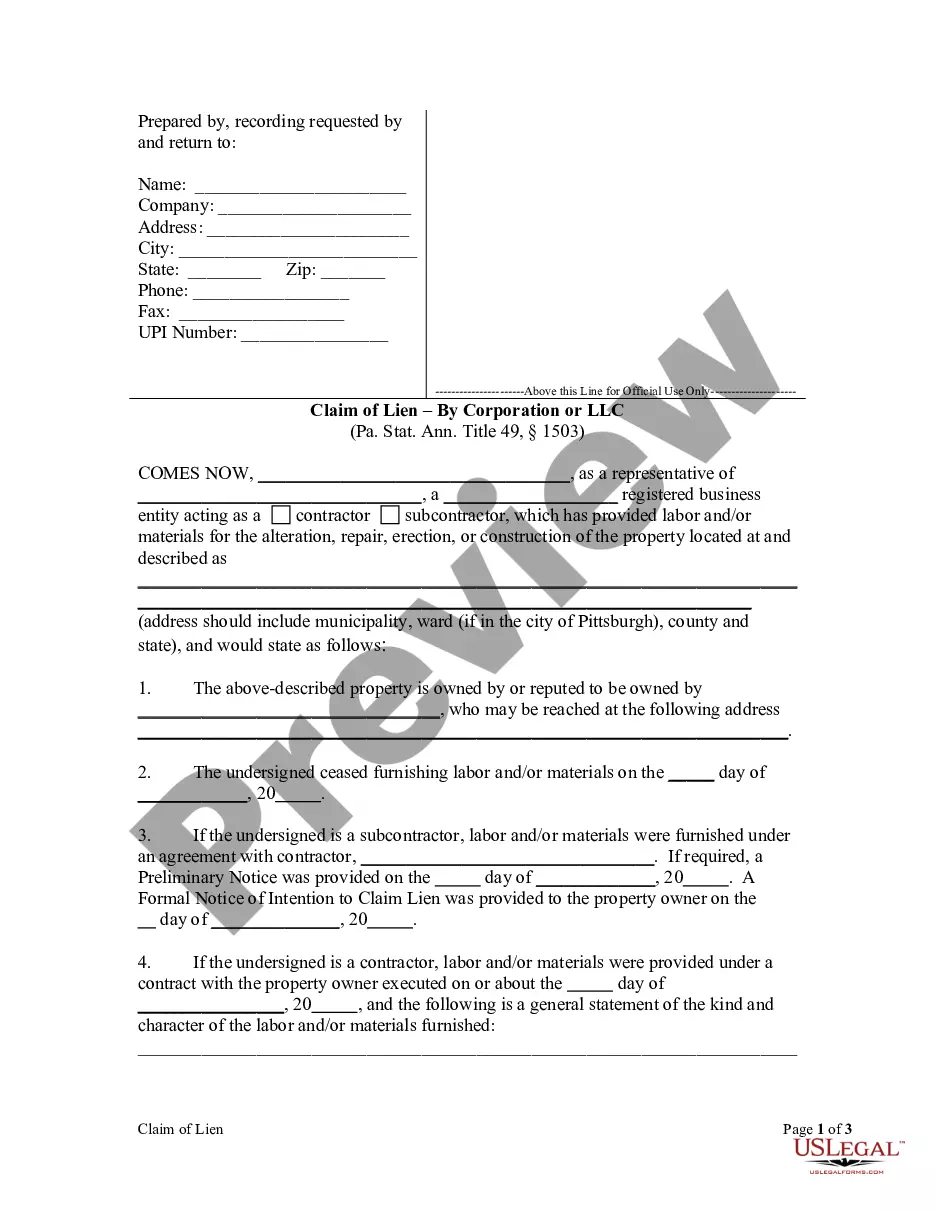

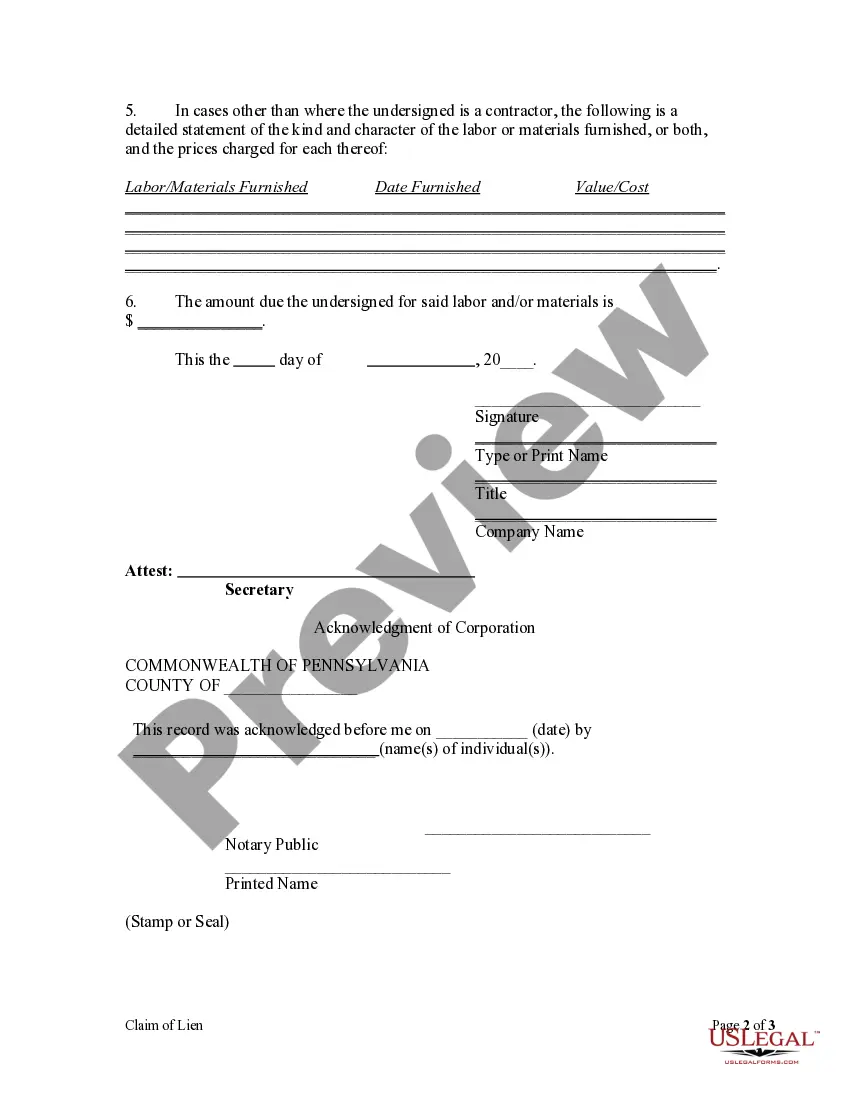

To perfect a lien in Pennsylvania, a contractor or subcontractor must file a lien claim with the prothonotary of the county in which the property is situated, within four (4) months after the completion of work. A notice of this filing must be served upon the property owner within (1) month of filing and an affidavit of said service must be filed within twenty (20) days of service.

Pennsylvania Lien Claim by Corporation

Description

How to fill out Pennsylvania Lien Claim By Corporation?

The work with documents isn't the most uncomplicated task, especially for people who rarely work with legal papers. That's why we recommend utilizing correct Pennsylvania Lien Claim by Corporation or LLC samples created by professional lawyers. It allows you to eliminate troubles when in court or handling formal institutions. Find the files you require on our website for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the file webpage. Right after getting the sample, it’ll be saved in the My Forms menu.

Users with no an active subscription can easily create an account. Make use of this simple step-by-step guide to get the Pennsylvania Lien Claim by Corporation or LLC:

- Make certain that the document you found is eligible for use in the state it is needed in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Buy Now if this file is what you need or utilize the Search field to get another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these easy steps, you can complete the form in an appropriate editor. Double-check completed data and consider asking a lawyer to review your Pennsylvania Lien Claim by Corporation or LLC for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

Those who have the right to file a mechanic's lien in Pennsylvania are limited to second-tier subs and suppliers who have a claim of at least $500. In other words, anyone who contracted directly with the property owner, the prime contractor, or a subcontractor hired by the prime contractor are eligible for lien rights.

Tax Deed states auction off the real estate when property owners become delinquent. A Tax Lien state sells tax certificates to investors when homeowners become delinquent. Once the homeowner pays the taxes the investor is paid off their investment plus interest. Florida is a Tax Deed and a Tax Lien state.

Pennsylvania is one of the states that auction off property deeds when back taxes are left unpaid. Because the deed itself is sold at auction, investors take full possession of the property when they're the winning bidder.

1Fill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately.2File your lien claim with the county recorder.3Serve a copy of the lien on the property owner.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

1 Fill out an Abstract Of Judgment form.2 Bring or mail the two paper copies to the court.3 Bring or mail two copies of the Abstract Of Judgment to the county recorder where the judgment debtor's property is located.

Fill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately. File your lien claim with the county recorder. Serve a copy of the lien on the property owner.

Failing to pay your real property taxes in Pennsylvania could lead to an upset tax sale or a judicial tax sale and the loss of your property.