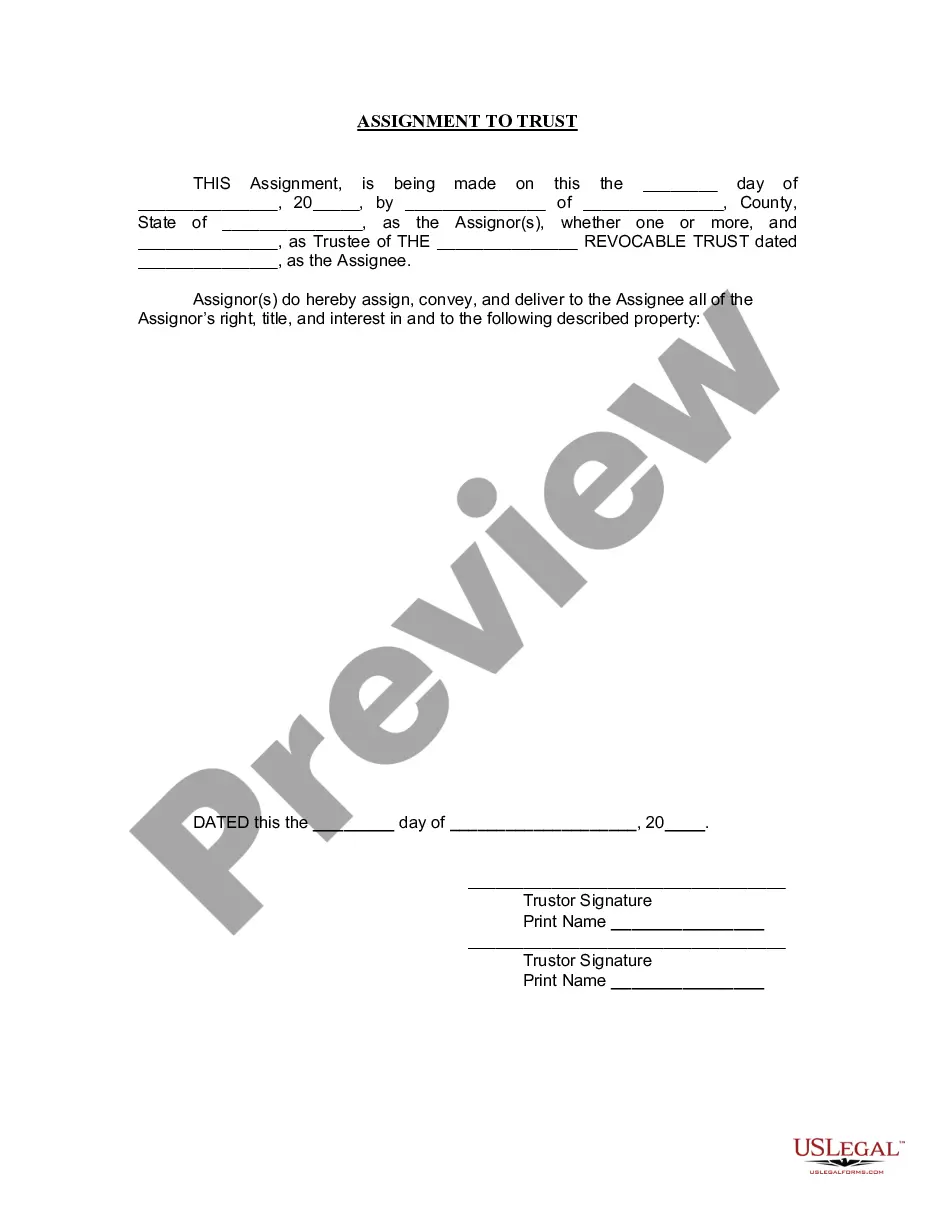

Pennsylvania Assignment to Living Trust

Description

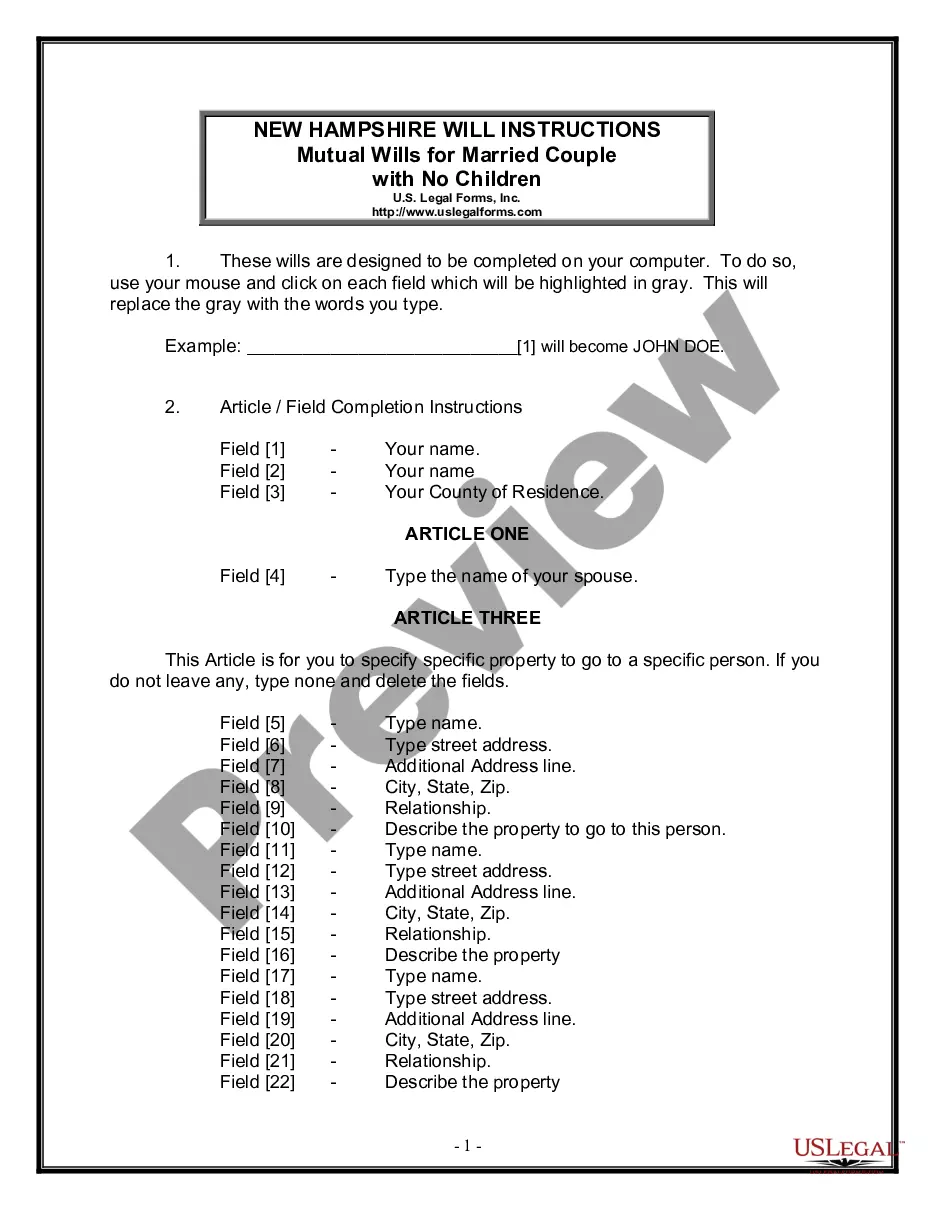

How to fill out Pennsylvania Assignment To Living Trust?

Creating documents isn't the most simple job, especially for those who rarely work with legal papers. That's why we recommend utilizing correct Pennsylvania Assignment to Living Trust samples made by skilled lawyers. It gives you the ability to prevent troubles when in court or handling formal institutions. Find the samples you need on our site for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will immediately appear on the template webpage. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Customers with no an activated subscription can easily get an account. Look at this brief step-by-step guide to get your Pennsylvania Assignment to Living Trust:

- Be sure that the form you found is eligible for use in the state it is required in.

- Verify the document. Use the Preview option or read its description (if available).

- Click Buy Now if this form is the thing you need or use the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these straightforward steps, you can complete the form in an appropriate editor. Recheck completed data and consider requesting an attorney to examine your Pennsylvania Assignment to Living Trust for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

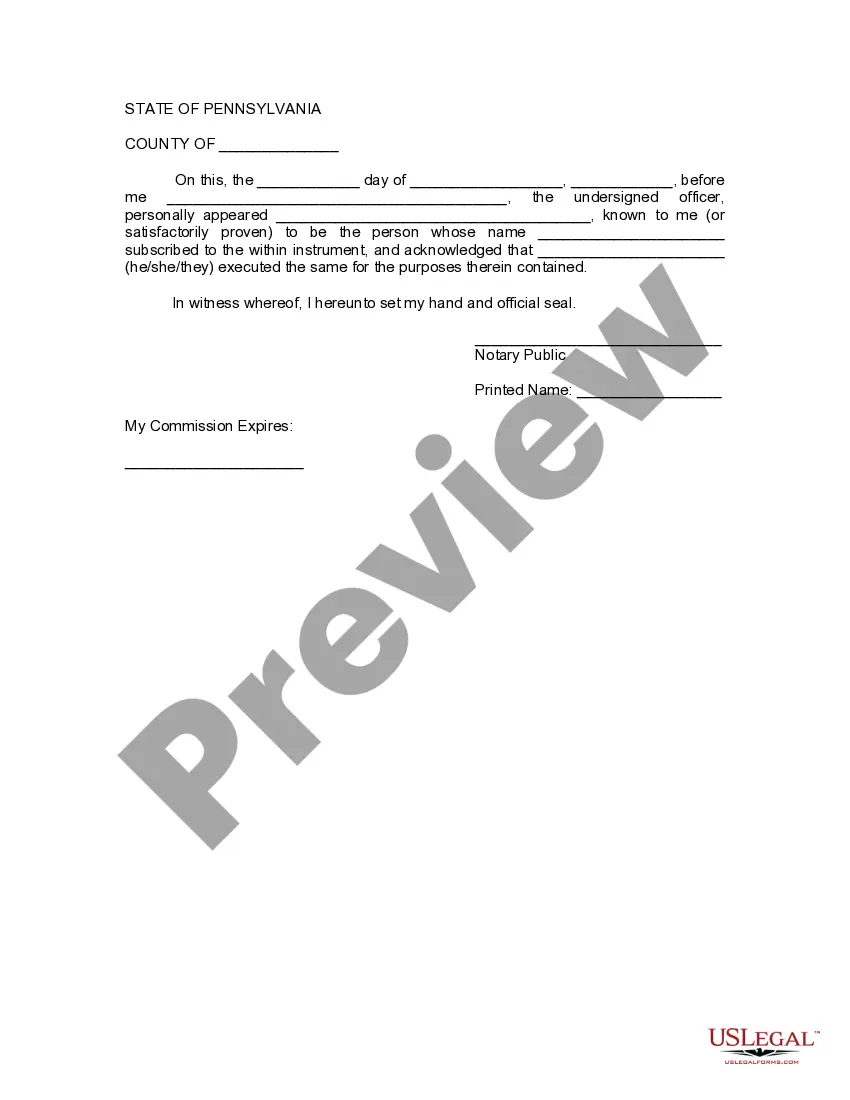

Select the trust that best fits your financial situation. Determine which property and assets you want to include in the trust. Select a trustee to manage your living trust. Create the trust document. Sign the trust while a notary public is present. Fund the trust by transferring property into it.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.