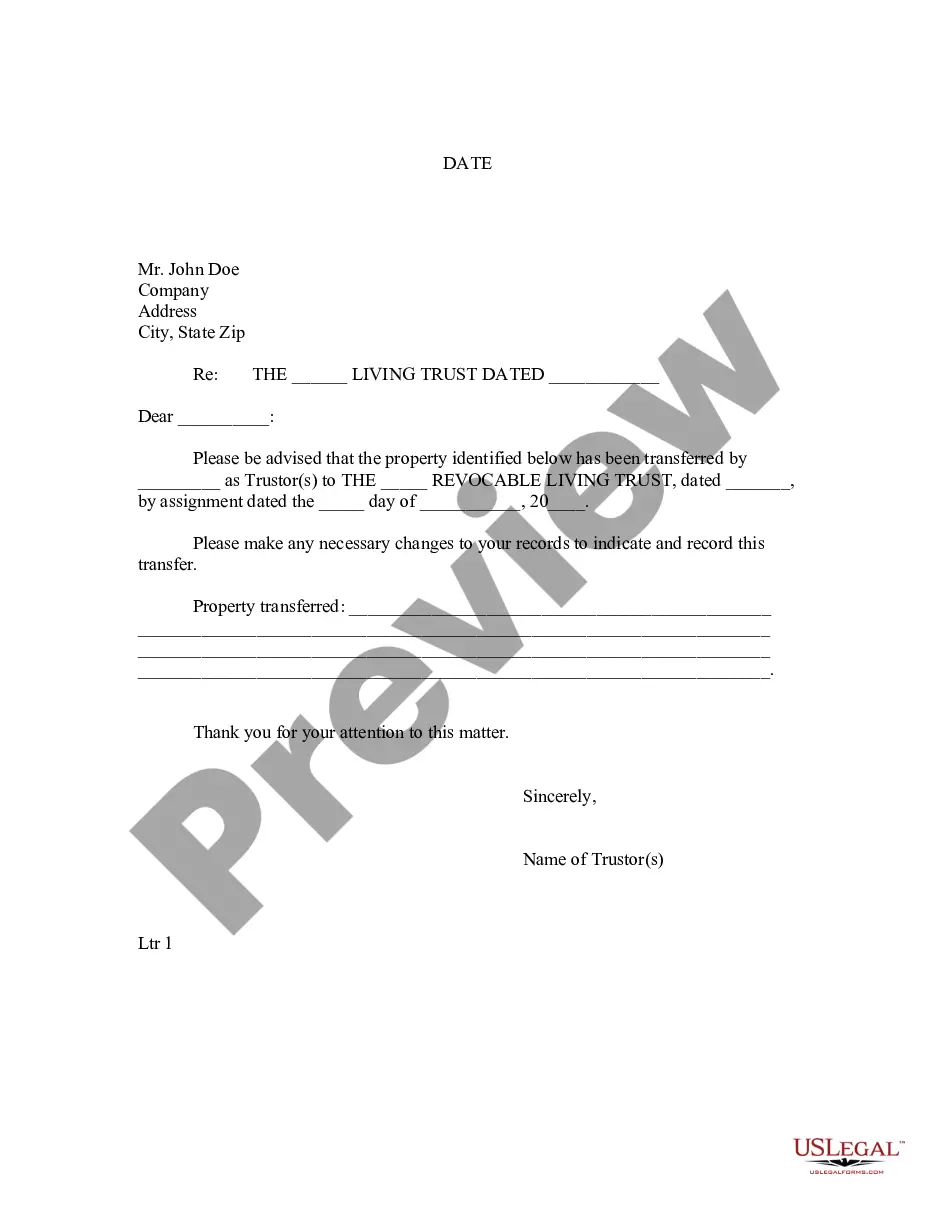

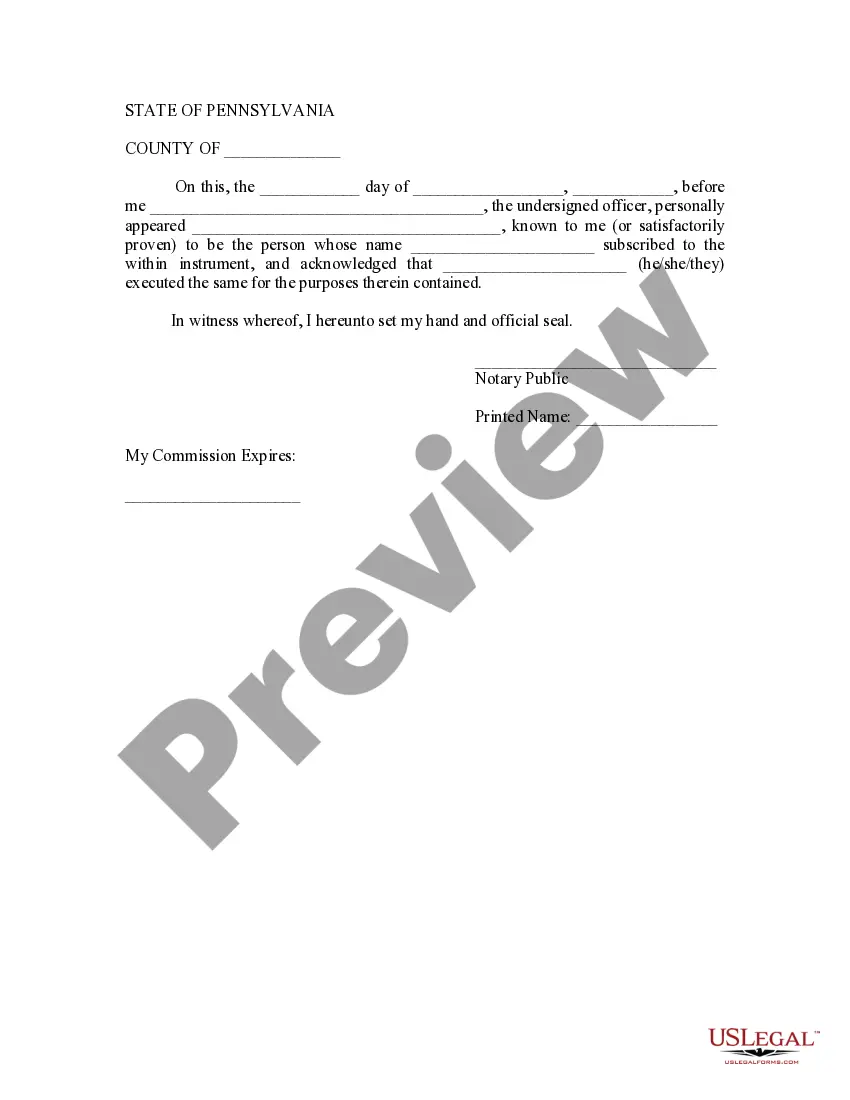

Pennsylvania Letter to Lienholder to Notify of Trust

Description

How to fill out Pennsylvania Letter To Lienholder To Notify Of Trust?

The work with papers isn't the most uncomplicated job, especially for those who almost never work with legal paperwork. That's why we advise making use of accurate Pennsylvania Letter to Lienholder to Notify of Trust templates created by professional lawyers. It gives you the ability to stay away from difficulties when in court or handling official organizations. Find the files you want on our site for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the file web page. After accessing the sample, it will be stored in the My Forms menu.

Customers with no a subscription can easily get an account. Utilize this simple step-by-step guide to get the Pennsylvania Letter to Lienholder to Notify of Trust:

- Make sure that file you found is eligible for use in the state it is necessary in.

- Confirm the file. Utilize the Preview option or read its description (if offered).

- Buy Now if this file is the thing you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after doing these straightforward actions, it is possible to fill out the sample in a preferred editor. Double-check completed data and consider asking an attorney to examine your Pennsylvania Letter to Lienholder to Notify of Trust for correctness. With US Legal Forms, everything becomes easier. Test it now!

Form popularity

FAQ

Go to your local notary public for the title transfer, both parties need to bring prof of identification. Advise the notary, that you will need to have a lien placed on the vehicle. The notary will take care of processing the lien on the vehicle. There is a fee for this service, in Pennsylvania it is $5.00.

The state of Pennsylvania requires that both the buyer and the seller go to the DMV together to transfer the title to the new owner. This is not optional (some states allow buyers and sellers the discretion here).

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

Lien release letters should have a conspicuous title such as Release of Lien at the top of the page. The first paragraph should list the date the lien was placed on the property and the names and addresses of both the lienholder and the owner of the property.

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish

Basically, a lienholder is the party that holds the lien. It could be a lender, bank, finance company, credit card issuer, or individual that a contract has been signed within which money is owed.

Congratulations on owning your vehicle free and clear. Now that your loan is paid off, you should receive a "letter of lien release" from the bank or financial institution that financed your vehicle.You cannot transfer ownership of a vehicle until the lien is cleared from the title.

You have the right idea. You want the registered owner to be the buyer. You will be the lien holder. Depending on the price of the car you may require your friend to carry full coverage insurance and list the lien holder (you) on the policy.