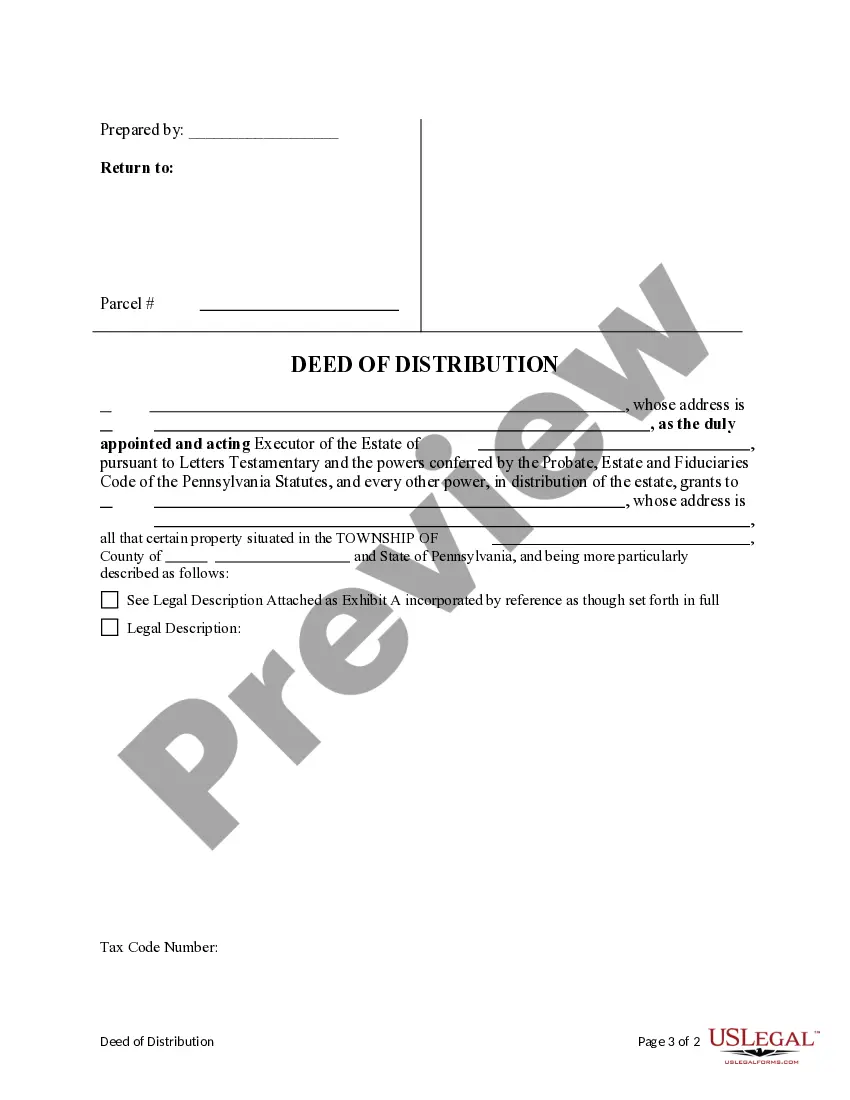

This form is a Deed of Distribution where the Grantor is the executor or personal representative of an estate and the Grantee is the beneficiary of the estate or purchaser of the real property. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual

Description Personal Representative Form Application

Understanding the Deed of Distribution

A Deed of Distribution is a legal document executed by the executor or administrator of an estate. It officially transfers title and ownership of assets from the deceased's estate to the heirs or beneficiaries as designated in the will or according to the state's intestacy laws.

Roles and Responsibilities of an Executor in Deed of Distribution

- Identify all assets within the estate.

- Assess and verify the legitimacy of all claims against the estate.

- Ensure all debts and taxes of the estate are paid.

- Distribute the remaining assets to the rightful beneficiaries.

- Execute and file the deed of distribution with relevant authorities.

Step-by-Step Guide to Preparing a Deed of Distribution

- Collect and inventory the estate's assets.

- Pay off any existing debts and obligations.

- Confirm beneficiary designations and entitlements.

- Prepare the deed of distribution document.

- Sign the deed before a notary public.

- File the deed with the local registry of deeds or similar authority.

Risk Analysis in the Execution of a Deed of Distribution

Executing a deed of distribution involves certain risks such as misidentification of assets, claims by omitted creditors, and legal challenges from dissatisfied beneficiaries. Proper due diligence and legal guidance are essential in mitigating these risks.

Comparison of Executor Duties in Different States

| State | Notice Requirements | Filing Requirements |

|---|---|---|

| California | Notice to creditors and beneficiaries | File deed with county recorder |

| New York | Notice to Attorney General if charitable bequests are involved | Mandatory filing within 9 months |

How to fill out What Is A Deed Of Distribution?

Creating documents isn't the most simple job, especially for people who rarely work with legal paperwork. That's why we recommend utilizing correct Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual samples made by skilled attorneys. It gives you the ability to stay away from troubles when in court or handling official organizations. Find the files you require on our website for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the template webpage. Right after getting the sample, it’ll be saved in the My Forms menu.

Users with no a subscription can easily get an account. Make use of this brief step-by-step guide to get the Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual:

- Be sure that file you found is eligible for use in the state it is necessary in.

- Confirm the document. Utilize the Preview option or read its description (if readily available).

- Buy Now if this file is what you need or use the Search field to get another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these easy steps, you are able to complete the form in a preferred editor. Recheck completed info and consider requesting an attorney to examine your Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Deed Distribution Representative Form Uslegal Form popularity

Deed Personal Representative Other Form Names

Personal Representative Form Pdf FAQ

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

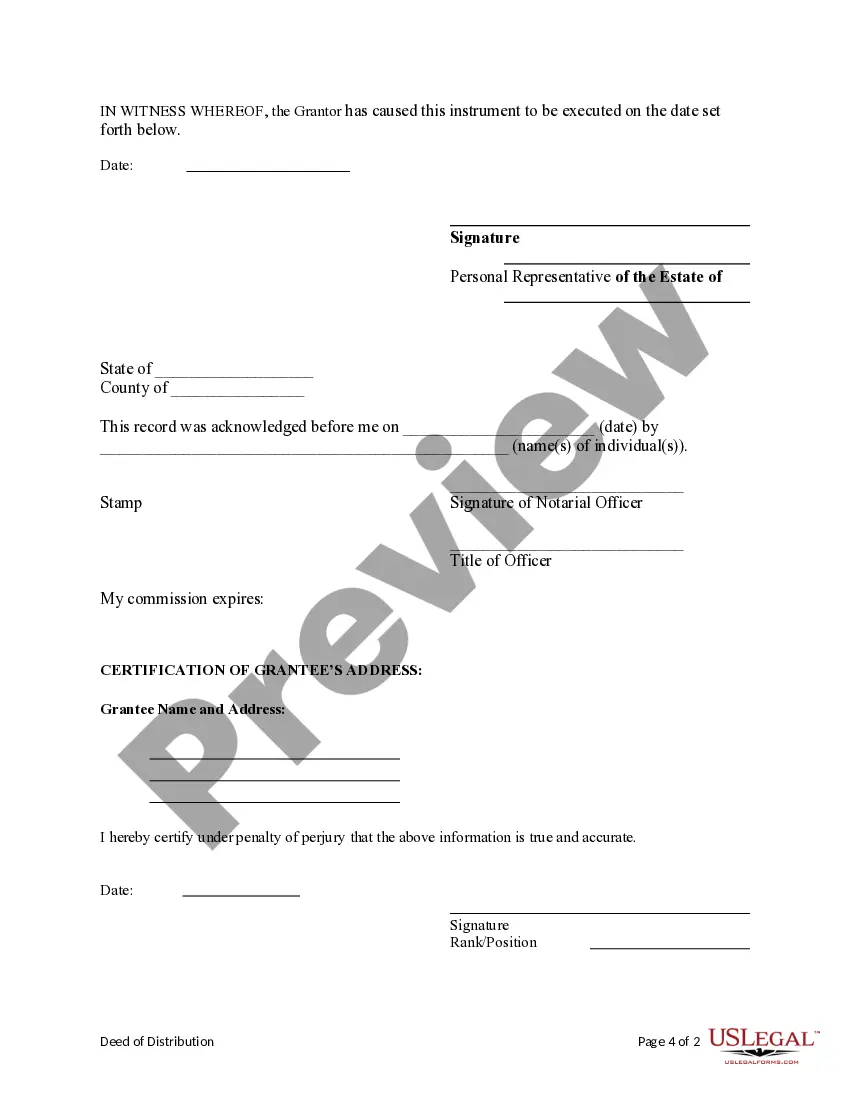

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

You can do this by simply signing your name and putting your title of executor of the estate afterward. One example of an acceptable signature would be Signed by Jane Doe, Executor of the Estate of John Doe, Deceased. Of course, many institutions may not simply take your word that you are the executor of the estate.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

Can I start the estate process without them? Co-Executors in Pennsylvania must serve jointly.

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.