Pennsylvania Limited Liability Company LLC Operating Agreement

Description Limited Liability Company Llc

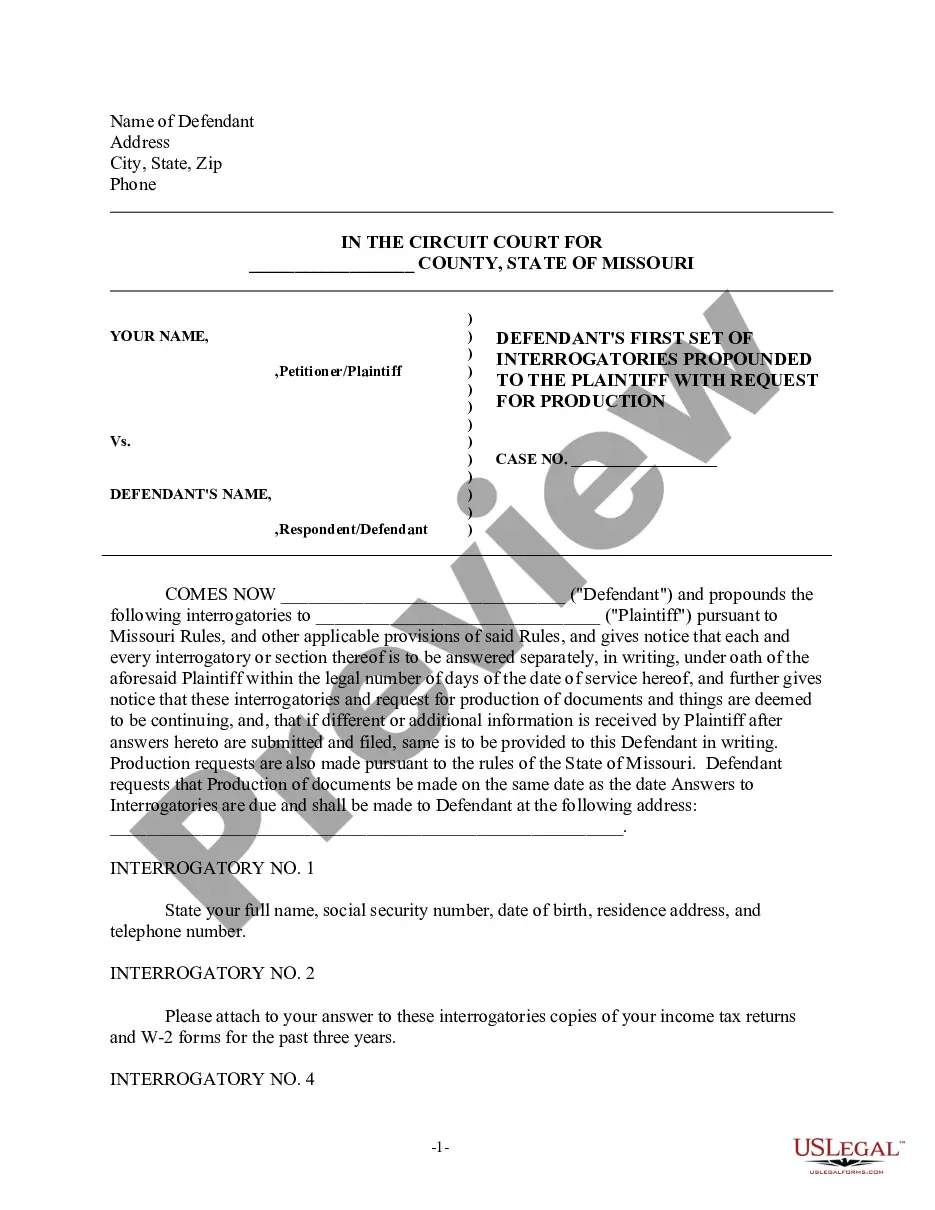

How to fill out Pa Llc Operating Agreement?

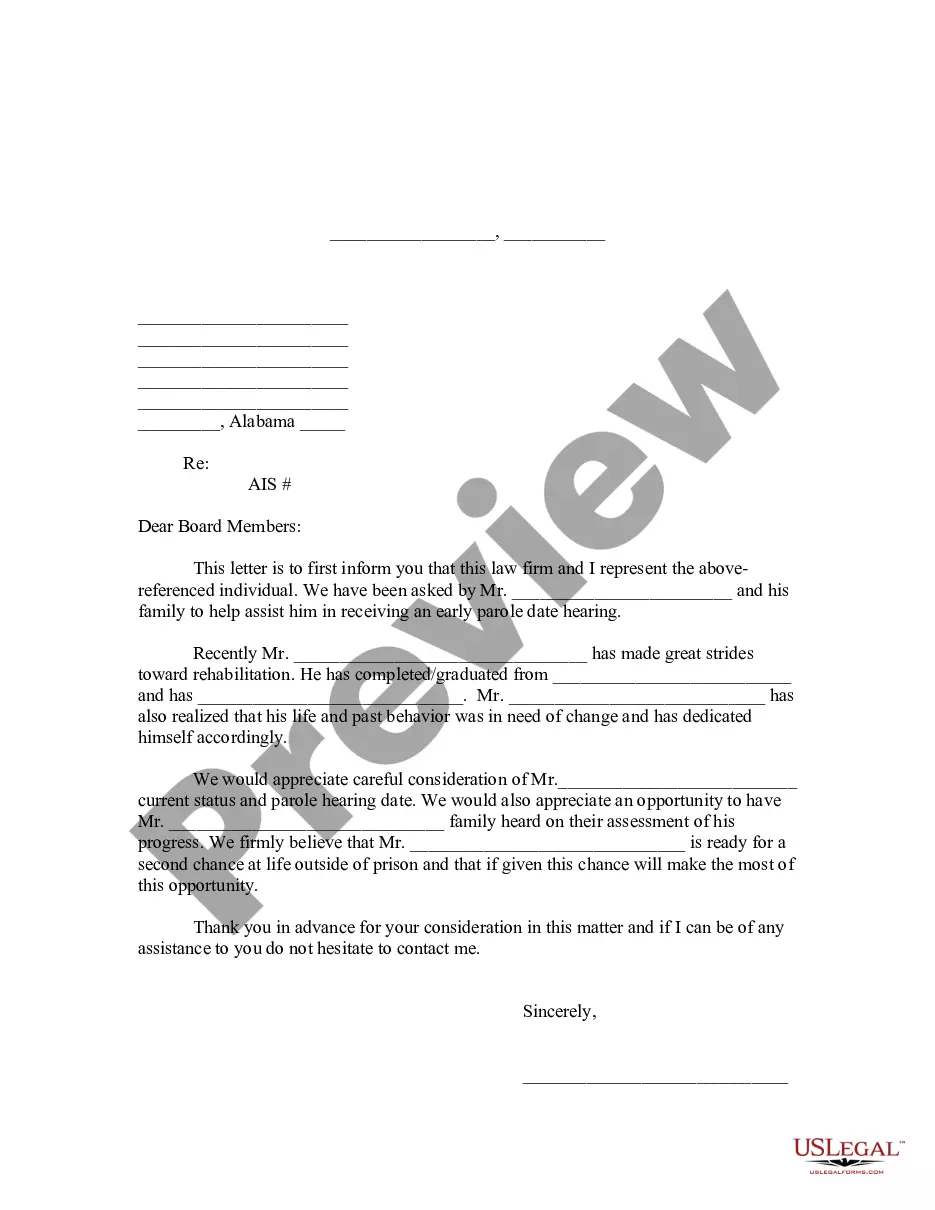

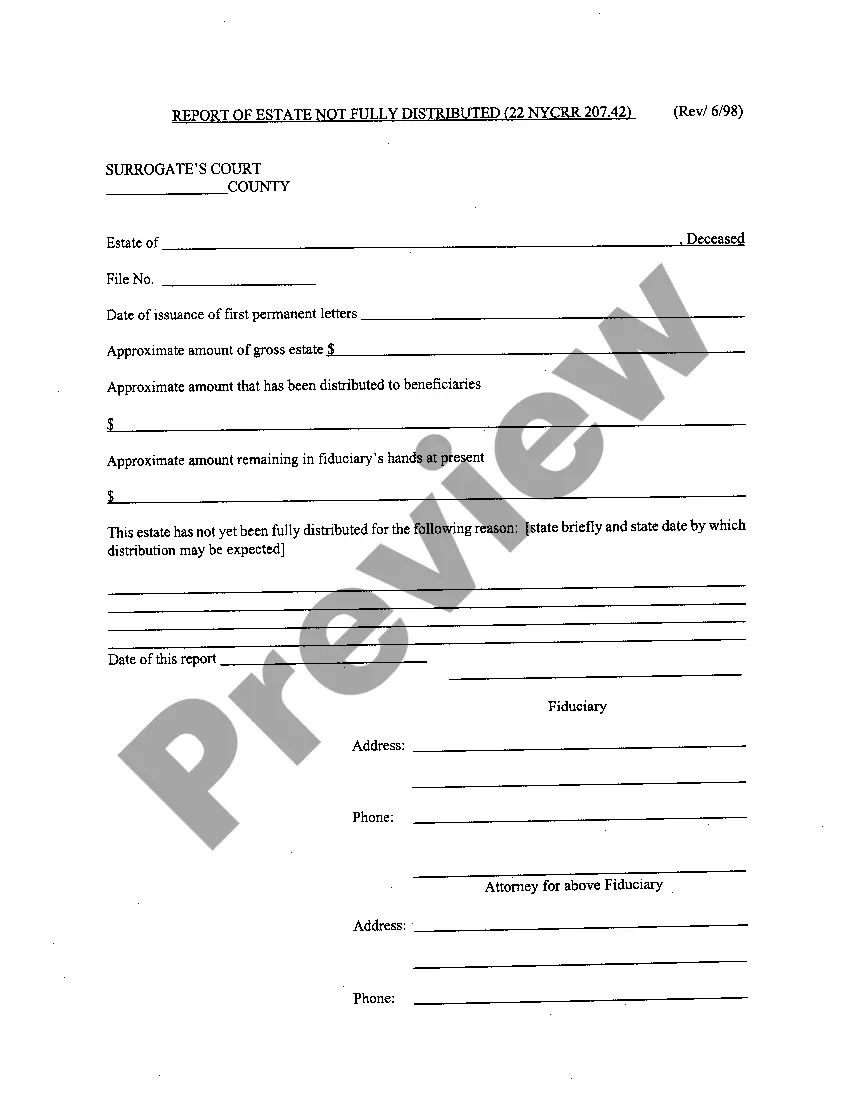

Creating documents isn't the most easy job, especially for people who almost never work with legal paperwork. That's why we advise utilizing accurate Pennsylvania Limited Liability Company LLC Operating Agreement templates made by professional attorneys. It gives you the ability to stay away from troubles when in court or working with official institutions. Find the files you need on our website for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the template web page. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Customers with no an active subscription can quickly create an account. Look at this short step-by-step guide to get your Pennsylvania Limited Liability Company LLC Operating Agreement:

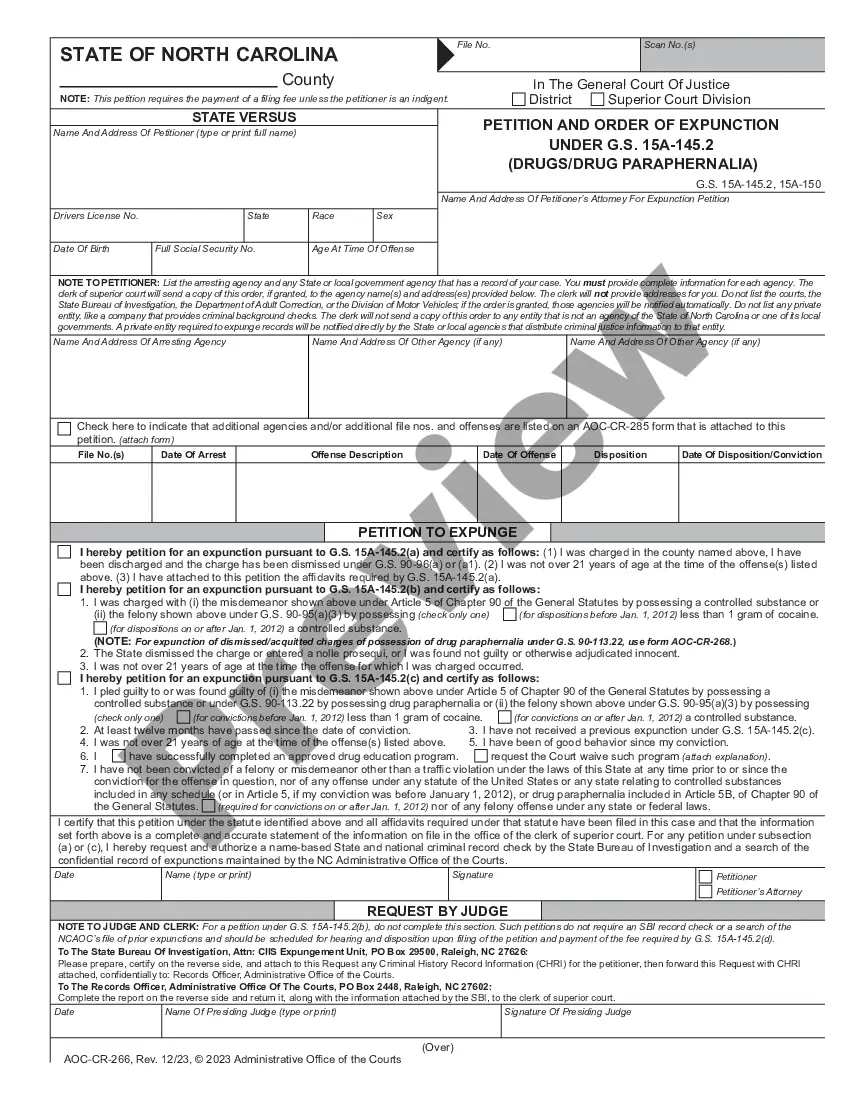

- Make certain that the sample you found is eligible for use in the state it’s required in.

- Verify the document. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this file is what you need or utilize the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after doing these easy actions, you can fill out the sample in a preferred editor. Double-check filled in information and consider requesting a legal representative to examine your Pennsylvania Limited Liability Company LLC Operating Agreement for correctness. With US Legal Forms, everything gets much easier. Test it now!

Limited Liability Llc Form popularity

Pa Llc Other Form Names

Liability Company Llc FAQ

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

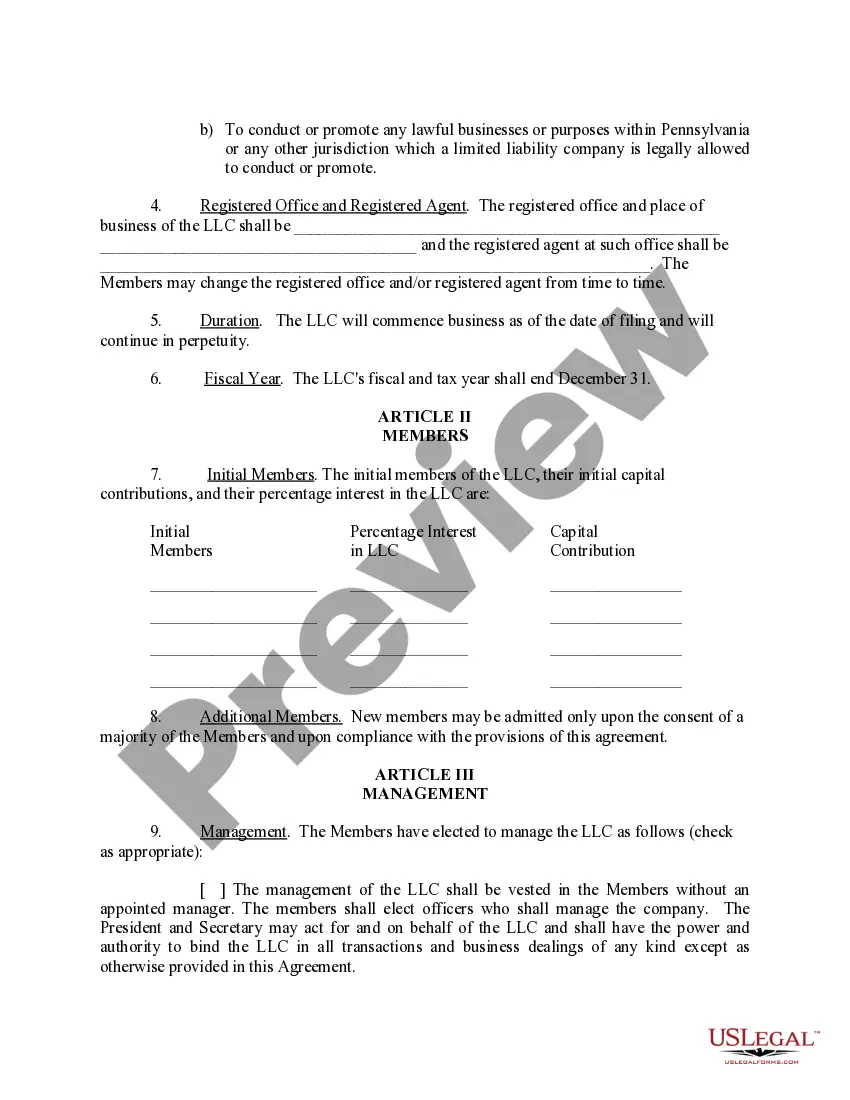

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

Pennsylvania does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.