Pennsylvania Single Member Limited Liability Company LLC Operating Agreement

Description Limited Liability Llc

How to fill out Single Member Llc Operating Agreement Pa?

Creating documents isn't the most simple process, especially for people who rarely work with legal papers. That's why we advise using accurate Pennsylvania Single Member Limited Liability Company LLC Operating Agreement templates created by skilled lawyers. It gives you the ability to prevent problems when in court or handling formal organizations. Find the files you want on our website for high-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the template web page. After getting the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can quickly get an account. Utilize this short step-by-step help guide to get the Pennsylvania Single Member Limited Liability Company LLC Operating Agreement:

- Be sure that the form you found is eligible for use in the state it is required in.

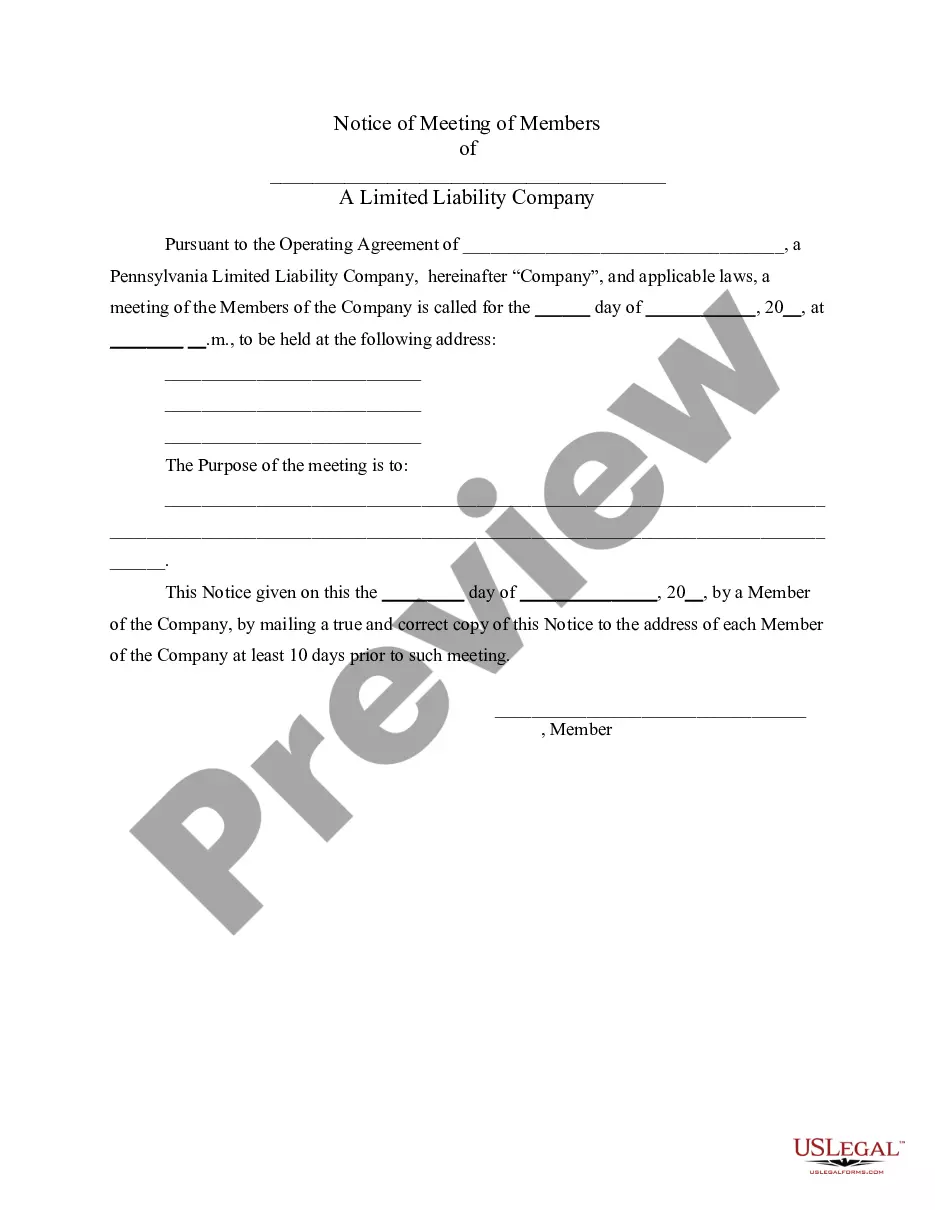

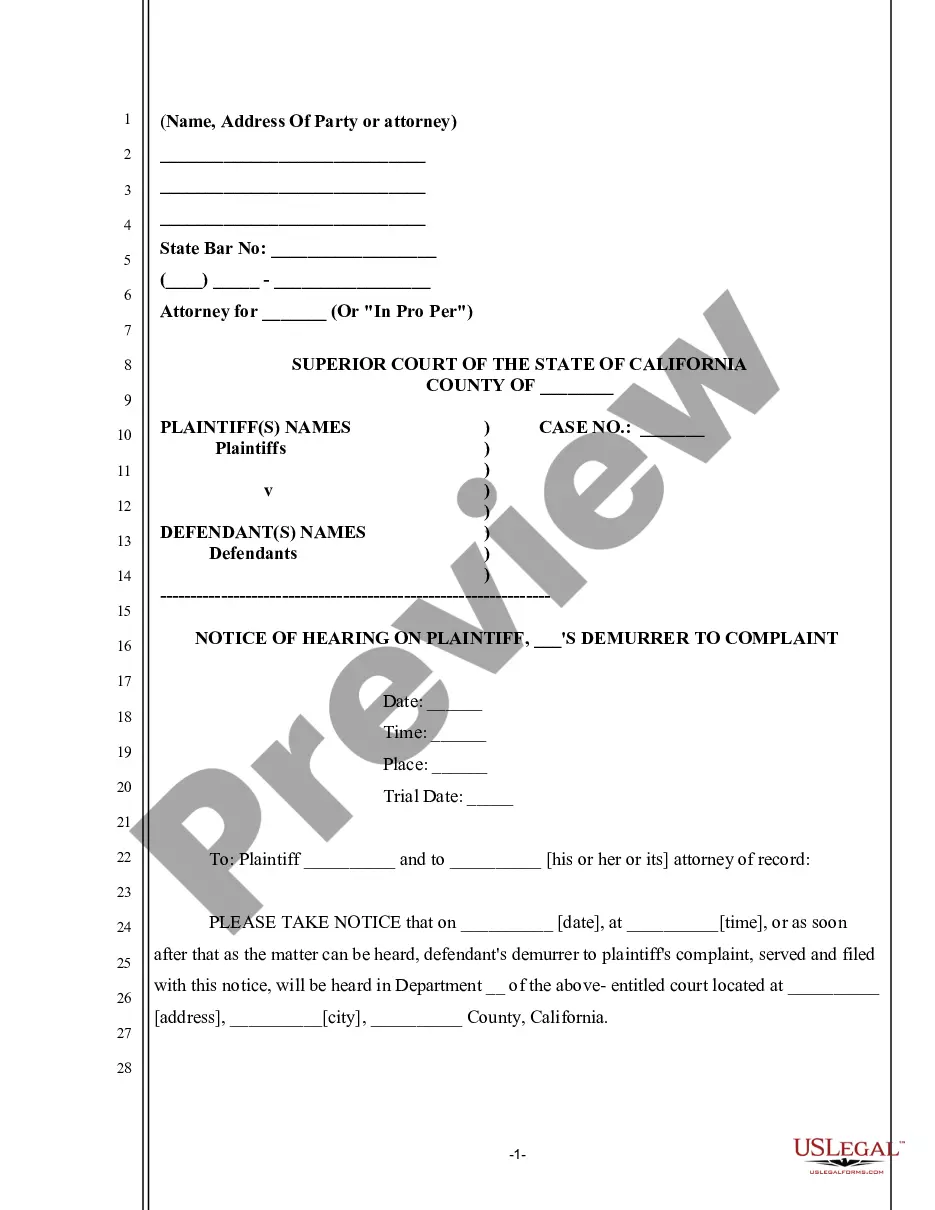

- Verify the document. Use the Preview feature or read its description (if offered).

- Buy Now if this template is what you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these easy actions, it is possible to fill out the form in an appropriate editor. Check the completed information and consider asking an attorney to review your Pennsylvania Single Member Limited Liability Company LLC Operating Agreement for correctness. With US Legal Forms, everything gets much easier. Try it now!

Operating Agreement Llc Pa Form popularity

Llc Operating Agreement Other Form Names

Limited Liability Company Agreement FAQ

Pennsylvania does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

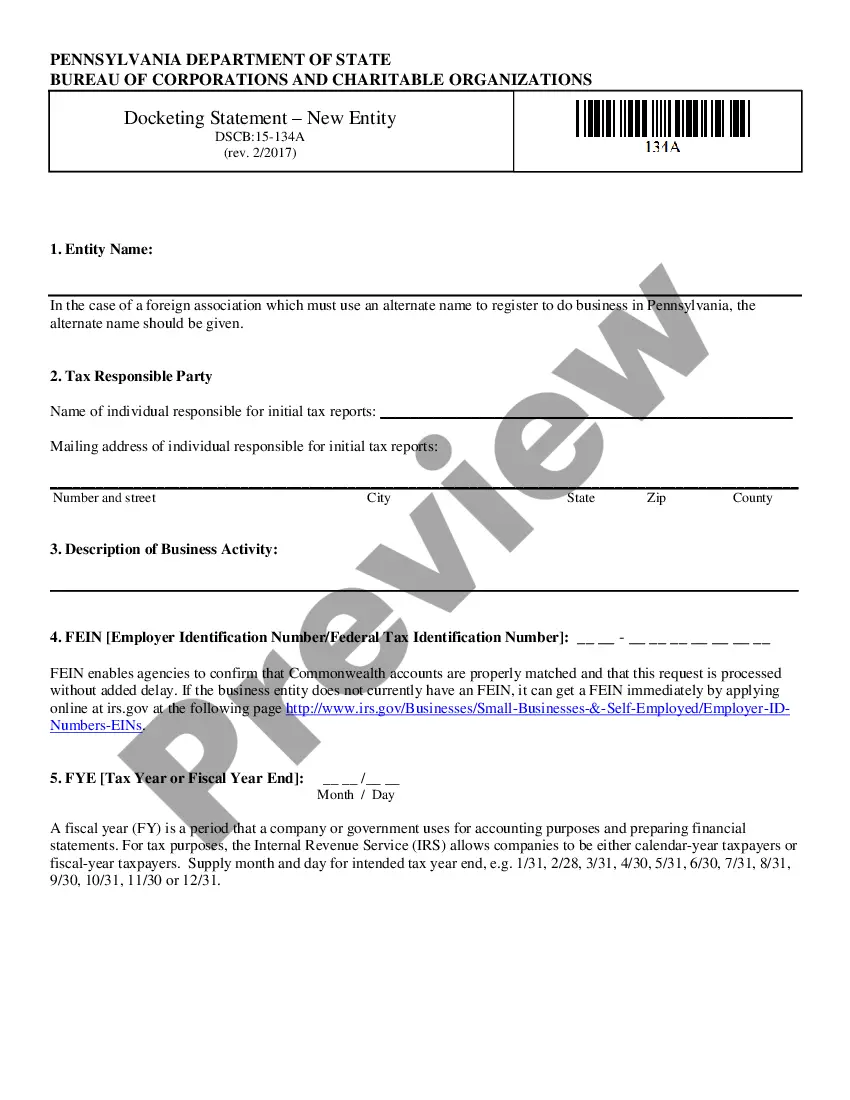

Want to form a single-member LLC (SMLLC) in Pennsylvania? Here's what you need to know. These are the steps to form a single-member limited liability company (SMLLC) in Pennsylvania. Remember: For most formation purposes, a Pennsylvania SMLLC is considered the same as a multi-member limited liability company (LLC).

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.