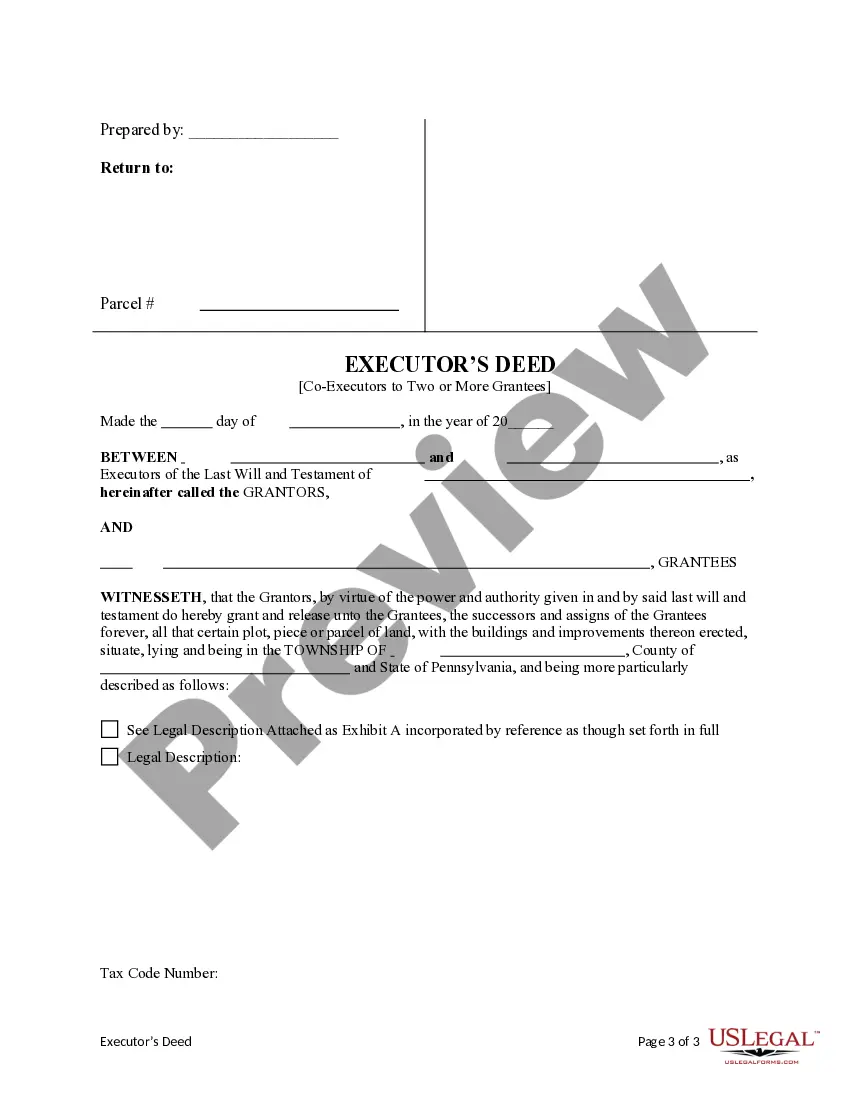

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Executor's Deed, can be used in the transfer process or related task. Adapt the language to fit your circumstances.

Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees

Description Executor's Deed Form

How to fill out Executor's Deed?

The work with papers isn't the most uncomplicated task, especially for those who almost never deal with legal paperwork. That's why we advise making use of accurate Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees samples made by professional attorneys. It gives you the ability to stay away from troubles when in court or handling formal institutions. Find the templates you require on our website for high-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the file page. Soon after downloading the sample, it will be saved in the My Forms menu.

Users without an active subscription can easily create an account. Look at this simple step-by-step guide to get your Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees:

- Make certain that the form you found is eligible for use in the state it is required in.

- Confirm the file. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this file is what you need or use the Search field to get another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these easy actions, you are able to complete the form in your favorite editor. Check the completed data and consider requesting an attorney to review your Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Pennsylvania Executors Form popularity

Deed Two Form Uslegal Other Form Names

Legal Executor Pennsylvania FAQ

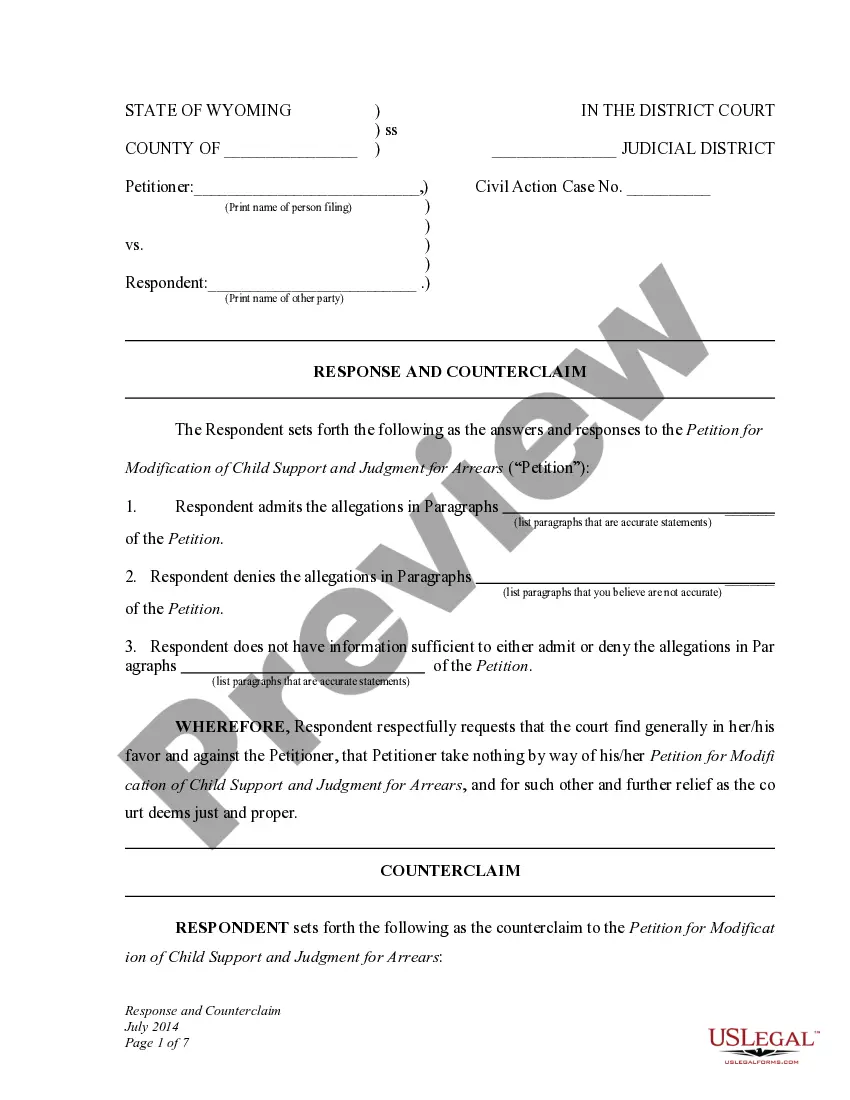

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.

A sole Executor is usually able to act alone during Probate, although there are some important factors to consider. A joint Executor will not usually be able to act alone unless the other Executors formally agree to this.

If one of the co-executors does not agree, then the estate cannot take the action. So, each co executor should be working together with the other co executor to administer the estate.

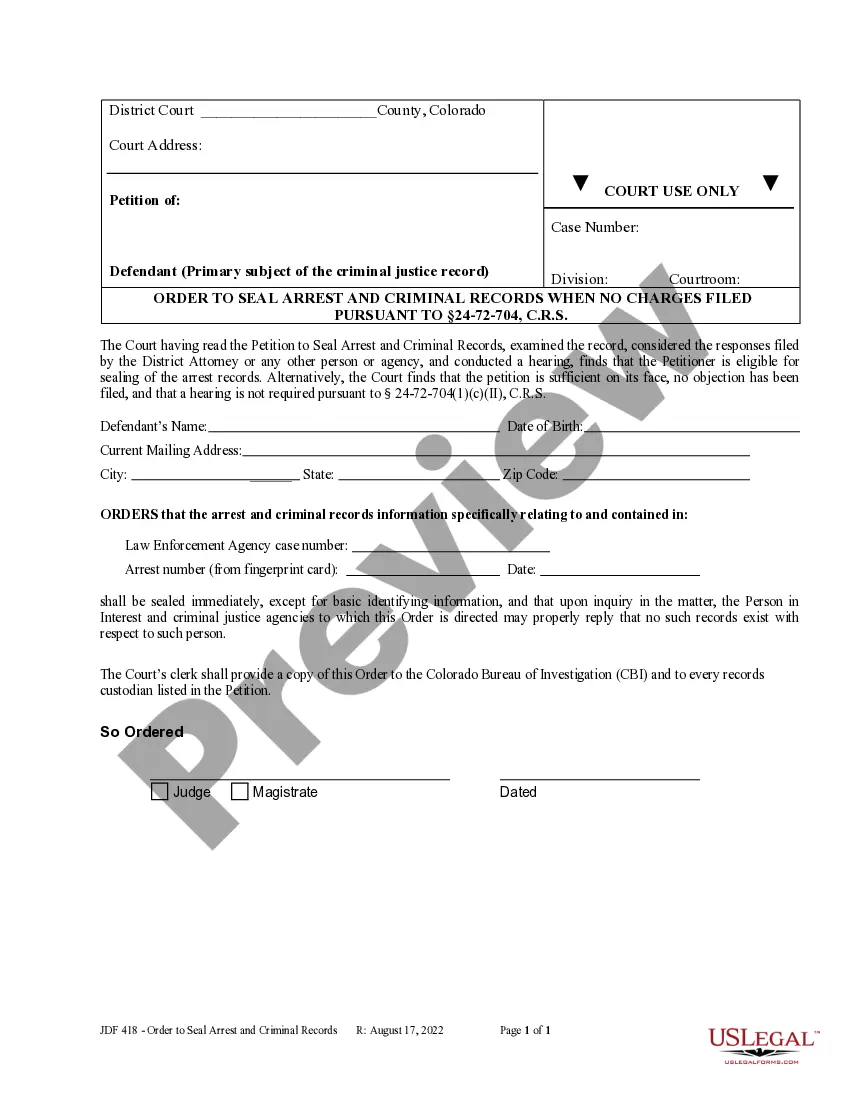

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Pennsylvania does not allow real estate to be transferred with transfer-on-death deeds.

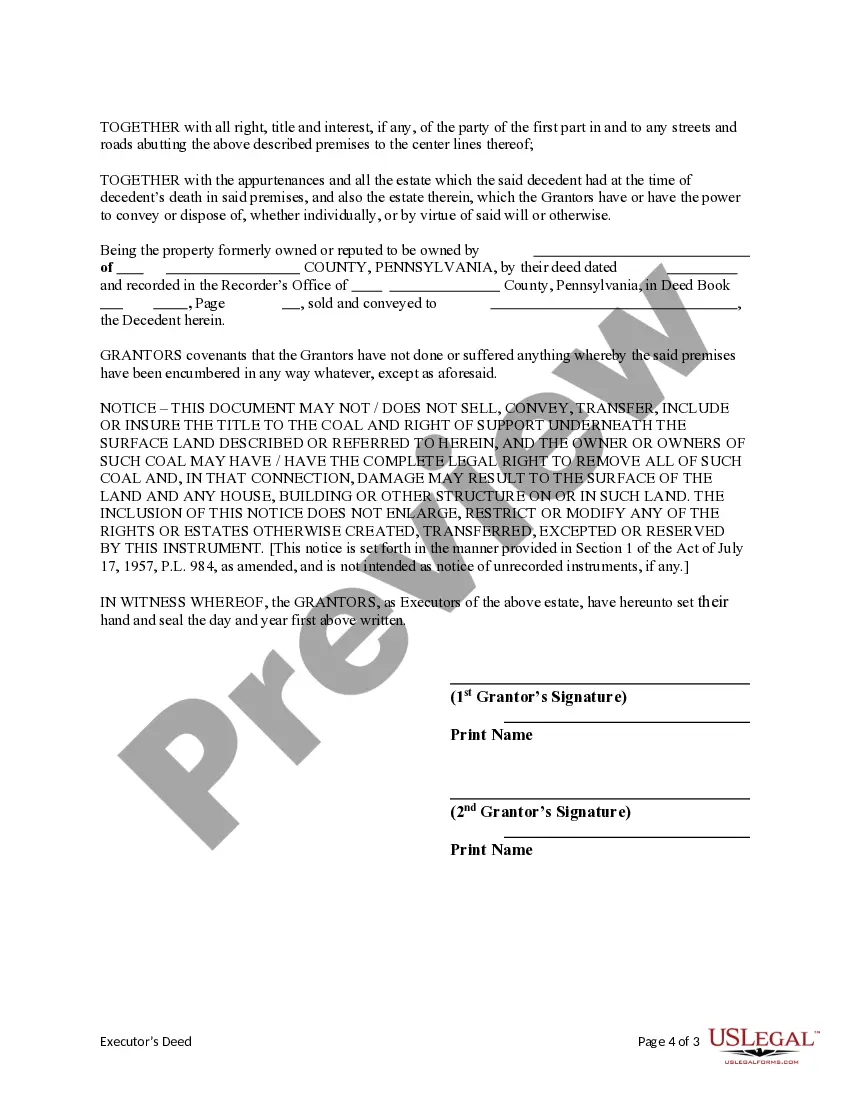

Both executors must sign the initial petition with the probate court. Typically, both executors will have to sign checks and other estate paperwork. Both executors may be responsible for filing tax returns. You have a duty to monitor the actions of the other executor and to report any unethical or illegal behavior.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

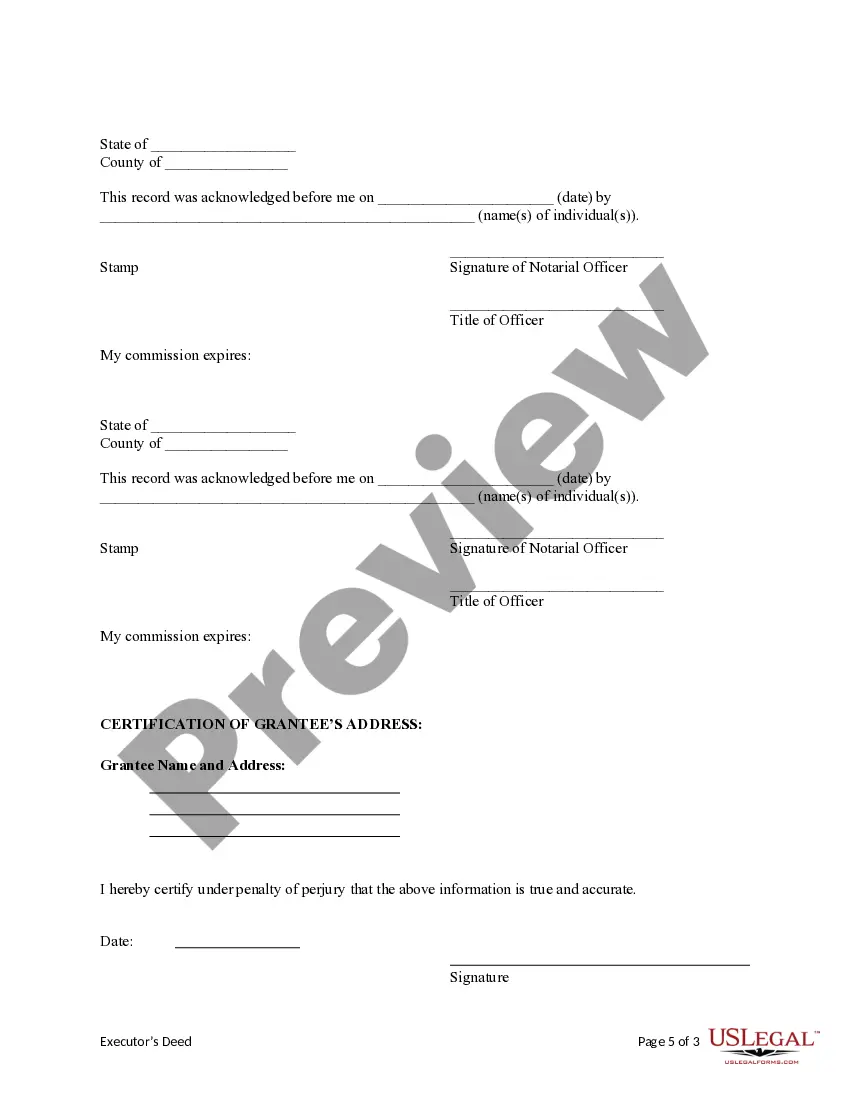

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Can I start the estate process without them? Co-Executors in Pennsylvania must serve jointly.