Pennsylvania Quitclaim Deed from Individual to Husband and Wife

Description Where Can I Get A Blank Quit Claim Deed Form

How to fill out Quick Claim Deed Form Pennsylvania?

Creating papers isn't the most straightforward job, especially for people who almost never work with legal paperwork. That's why we advise making use of accurate Pennsylvania Quitclaim Deed from Individual to Husband and Wife samples made by skilled attorneys. It allows you to eliminate troubles when in court or handling formal organizations. Find the templates you require on our site for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the template web page. After getting the sample, it will be saved in the My Forms menu.

Users without an active subscription can easily create an account. Follow this simple step-by-step help guide to get your Pennsylvania Quitclaim Deed from Individual to Husband and Wife:

- Make certain that file you found is eligible for use in the state it’s needed in.

- Verify the document. Utilize the Preview option or read its description (if offered).

- Buy Now if this file is what you need or return to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after finishing these easy steps, you can fill out the form in your favorite editor. Double-check filled in information and consider requesting a legal professional to review your Pennsylvania Quitclaim Deed from Individual to Husband and Wife for correctness. With US Legal Forms, everything gets much easier. Try it out now!

Pennsylvania Quitclaim Deed Form popularity

Quit Claim Deed Pennsylvania Other Form Names

Quick Claim Deed Pennsylvania FAQ

A quitclaim deed doesn't always need to be signed before the divorce is final. Your divorce judgment will detail the terms of your property settlement agreement, and the requirement for transferring title will likely be incorporated into this agreement.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

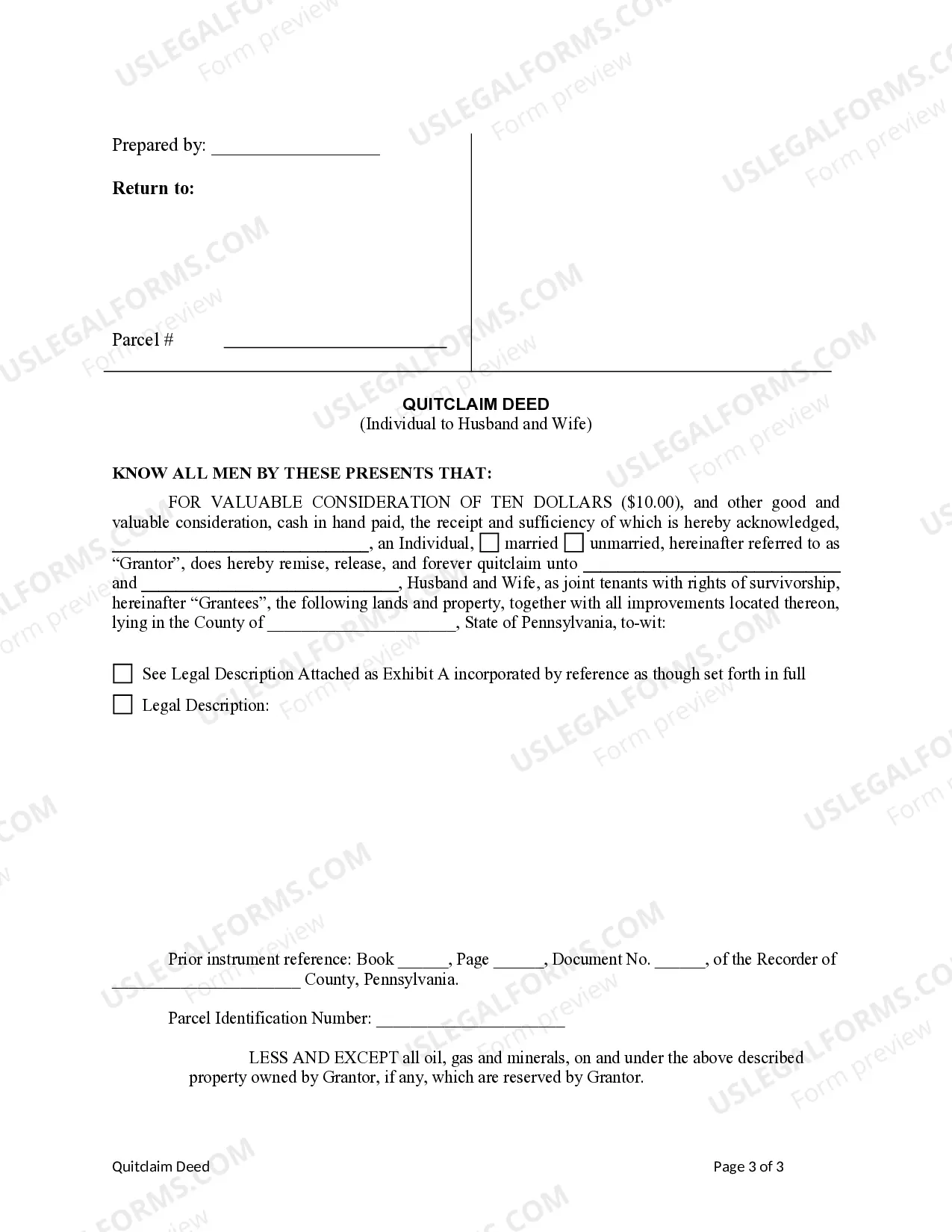

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

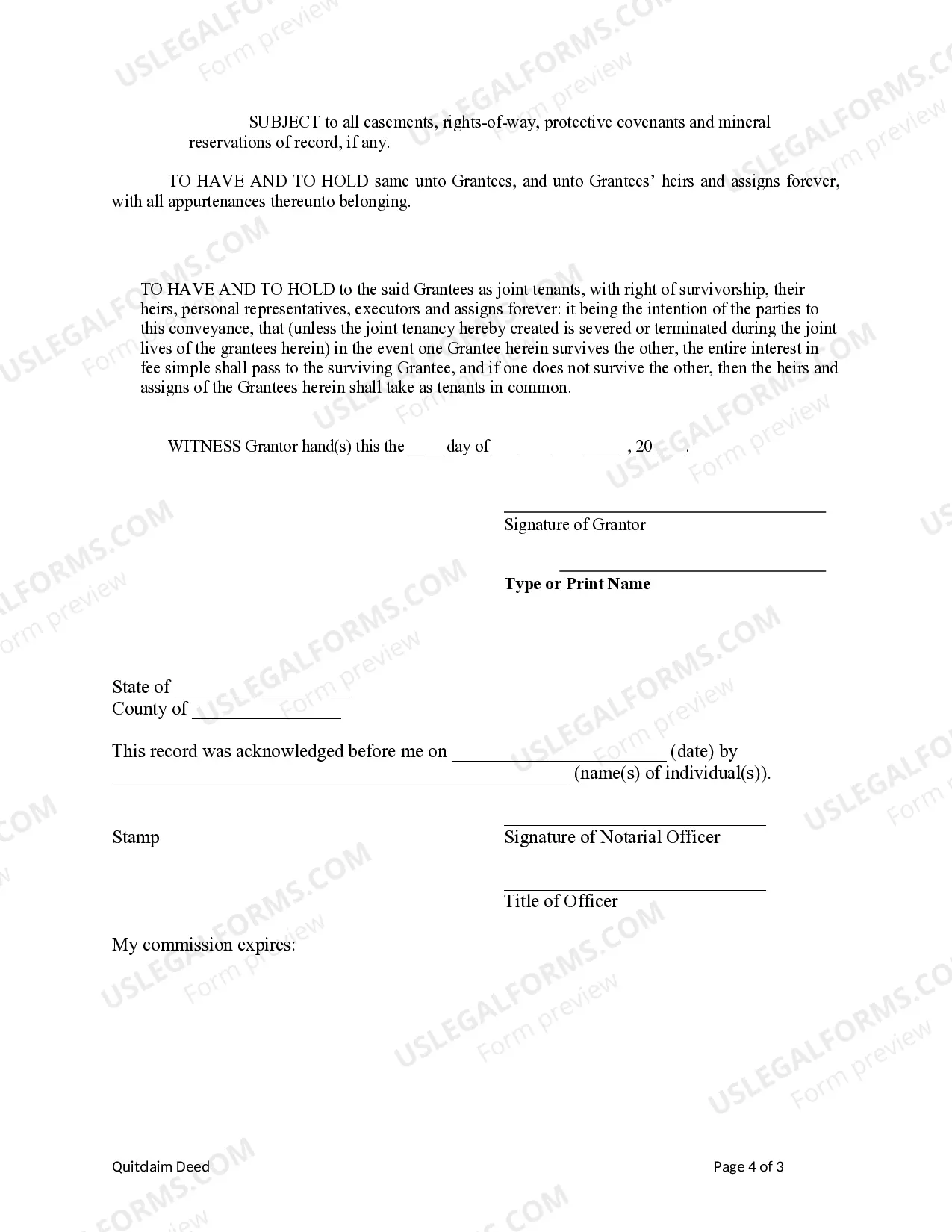

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.