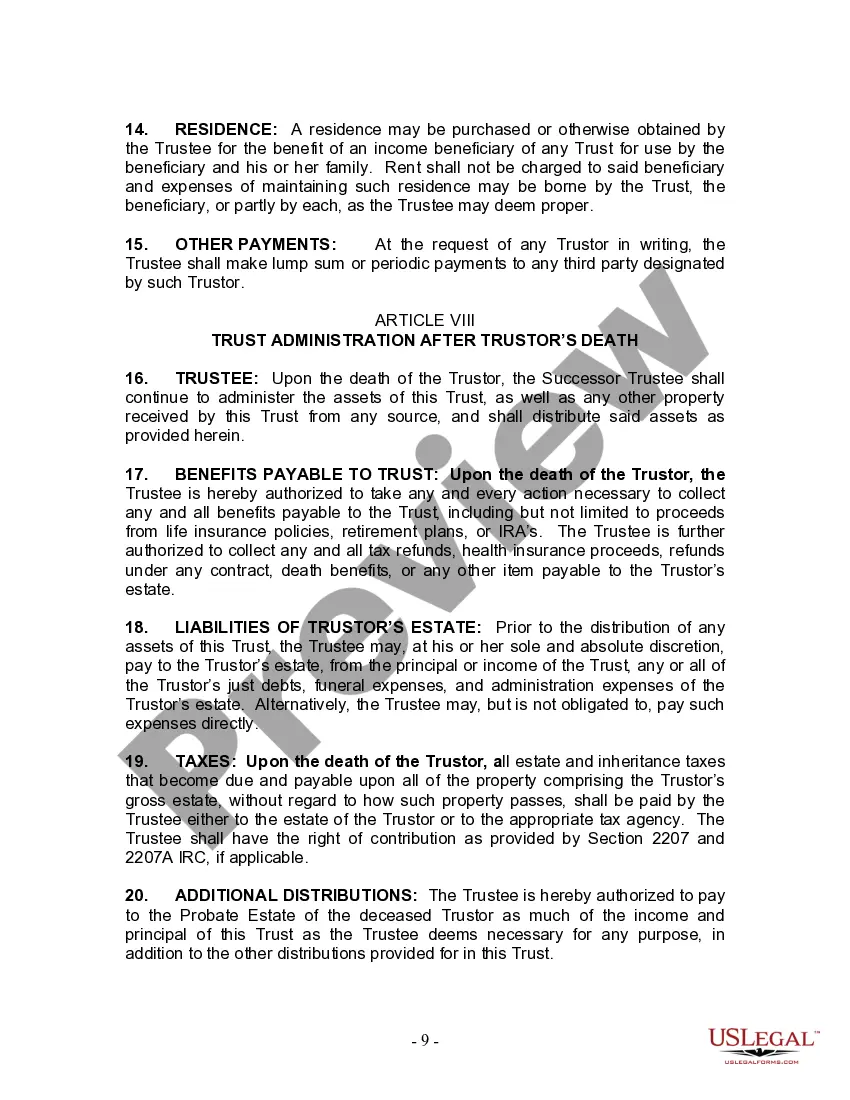

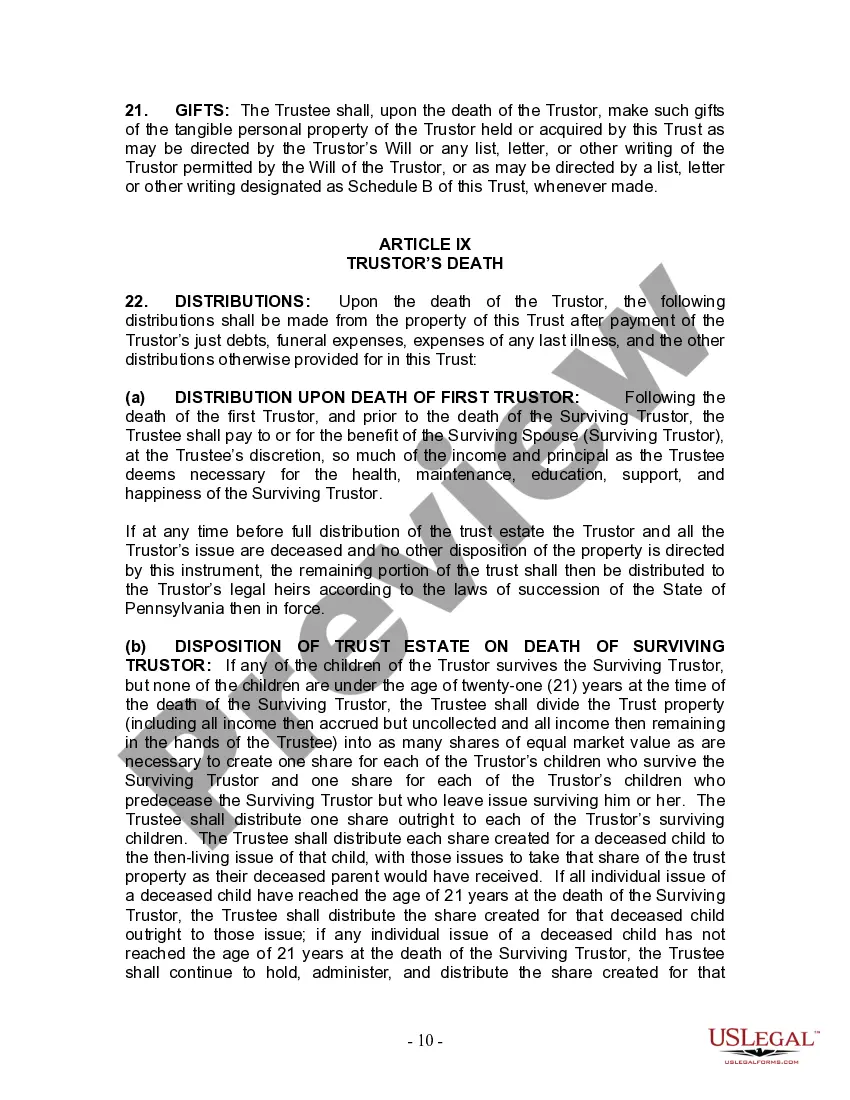

Pennsylvania Living Trust for Husband and Wife with Minor and or Adult Children

Description Pennsylvania Trust

How to fill out Living Form Revocable?

The work with documents isn't the most easy job, especially for those who almost never work with legal papers. That's why we recommend utilizing correct Pennsylvania Living Trust for Husband and Wife with Minor and or Adult Children samples created by skilled lawyers. It gives you the ability to avoid troubles when in court or working with formal organizations. Find the documents you need on our website for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Right after accessing the sample, it will be saved in the My Forms menu.

Users without a subscription can quickly create an account. Utilize this brief step-by-step guide to get your Pennsylvania Living Trust for Husband and Wife with Minor and or Adult Children:

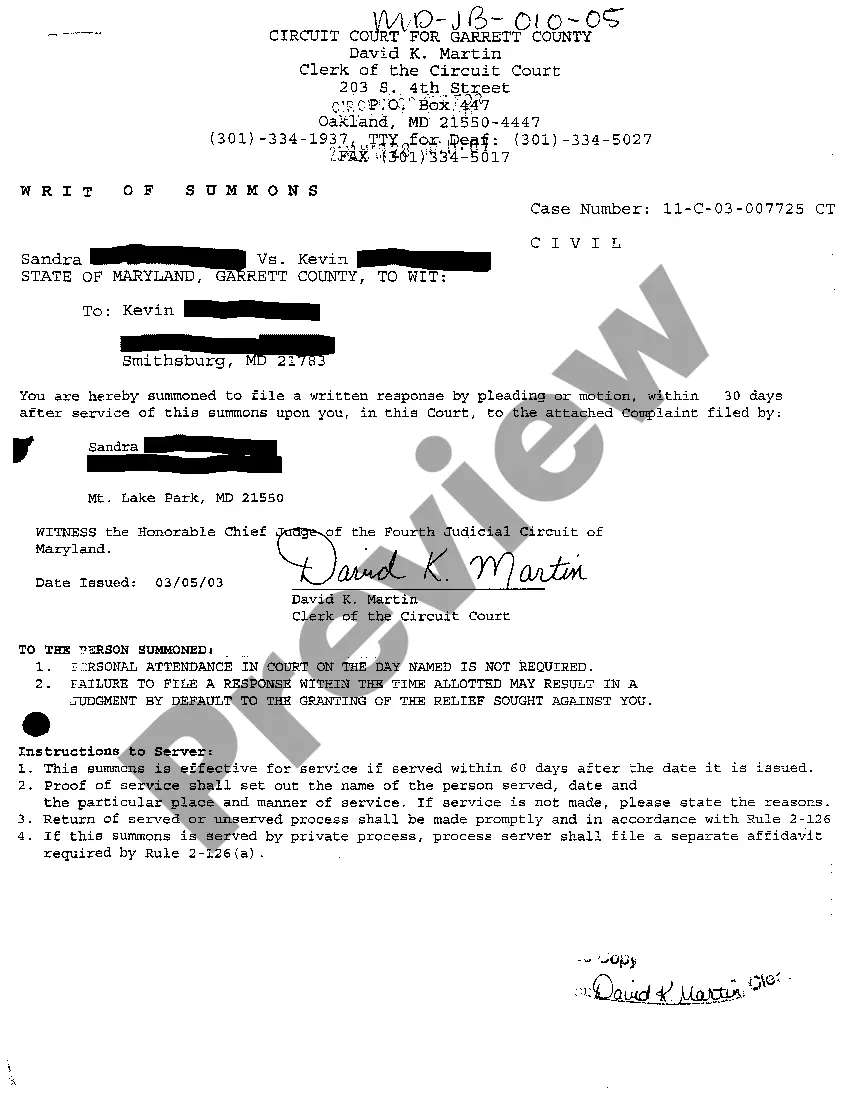

- Make sure that file you found is eligible for use in the state it is necessary in.

- Confirm the document. Use the Preview option or read its description (if offered).

- Buy Now if this form is what you need or use the Search field to get another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After doing these simple steps, you can complete the sample in an appropriate editor. Check the completed information and consider requesting a legal professional to review your Pennsylvania Living Trust for Husband and Wife with Minor and or Adult Children for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Trust Children Form Form popularity

Living Minor Adult Other Form Names

Pennsylvania Living Trust FAQ

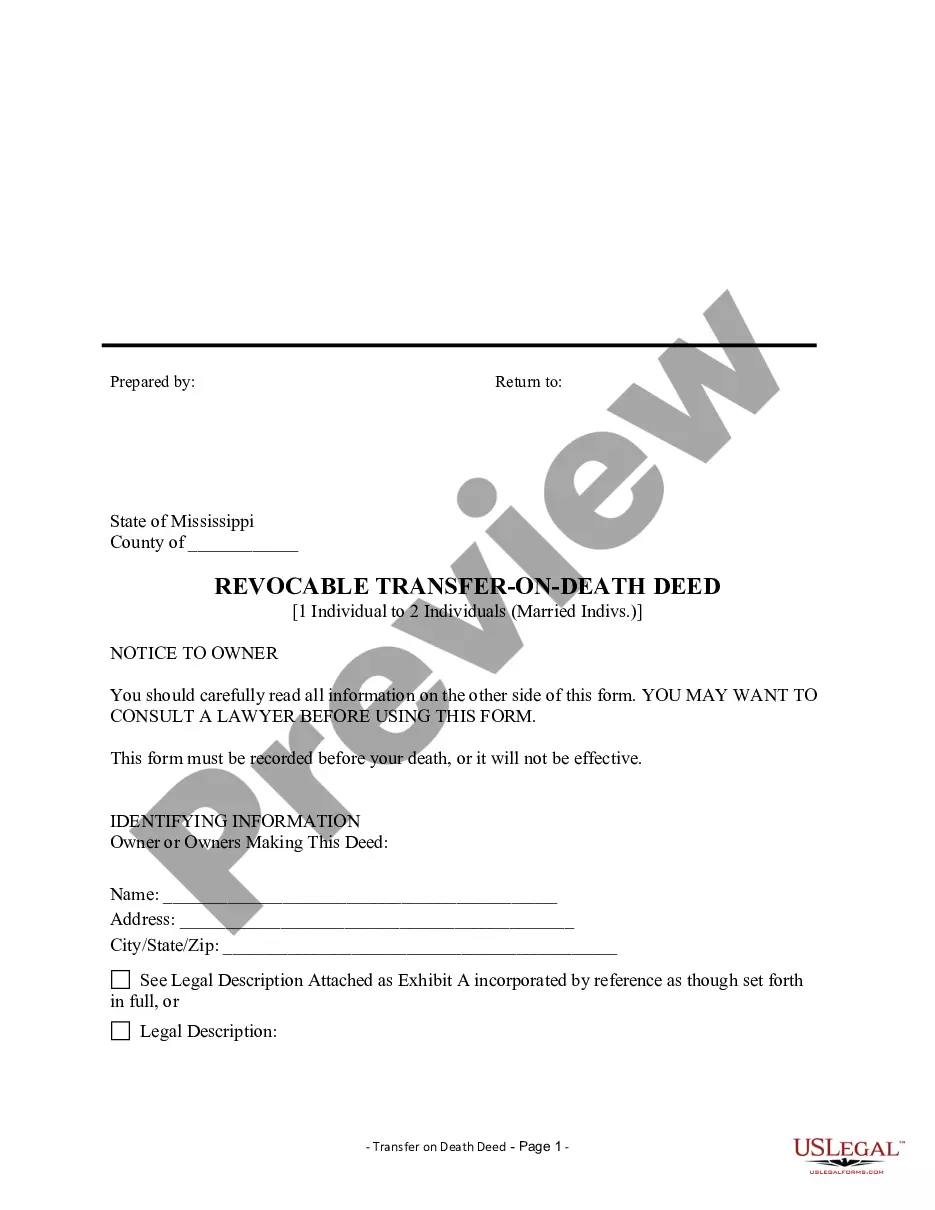

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

One type of trust that will protect your assets from your creditors is called an irrevocable trust. Once you establish an irrevocable trust, you no longer legally own the assets you used to fund it and can no longer control how those assets are distributed.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Next of kin is defined in Pennsylvania Title 20, Chapter 3, §305 as: The spouse and relatives by blood of the deceased in order that they be authorized to succeed to the deceased's estate under Chapter 21 (relating to intestate succession) as long as the person is an adult or an emancipated minor.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

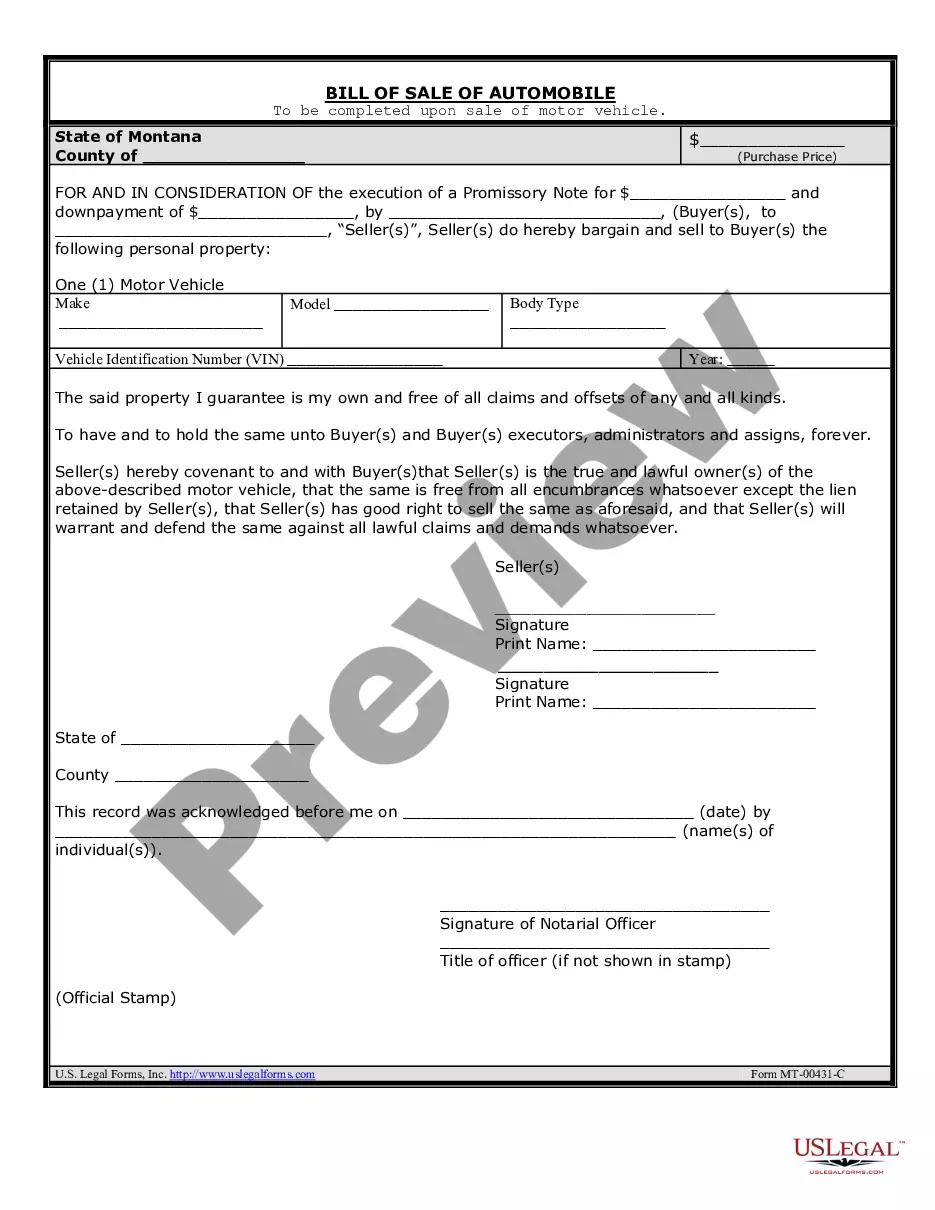

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

You can put your real estate into your living trust even if owe money on it. A loan on the property -- like a mortgage or deed of trust -- will follow the property into the trust, and it will also follow the property to the beneficiary.