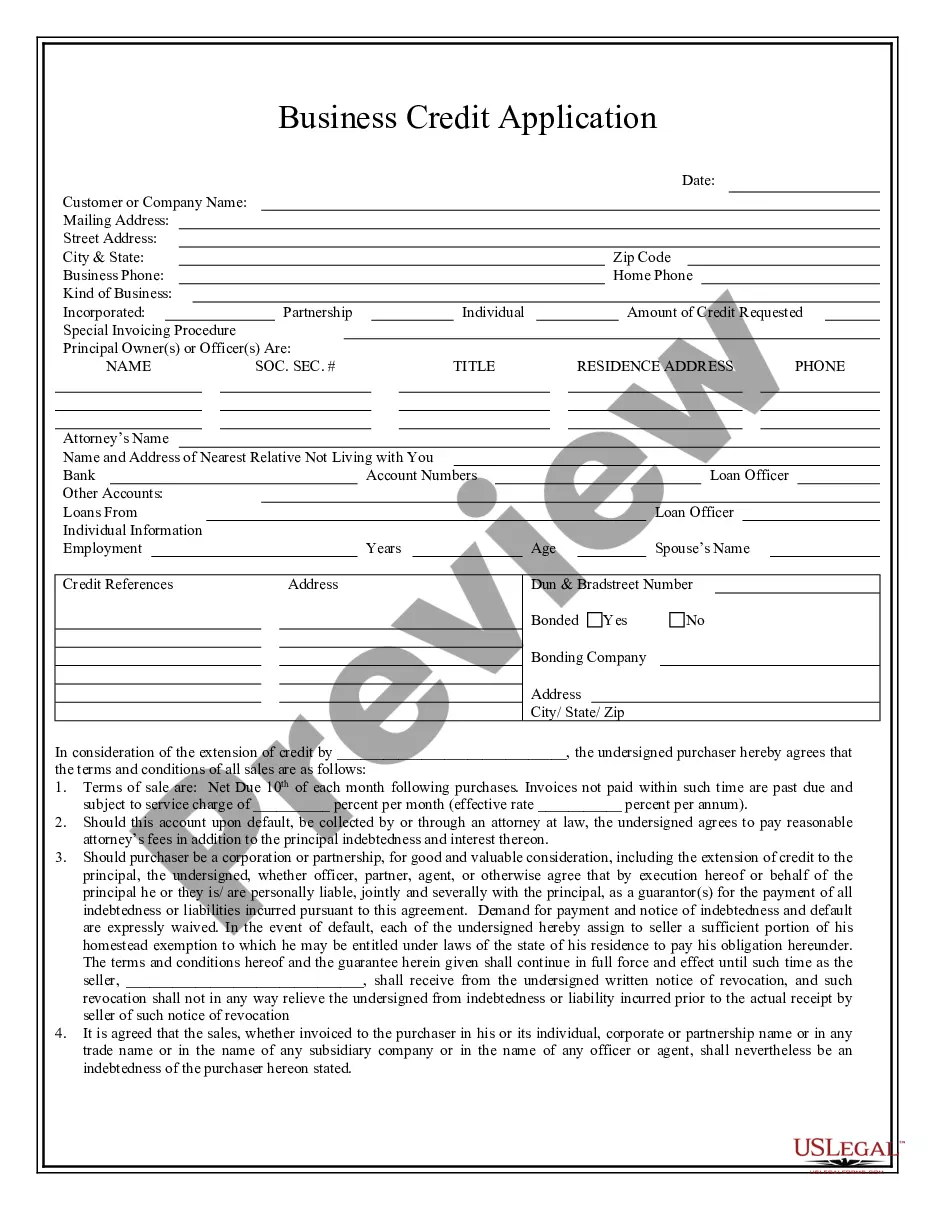

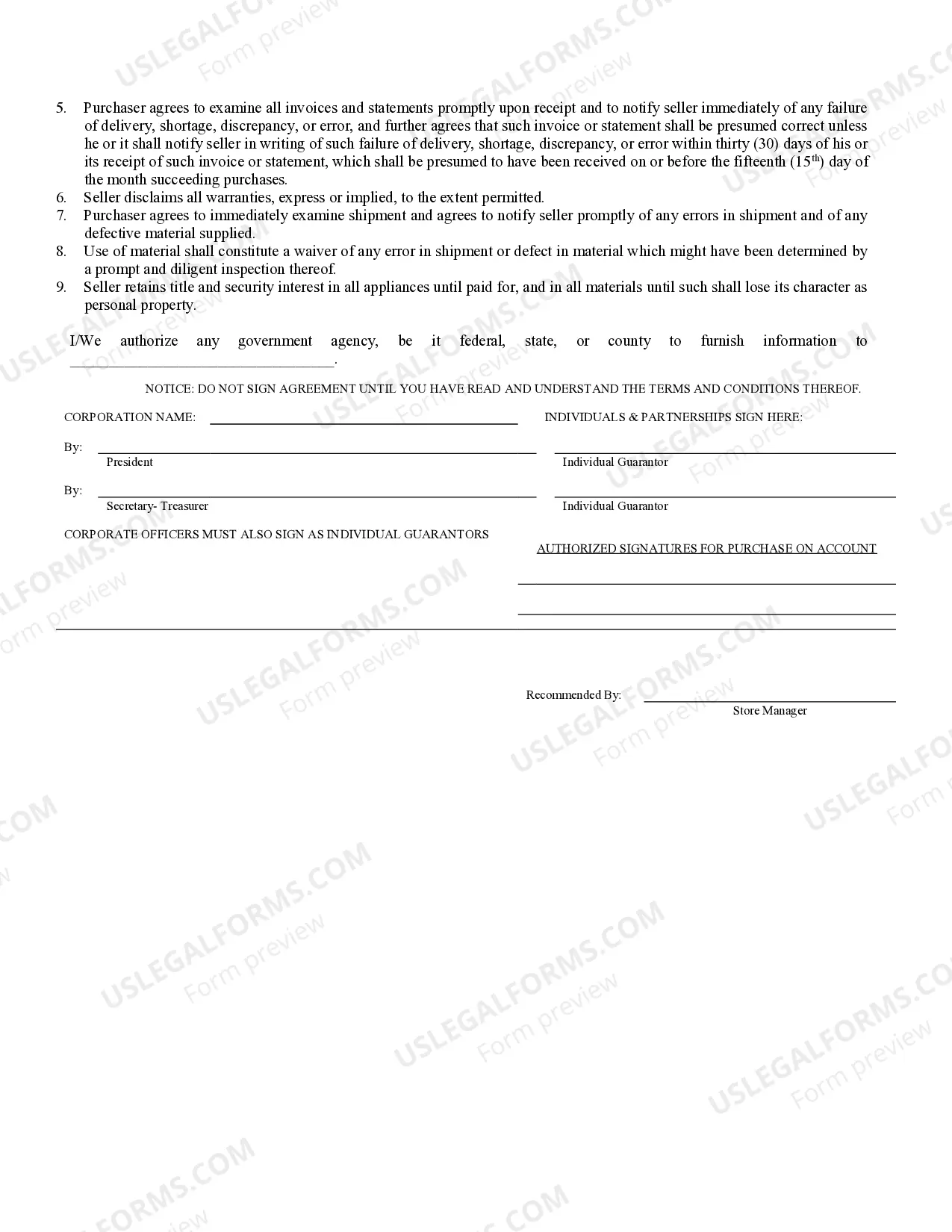

Pennsylvania Business Credit Application

Description Credit Application Form Template Word

How to fill out Pa Business Application Pdf?

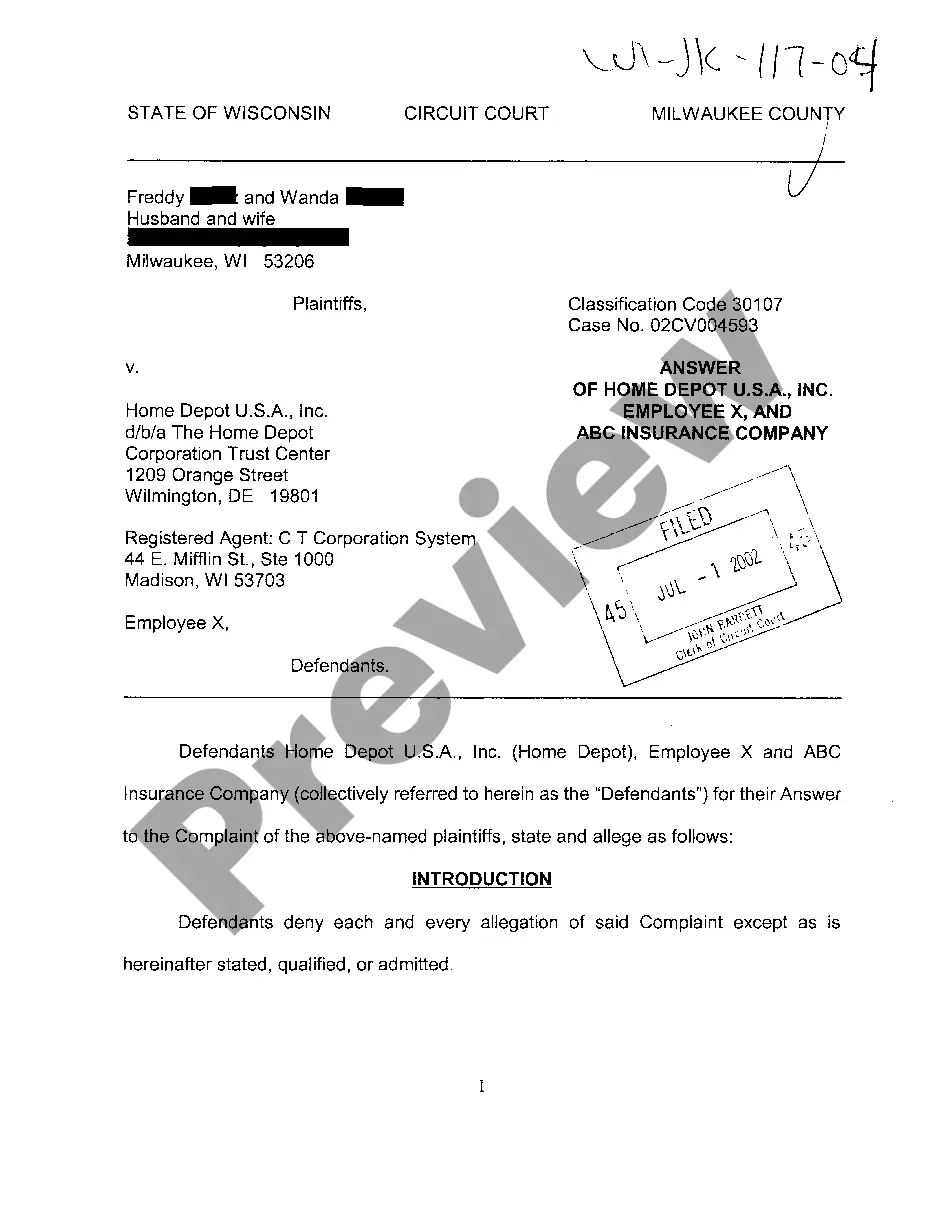

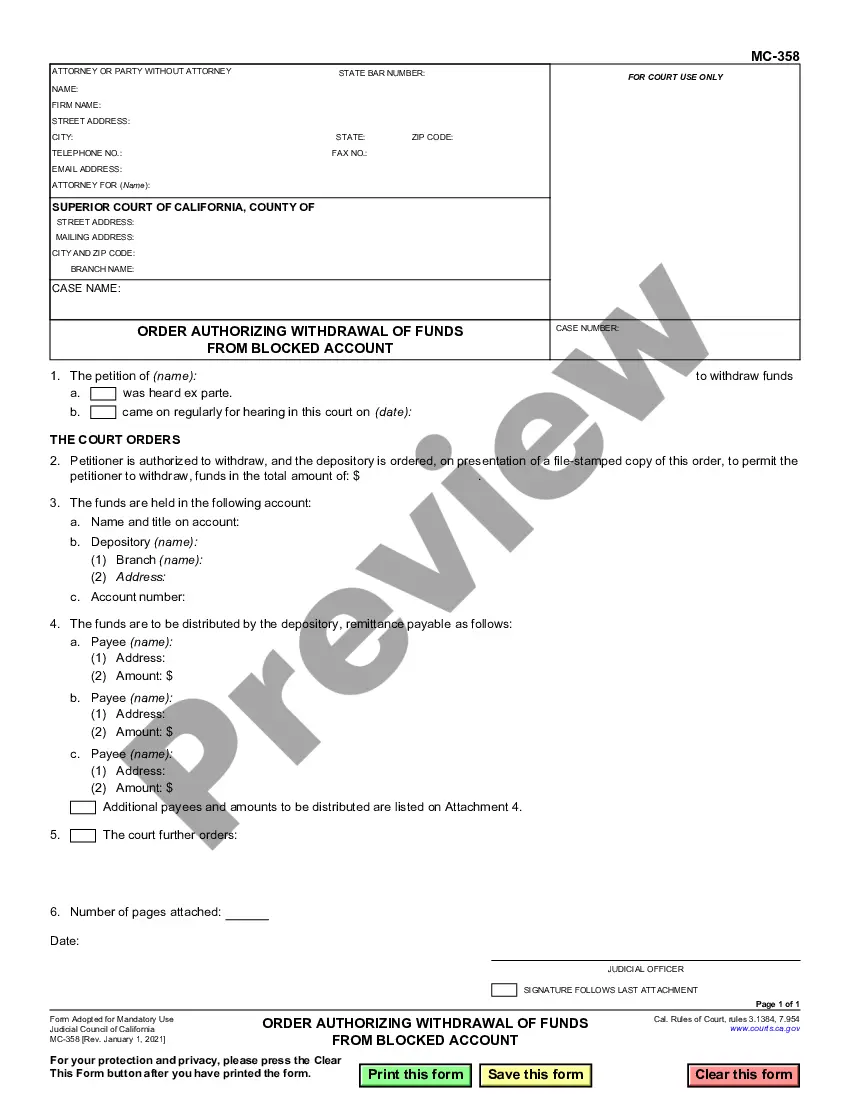

Creating documents isn't the most uncomplicated process, especially for people who almost never deal with legal papers. That's why we recommend utilizing correct Pennsylvania Business Credit Application templates created by professional attorneys. It gives you the ability to stay away from difficulties when in court or working with formal organizations. Find the templates you require on our site for top-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template webpage. Right after downloading the sample, it will be saved in the My Forms menu.

Customers with no a subscription can easily create an account. Utilize this short step-by-step help guide to get your Pennsylvania Business Credit Application:

- Ensure that the document you found is eligible for use in the state it is necessary in.

- Confirm the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this template is what you need or go back to the Search field to get another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these simple steps, you can fill out the form in an appropriate editor. Check the completed info and consider requesting an attorney to review your Pennsylvania Business Credit Application for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Business Credit Application Pdf Form popularity

Customer Credit Application Form Template Other Form Names

Corporate Credit Application Template FAQ

The majority of research on the EITC and expenditure patterns has relied on surveys of EITC recipients about how they spent or planned to spend refunds. The consensus from these surveys is that the primary use of EITC refunds is to pay bills.

Do you have to pay sales tax on a rebate? No, except in cases where cash is accepted, then sales tax is due.

For the 2020 tax year (the tax return due May 17, 2021), the earned income credit ranges from $538 to $6,660 depending on your filing status and how many children you have.

The PA EITC program, established in 2001, offers businesses and individuals a credit to lower their tax liability through donations to K-12 private schools, scholarship organizations, pre-K programs, and other educational enrichment initiatives. When it launched in 2001, it had an original budget of $30 million.

If your adjusted gross income is greater than your earned income your Earned Income Credit is calculated with your adjusted gross income and compared to the amount you would have received with your earned income. The lower of these two calculated amounts is your Earned Income Credit.

A 90% Pennsylvania EITC tax credit is available to offset the donation given.This check creates the credit for all the individual members when the CPSF thank you letter is delivered to DCED. Each donor on their joinder form can select a tuition based preschool or K-12 school to offer scholarships from their donation.

To qualify for the EITC, you must: Show proof of earned income. Have investment income below $3,650 in the tax year you claim the credit. Have a valid Social Security number.

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe and maybe increase your refund.