Pennsylvania Business Incorporation Package to Incorporate Corporation

Description Pa Business Pennsylvania

How to fill out Pa Business File?

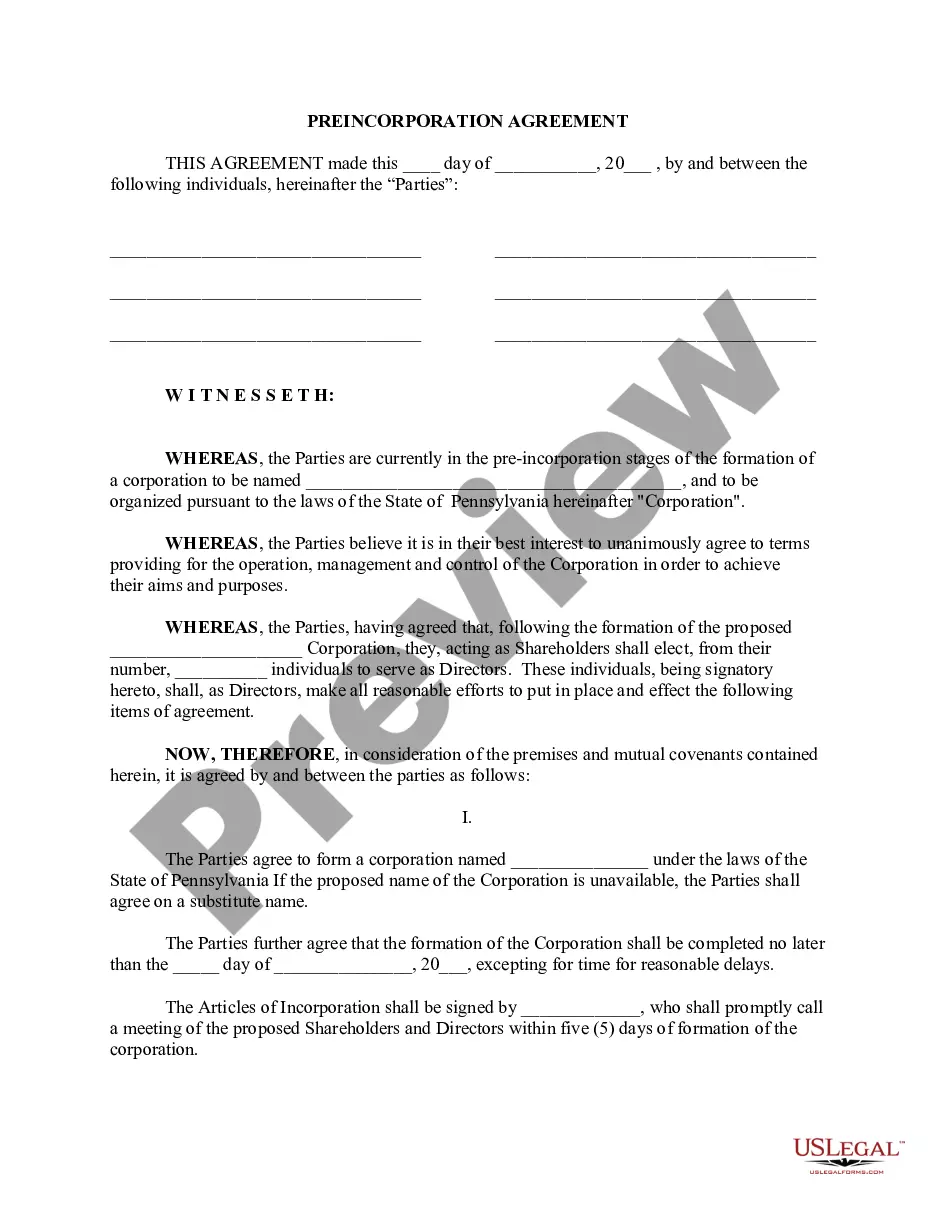

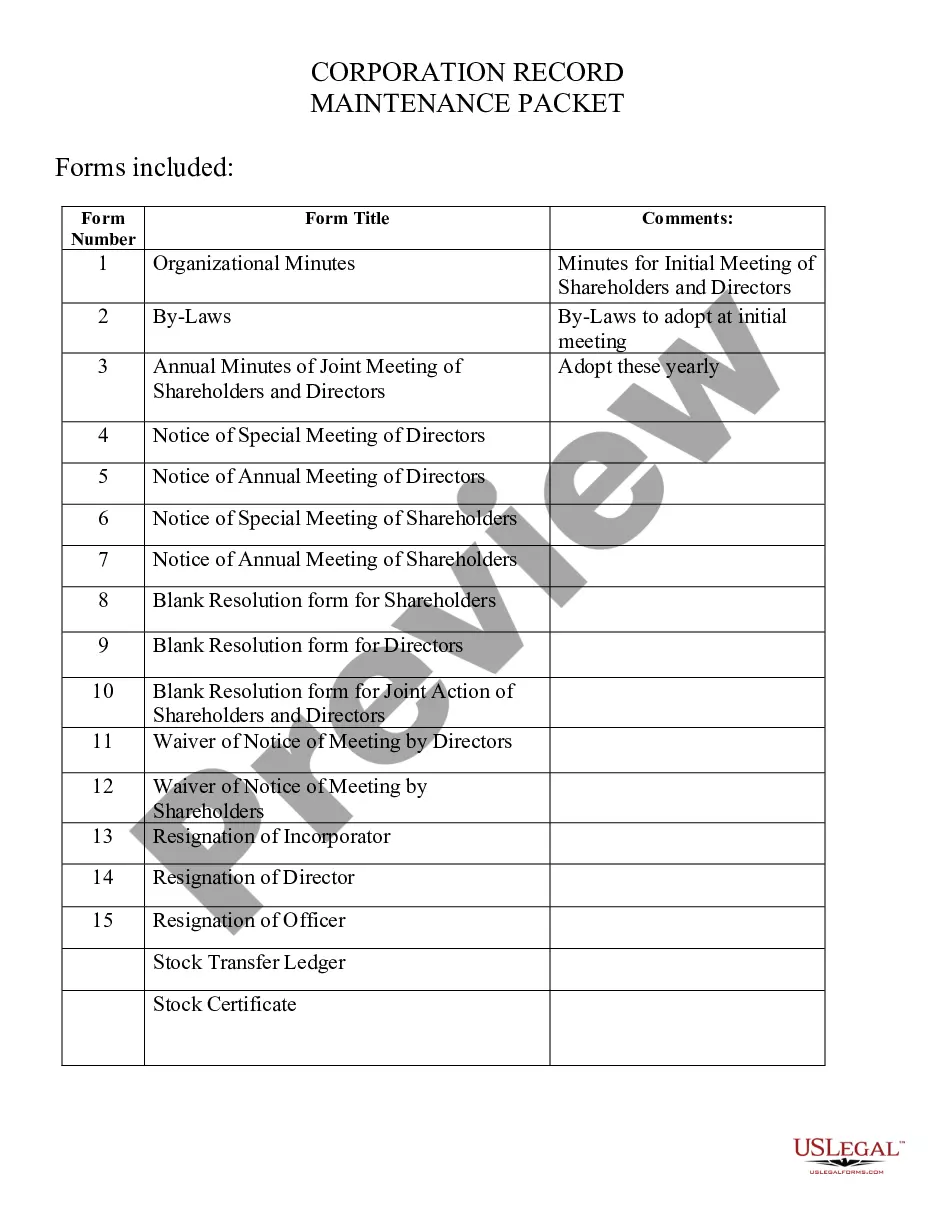

Creating documents isn't the most easy task, especially for people who almost never deal with legal paperwork. That's why we advise utilizing correct Pennsylvania Business Incorporation Package to Incorporate Corporation templates created by professional lawyers. It gives you the ability to stay away from problems when in court or working with formal institutions. Find the samples you need on our website for top-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the template page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Look at this short step-by-step guide to get the Pennsylvania Business Incorporation Package to Incorporate Corporation:

- Make sure that the document you found is eligible for use in the state it is required in.

- Verify the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this file is the thing you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these simple actions, it is possible to fill out the sample in a preferred editor. Recheck filled in information and consider asking a lawyer to review your Pennsylvania Business Incorporation Package to Incorporate Corporation for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Pa Business Form popularity

Incorporation Incorporate Corporation Other Form Names

Pa Corporation FAQ

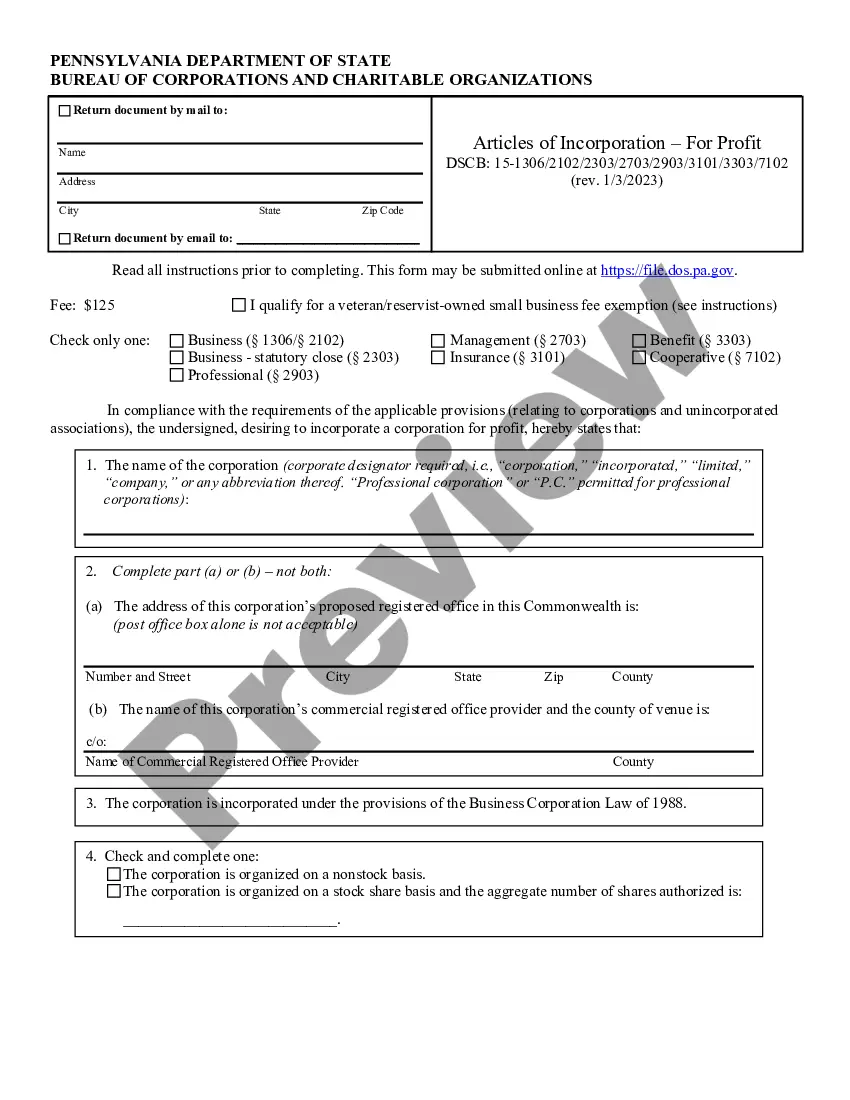

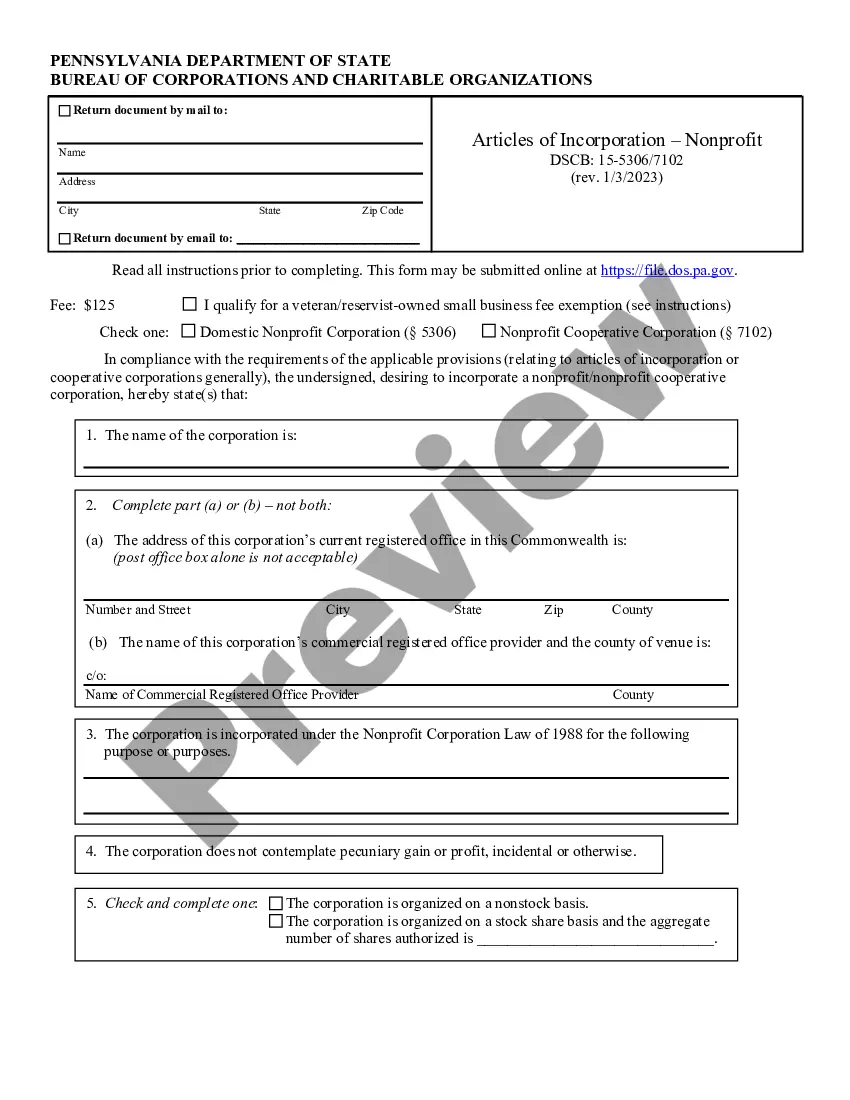

To start an LLC in Pennsylvania you will need to file a Certificate of Organization with the Pennsylvania Department of State, which costs $125. You can apply online or by mail.

Unlike most states, Pennsylvania does not require LLCs to file an annual report.An annual fee of $520 times the number of members of the LLC must be paid.

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. Expedited Processing will reduce that time to about 10 business days or less with the exception of just a few states.

Choose a corporate name. File Articles of Incorporation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. Comply with other tax and regulatory requirements.

To start a business in Pennsylvania, you will likely have to pay application and licensing fees. To obtain a Pennsylvania LLC Certificate of Organization, for example, costs about $125. Additional fees might be required if your business is structured as a corporation, sole proprietorship or partnership.

To start an LLC in Pennsylvania you will need to file a Certificate of Organization with the Pennsylvania Department of State, which costs $125. You can apply online or by mail.

Choose a corporate name. File Articles of Incorporation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. Comply with other tax and regulatory requirements.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

200bThe LLC filing fee is a one-time fee paid to the state to form your LLC. What's the LLC Annual Fee? 200bThe LLC annual fee is an ongoing fee paid to the state to keep your LLC in compliance and in good standing. It's usually paid every 1 or 2 years, depending on the state.