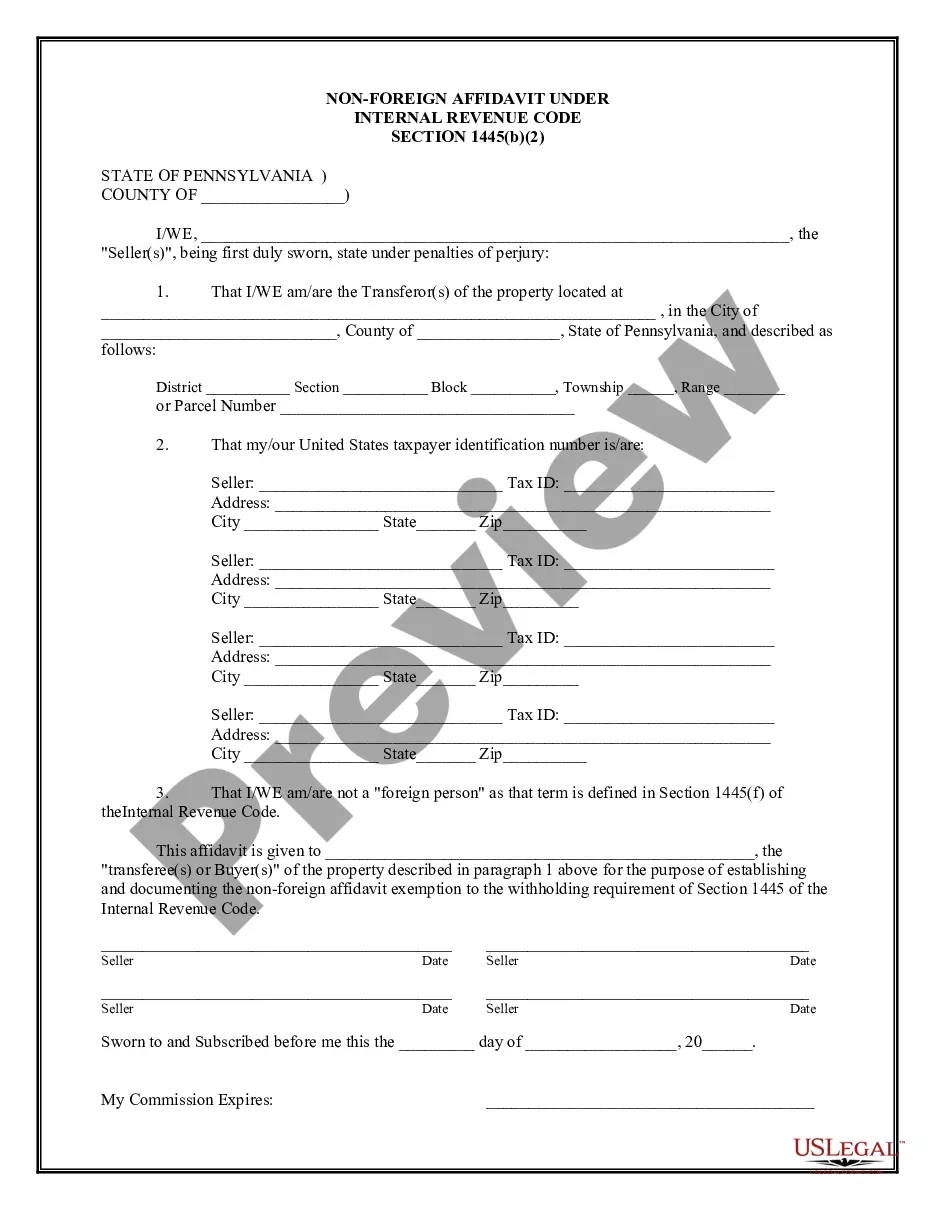

Pennsylvania Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Pennsylvania Non-Foreign Affidavit Under IRC 1445?

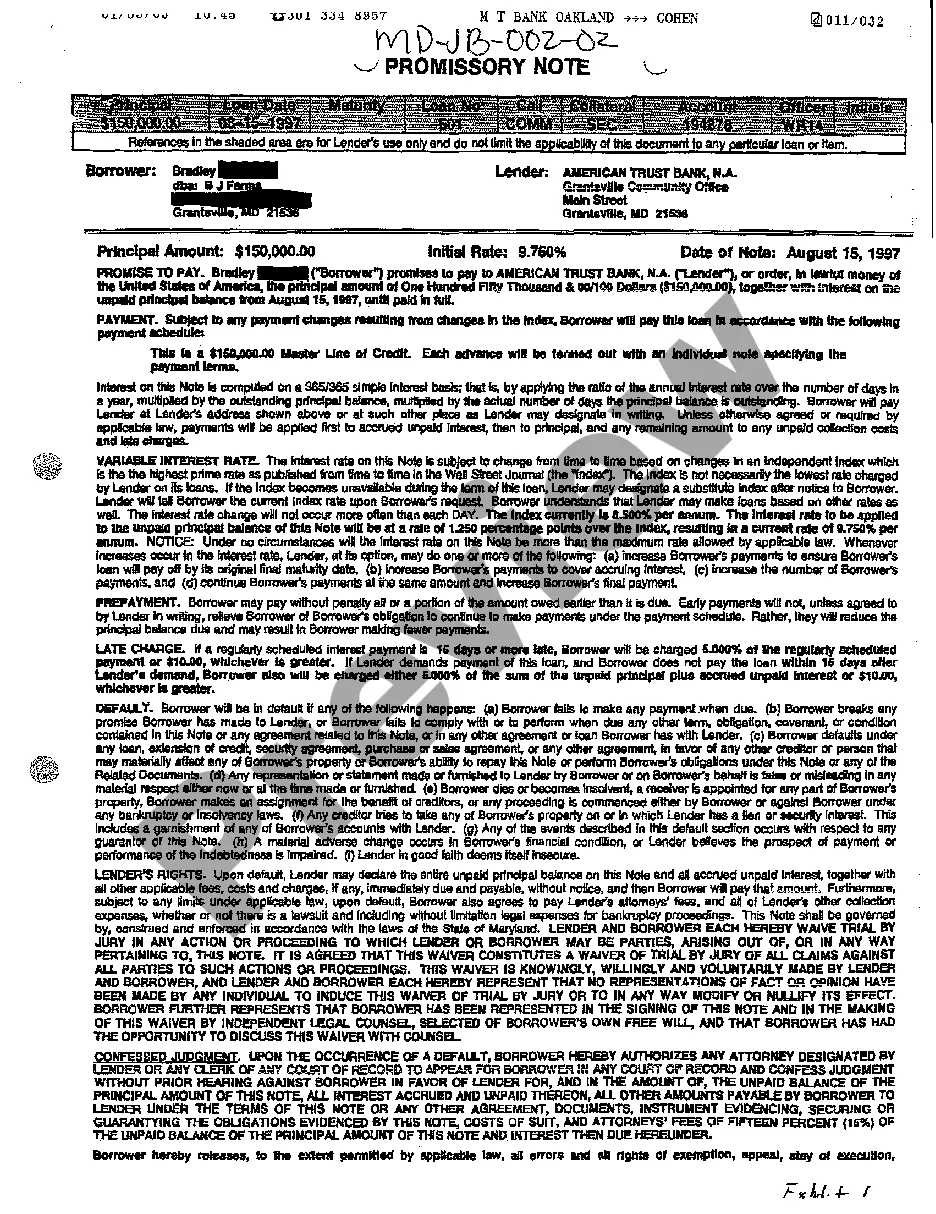

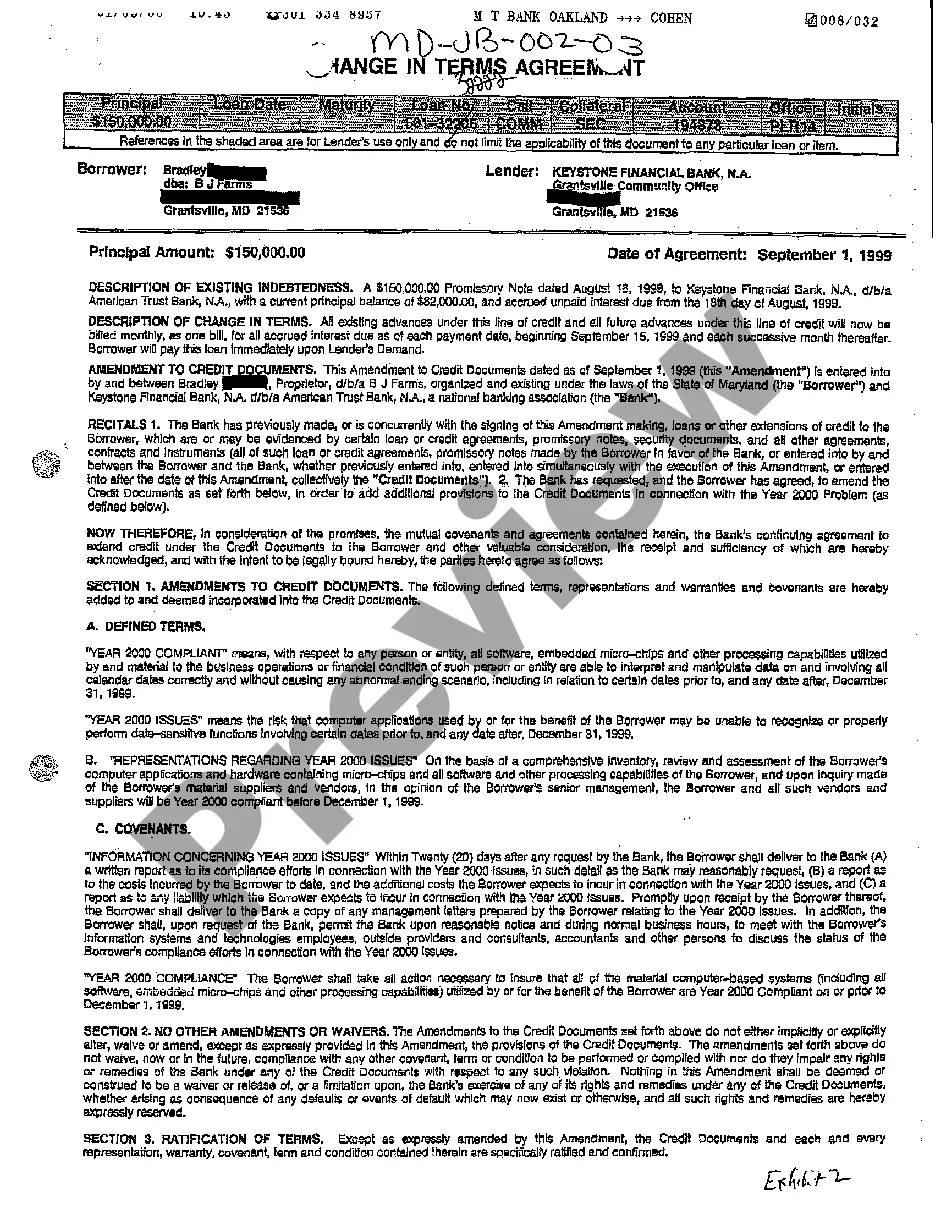

Creating papers isn't the most uncomplicated process, especially for those who rarely work with legal papers. That's why we advise using accurate Pennsylvania Non-Foreign Affidavit Under IRC 1445 templates created by professional attorneys. It allows you to eliminate troubles when in court or handling formal organizations. Find the files you need on our site for high-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file webpage. Soon after downloading the sample, it’ll be stored in the My Forms menu.

Users with no an active subscription can quickly get an account. Use this simple step-by-step guide to get the Pennsylvania Non-Foreign Affidavit Under IRC 1445:

- Make sure that the document you found is eligible for use in the state it is required in.

- Confirm the file. Utilize the Preview feature or read its description (if offered).

- Buy Now if this sample is the thing you need or utilize the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after completing these easy steps, you are able to complete the sample in your favorite editor. Recheck filled in details and consider asking a lawyer to examine your Pennsylvania Non-Foreign Affidavit Under IRC 1445 for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

Enter the FIRPTA certificate. Section 1445 and the underlying regulations provide that a buyer will be absolved of the seller's failure to pay the appropriate tax if the buyer reasonably relies on a properly drafted affidavit that no withholding is required.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.