Pennsylvania Bylaws for Corporation

Description Pa Corporation Pennsylvania

How to fill out Pennsylvania Bylaws Form?

The work with documents isn't the most straightforward job, especially for those who almost never deal with legal papers. That's why we advise making use of accurate Pennsylvania Bylaws for Corporation templates created by skilled lawyers. It allows you to prevent difficulties when in court or handling formal organizations. Find the samples you need on our site for high-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the template web page. Right after downloading the sample, it will be stored in the My Forms menu.

Users with no a subscription can easily get an account. Follow this simple step-by-step guide to get your Pennsylvania Bylaws for Corporation:

- Make sure that the sample you found is eligible for use in the state it is needed in.

- Verify the document. Make use of the Preview option or read its description (if available).

- Click Buy Now if this file is the thing you need or go back to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

After doing these straightforward steps, you can complete the sample in your favorite editor. Double-check completed data and consider requesting a lawyer to examine your Pennsylvania Bylaws for Corporation for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Pa Corporation File Form popularity

Pa Bylaws Pdf Other Form Names

Pennsylvania Corporation Sample FAQ

(b) Seal unnecessary. --The affixation of the corporate seal shall not be necessary to the valid execution, assignment or endorsement by a corporation of any instrument or other document.

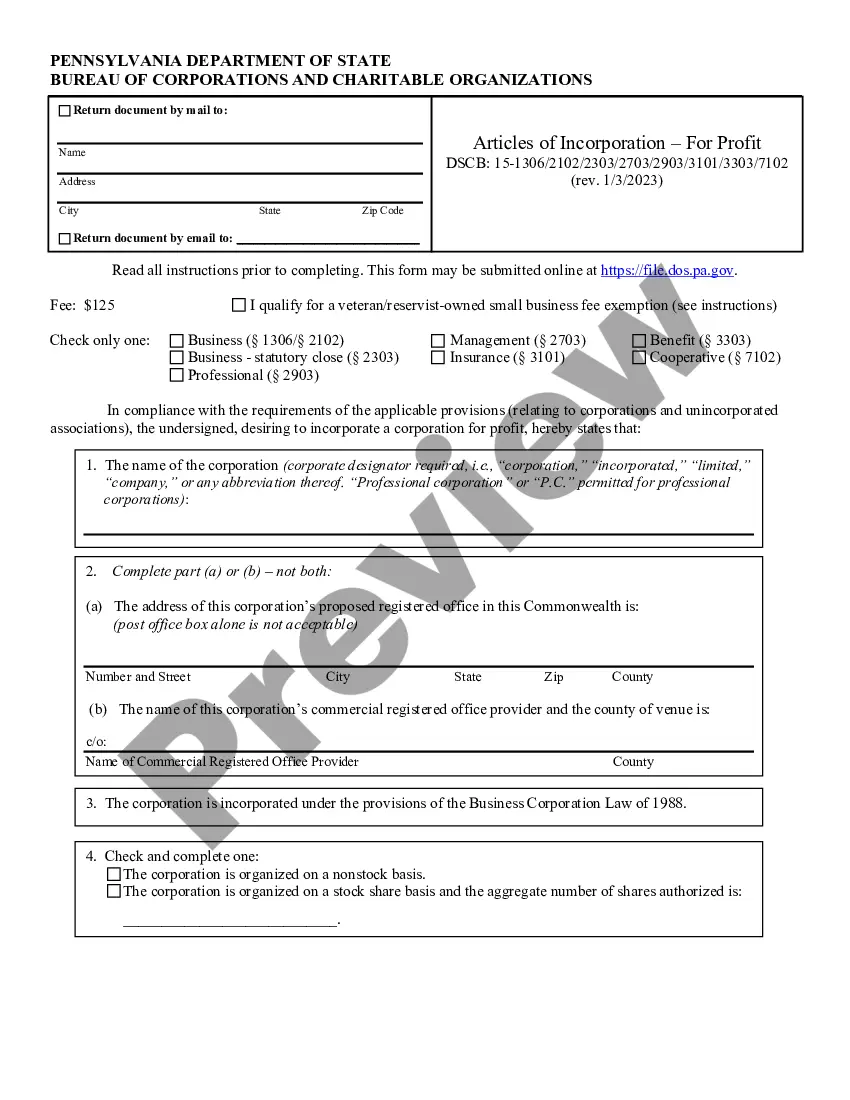

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation. Any corporation whose articles of incorporation do not specify the number of directors must adopt bylaws before the first meeting of the board of directors specifying the number of directors.

Most states require you to memorialize your bylaws and, even in the states where there is no such requirement, having bylaws is a great idea. After all, corporate bylaws define your business' structure, roles, and specifies how your company will conduct its affairs.

The bylaws are the corporation's operating manual; they describe how the corporation is organized and runs its affairs. You do not file the bylaws with the state, but you need to explain the roles of the corporation's participants, and technology can play a role in carrying out the bylaws.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.Aside from number of directors, all the matters typically covered in the bylaws are otherwise covered by California statute, which would apply in the absence of any contrary lawful bylaw provision.

Corporate bylaws commonly include information that specifies, for example, the number of directors the corporation has, how they will be elected, their qualification, and the length of their terms. It can also specify when, where, and how your board of directors can call and conduct meetings, and voting requirements.

Q: Are bylaws required to be filed with filing documents? A: No.

An S Corporation is required by state law to adopt bylaws that govern the corporation's internal management and the rights of the shareholders.

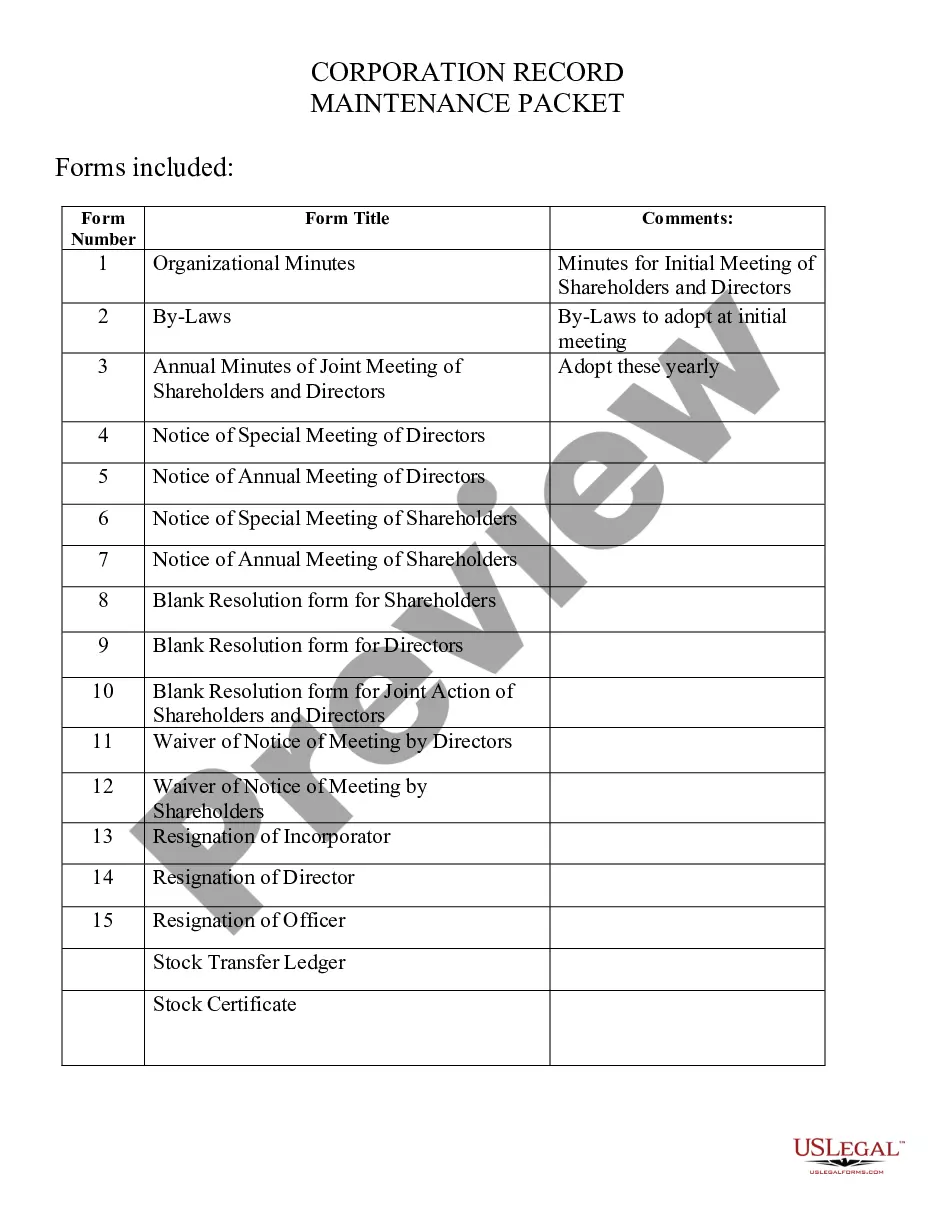

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.