Pennsylvania Warranty Deed from two Individuals to Corporation

Description

How to fill out Pennsylvania Warranty Deed From Two Individuals To Corporation?

Creating documents isn't the most easy job, especially for people who rarely work with legal paperwork. That's why we recommend using correct Pennsylvania Warranty Deed from two Individuals to Corporation templates made by professional attorneys. It allows you to avoid difficulties when in court or dealing with formal institutions. Find the samples you need on our site for high-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the template page. Right after getting the sample, it’ll be stored in the My Forms menu.

Customers with no an active subscription can quickly create an account. Follow this short step-by-step help guide to get your Pennsylvania Warranty Deed from two Individuals to Corporation:

- Make sure that the document you found is eligible for use in the state it is necessary in.

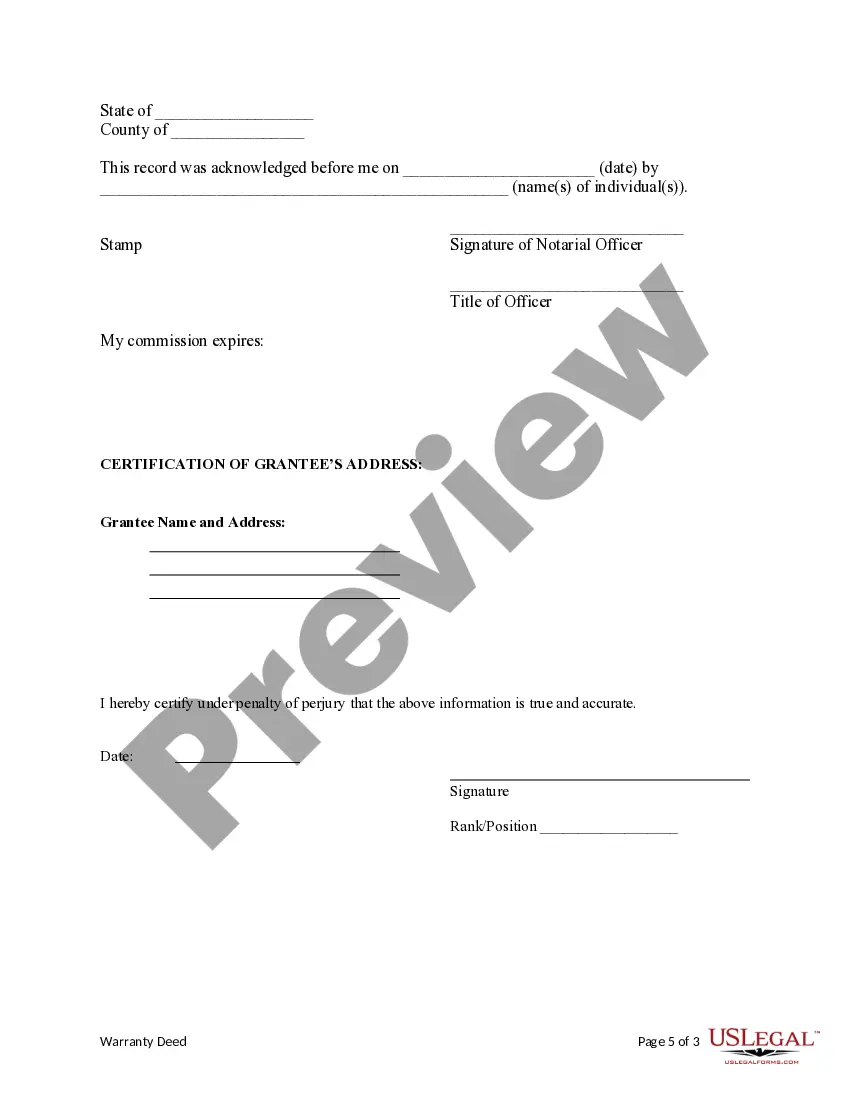

- Verify the document. Use the Preview option or read its description (if offered).

- Buy Now if this template is the thing you need or go back to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after completing these straightforward steps, you are able to complete the form in an appropriate editor. Double-check filled in information and consider asking an attorney to examine your Pennsylvania Warranty Deed from two Individuals to Corporation for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

A: A "special warranty" deed is the type of deed used most frequently in Pennsylvania real estate sales. It essentially represents that the seller did nothing to weaken the status of title from the time that he/she received it.A "quit-claim" deed is a deed that contains no warranties at all.

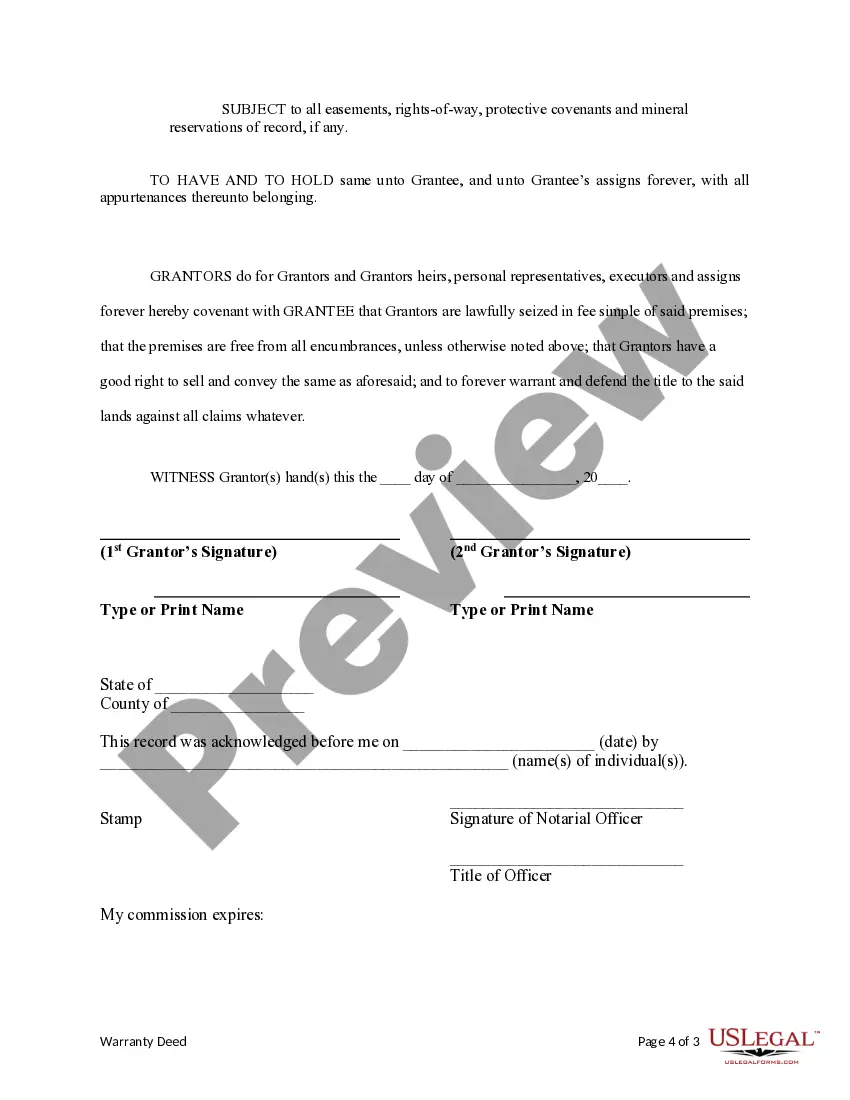

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

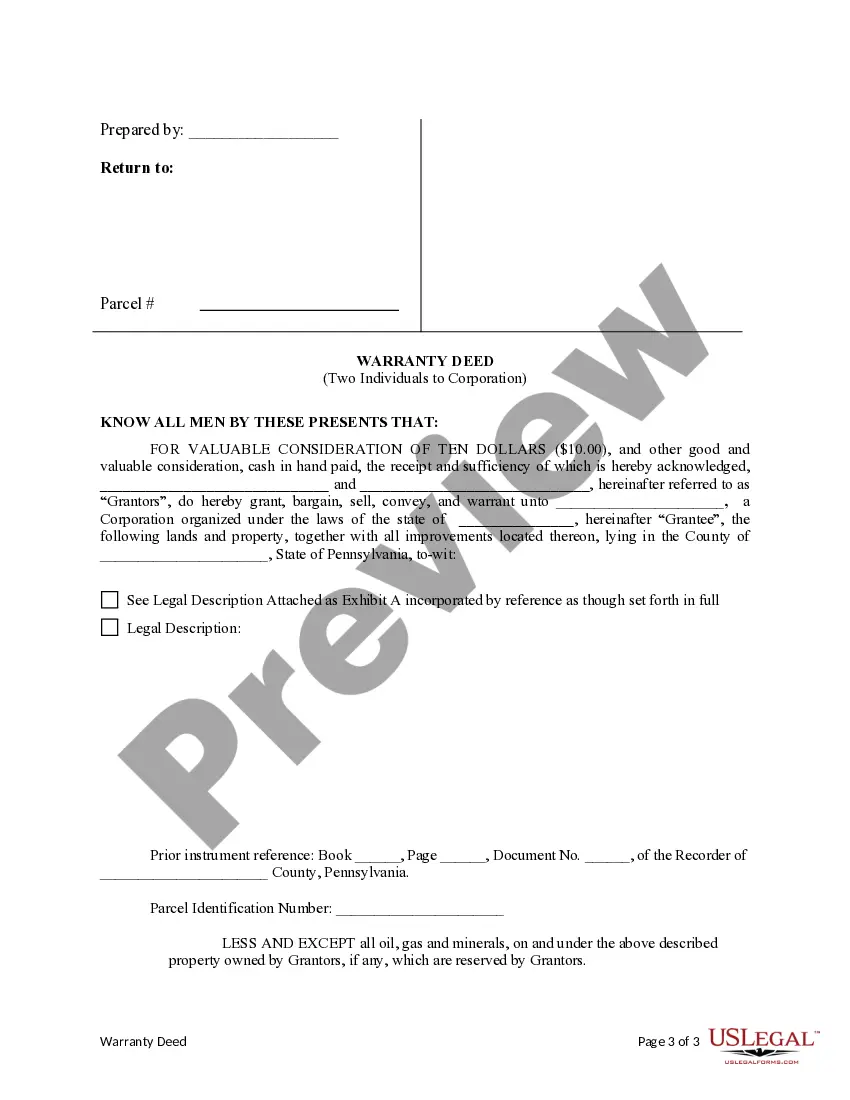

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

If you give your house to your children, the tax basis will be $150,000.PA INHERITANCE TAX ISSUES: In Pennsylvania, there is no gift tax. However, to avoid PA Inheritance Taxes (the rate is 4.5% for assets passed to children or grandchildren), you must live at least one year from the time the gift was made.