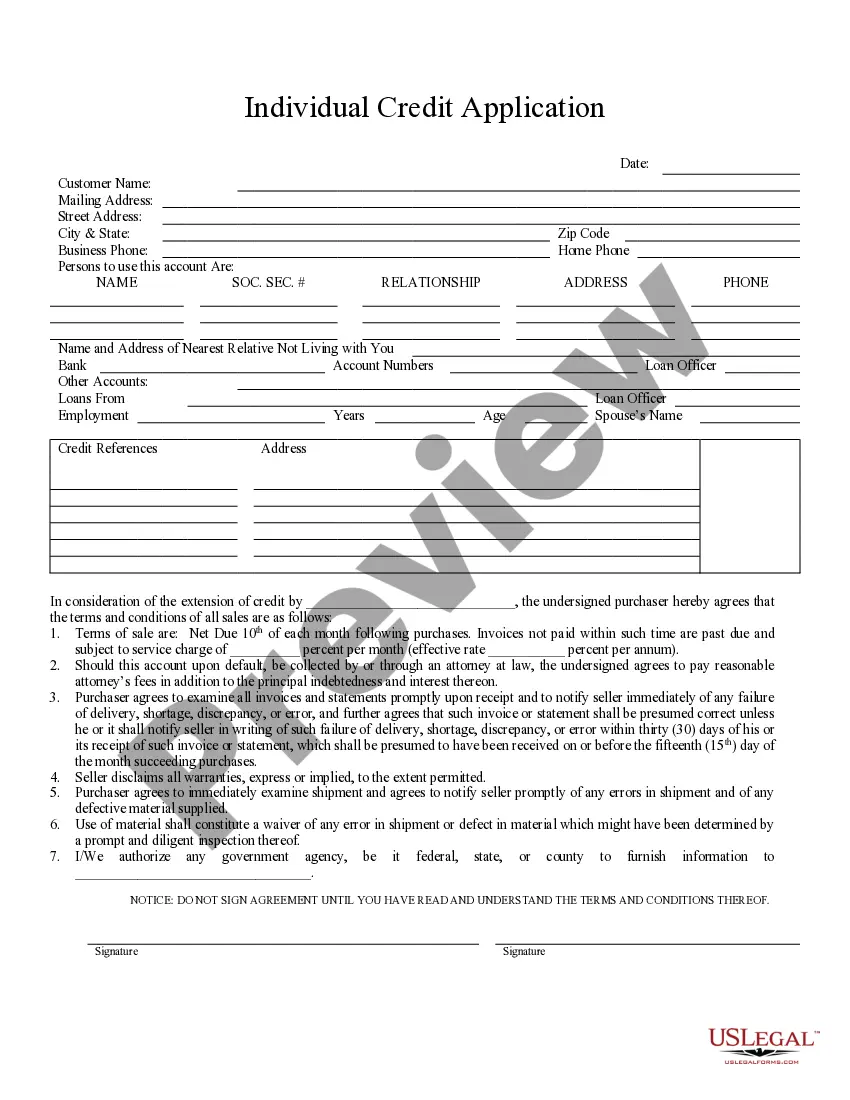

Pennsylvania Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania Individual Credit Application?

Creating documents isn't the most straightforward process, especially for those who rarely work with legal papers. That's why we advise making use of correct Pennsylvania Individual Credit Application templates made by skilled attorneys. It gives you the ability to eliminate difficulties when in court or dealing with formal organizations. Find the files you want on our website for top-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the template page. After accessing the sample, it will be saved in the My Forms menu.

Customers without an active subscription can easily create an account. Look at this brief step-by-step guide to get the Pennsylvania Individual Credit Application:

- Ensure that the document you found is eligible for use in the state it’s required in.

- Verify the document. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this sample is the thing you need or utilize the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after finishing these simple steps, you are able to fill out the form in an appropriate editor. Recheck filled in details and consider asking a legal representative to examine your Pennsylvania Individual Credit Application for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Listing these deductions separately is called itemizing. For 2020, the standard deduction is $12,400 for single filers and $24,800 for married couples filing jointly. For 2021, it is $12,550 for singles and $25,100 for married couples.

If a taxpayer claims a credit for taxes paid to other states, the taxpayer must complete PA-40 Schedule G-L.The credit is limited to the lesser of the tax paid to the state with the highest tax rate or 3.07% of the income subject to tax in Pennsylvania and the state with the highest tax rate.

The California Standard Deduction As of the 2020 tax yearthe return you'd file in 2021the state-level standard deductions are: $4,601 for single taxpayers, as well as married and registered domestic partner (RDP) taxpayers who file separate returns.

Claim the standard deduction. Certain retirement contributions. Medical expenses that exceed 10 percent of your income. Interest paid on a portion of your mortgage loans. Up to $2,500 of student loan interest. Donations to charity. A portion of state, local and property taxes.

A 90% Pennsylvania EITC tax credit is available to offset the donation given.This check creates the credit for all the individual members when the CPSF thank you letter is delivered to DCED. Each donor on their joinder form can select a tuition based preschool or K-12 school to offer scholarships from their donation.

Disallowed deductions include the federal standard deduction and itemized deductions (with the limited exception for unreimbursed employee business expenses deducted from gross compensation). Additionally, Pennsylvania does not allow a deduction for the personal exemption.

The PA EITC program, established in 2001, offers businesses and individuals a credit to lower their tax liability through donations to K-12 private schools, scholarship organizations, pre-K programs, and other educational enrichment initiatives. When it launched in 2001, it had an original budget of $30 million.

Resident credit is available on interest and dividend income for taxes paid. to another state only if it is classified as business income in Pennsylvania. to another country only if it is classified as interest and/or dividend income in PA and is also subject to tax in other countries from foreign sources.

The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption. However, individuals may reduce tax liabilities through certain deductions, credits and exclusions.