Commonwealth of Pennsylvania Realty Transfer Tax Statement of Value

Description

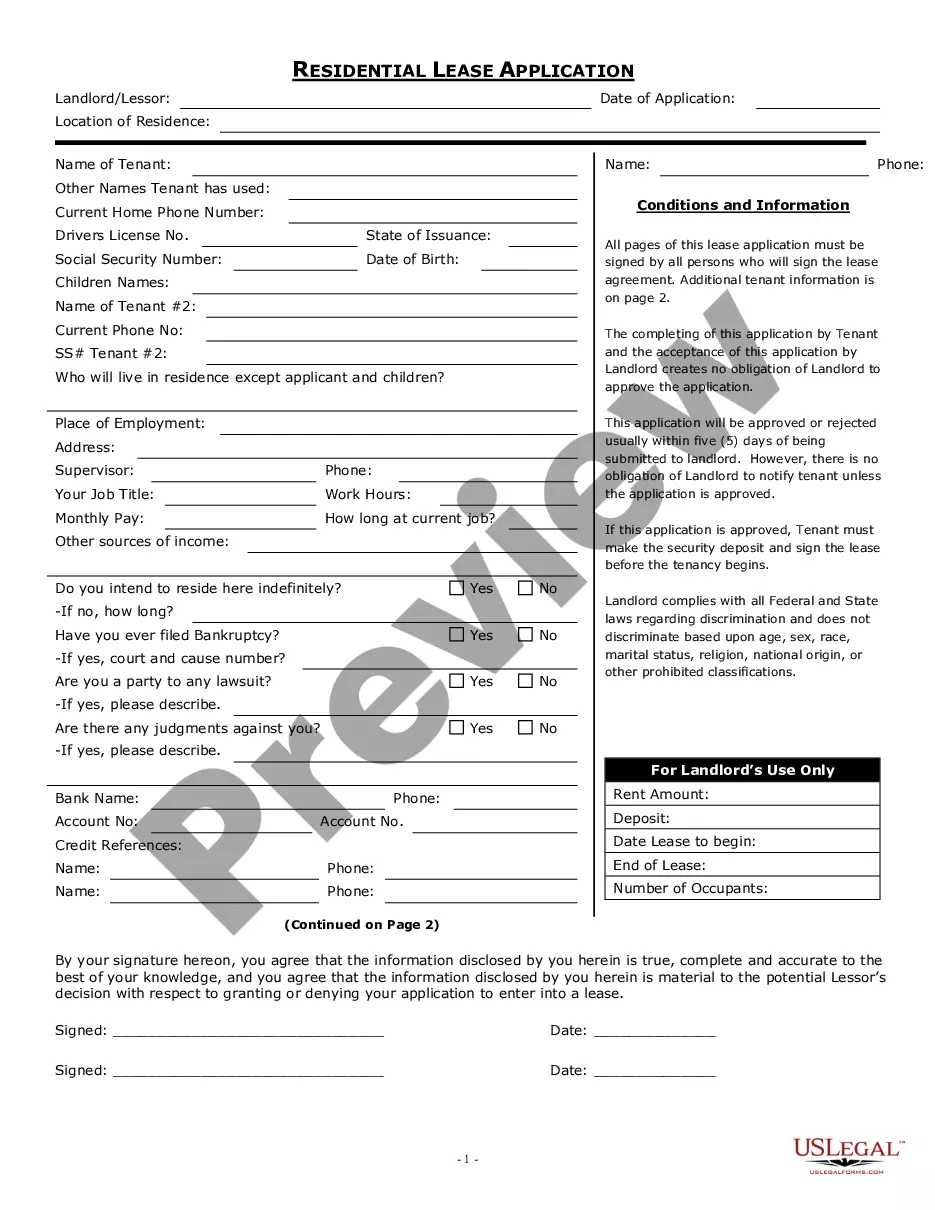

How to fill out Commonwealth Of Pennsylvania Realty Transfer Tax Statement Of Value?

Creating documents isn't the most straightforward task, especially for those who rarely work with legal paperwork. That's why we recommend using correct Commonwealth of Pennsylvania Realty Transfer Tax Statement of Value templates made by professional attorneys. It gives you the ability to avoid troubles when in court or handling formal organizations. Find the templates you want on our website for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the template webpage. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Users without an activated subscription can quickly create an account. Use this brief step-by-step help guide to get your Commonwealth of Pennsylvania Realty Transfer Tax Statement of Value:

- Ensure that file you found is eligible for use in the state it is needed in.

- Verify the file. Use the Preview option or read its description (if readily available).

- Buy Now if this template is what you need or use the Search field to find a different one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these easy steps, you can complete the sample in a preferred editor. Double-check filled in info and consider requesting an attorney to examine your Commonwealth of Pennsylvania Realty Transfer Tax Statement of Value for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

Transfer tax is a tax imposed by states, counties, and cities on the transfer of the title of real property from one person (or entity) to another within the jurisdiction. It is based on the property's sale price and is paid by the buyer, seller, or both parties upon transfer of real property.

Think of the transfer tax (or tax stamp) as a sales tax on real estate. The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost.

Transfer taxes are paid at the closing of a deal, and in most cases are paid by the seller. So, when you're filing your taxes, sellers should be sure to deduct the transfer tax from their capital gain.

In Pennsylvania you pay a transfer tax when you buy or sell a home.If so, is it a sales tax or a real estate tax? No , you cannot deduct county transfer taxes that you paid when you bought or sold your home, on your Federal Income Tax Return.

Unfortunately, transfer taxes are not tax deductible. Transfer taxes are fees imposed to legally transfer a real estate title, and they vary by state. Often, the seller will pay the tax; however, the tax is not deductible for either the buyer or the seller.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing.

A transfer tax is charged by a state or local government to complete a sale of property from one owner to another. The tax is typically based on the value of the property. A federal or state inheritance tax or estate tax may be considered a type of transfer tax.