Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession

Description Property Succession Fillable

How to fill out Pa Intestate Succession Order?

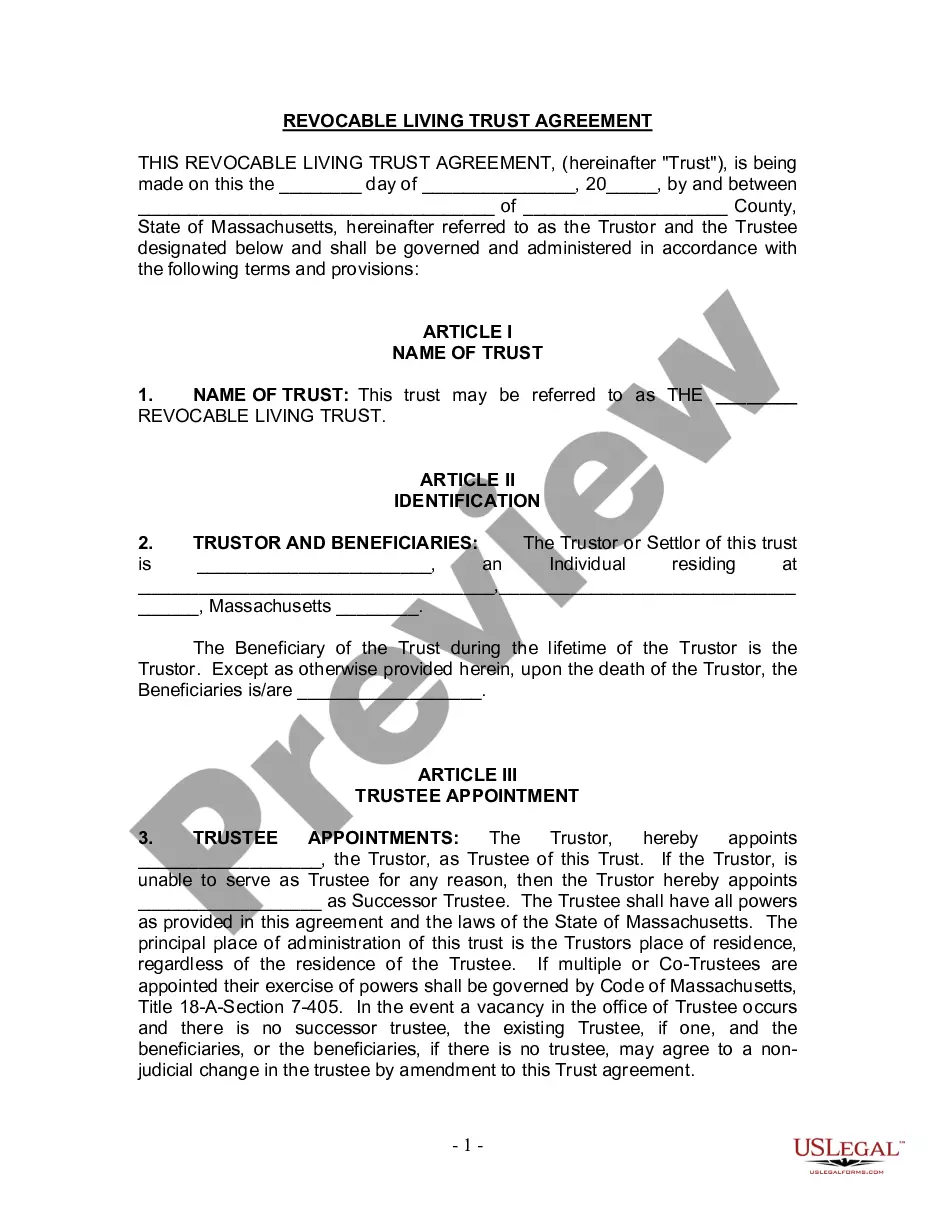

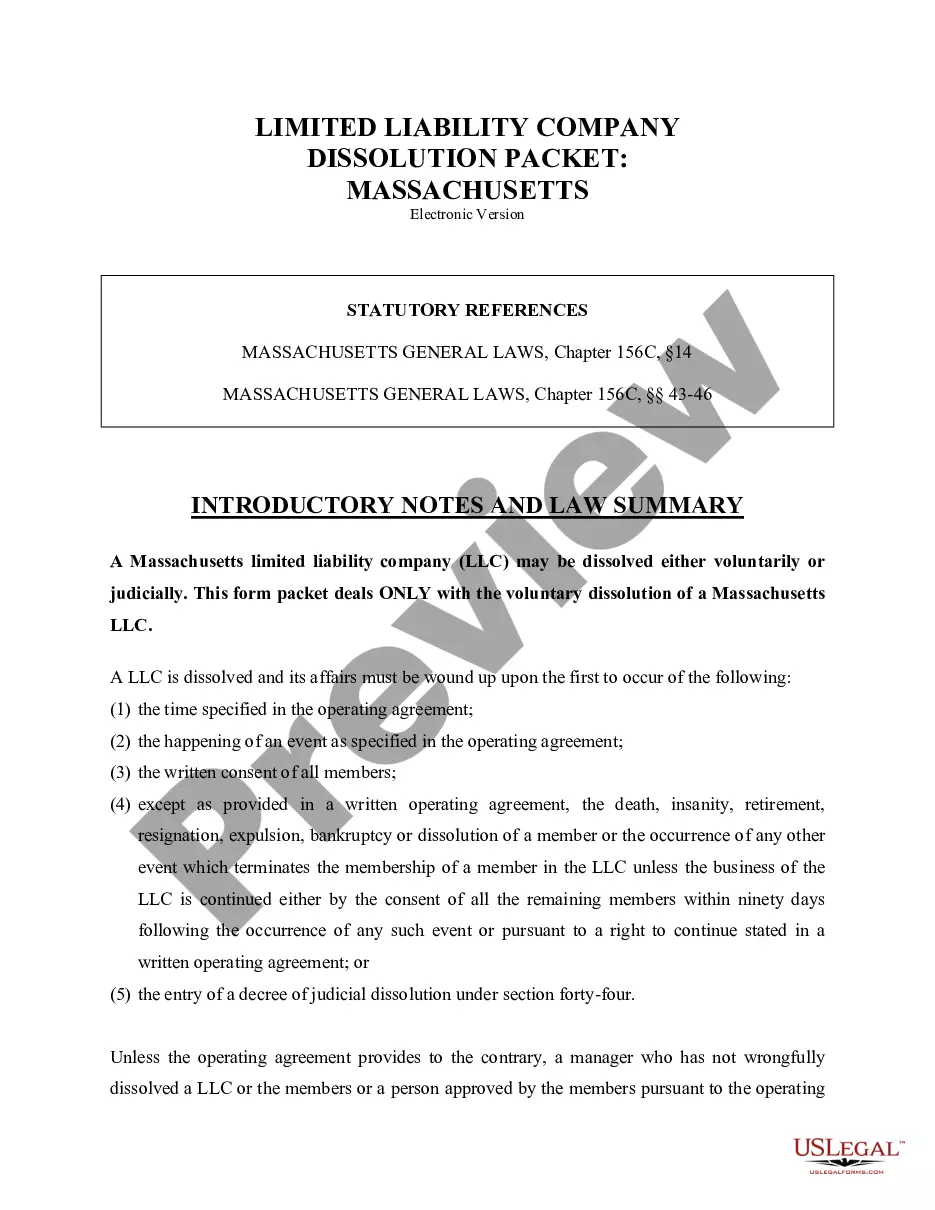

The work with documents isn't the most simple process, especially for those who rarely deal with legal papers. That's why we recommend making use of accurate Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession samples made by professional lawyers. It allows you to prevent problems when in court or dealing with official institutions. Find the templates you require on our site for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the template webpage. Right after downloading the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can easily create an account. Look at this simple step-by-step guide to get the Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession:

- Make certain that the form you found is eligible for use in the state it is needed in.

- Verify the document. Use the Preview feature or read its description (if available).

- Buy Now if this file is what you need or utilize the Search field to get a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these simple actions, you are able to complete the form in a preferred editor. Check the completed info and consider asking a legal professional to review your Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Pa Intestate Succession Form popularity

Intestate Succession Pa Other Form Names

Pa Intestate Pennsylvania FAQ

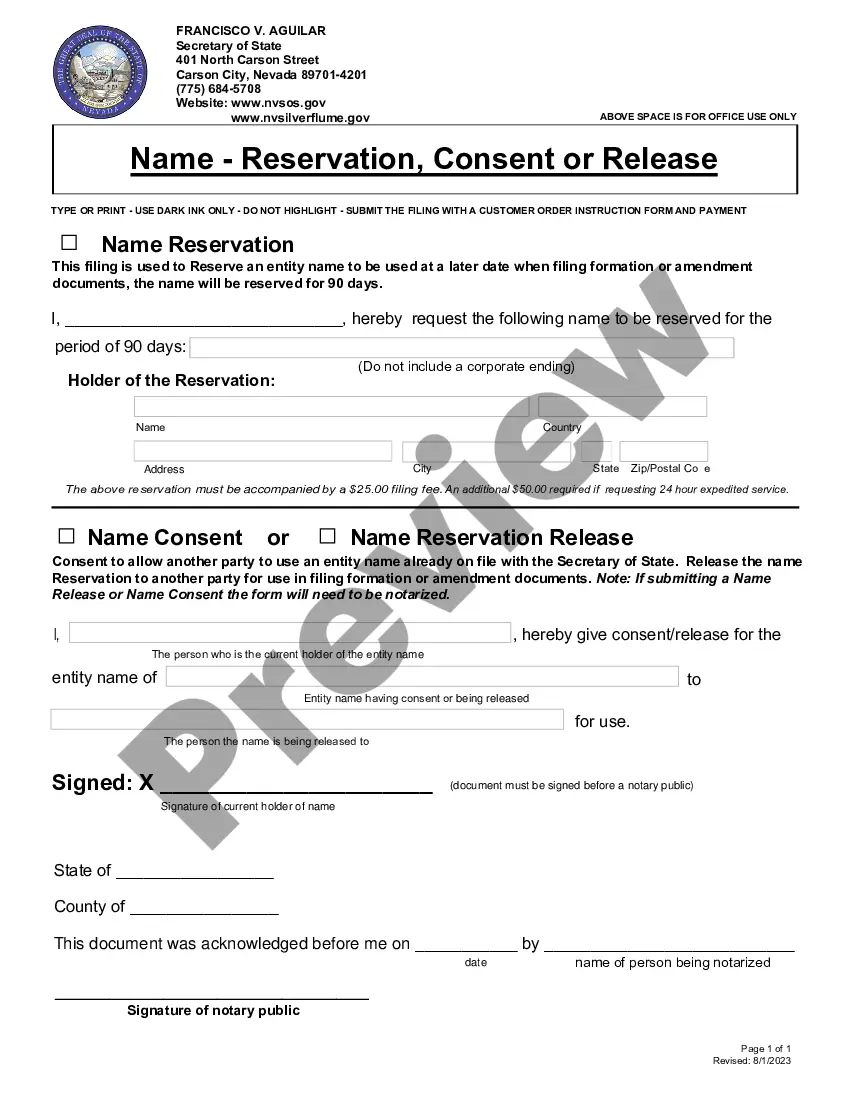

The disclaimer deed is a legal document that has legal consequences. Further, the disclaimer deed will clearly state that the spouse signing it is waiving (disclaiming) any interest in the house being purchased.

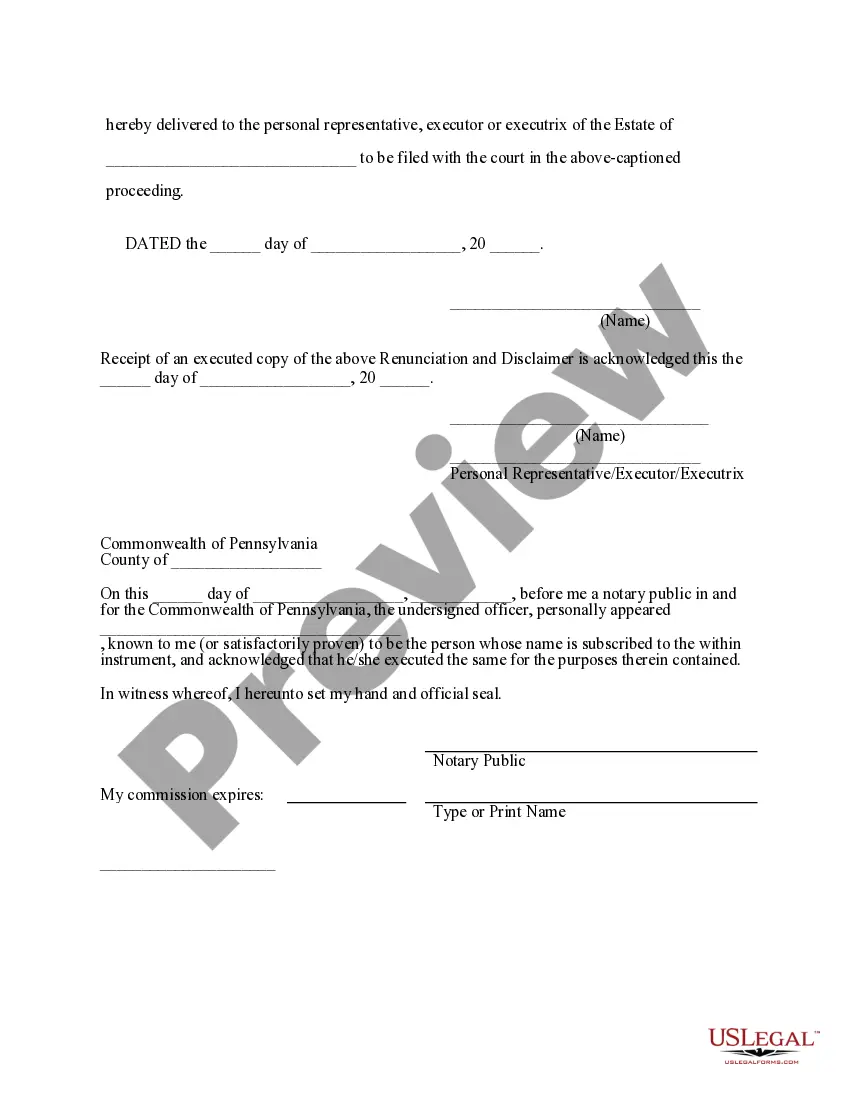

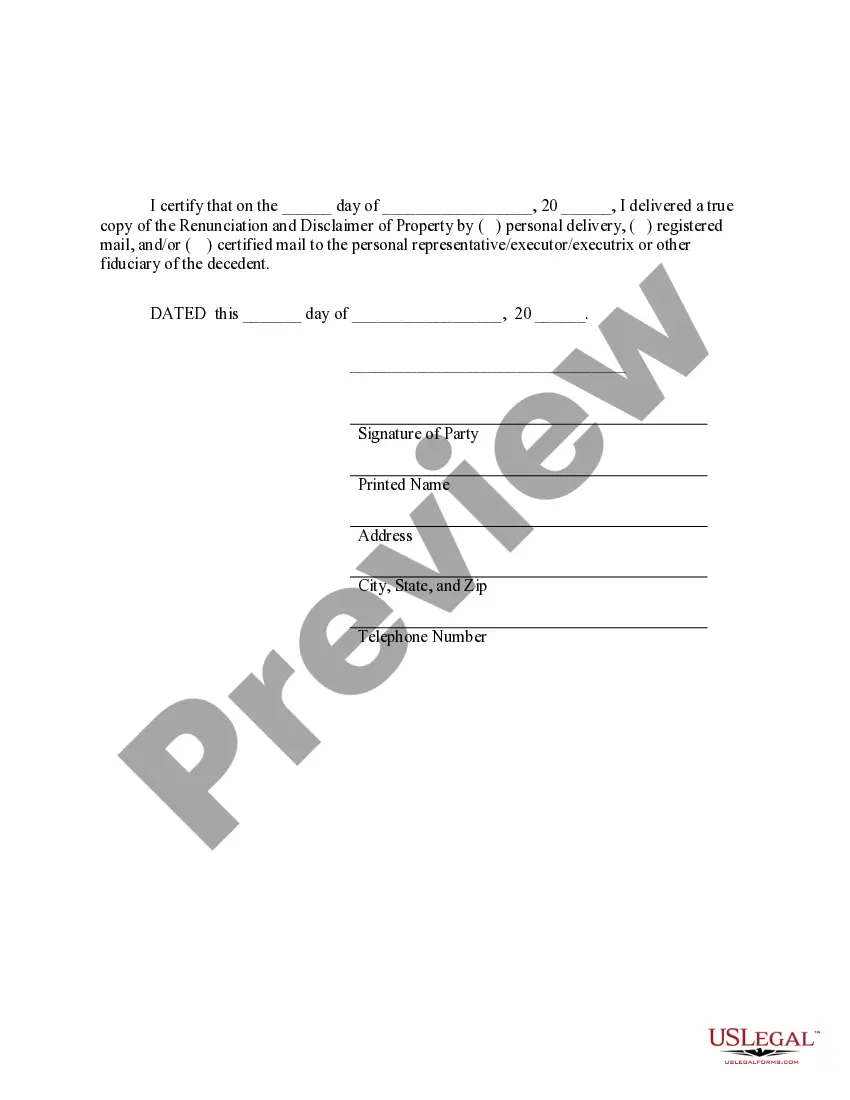

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument.A gift, bequest, or other interest or obligation may be disclaimed via a written disclaimer of interest.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

A beneficiary of an estate, whether by Will or the laws of intestacy is perfectly within their rights to reject their inheritance. Beneficiaries may wish to vary dispositions of property following death in order to redirect benefits to other family members who are more in need or less well provided for and to save tax.