Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Pennsylvania Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Pennsylvania Middle District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Creating papers isn't the most simple job, especially for those who rarely deal with legal papers. That's why we advise utilizing accurate Pennsylvania Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 samples created by skilled attorneys. It allows you to avoid difficulties when in court or dealing with official organizations. Find the documents you want on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will immediately appear on the file web page. Right after accessing the sample, it will be saved in the My Forms menu.

Customers with no an active subscription can easily create an account. Utilize this short step-by-step help guide to get your Pennsylvania Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13:

- Make certain that the form you found is eligible for use in the state it’s required in.

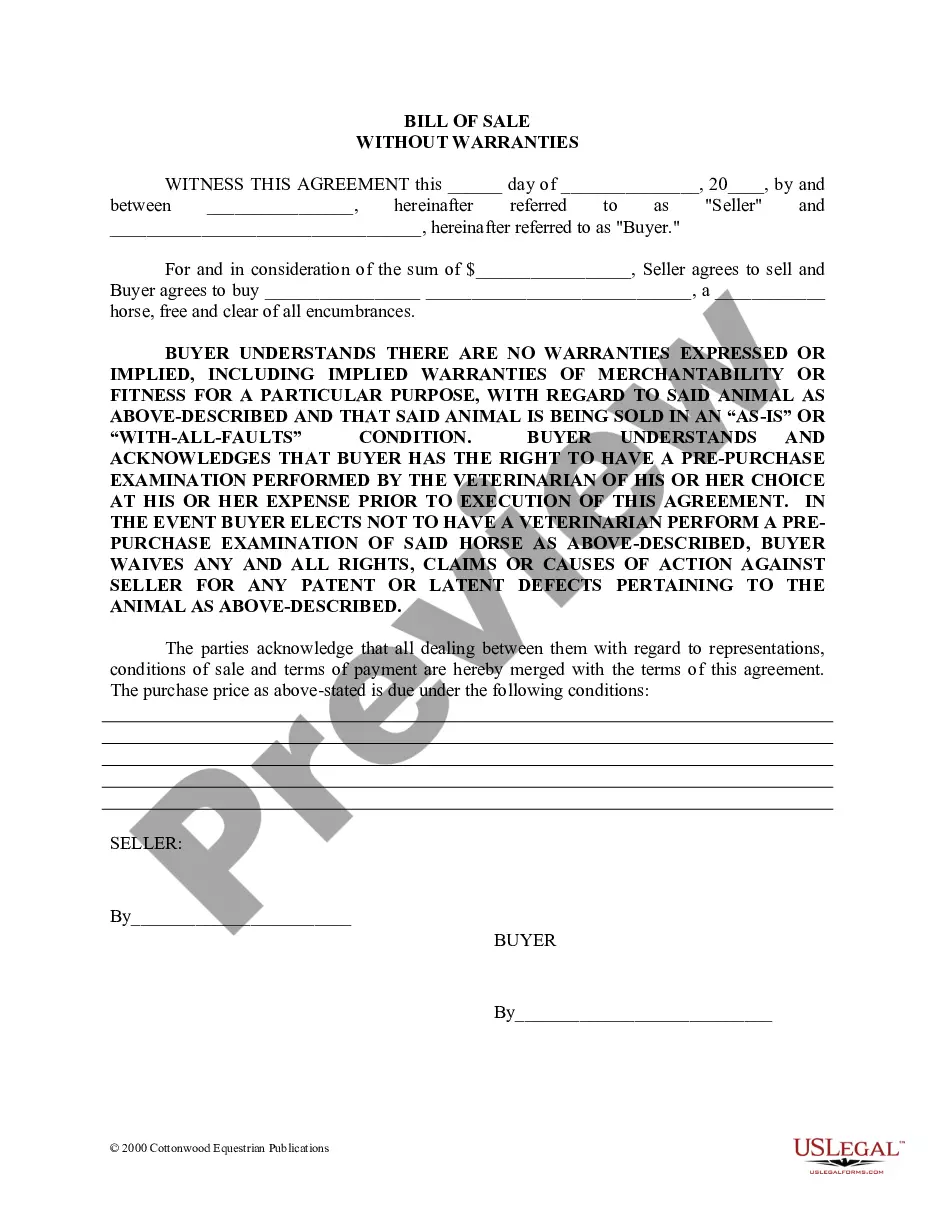

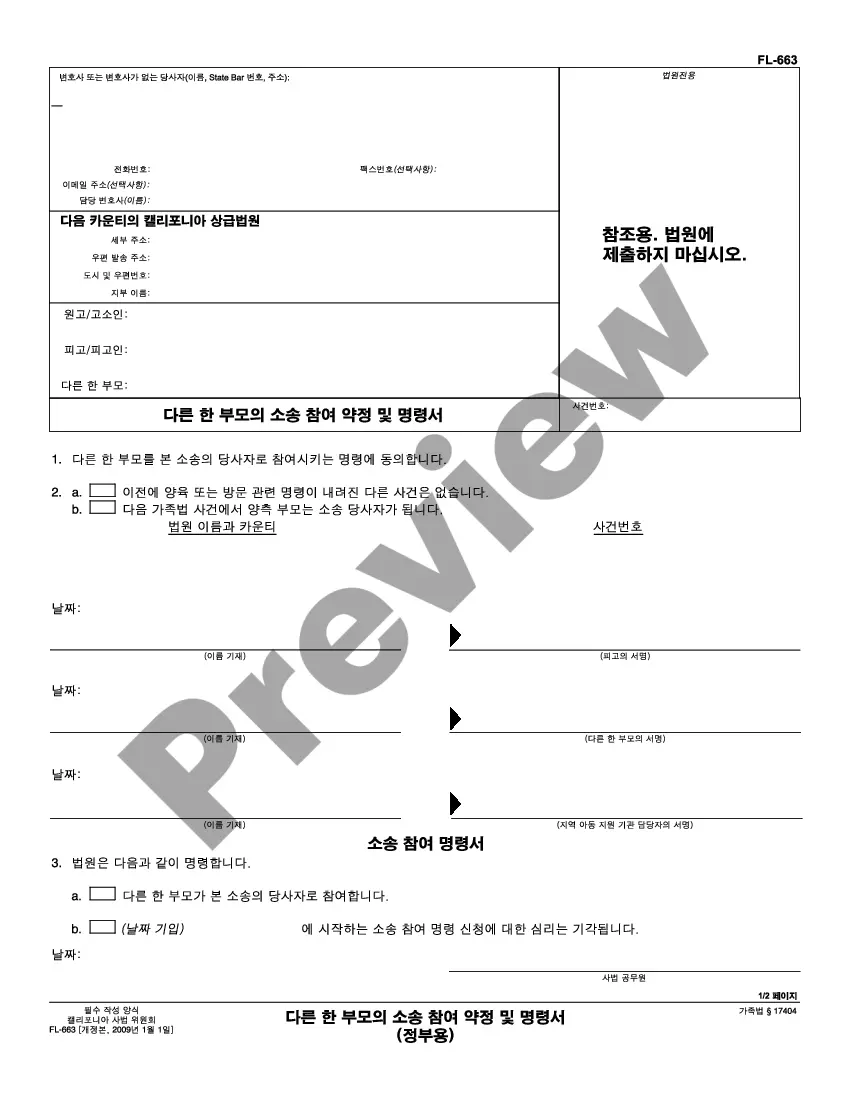

- Verify the file. Use the Preview option or read its description (if offered).

- Click Buy Now if this template is what you need or utilize the Search field to find a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after finishing these easy actions, you are able to fill out the sample in your favorite editor. Recheck completed data and consider asking a legal professional to review your Pennsylvania Middle District Bankruptcy Guide and Forms Package for Chapters 7 or 13 for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

Bankruptcies: 7 years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies. Foreclosures: 7 years. Collections: Generally, about 7 years, depending on the age of the debt being collected. Public Record: 7 years.

If you have a PACER account, you can search using the PACER Case Locator. You can visit the courthouse and use a public terminal. If you know the social security number, you can use the VCIS system. It's a toll free call to 1-866-222-8029. See VCIS instructions here.

Unless sealed, all documents filed in a bankruptcy case are available for public viewing. Information contained in bankruptcy case documents is a matter of public record. Documents may be accessed in the Clerk's Office during regular business hours, or 24 hours a day via internet access to PACER.

Case Information Online Public Access to Court Electronic Records (PACER) is a web-based system that allows users with an internet connection and a PACER account to view or print case documents online. A fee is charged for each page viewed. To sign up for a PACER account, register at http://www.pacer.gov .

You take and complete a credit counseling course. You'll prepare the bankruptcy petition and the proposed Chapter 13 plan. You file your bankruptcy petition, proposed plan, and other required documents. The court appoints a bankruptcy trustee to administer your case. The automatic stay takes effect.

In the majority of cases where the court denies a chapter 13 plan, it is because a debtor did not comply with requirements outlined by your attorney or the court. In order for your chapter 13 plan to be confirmed, you must:2) Have made your first chapter 13 payment within 30 days of filing your case.

Because a chapter 7 discharge is subject to many exceptions, debtors should consult competent legal counsel before filing to discuss the scope of the discharge. Generally, excluding cases that are dismissed or converted, individual debtors receive a discharge in more than 99 percent of chapter 7 cases.

A bankruptcy dismissal closes your bankruptcy case, and if it occurs before you receive a discharge, it will mean that: you've lost the protection of the automatic stay (the order that prohibits creditors from collecting debts), and. you'll continue to be liable for your debts.

The truth: Bankruptcies are considered public records, which is how they're reported on your credit. The public record associated with a Chapter 7 bankruptcy will remain on your credit report for as long as 10 years. That time period starts on the date you file the bankruptcy petition.