Pennsylvania Warranty Deed from Individual to Individual

Description West Virginia Warranty

How to fill out Pa Deed?

The work with documents isn't the most uncomplicated process, especially for those who almost never deal with legal paperwork. That's why we recommend using accurate Pennsylvania Warranty Deed from Individual to Individual templates created by professional attorneys. It allows you to prevent difficulties when in court or dealing with official institutions. Find the files you require on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will immediately appear on the file page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users without a subscription can quickly get an account. Utilize this brief step-by-step help guide to get the Pennsylvania Warranty Deed from Individual to Individual:

- Make certain that the document you found is eligible for use in the state it is needed in.

- Verify the file. Make use of the Preview option or read its description (if readily available).

- Click Buy Now if this sample is what you need or utilize the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these simple actions, you can fill out the form in an appropriate editor. Double-check filled in info and consider requesting a legal representative to review your Pennsylvania Warranty Deed from Individual to Individual for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Warranty Deed Form Blank Form popularity

Warranty Deed Form Printable Other Form Names

Warranty Deed General Printable FAQ

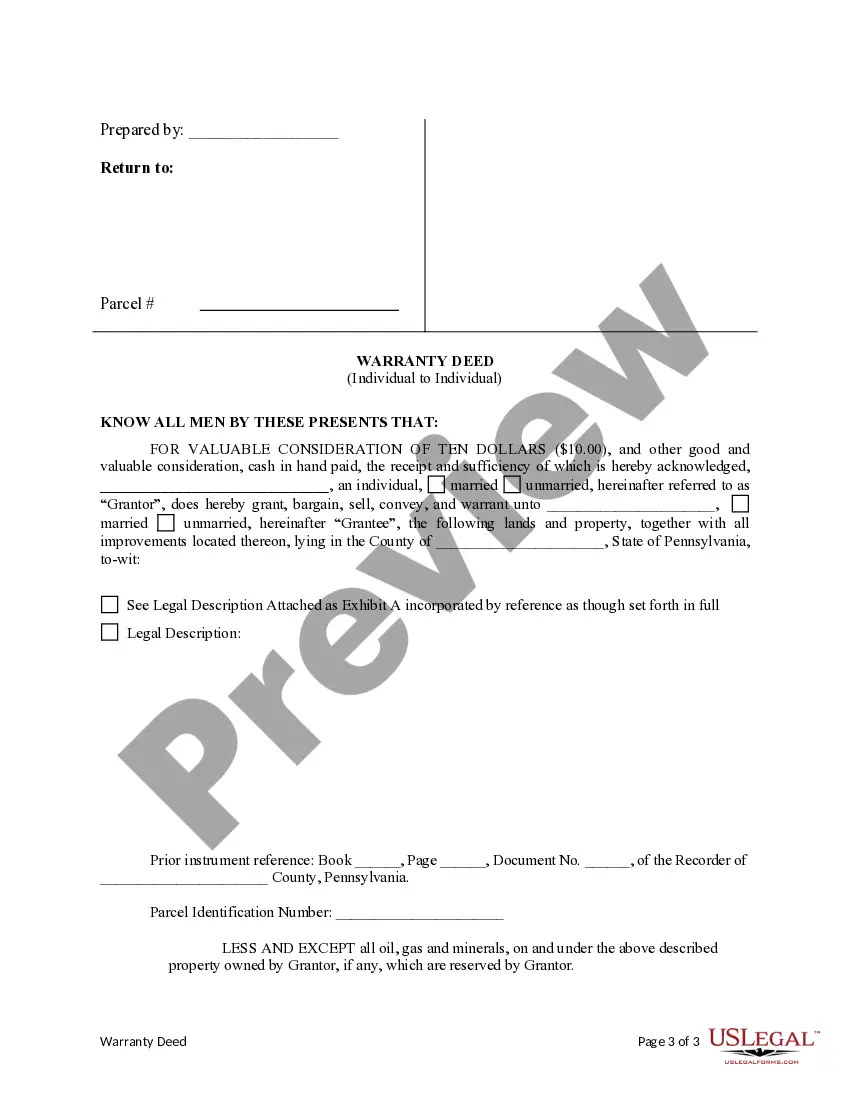

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

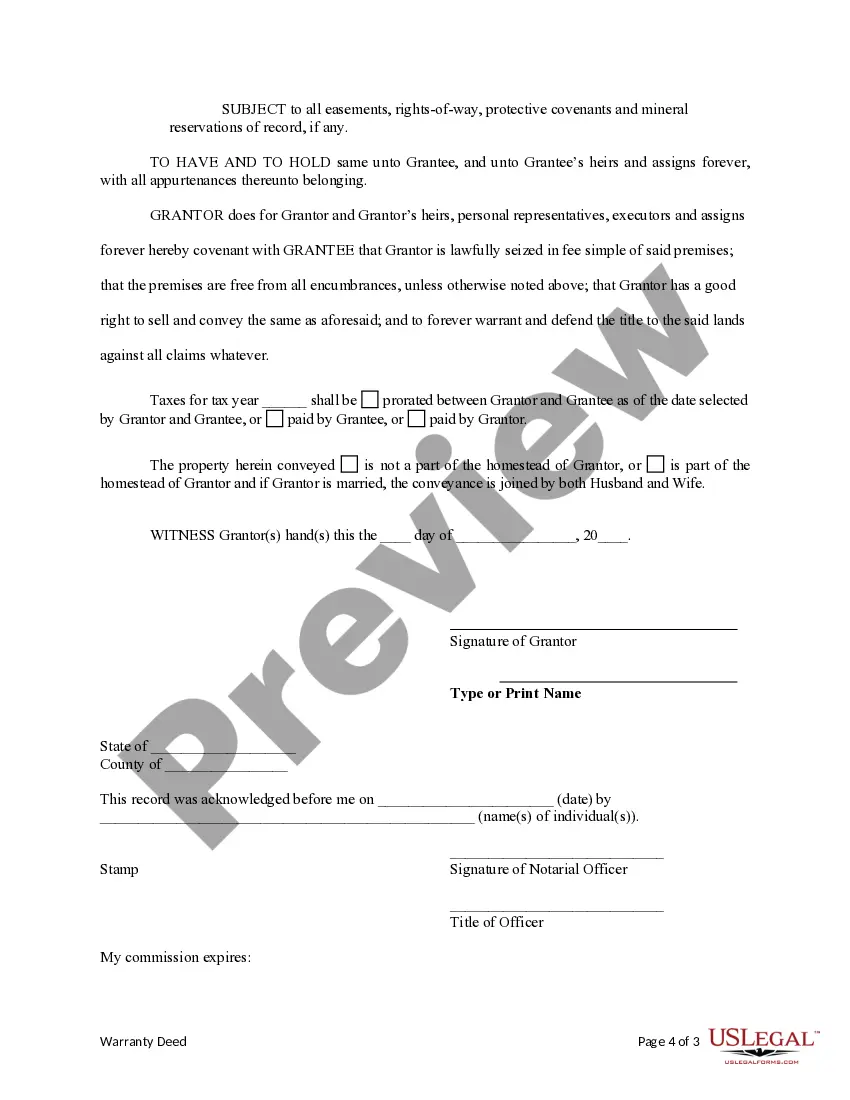

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Used to transfer property rights from a deceased person's estate. Involves Probate Court. Like a Quit Claim deed, there are no warranties. Generally, the Personal Representative is unwilling to warrant or promise anything relating to property that he/she has never personally owned.

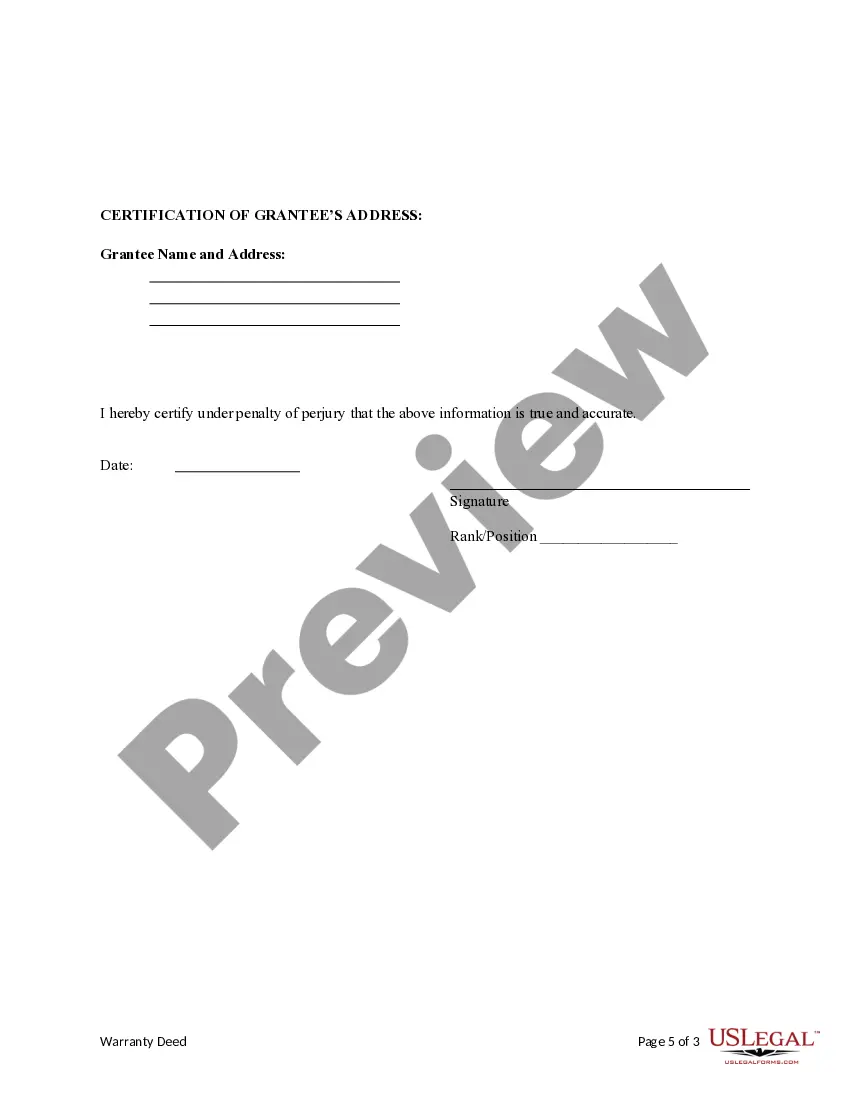

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.