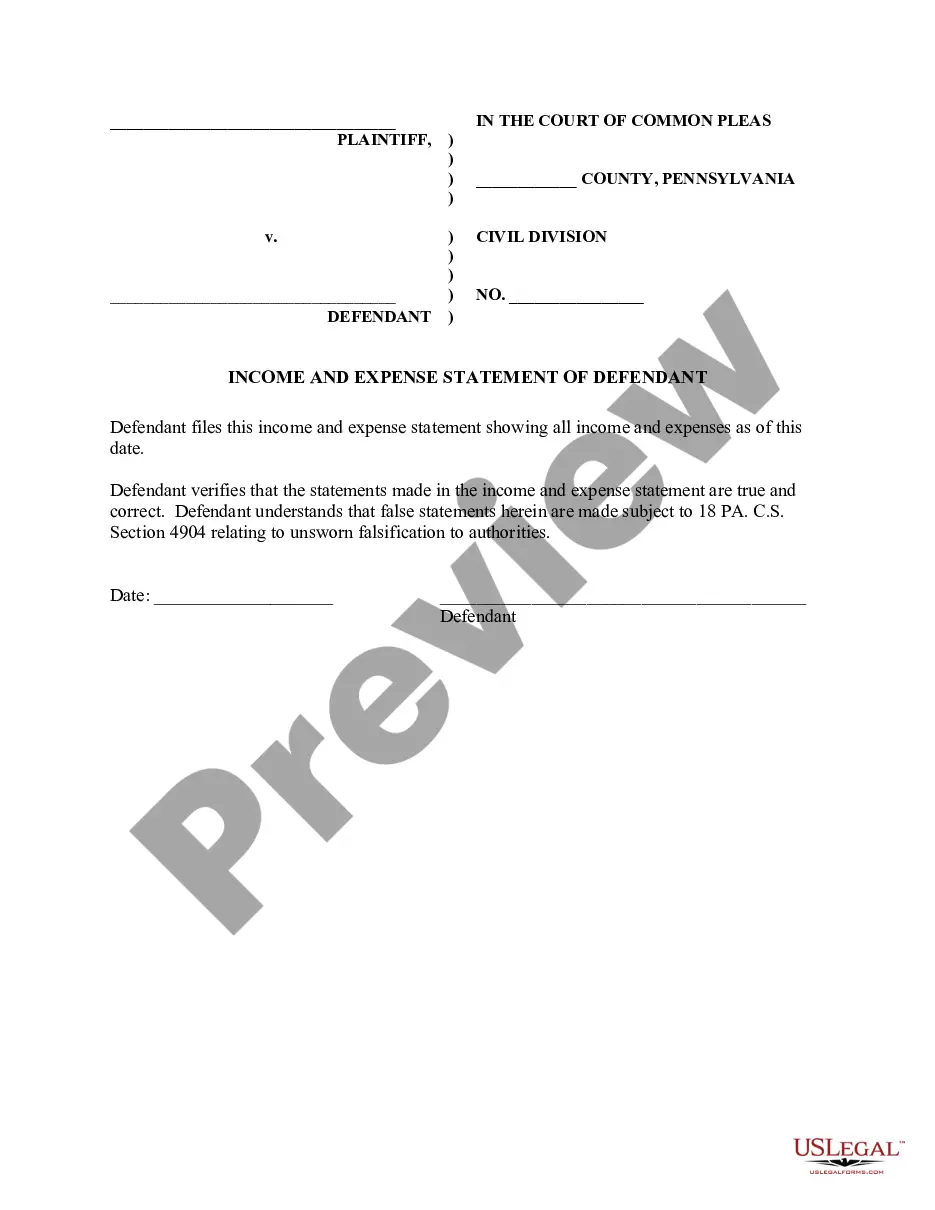

Pennsylvania Income and Expense Statement for Defendant

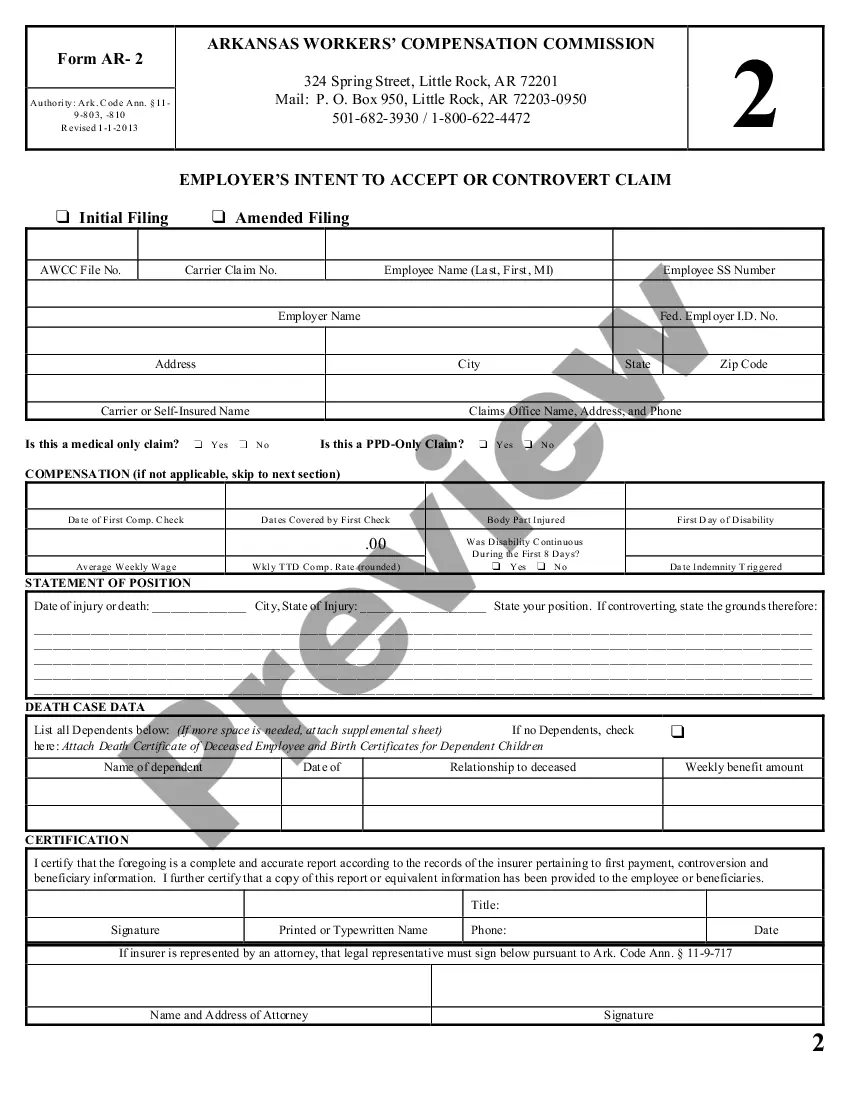

Description Employer Statement Of Income

How to fill out Pennsylvania Income And Expense Statement For Defendant?

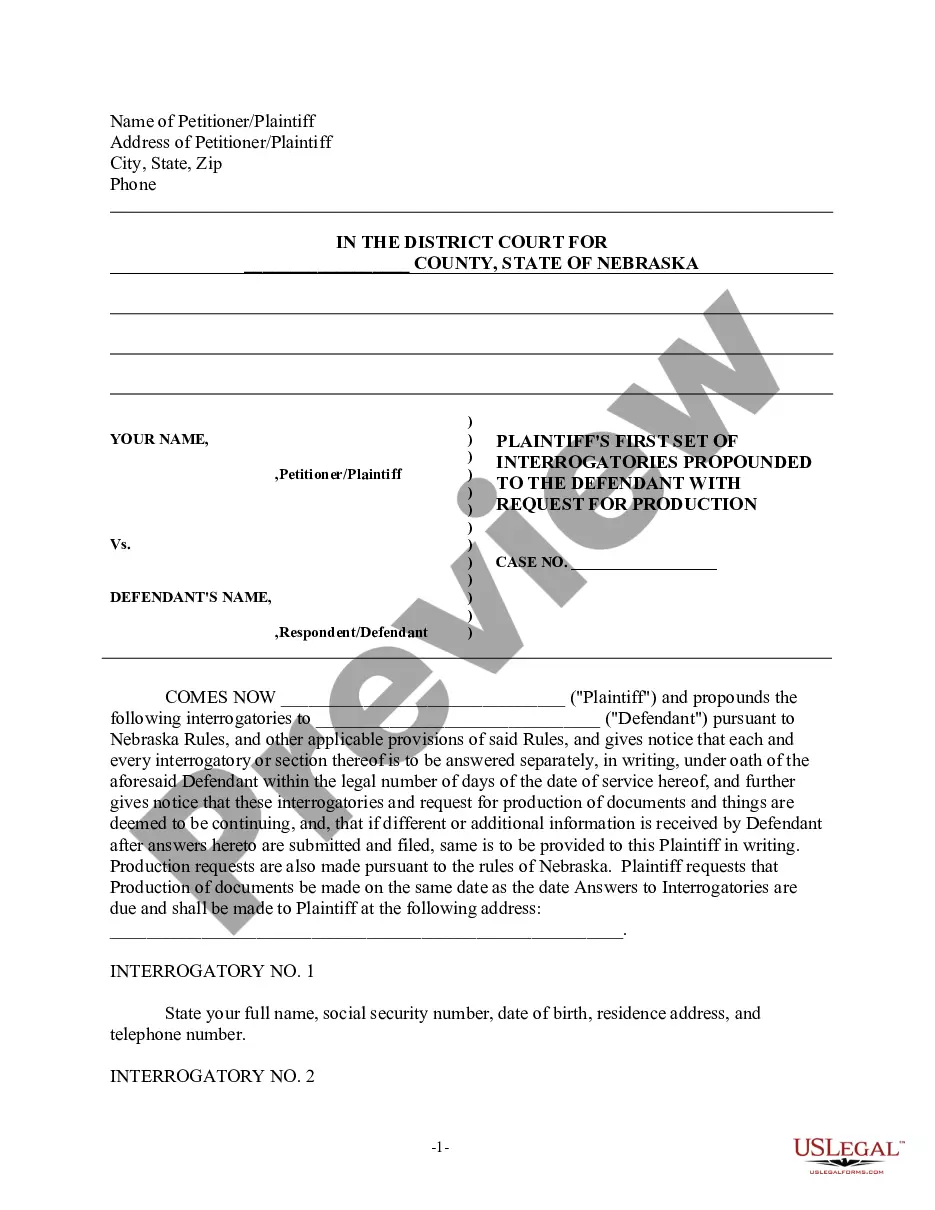

The work with documents isn't the most simple process, especially for those who almost never deal with legal paperwork. That's why we recommend using accurate Pennsylvania Income and Expense Statement for Defendant templates created by professional lawyers. It gives you the ability to prevent troubles when in court or dealing with formal organizations. Find the documents you require on our website for top-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file webpage. Right after accessing the sample, it will be saved in the My Forms menu.

Customers without an activated subscription can easily get an account. Look at this simple step-by-step guide to get the Pennsylvania Income and Expense Statement for Defendant:

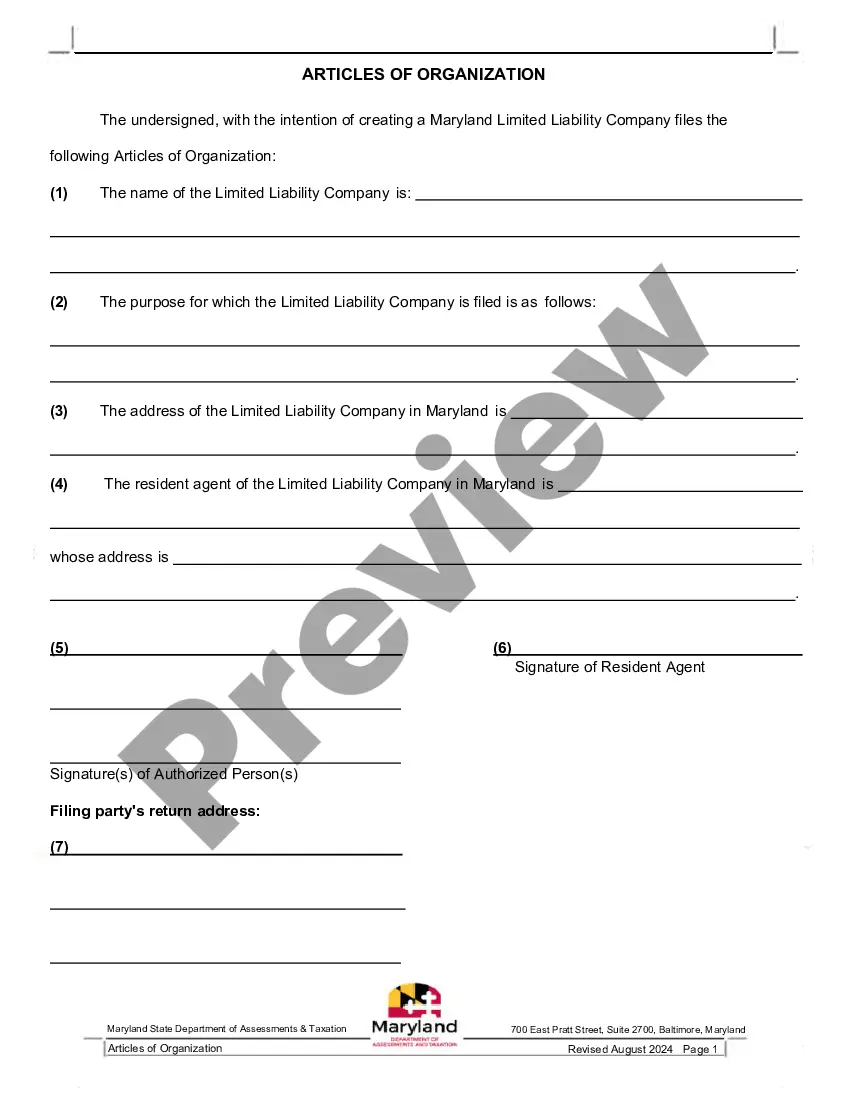

- Make sure that the document you found is eligible for use in the state it’s required in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this file is the thing you need or return to the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these easy steps, you can fill out the form in a preferred editor. Recheck filled in information and consider asking a legal representative to examine your Pennsylvania Income and Expense Statement for Defendant for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

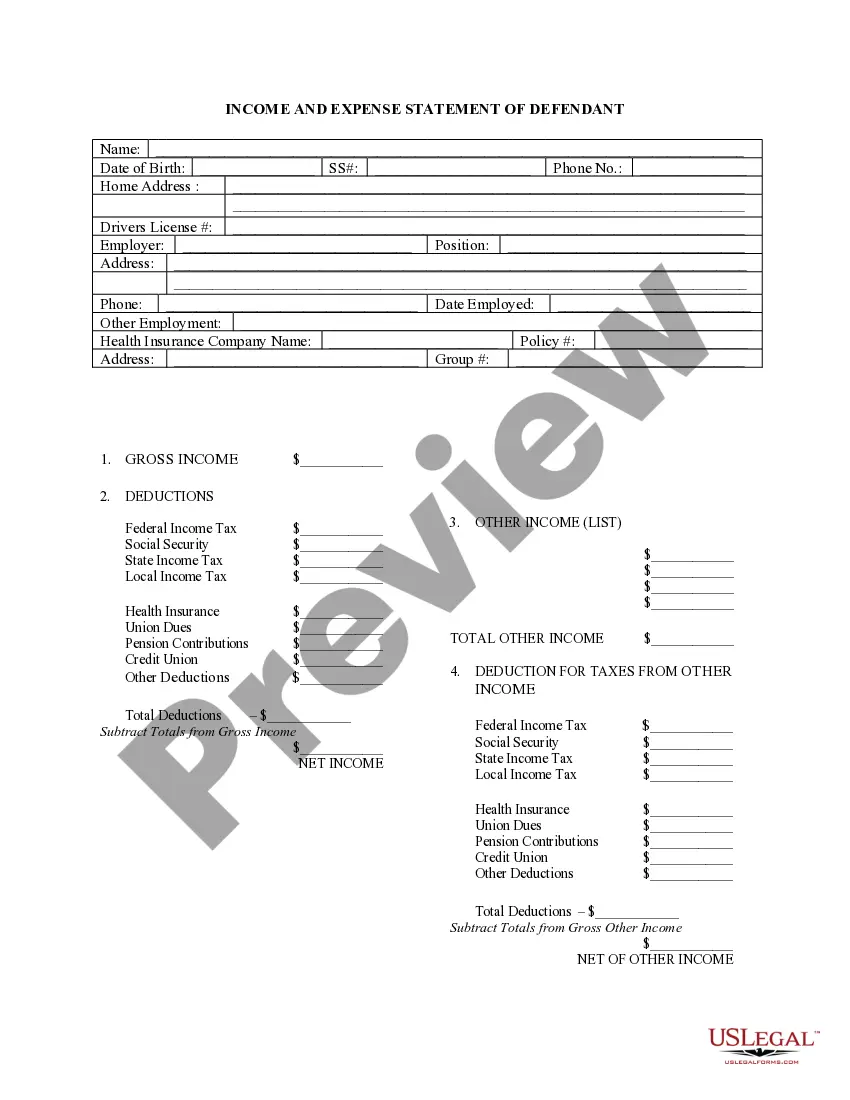

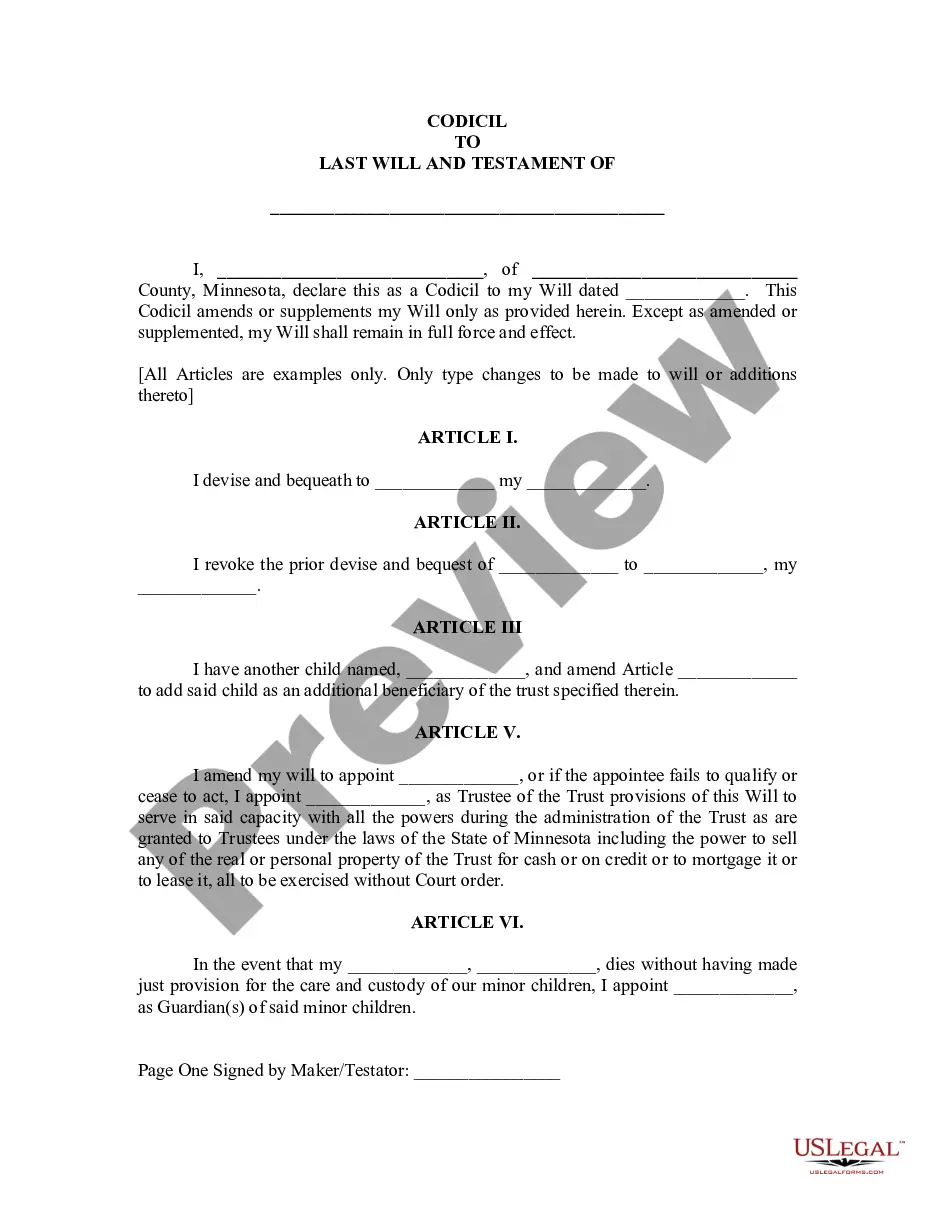

An income statement is a financial statement that shows you the company's income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

An income statement is a financial statement that shows you the company's income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

Expenses are listed on the income statement as they appear in the chart of accounts or in descending order (by dollar amount).

The income statement consists of revenues (money received from the sale of products and services, before expenses are taken out, also known as the top line) and expenses, along with the resulting net income or loss over a period of time due to earning activities.

Definition: A financial document generated monthly and/or annually that reports the earnings of a company by stating all relevant revenues (or gross income) and expenses in order to calculate net income. Also referred to as a profit and loss statement.

Expenses: Expenses are the costs that the company has to pay in order to generate revenue. Some examples of common expenses are equipment depreciation, employee wages, and supplier payments.

The difference between income and expenses is simple: income is the money your business takes in and expenses are what it spends money on. Your net income is generally your revenue, or all the money coming into your business, minus all of your expenses.

Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income.