This form is a Warranty Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and warrant the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Pennsylvania Husband and Wife to a Trust

Description Pennsylvania To Trust

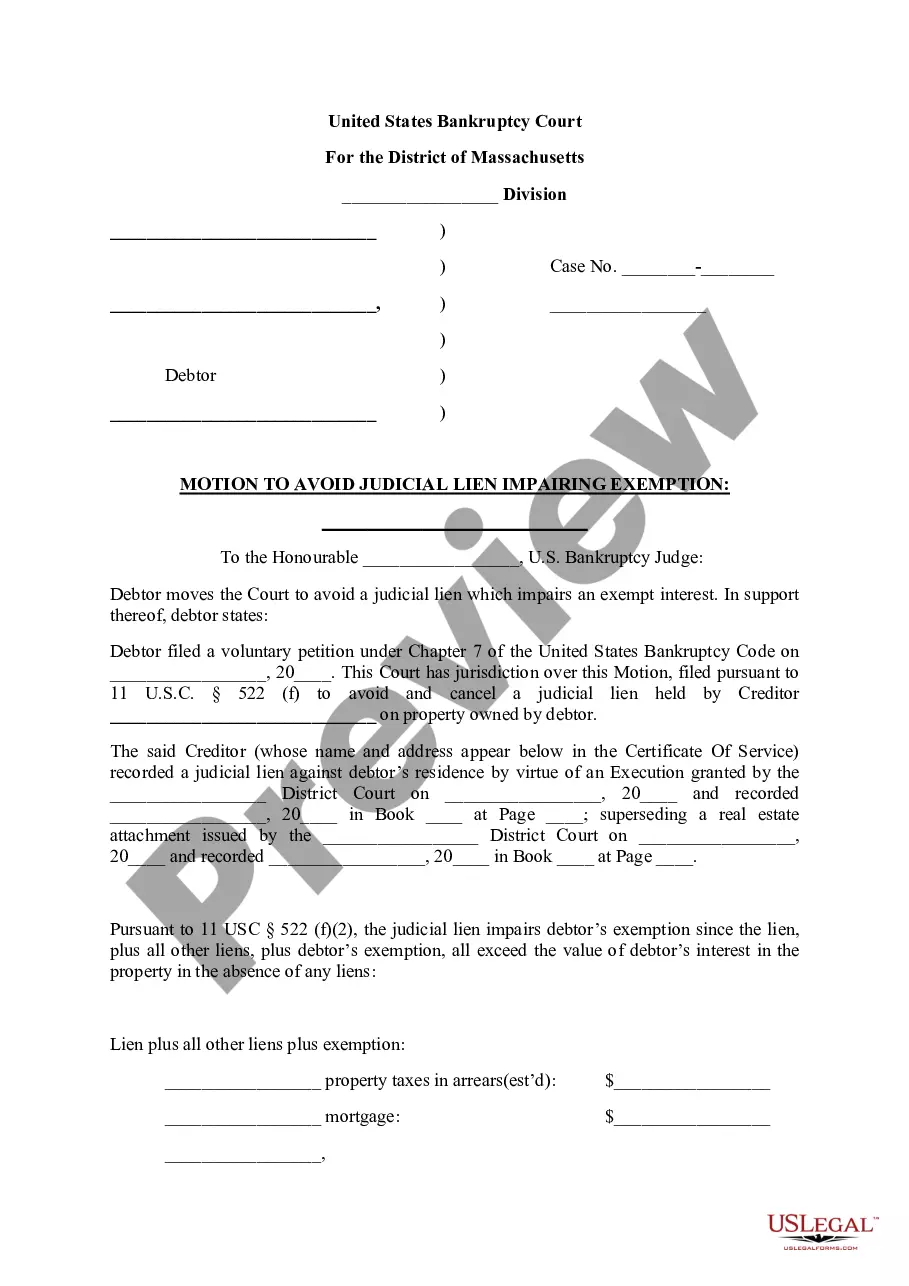

How to fill out Pennsylvania Wife Form?

The work with papers isn't the most uncomplicated task, especially for those who almost never deal with legal papers. That's why we recommend using correct Pennsylvania Husband and Wife to a Trust templates created by skilled attorneys. It gives you the ability to prevent difficulties when in court or handling formal organizations. Find the templates you want on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the file web page. After accessing the sample, it will be stored in the My Forms menu.

Customers without an active subscription can quickly create an account. Follow this brief step-by-step guide to get the Pennsylvania Husband and Wife to a Trust:

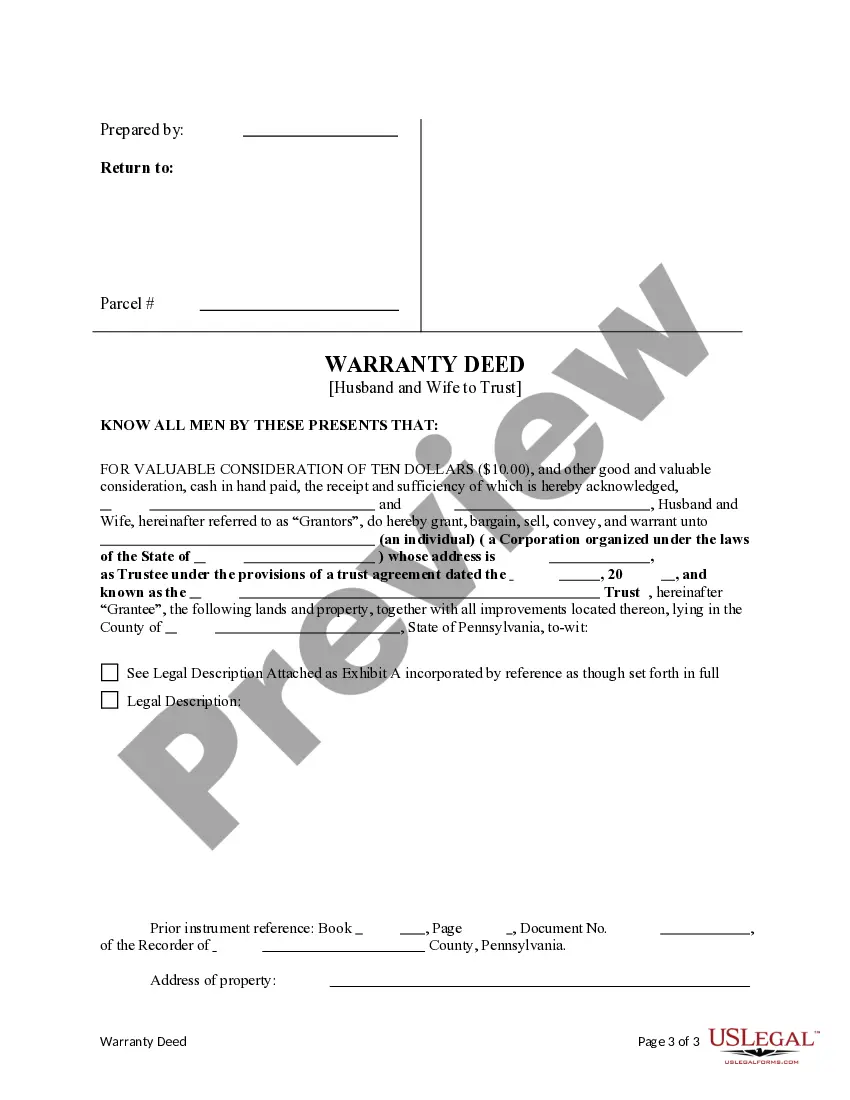

- Be sure that the sample you found is eligible for use in the state it’s required in.

- Verify the document. Make use of the Preview feature or read its description (if readily available).

- Click Buy Now if this form is what you need or return to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after completing these simple actions, it is possible to fill out the form in your favorite editor. Check the filled in info and consider asking a legal professional to review your Pennsylvania Husband and Wife to a Trust for correctness. With US Legal Forms, everything gets easier. Test it now!

Pennsylvania Wife Trust Form popularity

Pennsylvania Wife Pa Other Form Names

Pennsylvania Husband Pa FAQ

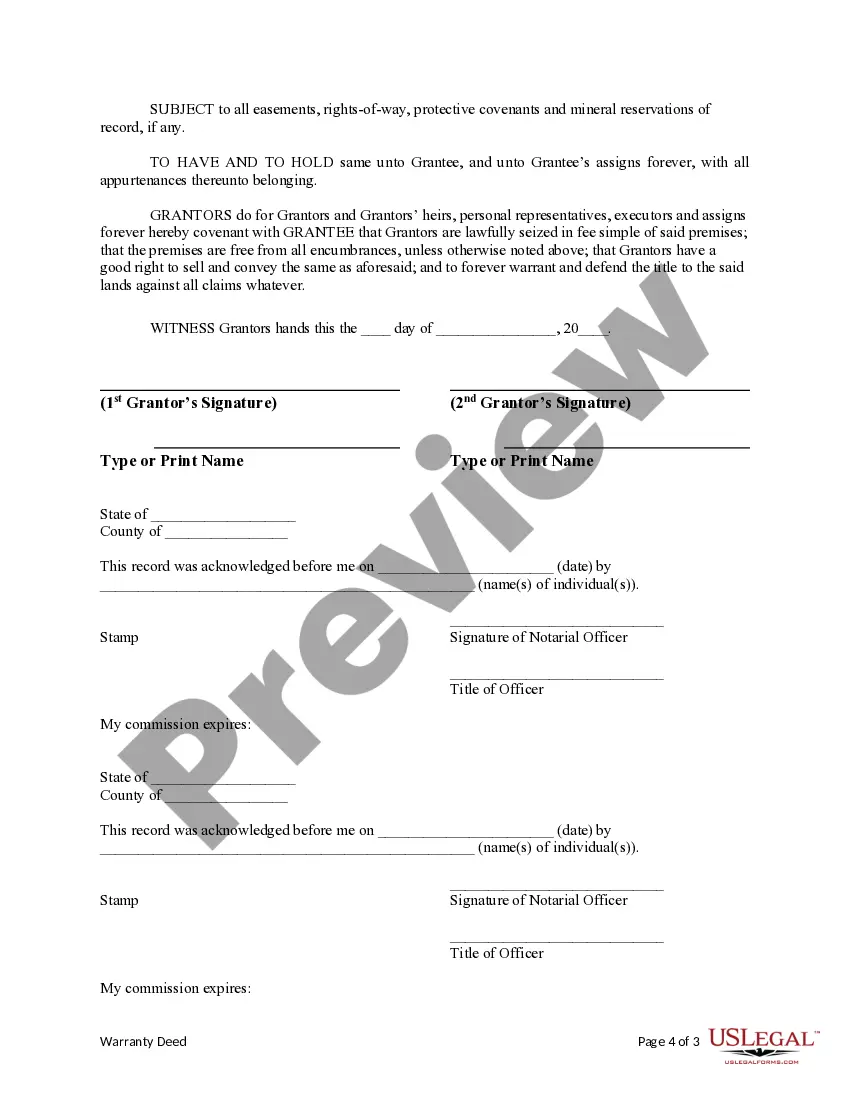

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

Select the trust that best fits your financial situation. Determine which property and assets you want to include in the trust. Select a trustee to manage your living trust. Create the trust document. Sign the trust while a notary public is present. Fund the trust by transferring property into it.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

In California, surviving spouses already receive all of the community property upon the death of their spouse.However, creating a joint will is still an option in California, and while it might help a couple save some time and money on their estate plan, it can also lead to some complex problems.

Q: Can a person have more than one trust? A: Yes, it is not that uncommon for a person to be the beneficiary of multiple trusts. However, caution should be used. Trusts come in many shapes and sizes and can serve multiple purposes and can be established by you or by someone else for your benefit.