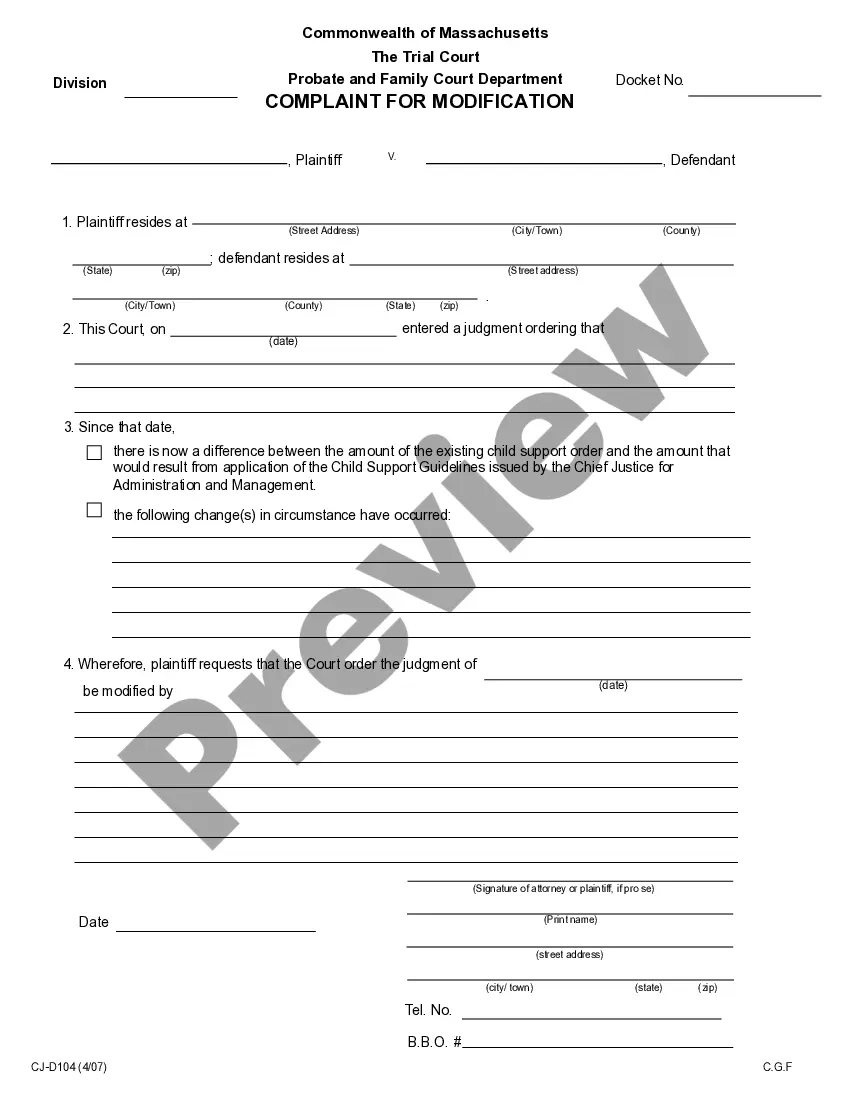

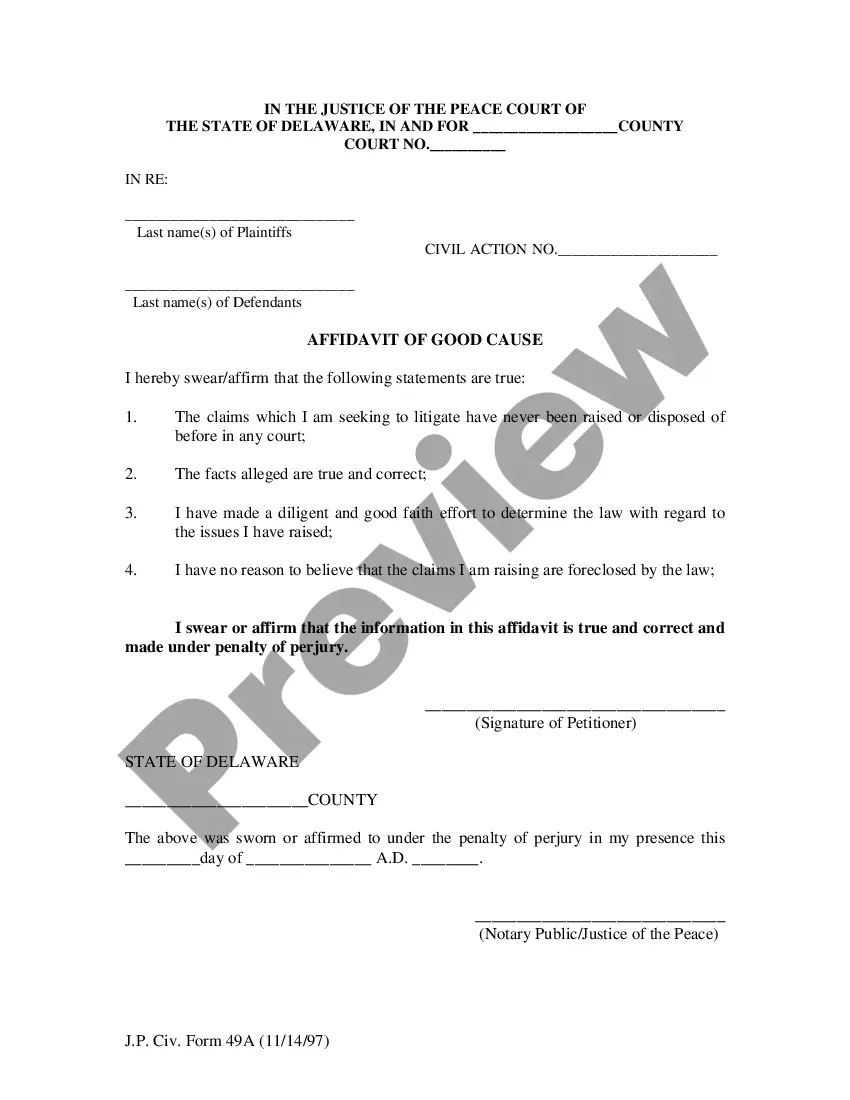

How to fill out Pennsylvania Registration Of Foreign Corporation?

The work with papers isn't the most easy task, especially for those who almost never deal with legal paperwork. That's why we recommend using correct Pennsylvania Registration of Foreign Corporation templates created by skilled lawyers. It gives you the ability to avoid difficulties when in court or dealing with official organizations. Find the documents you need on our site for high-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template web page. Right after downloading the sample, it’ll be saved in the My Forms menu.

Customers with no a subscription can easily create an account. Utilize this simple step-by-step guide to get your Pennsylvania Registration of Foreign Corporation:

- Be sure that the form you found is eligible for use in the state it is needed in.

- Confirm the file. Make use of the Preview option or read its description (if readily available).

- Click Buy Now if this form is what you need or utilize the Search field to find another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After finishing these straightforward actions, you can complete the sample in a preferred editor. Check the completed info and consider asking an attorney to review your Pennsylvania Registration of Foreign Corporation for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Pa Foreign Corporation Registration Form popularity

Pa Llc Application Other Form Names

FAQ

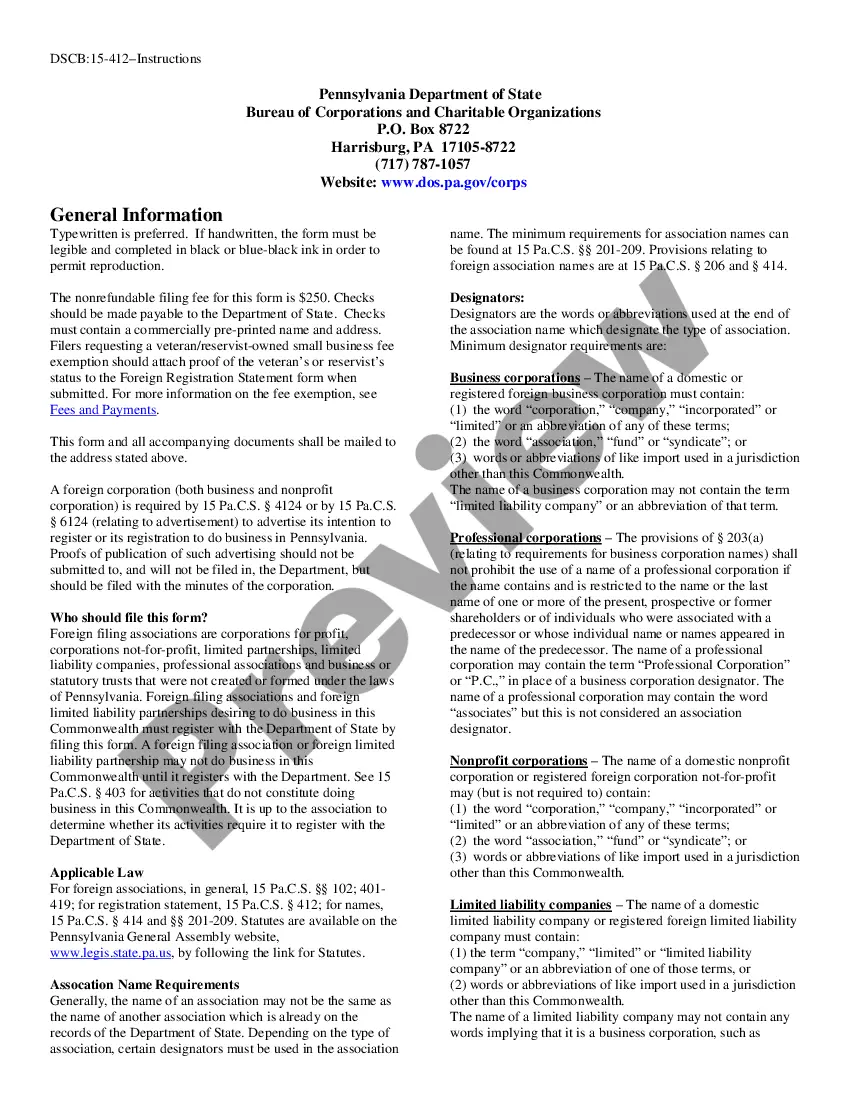

Foreign Entity - Any business organization that transacts business outside of its state of formation is recognized as foreign in the states in which it obtains a certificate of authority. Foreign Qualification - Refers to registering your business or nonprofit outside its state of formation.

The Pennsylvania Business Entity Registration Form (PA-100) must be completed by Business Entities to register for certain taxes and services administered by the PA Department of Revenue and the Department of Labor & Industry.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

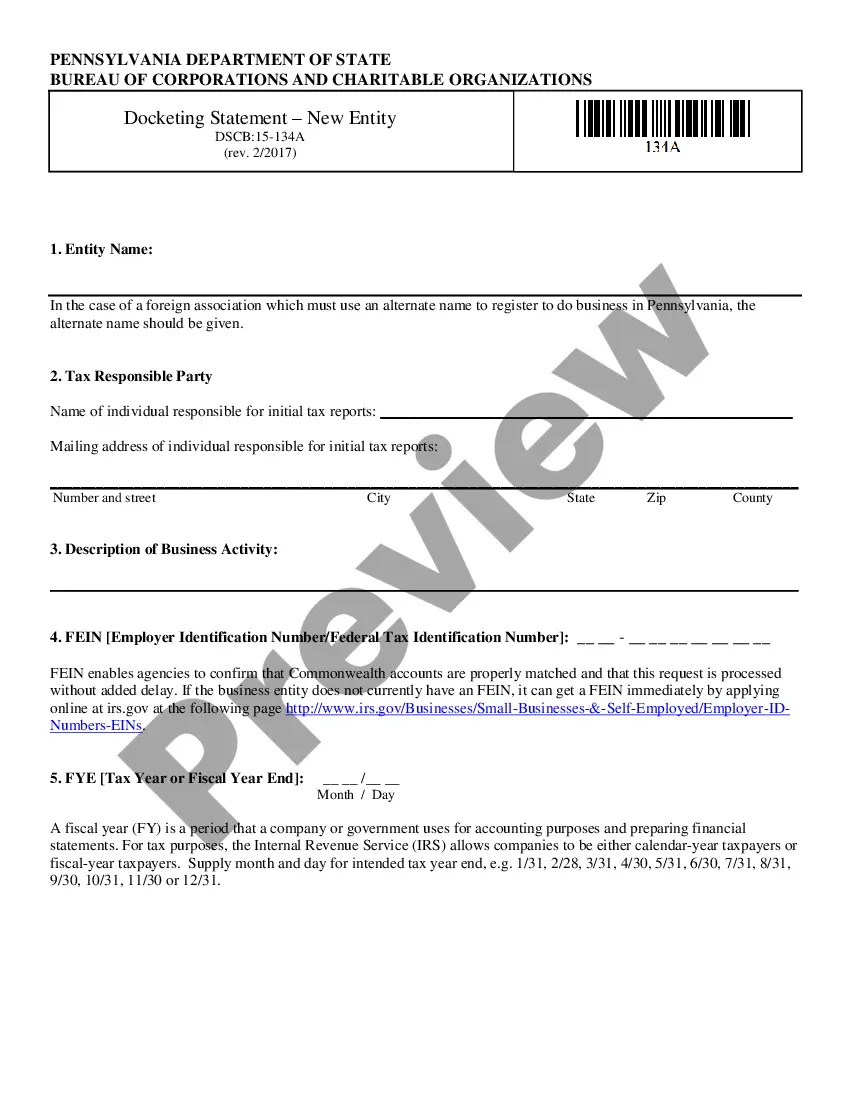

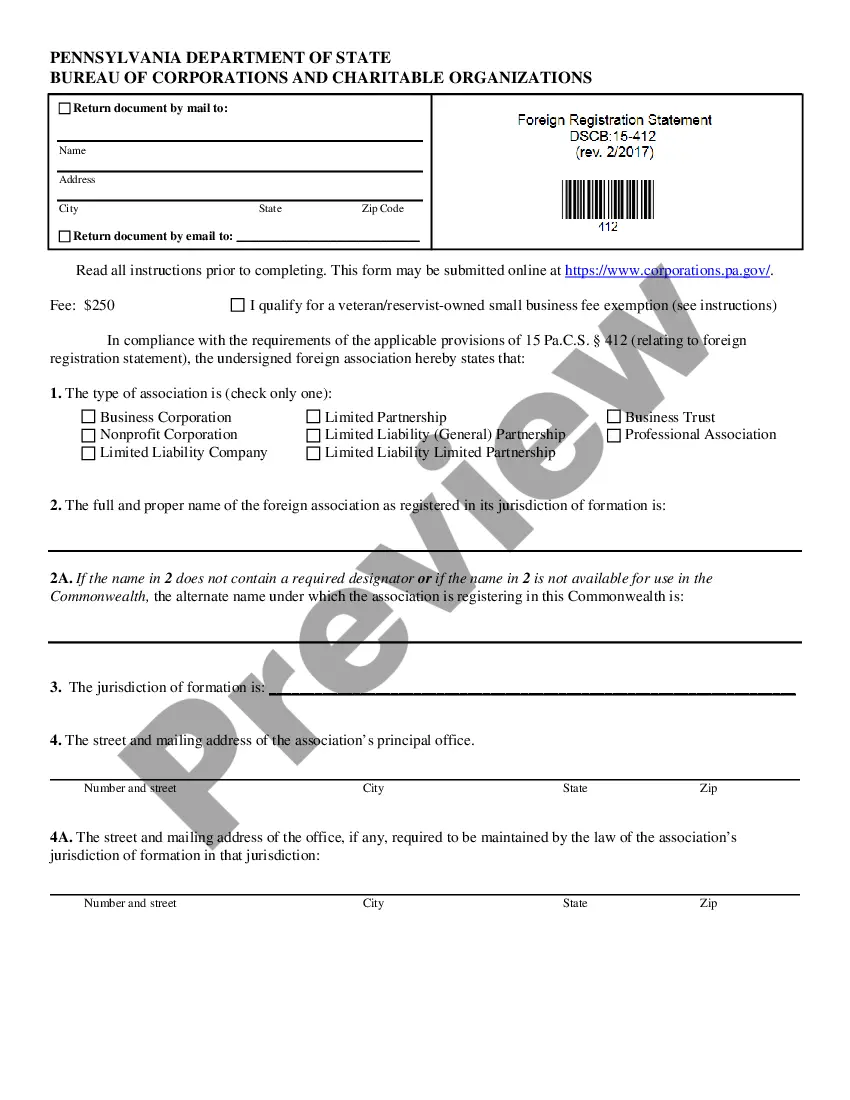

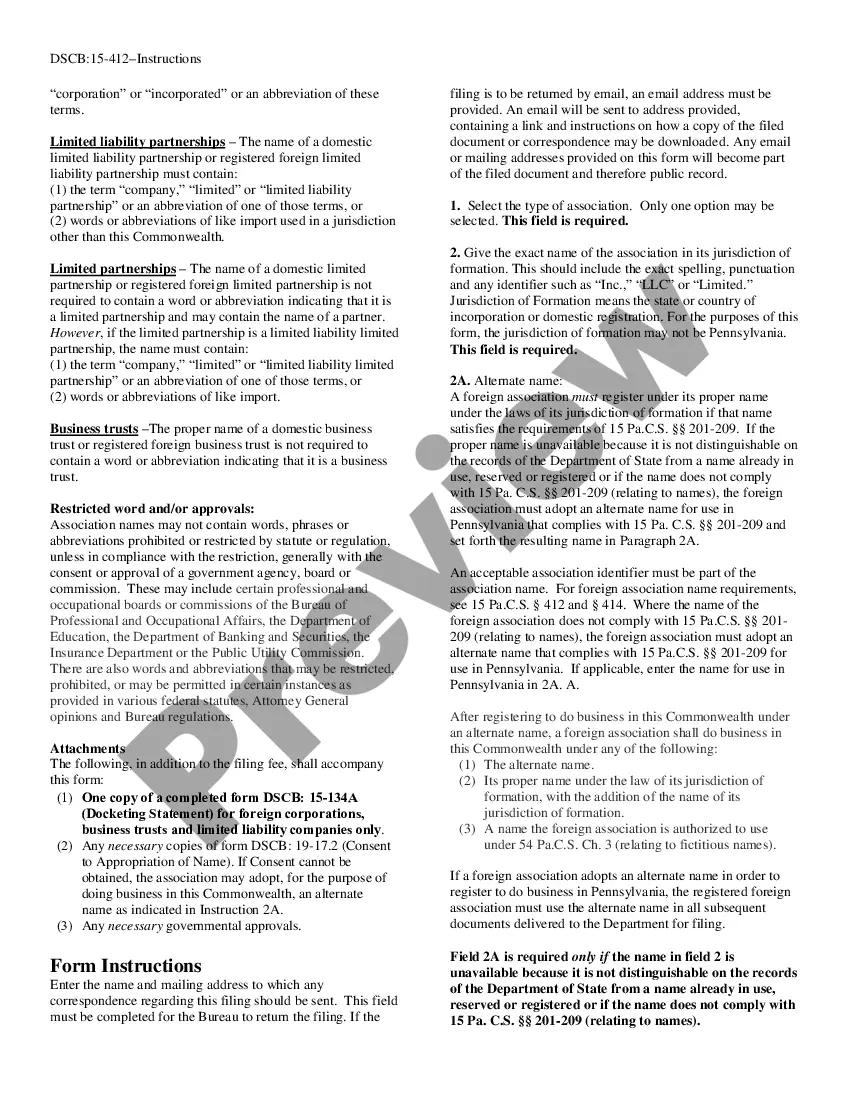

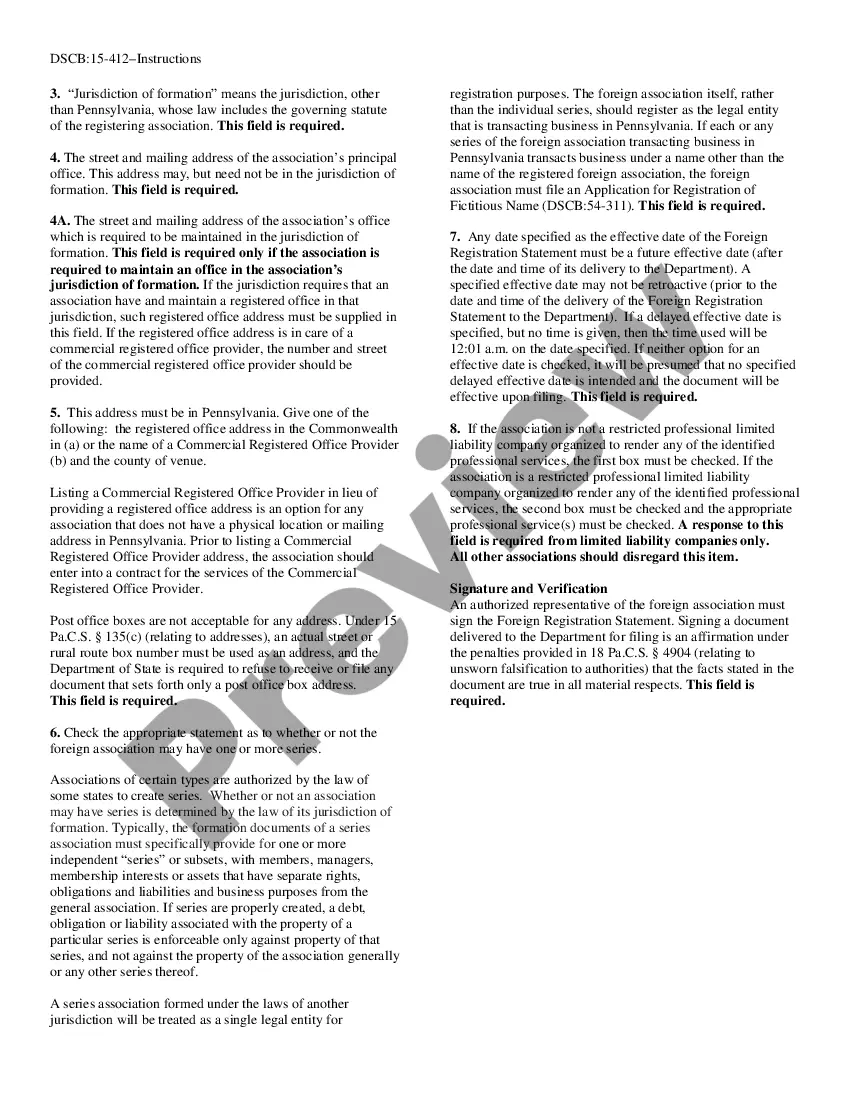

A Foreign Limited Liability Company is formed by filing the appropriate form , accompanied by a docketing statement. The Foreign Limited Liability Company name must be available for use in Pennsylvania. If the chosen name is not available they may register and transact business under another business name.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

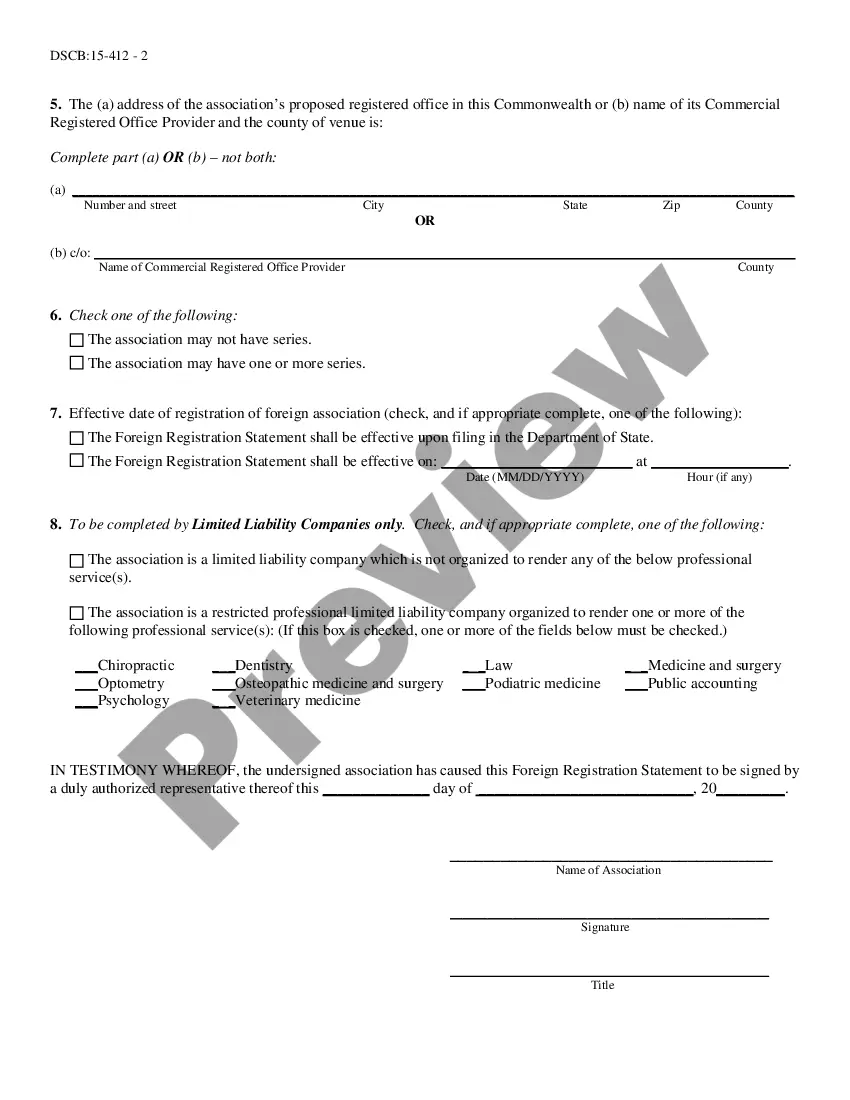

File a Foreign Registration Statement: To qualify a foreign corporation, you file a Foreign Registration Statement, along with a New Entity Docketing Statement. The filing is made with the Bureau of Corporations and Charitable Organizations. There is a $250 filing fee. The filing can be submitted online.

The state of Pennsylvania does not require registration if you are operating the business under your own legal name.To find out if a name is available visit the Department of State website. The state's online wizard will help guide you through the registration process.