Professional Corporation Package for Pennsylvania

Description Pa Professional Corporation

1. PA-NAMERESV: Application for Reservation of Entity Name

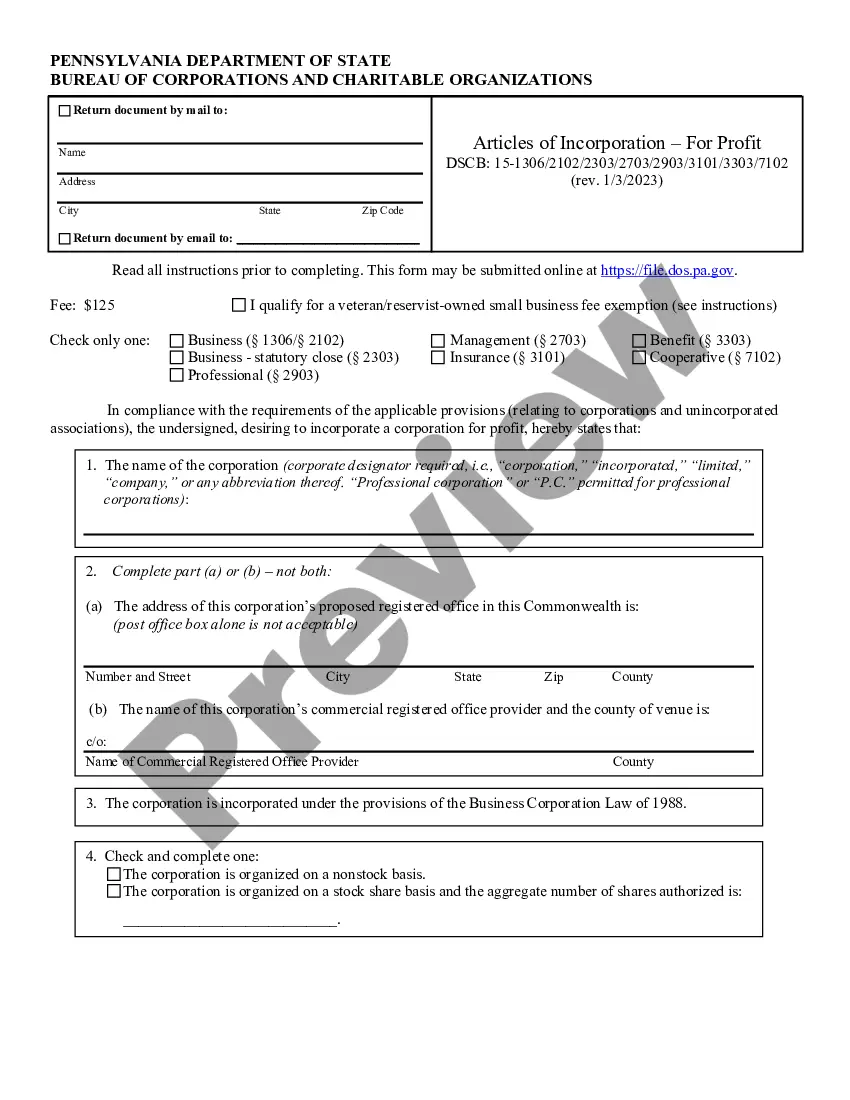

2. PA-00INCP: Articles of Incorporation, including Docketing Statement

3. PA-PC-TL: Sample Transmittal Letter

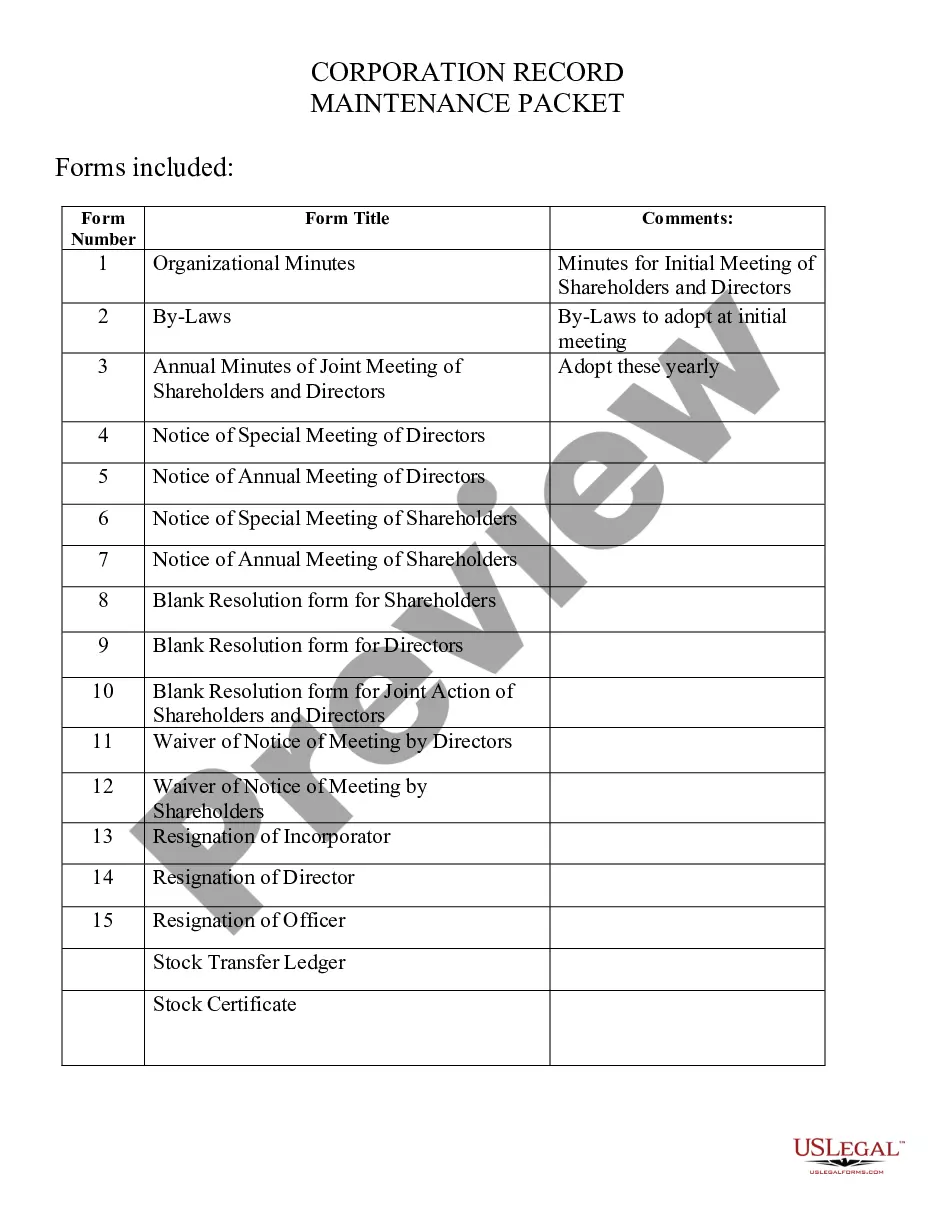

4. PA-PC-OM: Sample Organizational Minutes

5. PA-PC-BL: Sample Bylaws

6. US-IRS-SS-4: Application for Federal Tax Identification Number & Instructions

7. US-IRS-2553: Election of “S” Corporation Status & Instructions

8. PA-PC-AM: Sample Annual Minutes

9. PA-PC-CR: Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate

How to fill out Professional Corporation Package For Pennsylvania?

Among hundreds of free and paid templates that you’re able to find on the web, you can't be certain about their accuracy and reliability. For example, who created them or if they’re qualified enough to take care of what you need those to. Keep relaxed and use US Legal Forms! Find Professional Corporation Package for Pennsylvania samples developed by skilled legal representatives and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and then paying them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all your earlier downloaded documents in the My Forms menu.

If you are utilizing our service the very first time, follow the instructions listed below to get your Professional Corporation Package for Pennsylvania fast:

- Ensure that the document you discover applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you have signed up and paid for your subscription, you can use your Professional Corporation Package for Pennsylvania as many times as you need or for as long as it remains valid in your state. Revise it with your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Pa Llc Forms Form popularity

Incorporation In Pennsylvania Other Form Names

FAQ

(b) Additional powers. --A professional corporation may be an equity owner of a partnership, limited liability company, corporation or other association engaged in the business of rendering the professional service or services for which the professional corporation was incorporated.

Professional association (P.A.) An entity recognized as a legal person that is set up to conduct a business of professionals, such as attorneys or doctors.

To start a business in Pennsylvania, you will likely have to pay application and licensing fees. To obtain a Pennsylvania LLC Certificate of Organization, for example, costs about $125. Additional fees might be required if your business is structured as a corporation, sole proprietorship or partnership.

Benefit Corporations are Pennsylvania business corporations organized for profit. Benefit Corporations are very similar to typical corporations; however, beyond pursuing typical business interests, a Benefit Corporation has the additional corporate focus of creating and/ or supporting general public benefits.

Unlike most states, Pennsylvania does not require LLCs to file an annual report.An annual fee of $520 times the number of members of the LLC must be paid.

Choose a corporate name. File Articles of Incorporation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. Comply with other tax and regulatory requirements.

To start an LLC in Pennsylvania you will need to file a Certificate of Organization with the Pennsylvania Department of State, which costs $125. You can apply online or by mail. The Certificate of Organization is the legal document that officially creates your Pennsylvania limited liability company.

Restricted professional services are defined as the following professional services: chiropractic, dentistry, law, medicine and surgery, optometry, osteopathic medicine and surgery, podiatric medicine, public accounting, psychology or veterinary medicine.

Pennsylvania does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.