Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description Living Trust With

How to fill out Trust Who With?

Creating documents isn't the most easy task, especially for people who rarely deal with legal papers. That's why we advise using accurate Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children templates made by skilled lawyers. It gives you the ability to eliminate difficulties when in court or working with formal organizations. Find the documents you want on our website for high-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Soon after downloading the sample, it will be saved in the My Forms menu.

Users without an activated subscription can quickly get an account. Follow this brief step-by-step guide to get your Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children:

- Be sure that file you found is eligible for use in the state it is necessary in.

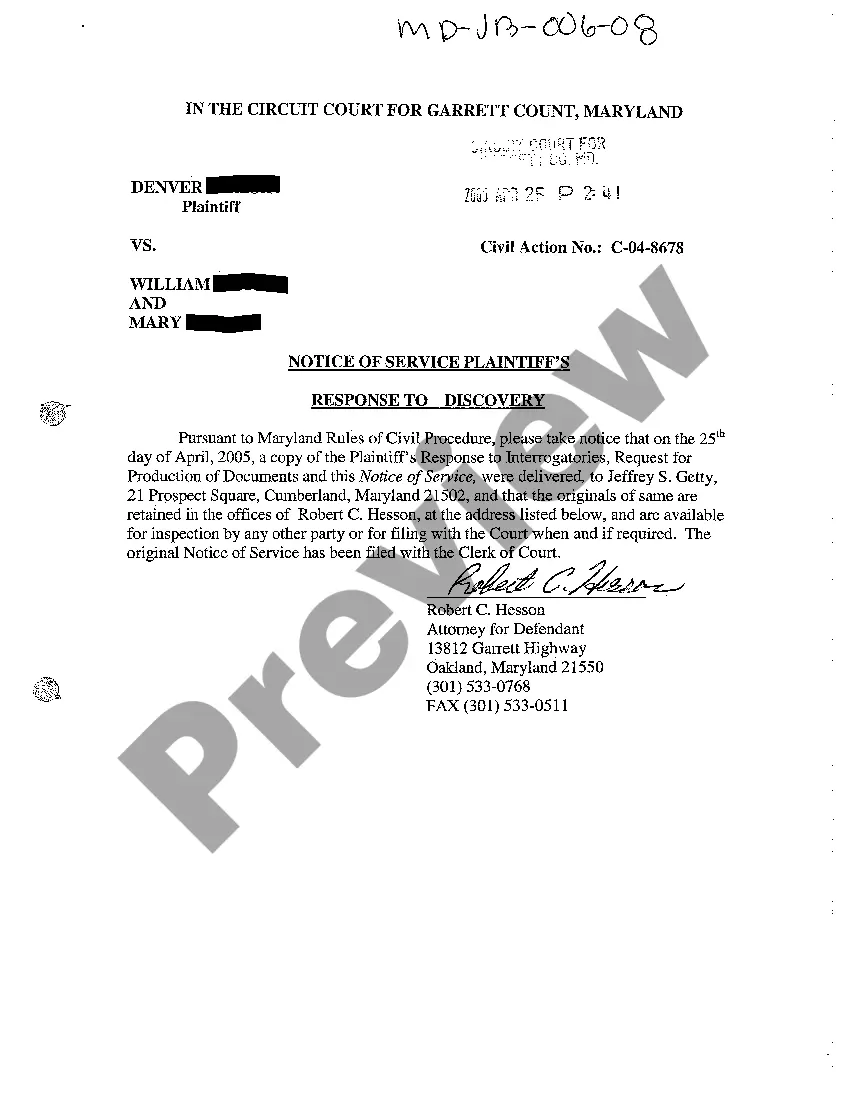

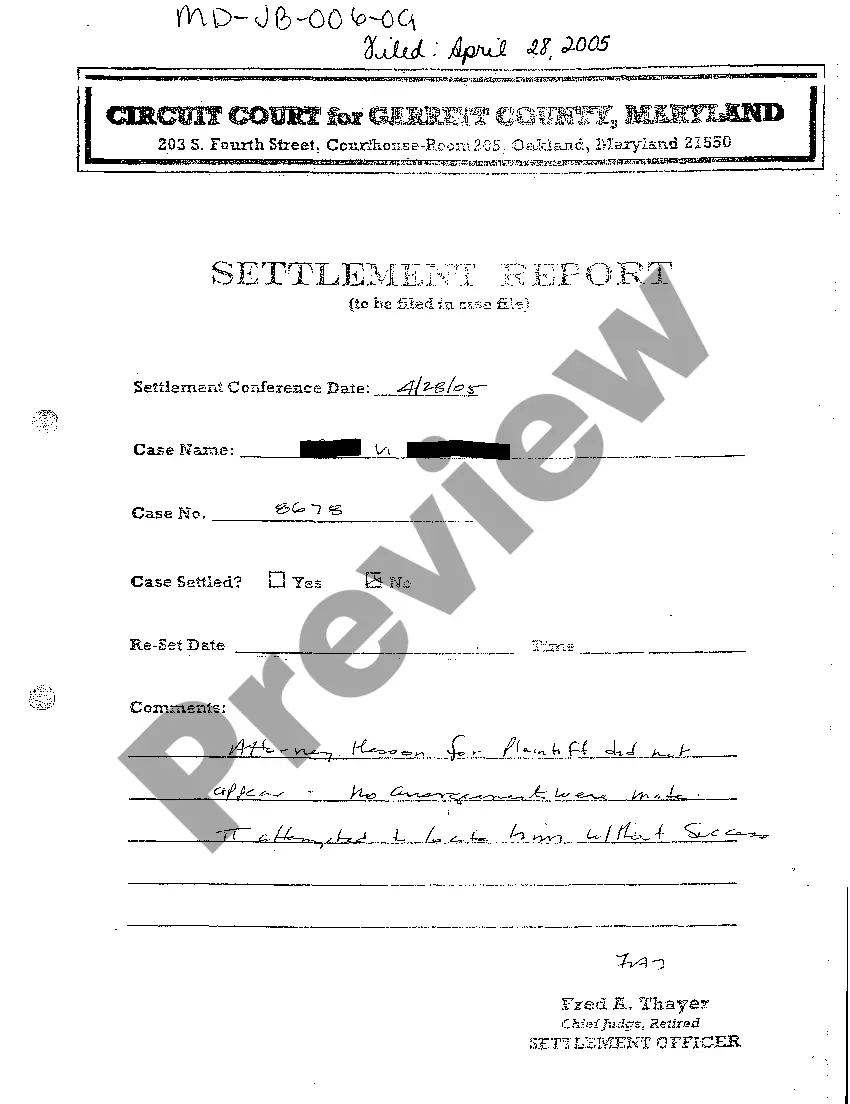

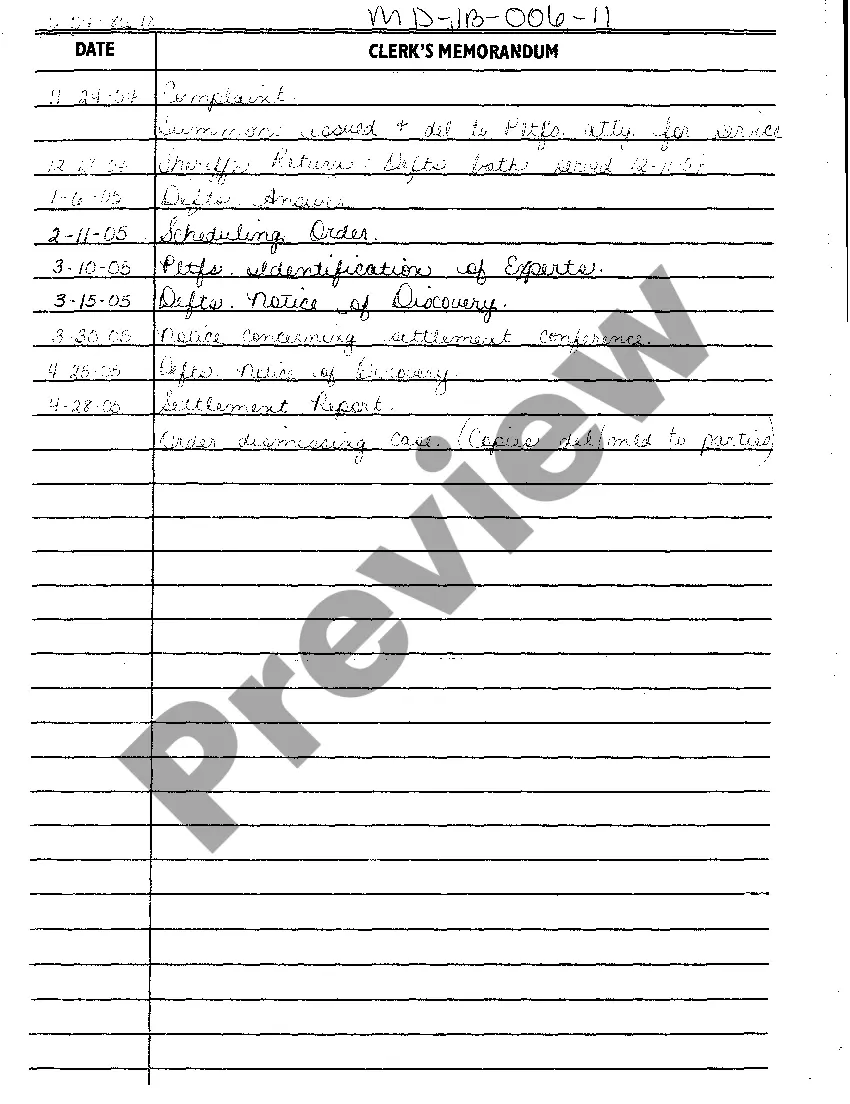

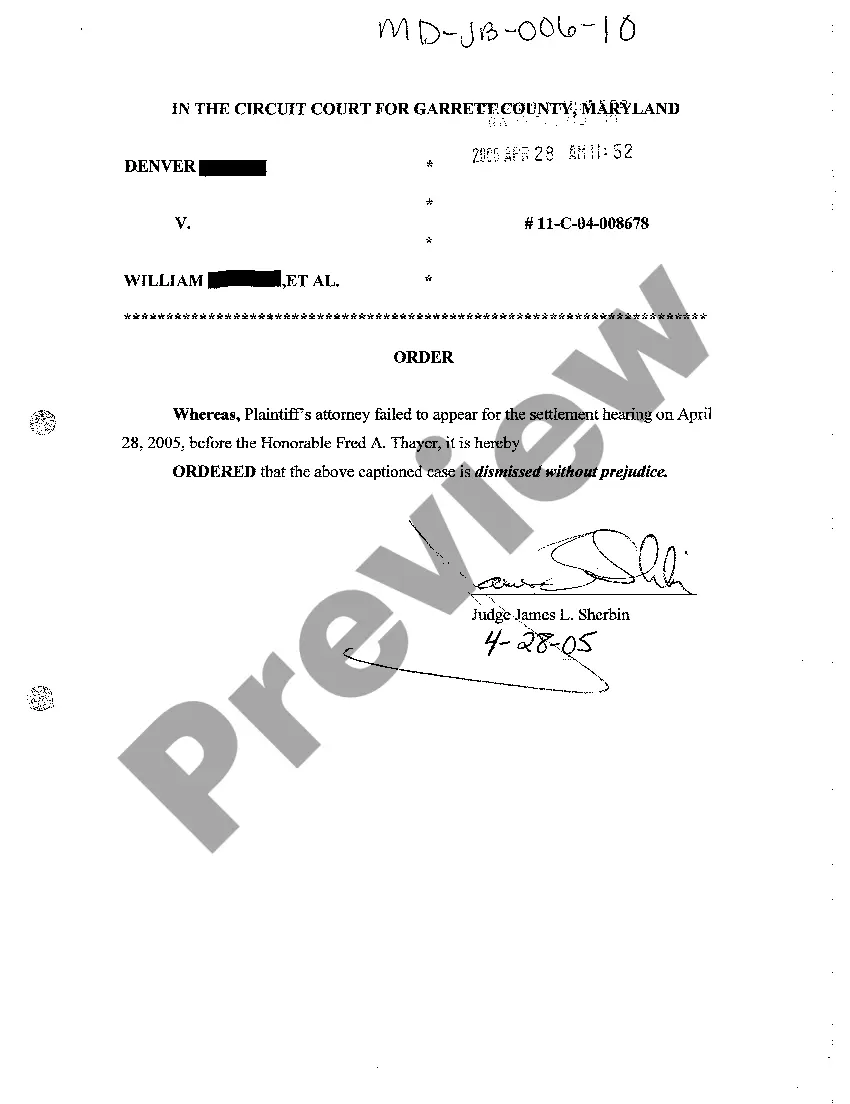

- Confirm the file. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this template is the thing you need or return to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these straightforward steps, you can fill out the form in an appropriate editor. Recheck filled in info and consider requesting a legal representative to examine your Pennsylvania Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Pa Living Trust Form popularity

Pennsylvania Trust With Other Form Names

Pennsylvania Individual Application FAQ

But for estates in Pennsylvania that exceed the small estate's threshold, and for which there is either no Will, or a Will (but not a Living Trust), probate will be required before an estate can be tranferred to the decedent's heirs or beneficiaries.

How long does probate in Pennsylvania take? In Pennsylvania, most probates can be done in 9 to 18 months.

In Pennsylvania, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Examples of probate assets include: Single name bank or investment accounts. Assets owned jointly as tenants in common (as opposed to joint tenancy) Art and collectibles.

At its most basic level, the probate process in Pennsylvania involves two steps: paying your debts and transferring any assets to your beneficiaries. A probate proceeding begins when the court appoints someone to handle the administration of estate, i.e. a personal representative.

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

Typically, the entire process may take up to 12 months. The longest delay seems to be for the PA Department of Revenue to approve a PA Inheritance Tax Return, once submitted...

Property that is held in joint tenancy or as tenants by the entirety. Bank or brokerage accounts held in joint tenancy or with payable on death (POD) or transfer on death (TOD) beneficiaries. Property held in a trust.

How long does probate in Pennsylvania take? In Pennsylvania, most probates can be done in 9 to 18 months.