Pennsylvania Gift Deed for Individual to Individual

Description Gift Deed Draft

How to fill out Gift Deed Paper?

The work with documents isn't the most uncomplicated job, especially for people who rarely work with legal paperwork. That's why we recommend utilizing accurate Pennsylvania Gift Deed for Individual to Individual samples created by professional attorneys. It gives you the ability to stay away from troubles when in court or working with formal organizations. Find the samples you need on our site for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users without a subscription can quickly create an account. Use this short step-by-step help guide to get the Pennsylvania Gift Deed for Individual to Individual:

- Ensure that file you found is eligible for use in the state it’s needed in.

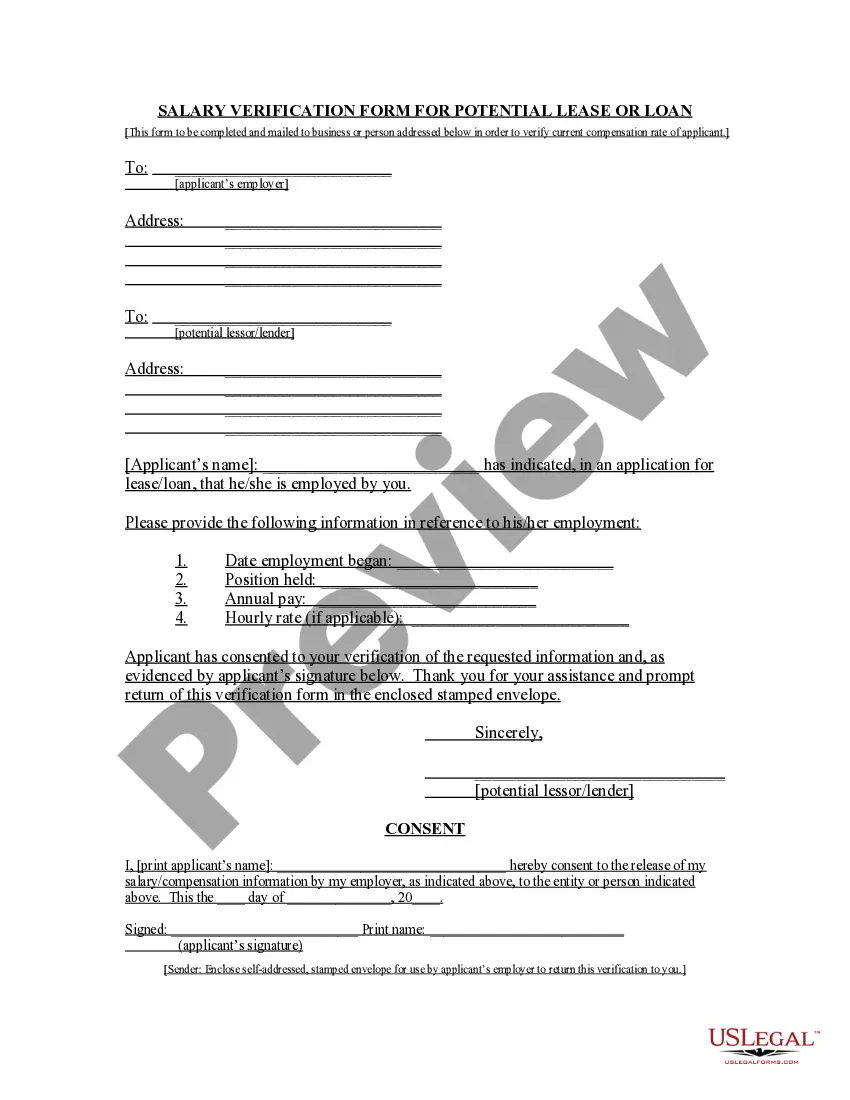

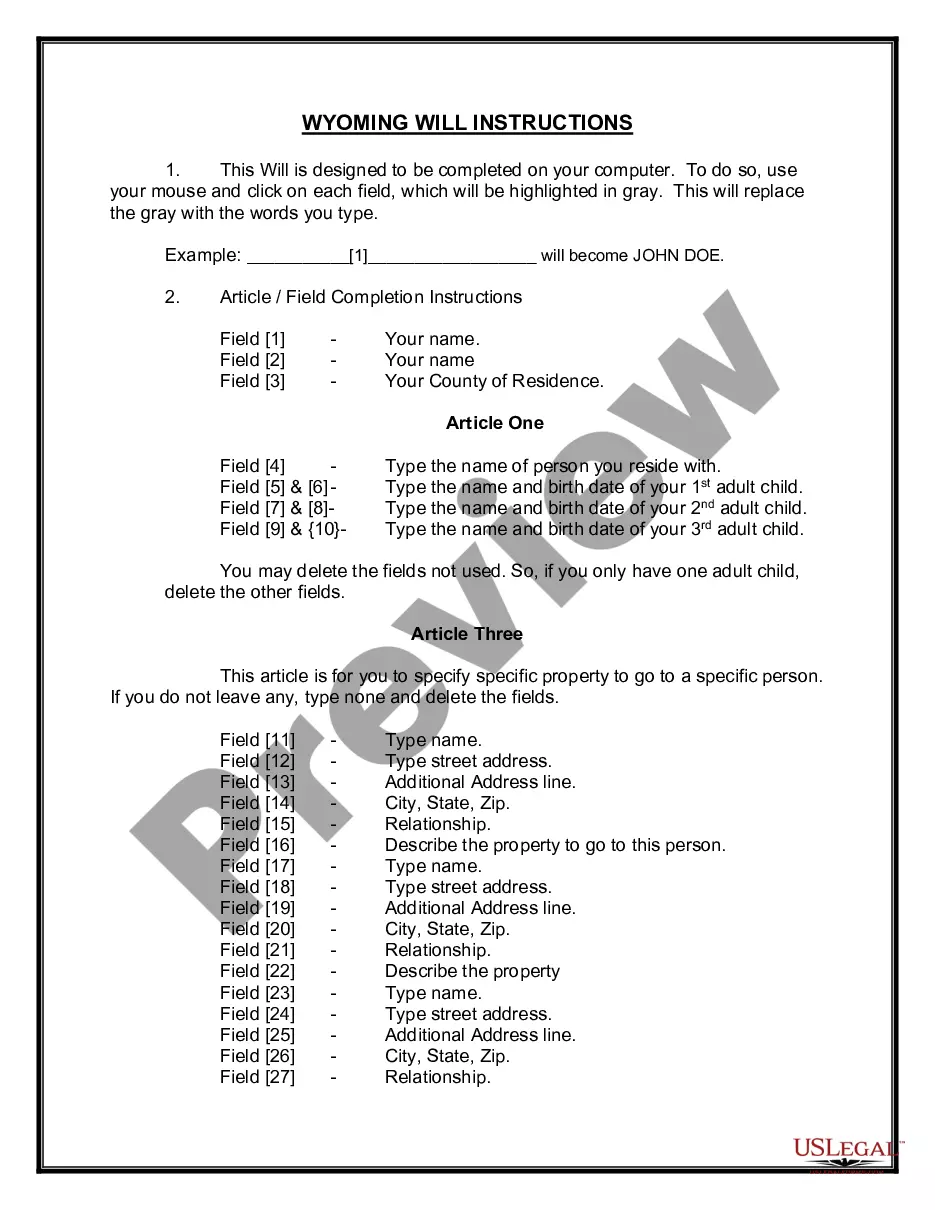

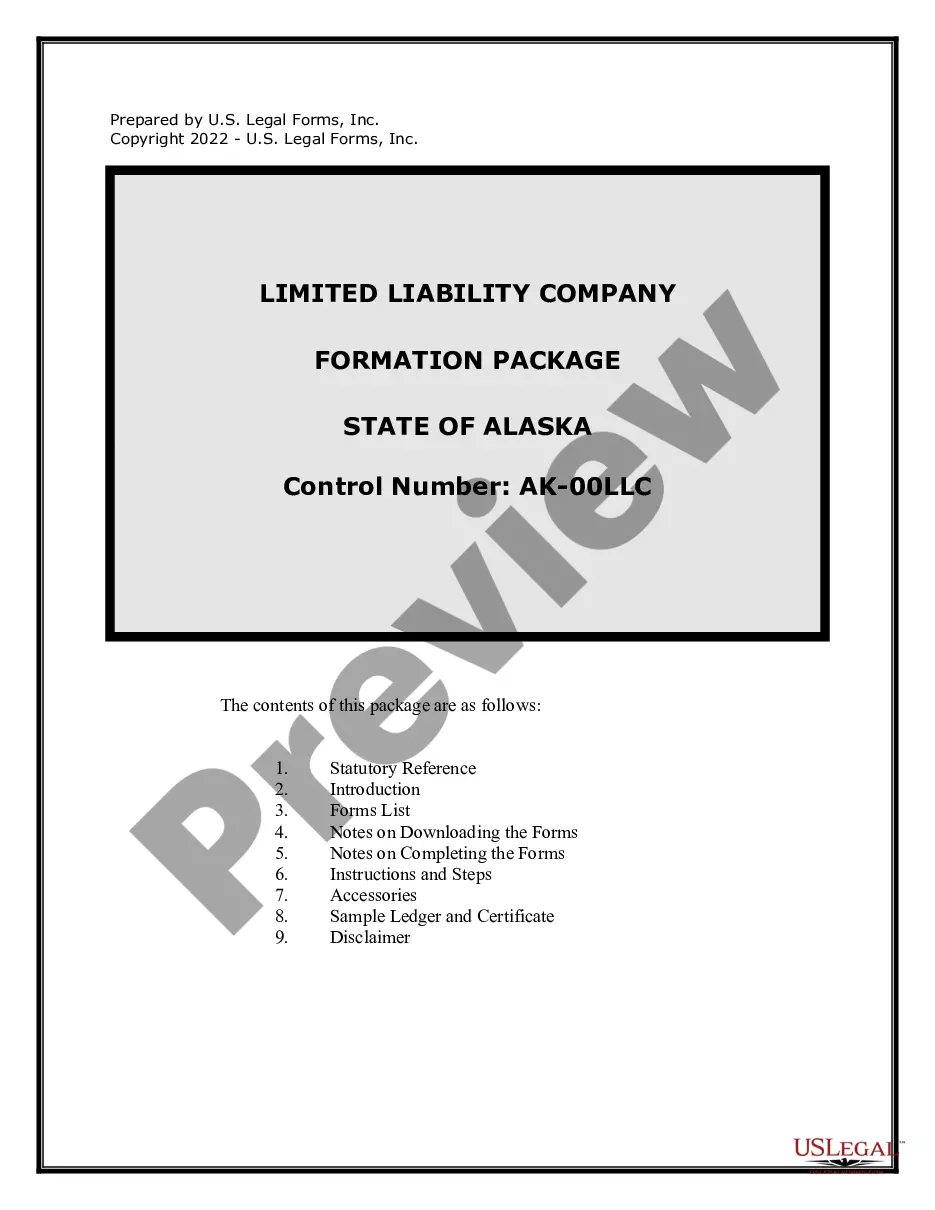

- Confirm the file. Use the Preview option or read its description (if readily available).

- Click Buy Now if this form is the thing you need or utilize the Search field to get another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these simple steps, you are able to fill out the form in an appropriate editor. Check the filled in details and consider requesting a lawyer to examine your Pennsylvania Gift Deed for Individual to Individual for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Gift Deed Form Form popularity

Gift Deed Agreement Other Form Names

Pennsylvania Gift Deed FAQ

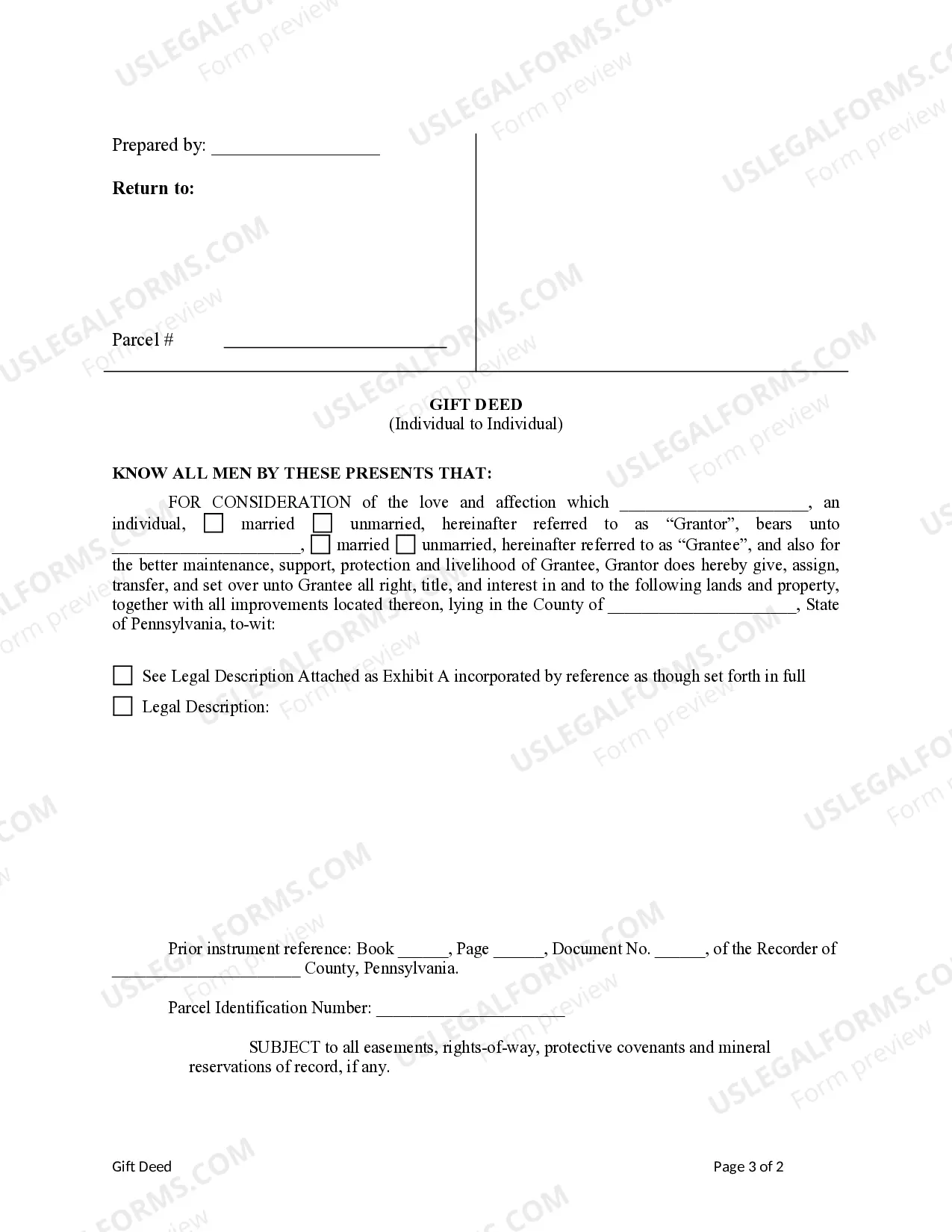

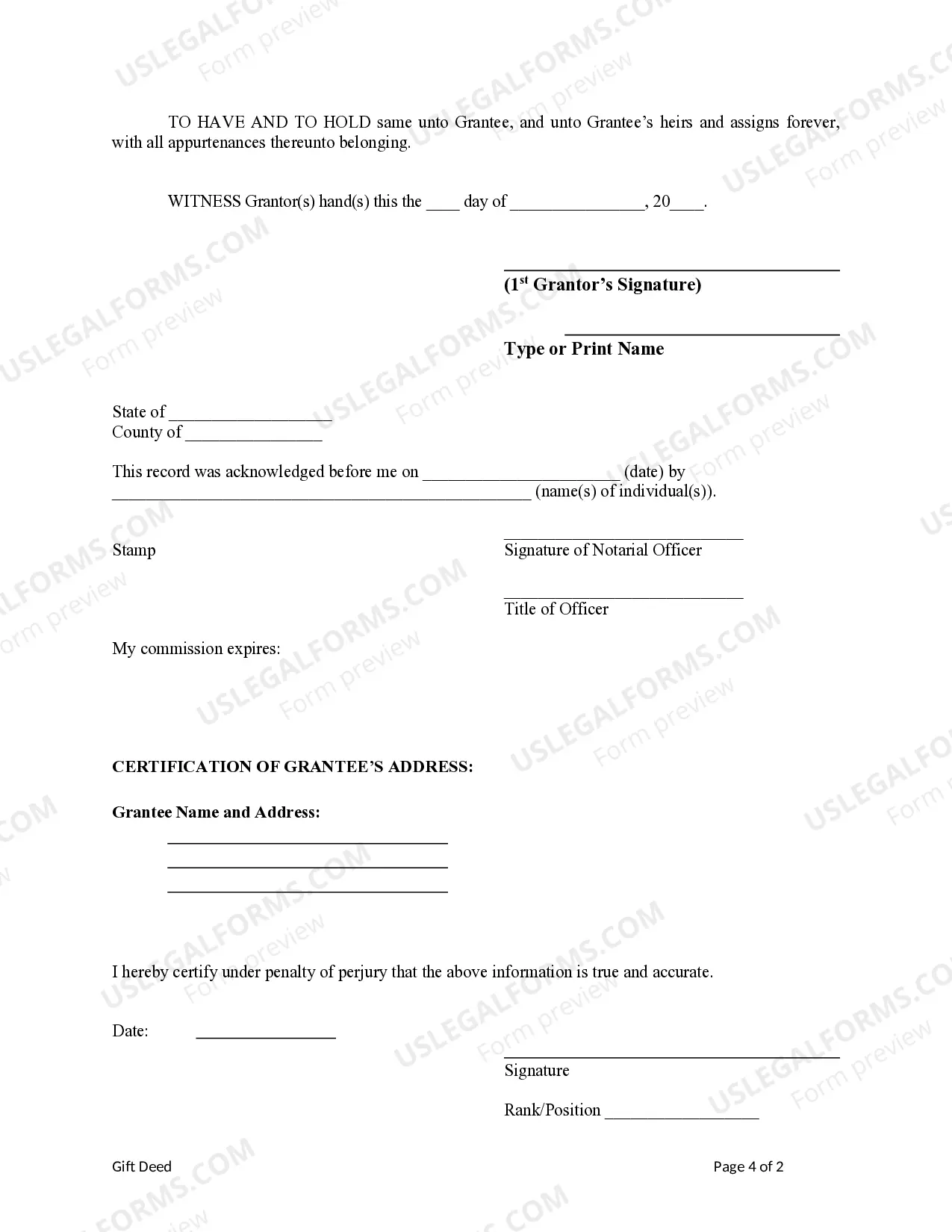

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

The law provides that any gift that is made and accepted by the donee, is final and cannot be revoked later on. So, if all the conditions of a valid gift are present, the same cannot be annulled by the donor later on, except on the ground that the consent of the donor was obtained by fraud, undue influence or coercion.

A gift is valid and complete on registration.A deed of gift once executed and registered cannot be revoked, unless the mandatory requirement of Section 126 of Transfer of Property Act, 1882 is fulfilled.

It is however difficult to prove the same. You should have clinging evidence to show that it was against the wish of owner of through fraud, misrepresentation, coercion etc. As it is registered gift deed under sec 17 of Registration Act 1908 it becomes a valid and authentic document.

If you give your house to your children, the tax basis will be $150,000.PA INHERITANCE TAX ISSUES: In Pennsylvania, there is no gift tax. However, to avoid PA Inheritance Taxes (the rate is 4.5% for assets passed to children or grandchildren), you must live at least one year from the time the gift was made.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.