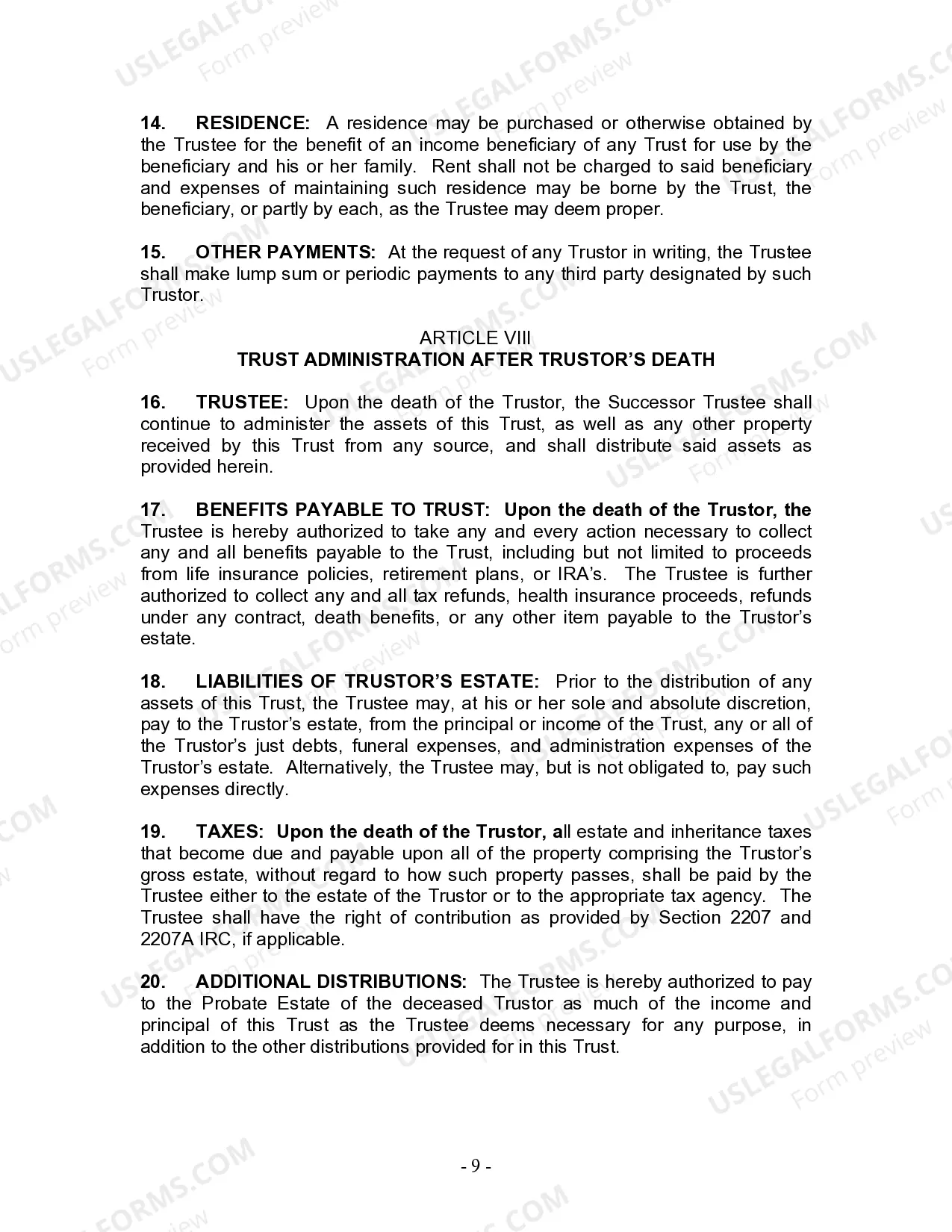

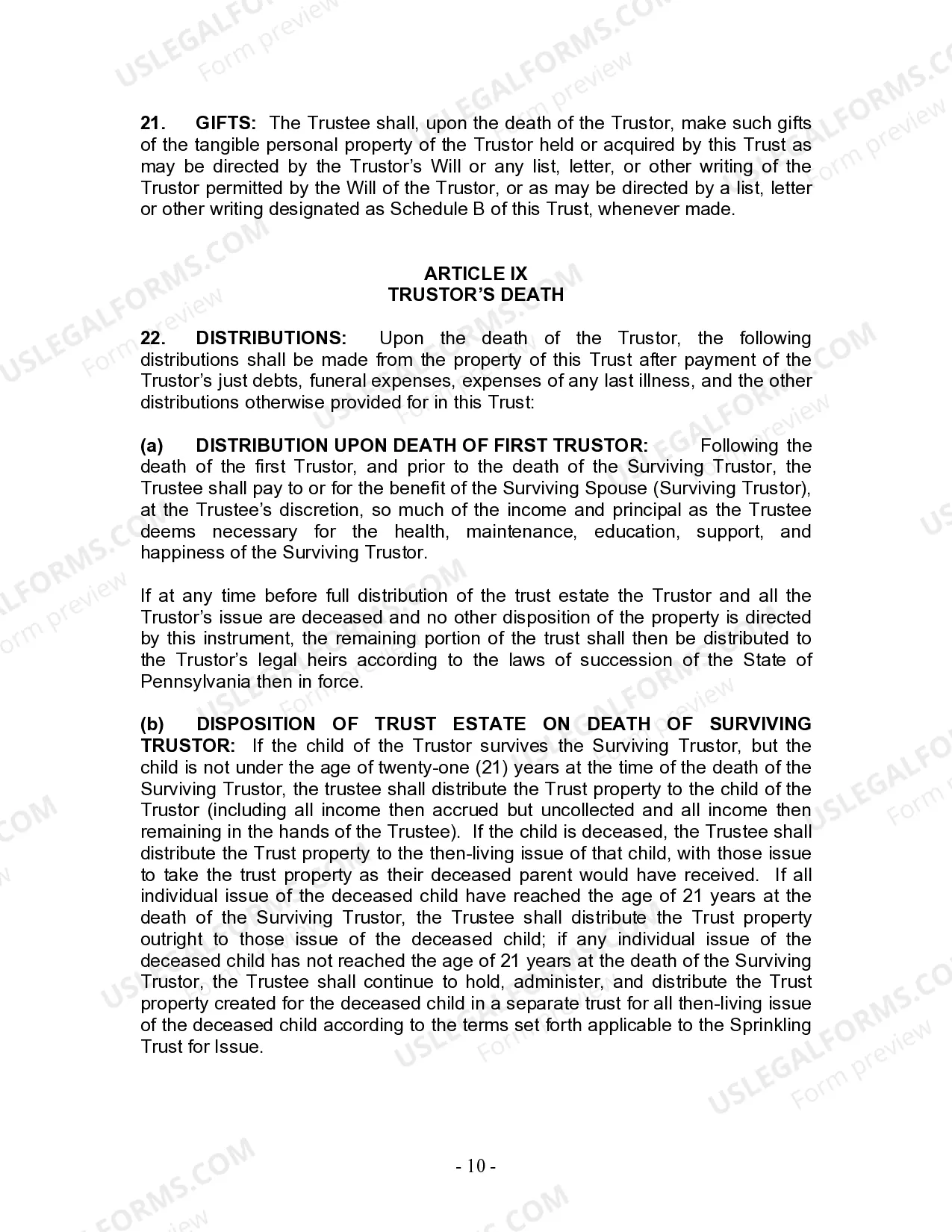

Pennsylvania Living Trust for Husband and Wife with One Child

Description Pa Living Trust Form

How to fill out Pennsylvania Living Trust For Husband And Wife With One Child?

Creating documents isn't the most uncomplicated process, especially for people who rarely work with legal paperwork. That's why we recommend using correct Pennsylvania Living Trust for Husband and Wife with One Child templates made by skilled attorneys. It allows you to eliminate problems when in court or working with formal institutions. Find the samples you require on our site for top-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will immediately appear on the template webpage. Soon after getting the sample, it will be saved in the My Forms menu.

Customers without an activated subscription can quickly get an account. Look at this brief step-by-step help guide to get your Pennsylvania Living Trust for Husband and Wife with One Child:

- Ensure that file you found is eligible for use in the state it’s necessary in.

- Verify the file. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this sample is the thing you need or go back to the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

After doing these straightforward steps, you are able to complete the form in a preferred editor. Recheck filled in info and consider requesting a legal professional to review your Pennsylvania Living Trust for Husband and Wife with One Child for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

Q: Can a person have more than one trust? A: Yes, it is not that uncommon for a person to be the beneficiary of multiple trusts. However, caution should be used. Trusts come in many shapes and sizes and can serve multiple purposes and can be established by you or by someone else for your benefit.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

A main characteristic of the common law trust is the concept of dual ownership. This concept establishes a distinction between a trustee's legal ownership of the assets of the trust and a beneficiary's equitable title to those same assets.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.

Next of kin is defined in Pennsylvania Title 20, Chapter 3, §305 as: The spouse and relatives by blood of the deceased in order that they be authorized to succeed to the deceased's estate under Chapter 21 (relating to intestate succession) as long as the person is an adult or an emancipated minor.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

While there are a number of different types of trusts, the basic types are revocable and irrevocable.