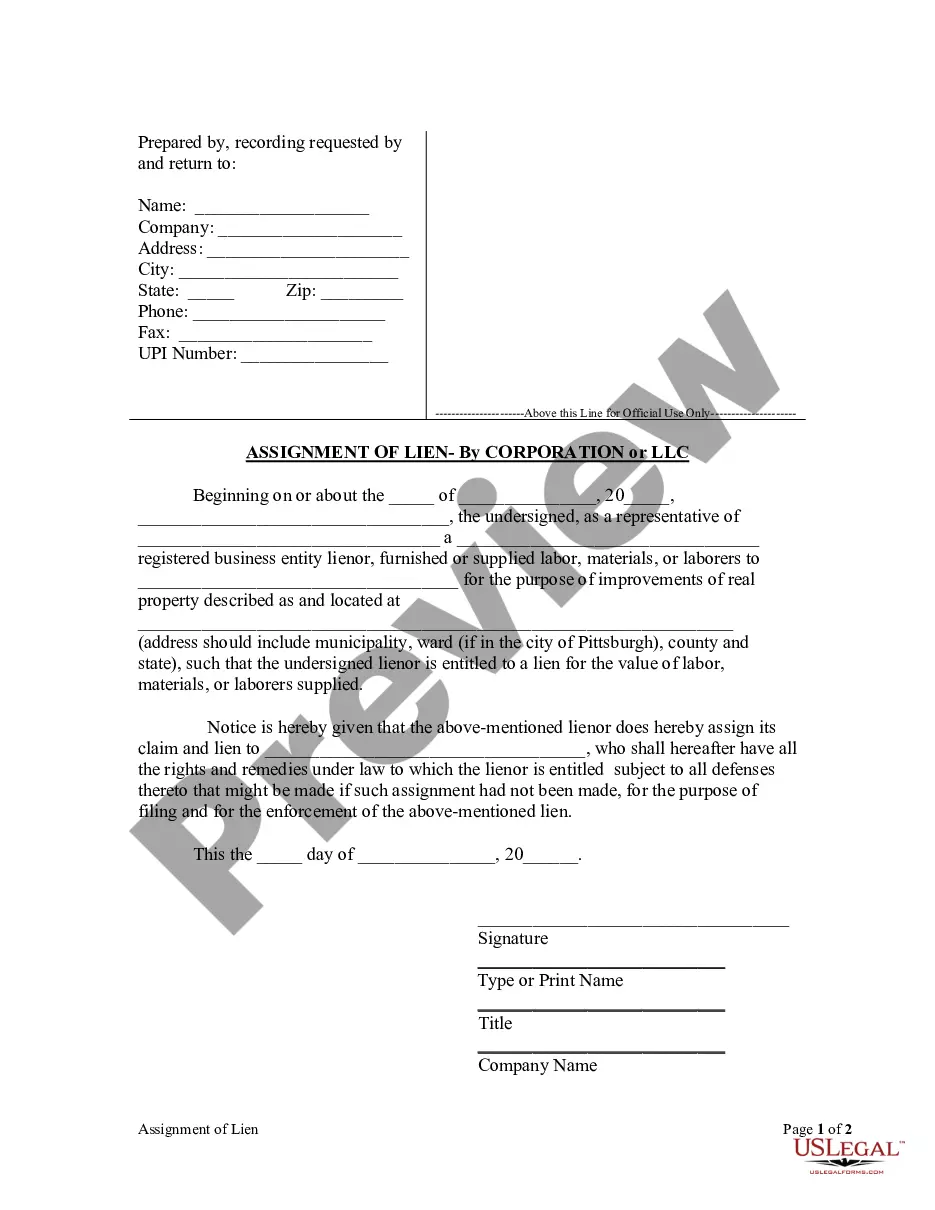

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements to real property to provide notice that the lienor assigns the lienor's claim and lien for the value of labor, materials, or laborers supplied to a designated person who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Pennsylvania Assignment of Lien - Corporation

Description Pennsylvania Lien Form

How to fill out Pennsylvania Assignment Of Lien - Corporation?

The work with documents isn't the most uncomplicated process, especially for people who rarely deal with legal papers. That's why we advise using accurate Pennsylvania Assignment of Lien - Corporation or LLC samples made by skilled attorneys. It gives you the ability to avoid difficulties when in court or working with official organizations. Find the templates you require on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template webpage. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can easily create an account. Utilize this short step-by-step guide to get your Pennsylvania Assignment of Lien - Corporation or LLC:

- Make sure that the form you found is eligible for use in the state it’s needed in.

- Verify the file. Make use of the Preview feature or read its description (if available).

- Click Buy Now if this form is the thing you need or use the Search field to find another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these easy steps, you are able to fill out the form in a preferred editor. Double-check filled in info and consider asking a legal representative to examine your Pennsylvania Assignment of Lien - Corporation or LLC for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

Pennsylvania does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

The Online PA-100 may be used to register a new business entity, add additional taxes or services, or to register a new business entity that is acquiring all or part of an existing business entity. Taxes included online: Employer Withholding Tax.Public Transportation Assistance Taxes and Fees.

Form 2553 S Corporation Election. Form 1120S S Corporation Tax Return. Schedule B Other Return Information. Schedule K Summary of Shareholder Information. Schedule K-1 Individual Shareholder Information.

If you want your LLC to be taxed as an S corporation, you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C corporation. You may use online tax filing, or can file by fax or mail.

A PA is an entity designed for businesses offering a professional service. In some jurisdictions, only certain service professions can form a PA. Common professions that utilize the PA designation include: Medical doctors.

Individuals may operate a business as a sole proprietor or they may take steps to form an incorporated business entity, such as an S corporation.While single-member S corporations are legal, a sole proprietor cannot file as an S corporation unless he takes the proper steps to create the corporate entity.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100. Note that your corporation will also be responsible for an annual tax of $800 to the California Franchise Tax Board.

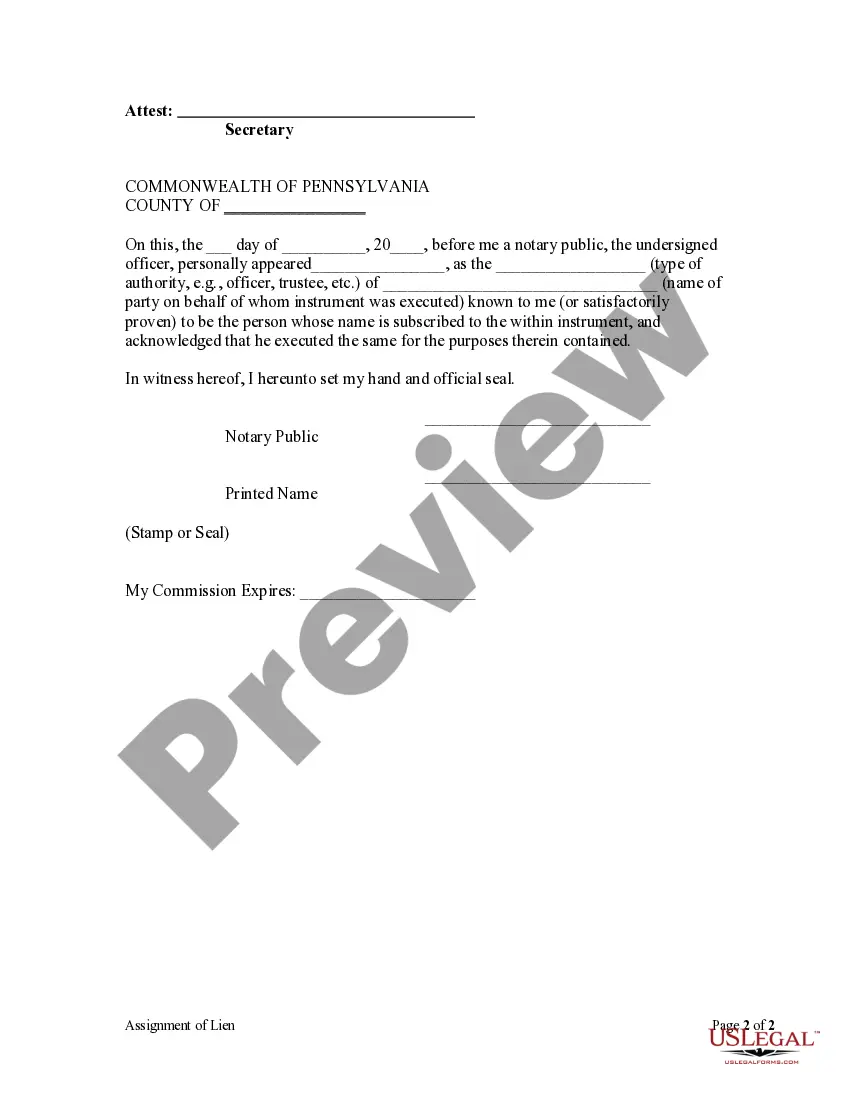

(b) Seal unnecessary. --The affixation of the corporate seal shall not be necessary to the valid execution, assignment or endorsement by a corporation of any instrument or other document.

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.