Pennsylvania Warranty Deed from Husband and Wife to a Trust

Description Pennsylvania Deed Wife

How to fill out Pennsylvania Warranty Deed From Husband And Wife To A Trust?

Creating papers isn't the most easy task, especially for those who almost never deal with legal papers. That's why we advise utilizing correct Pennsylvania Warranty Deed from Husband and Wife to a Trust templates created by skilled lawyers. It gives you the ability to stay away from problems when in court or dealing with official organizations. Find the files you require on our website for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template web page. Soon after getting the sample, it will be saved in the My Forms menu.

Customers without a subscription can easily create an account. Make use of this brief step-by-step help guide to get your Pennsylvania Warranty Deed from Husband and Wife to a Trust:

- Be sure that the document you found is eligible for use in the state it is required in.

- Verify the document. Make use of the Preview option or read its description (if readily available).

- Click Buy Now if this sample is what you need or use the Search field to find another one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these straightforward actions, you are able to fill out the form in a preferred editor. Check the filled in information and consider asking a legal representative to examine your Pennsylvania Warranty Deed from Husband and Wife to a Trust for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

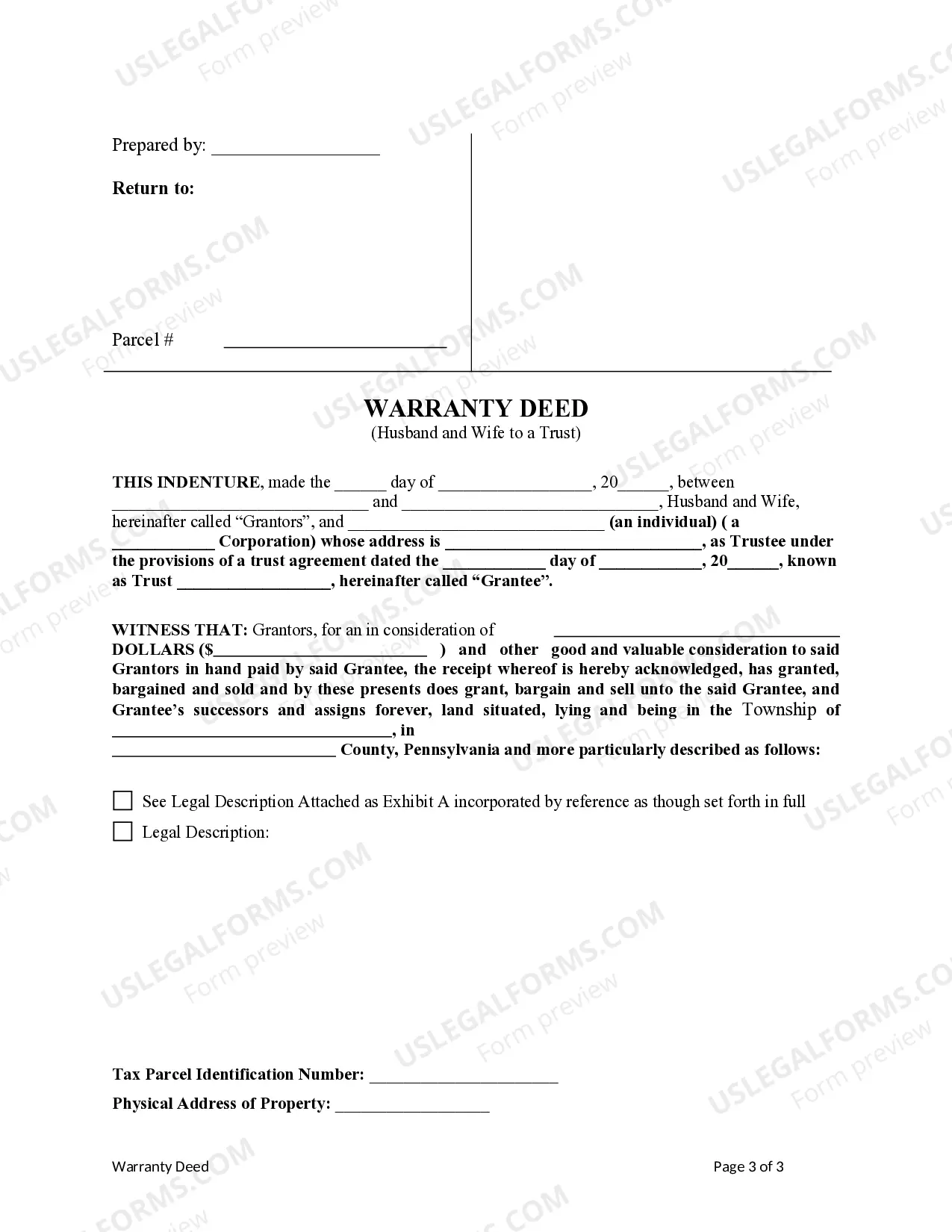

A trustee deed offers no such warranties about the title.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

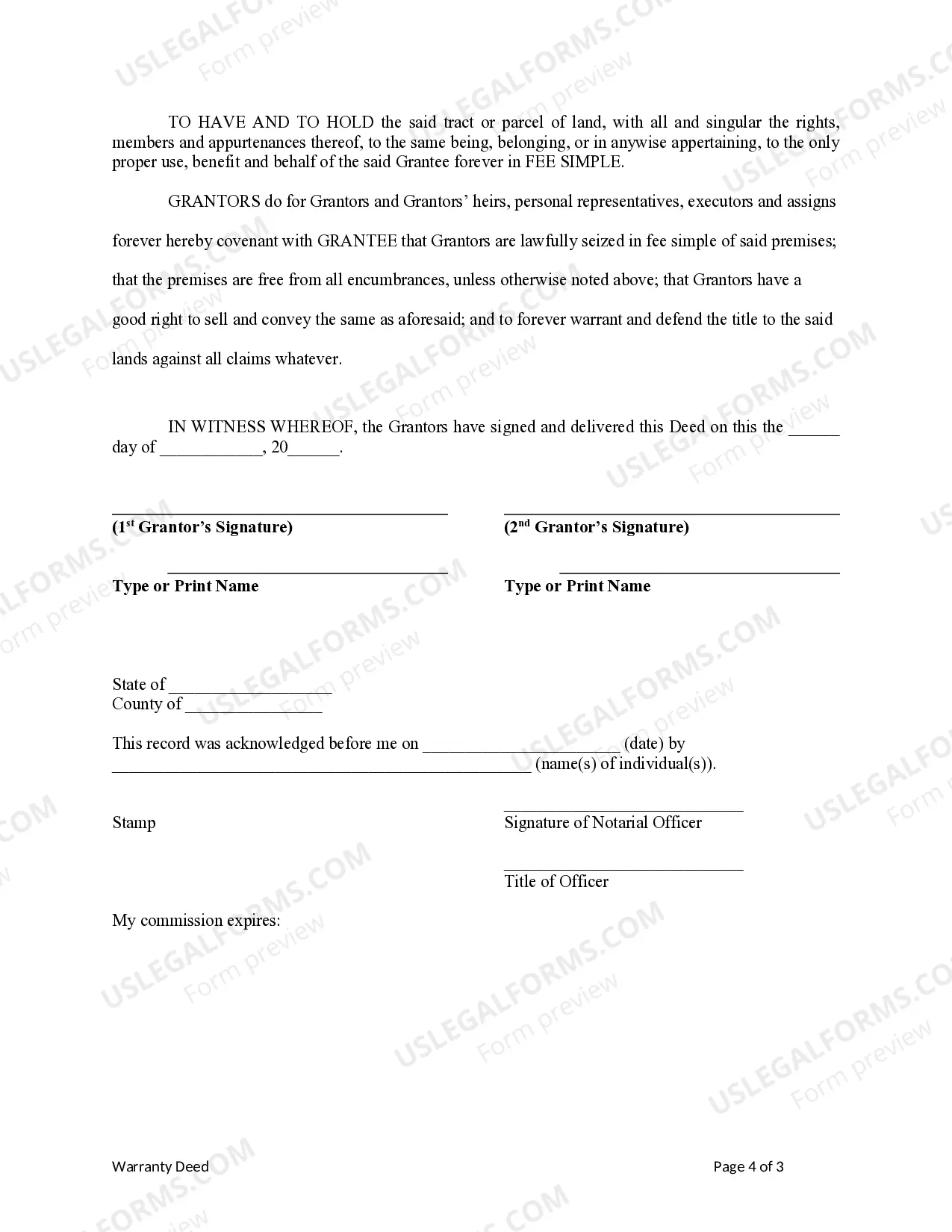

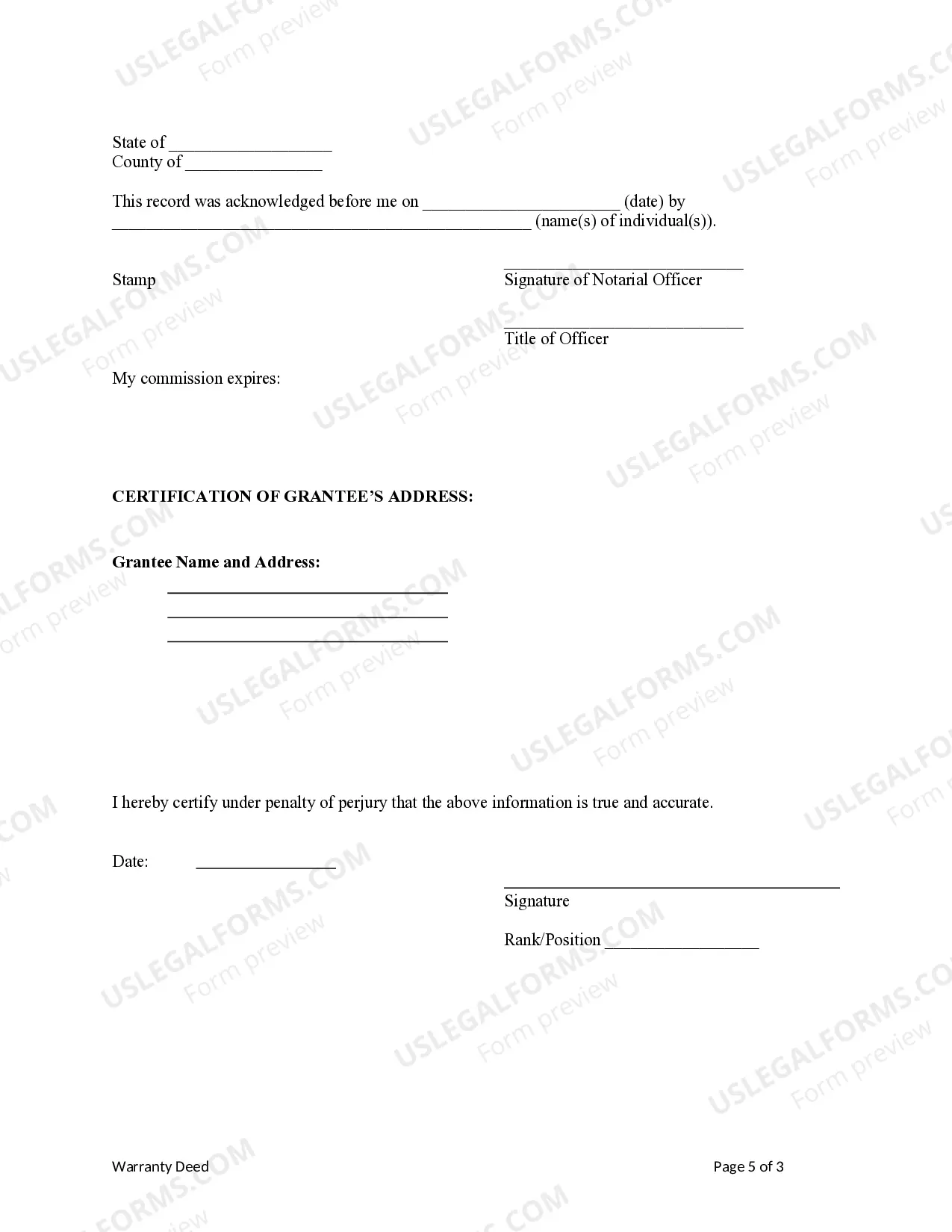

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.