Pennsylvania Warranty Deed from two Individuals to Husband and Wife

Description

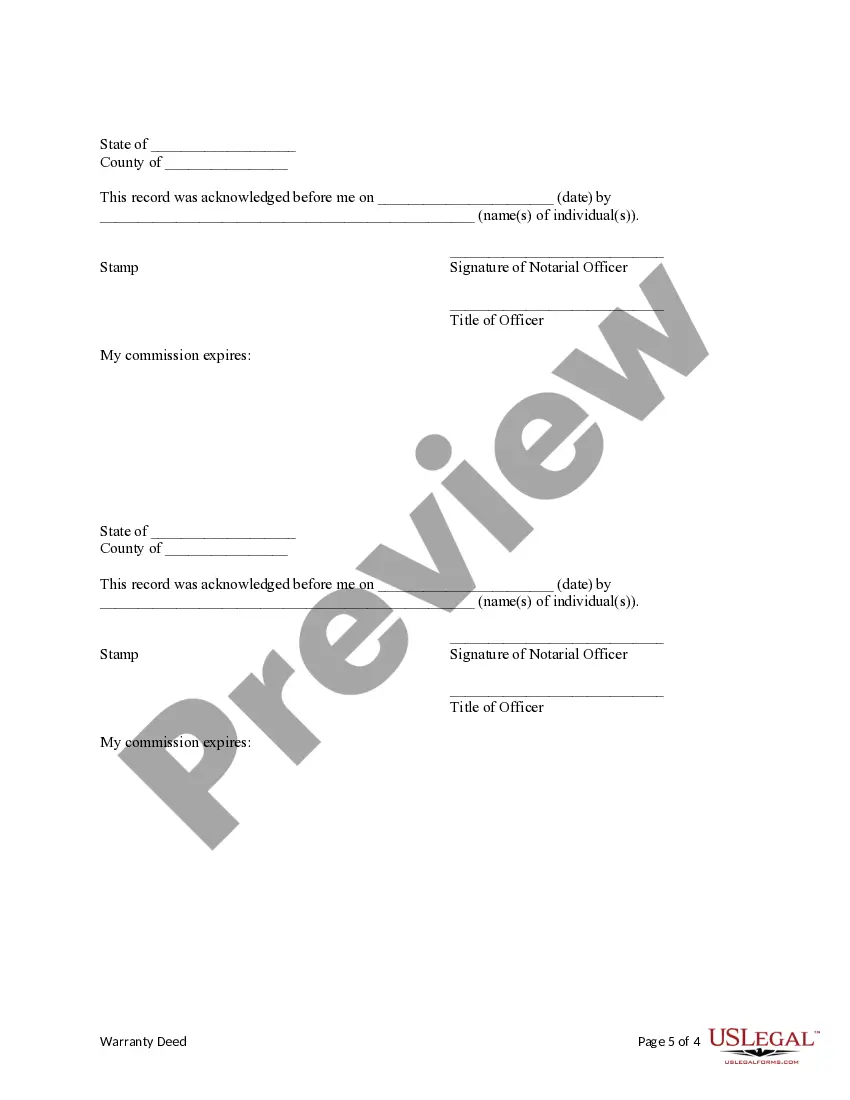

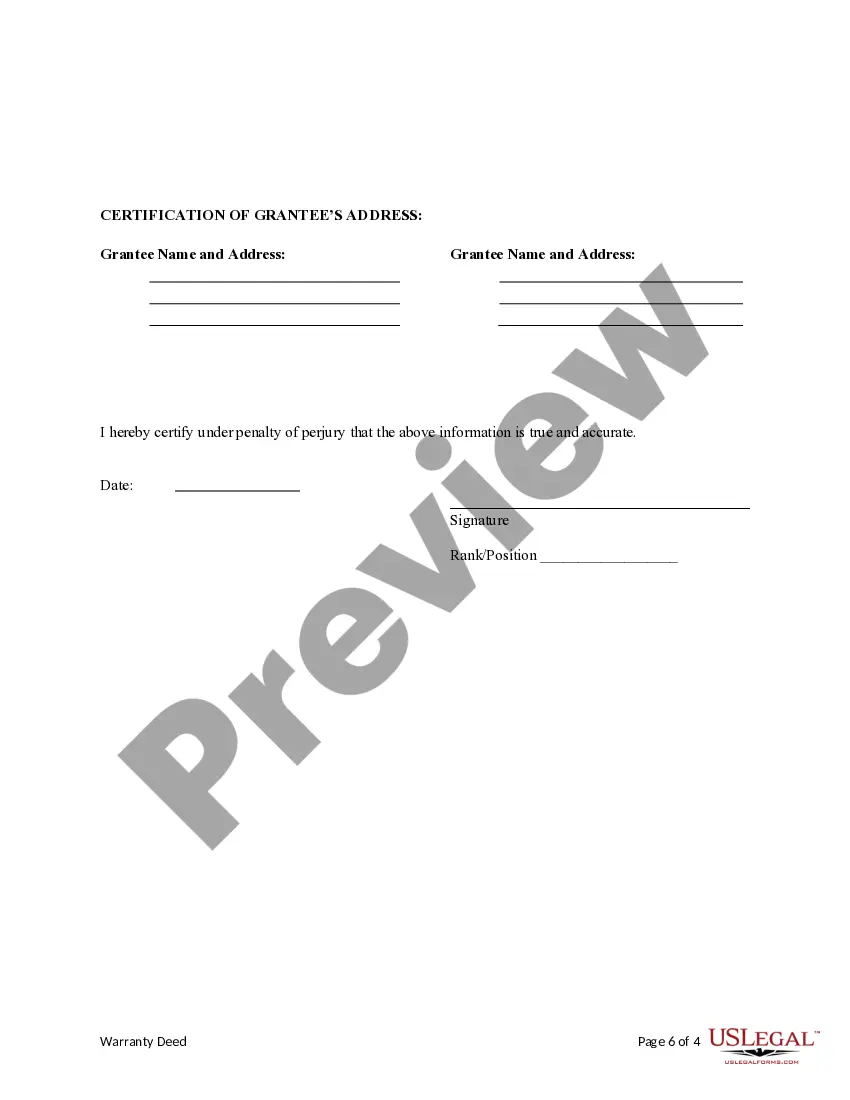

How to fill out Pennsylvania Warranty Deed From Two Individuals To Husband And Wife?

Creating documents isn't the most simple process, especially for those who rarely deal with legal papers. That's why we recommend utilizing accurate Pennsylvania Warranty Deed from two Individuals to Husband and Wife samples made by professional lawyers. It gives you the ability to stay away from problems when in court or working with official institutions. Find the documents you need on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will automatically appear on the file page. Soon after getting the sample, it’ll be saved in the My Forms menu.

Users without a subscription can easily get an account. Make use of this short step-by-step guide to get the Pennsylvania Warranty Deed from two Individuals to Husband and Wife:

- Ensure that file you found is eligible for use in the state it is needed in.

- Confirm the file. Use the Preview option or read its description (if offered).

- Click Buy Now if this form is the thing you need or use the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after finishing these easy actions, you are able to fill out the form in a preferred editor. Double-check filled in details and consider asking a lawyer to review your Pennsylvania Warranty Deed from two Individuals to Husband and Wife for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

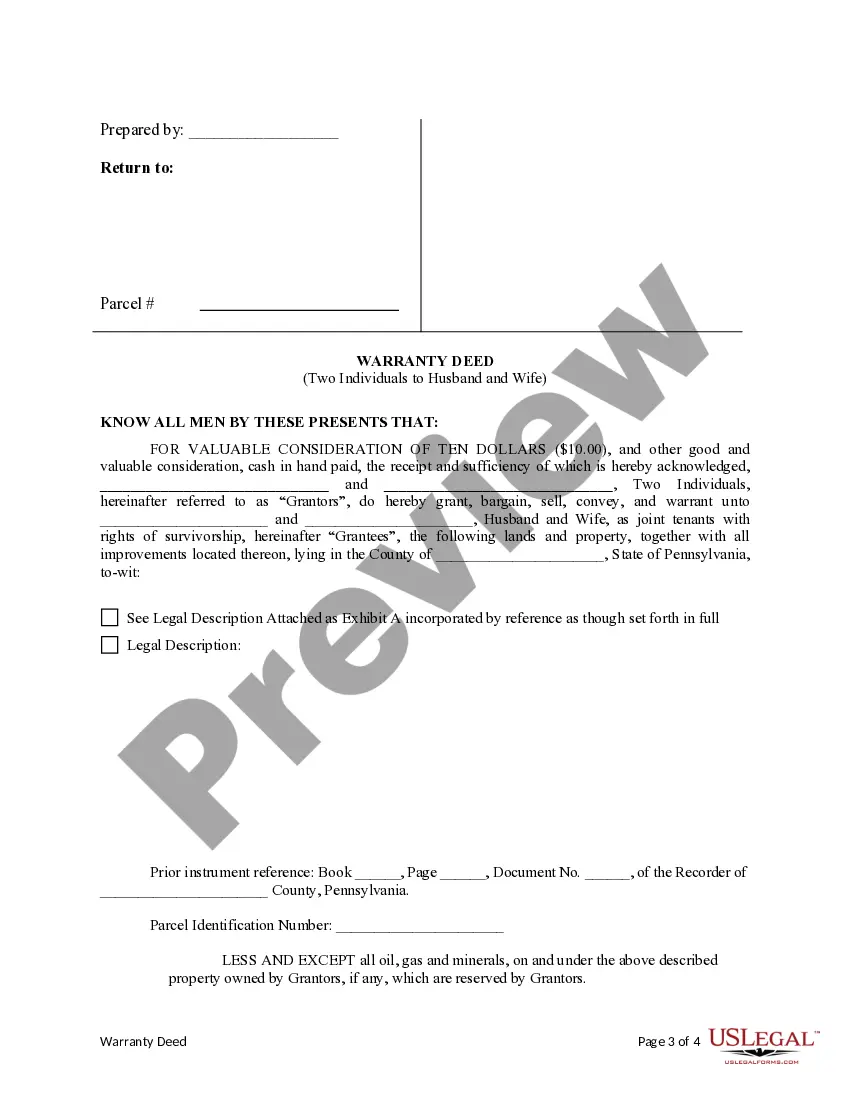

To add a name to a house deed in Pennsylvania, a new deed is prepared. The owner can prepare his own deed or contact an attorney or document service to provide one. Using an attorney is the best route because the attorney ensures that the deed is prepared per the requirements of the state.

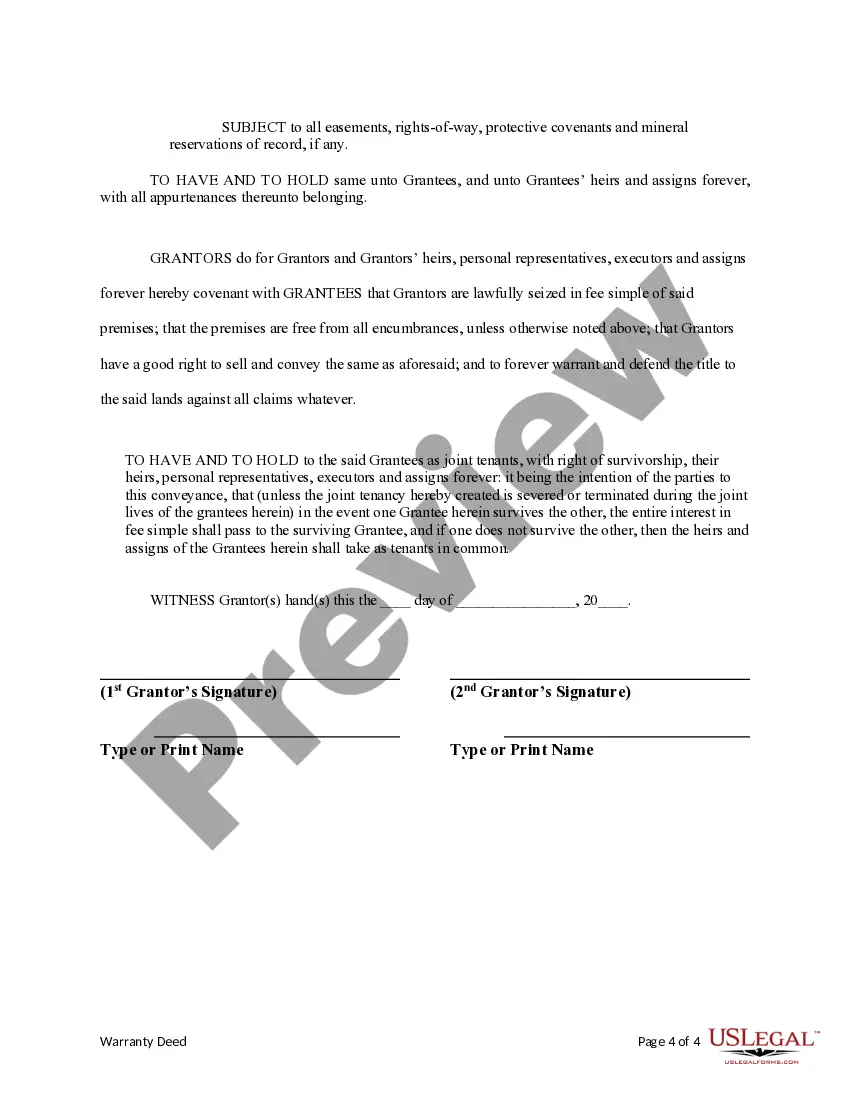

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

Signing over the interest in the property, whether land or house, can be done in several ways. However, the most common instruments of transfer of property between family members are the quitclaim deed, the gift deed or the transfer on death (TOD) deed.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

If you give your house to your children, the tax basis will be $150,000.PA INHERITANCE TAX ISSUES: In Pennsylvania, there is no gift tax. However, to avoid PA Inheritance Taxes (the rate is 4.5% for assets passed to children or grandchildren), you must live at least one year from the time the gift was made.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.