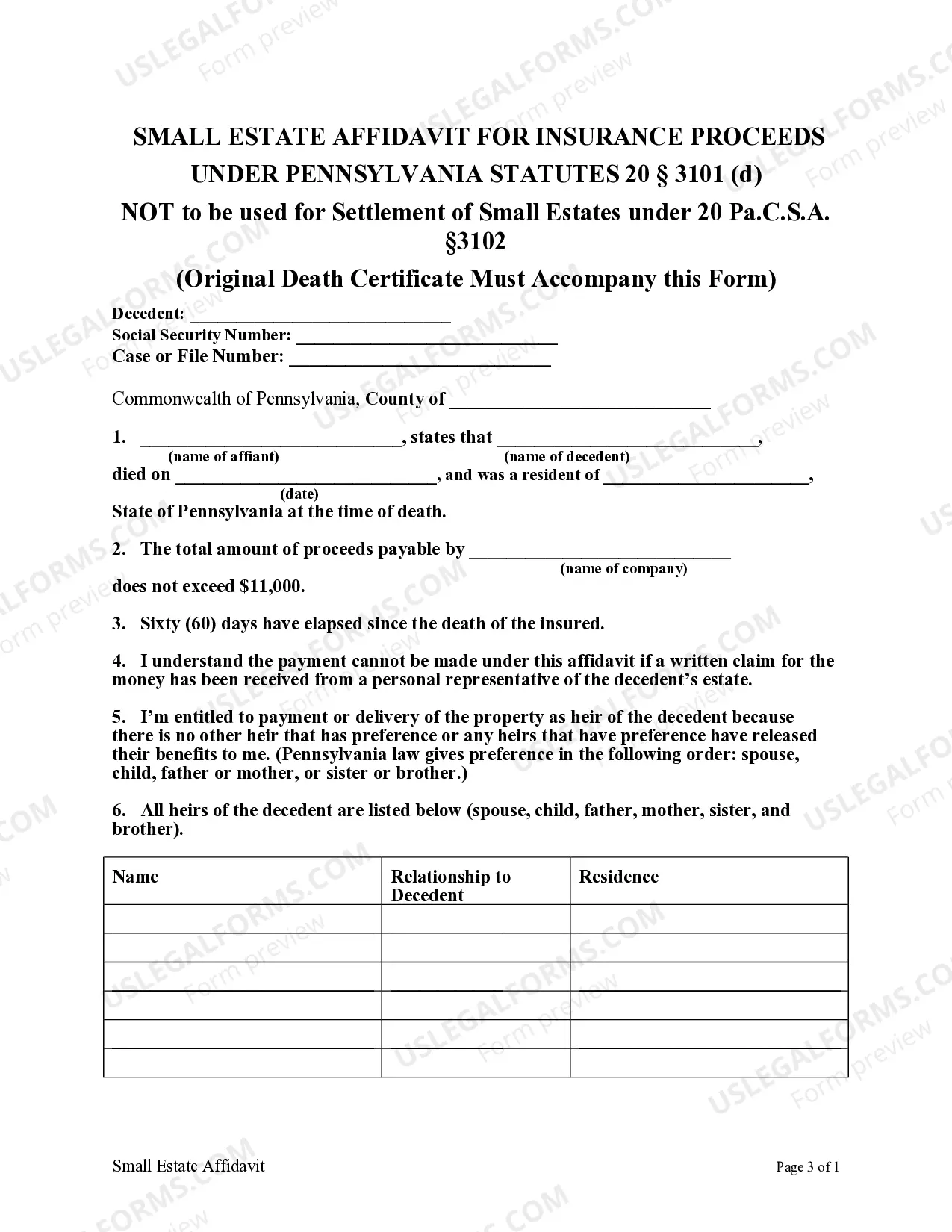

Pennsylvania Small Estate Affidavit for the Collection of Insurance Proceeds of $11,000 or less

Description

How to fill out Pennsylvania Small Estate Affidavit For The Collection Of Insurance Proceeds Of $11,000 Or Less?

The work with papers isn't the most simple job, especially for people who almost never deal with legal papers. That's why we advise using accurate Pennsylvania Small Estate Affidavit for the Collection of Insurance Proceeds of $11,000 or less. samples created by skilled lawyers. It gives you the ability to prevent problems when in court or handling official institutions. Find the documents you require on our website for top-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users without a subscription can quickly get an account. Make use of this brief step-by-step help guide to get the Pennsylvania Small Estate Affidavit for the Collection of Insurance Proceeds of $11,000 or less.:

- Ensure that the sample you found is eligible for use in the state it is needed in.

- Verify the file. Utilize the Preview feature or read its description (if readily available).

- Click Buy Now if this template is what you need or return to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these straightforward steps, you are able to complete the sample in a preferred editor. Double-check filled in information and consider asking a legal professional to review your Pennsylvania Small Estate Affidavit for the Collection of Insurance Proceeds of $11,000 or less. for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

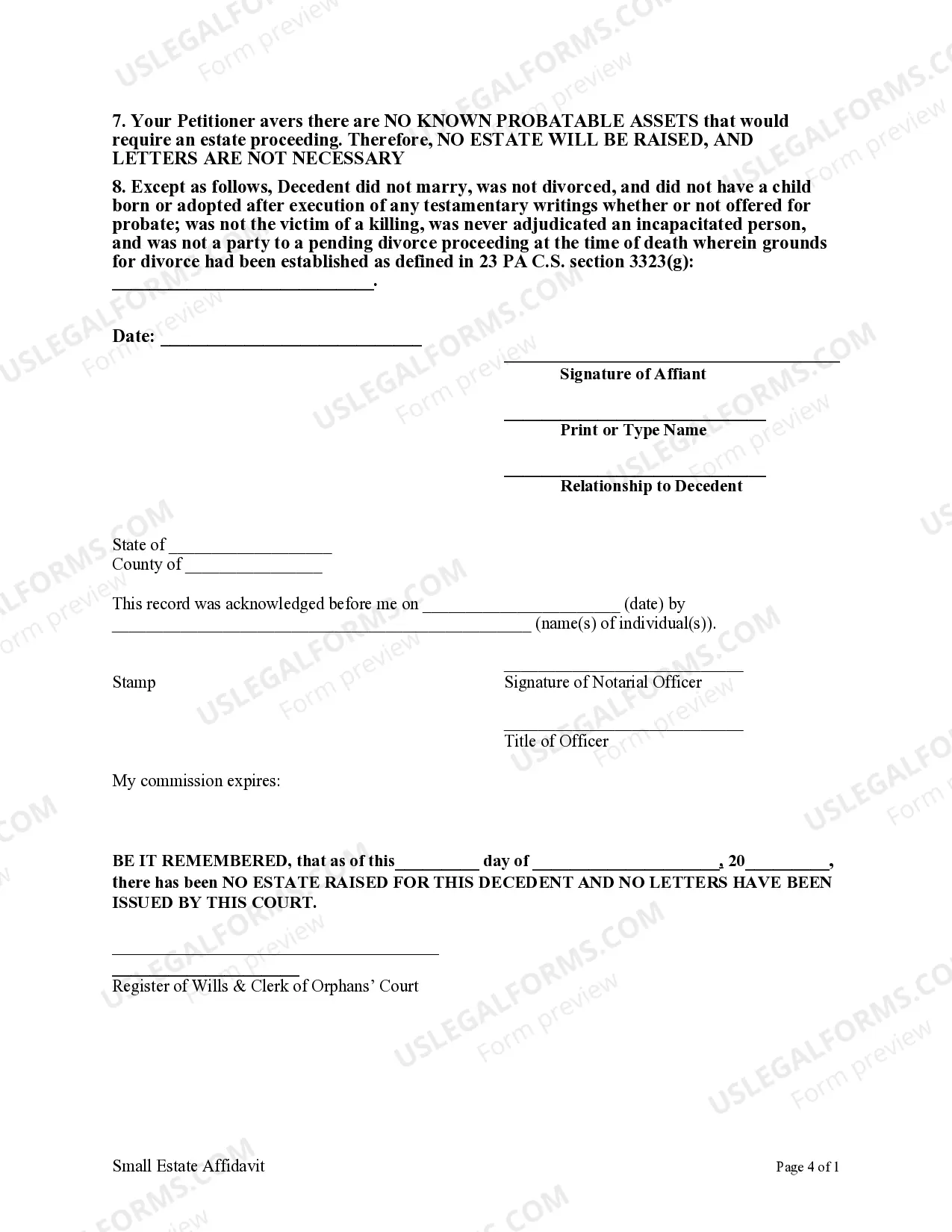

One particularly important deadline to be aware of is the deadline for creditors of the decedent to bring a claim against the estate. In Pennsylvania, a creditor has one year from the date of first publication of the grant of letters to bring a claim against the estate.

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

Examples of probate assets include: Single name bank or investment accounts. Assets owned jointly as tenants in common (as opposed to joint tenancy) Art and collectibles.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In Pennsylvania, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

But for estates in Pennsylvania that exceed the small estate's threshold, and for which there is either no Will, or a Will (but not a Living Trust), probate will be required before an estate can be tranferred to the decedent's heirs or beneficiaries.

Pennsylvania law allows estates worth less than $50,000.00 to seek direct Orphans' Court approval of the proposed distribution of the estate.