Pennsylvania Reaffirmation Agreement

Description

How to fill out Pennsylvania Reaffirmation Agreement?

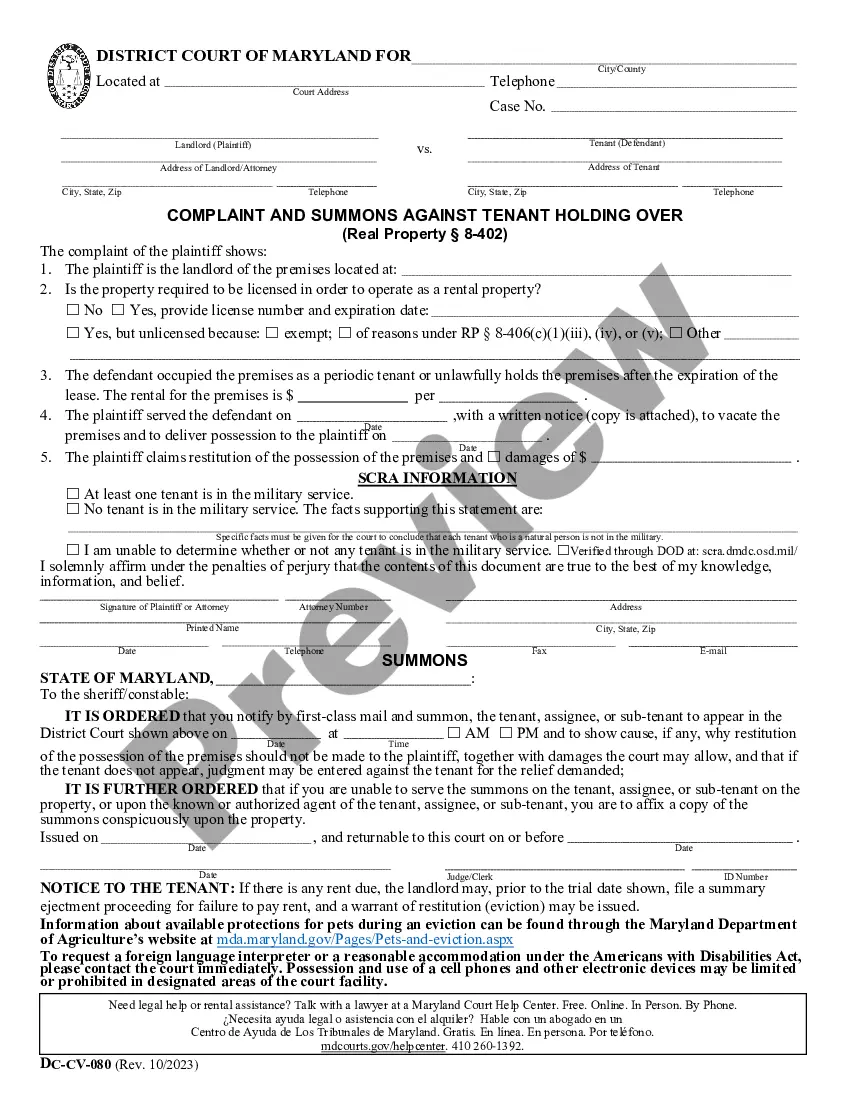

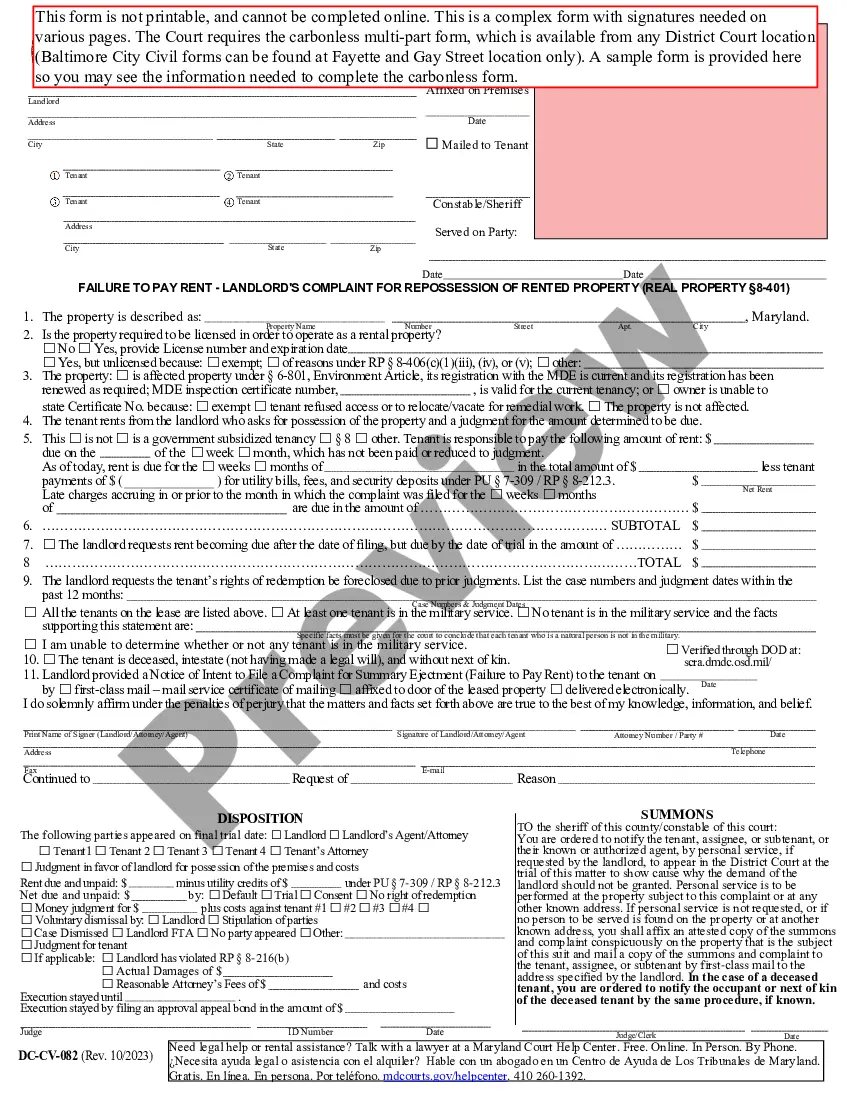

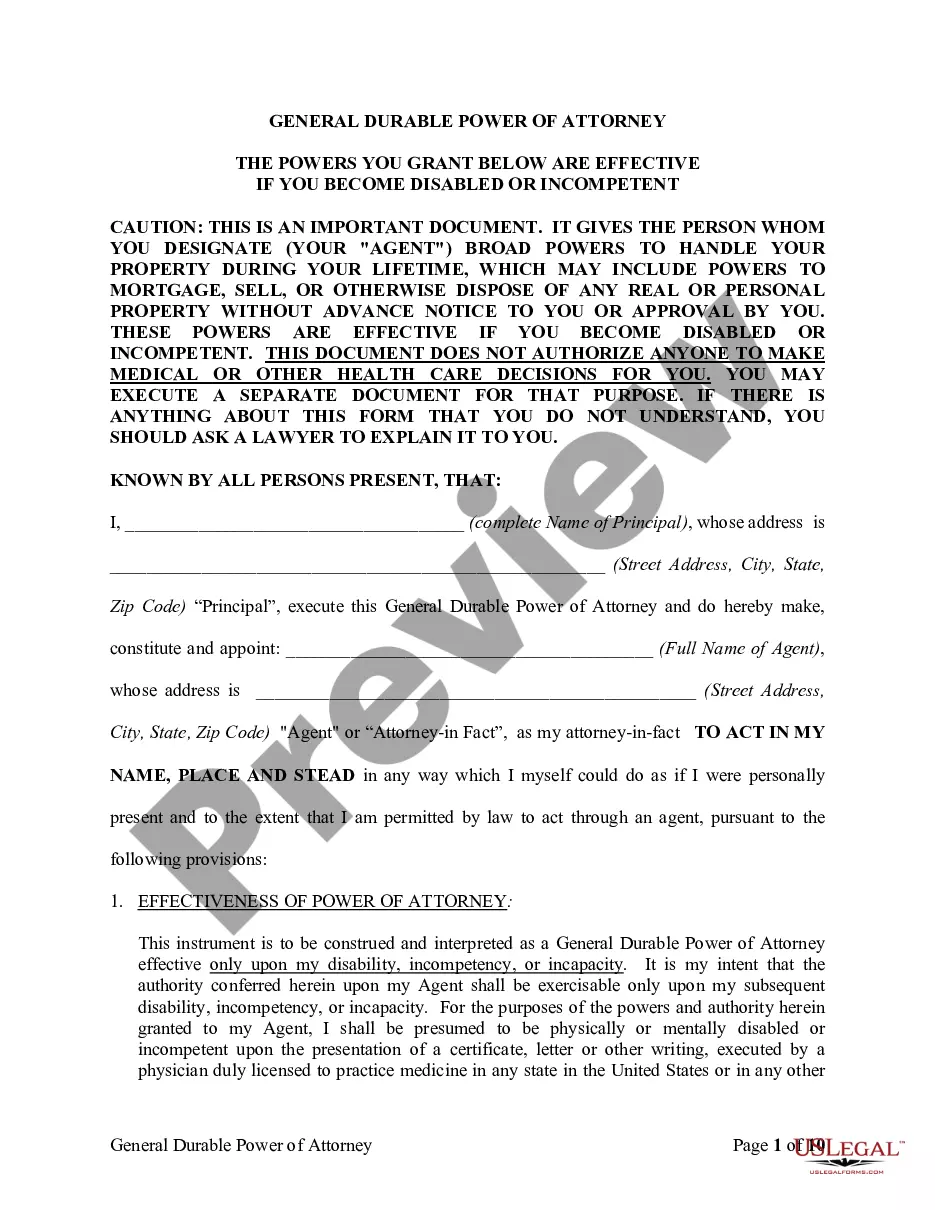

The work with papers isn't the most uncomplicated job, especially for people who rarely deal with legal papers. That's why we advise using correct Pennsylvania Reaffirmation Agreement templates made by professional attorneys. It gives you the ability to stay away from difficulties when in court or working with official institutions. Find the templates you need on our website for high-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file webpage. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Users with no an activated subscription can easily create an account. Follow this brief step-by-step guide to get the Pennsylvania Reaffirmation Agreement:

- Be sure that the form you found is eligible for use in the state it is necessary in.

- Confirm the document. Make use of the Preview option or read its description (if available).

- Buy Now if this sample is the thing you need or go back to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these straightforward steps, you can fill out the form in a preferred editor. Check the completed information and consider asking a legal representative to examine your Pennsylvania Reaffirmation Agreement for correctness. With US Legal Forms, everything gets much easier. Try it out now!

Form popularity

FAQ

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.

If you don't sign a reaffirmation agreement, the lender can repossess your car after your case closes and the automatic stay lifts. Some car lenders are known to repossess the car immediately, even if you are current on payments.

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case. There may be other ways to renegotiate payments with creditors without entering into a reaffirmation agreement.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

If you do not reaffirm the mortgage, your personal liability for paying the debt represented by the promissory note is discharged in your bankruptcy case.The company can foreclose the mortgage and force a foreclosure sale if you stop making payments.