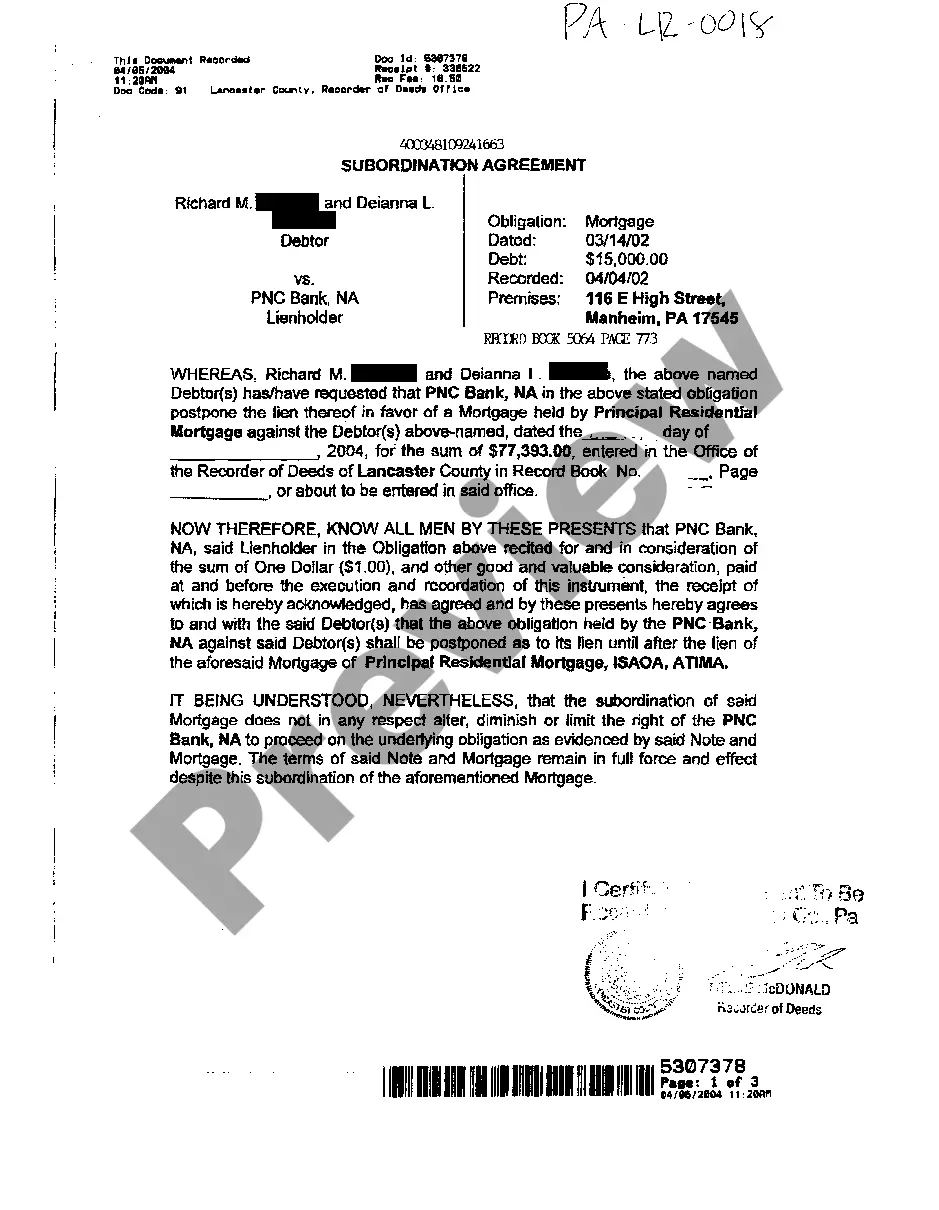

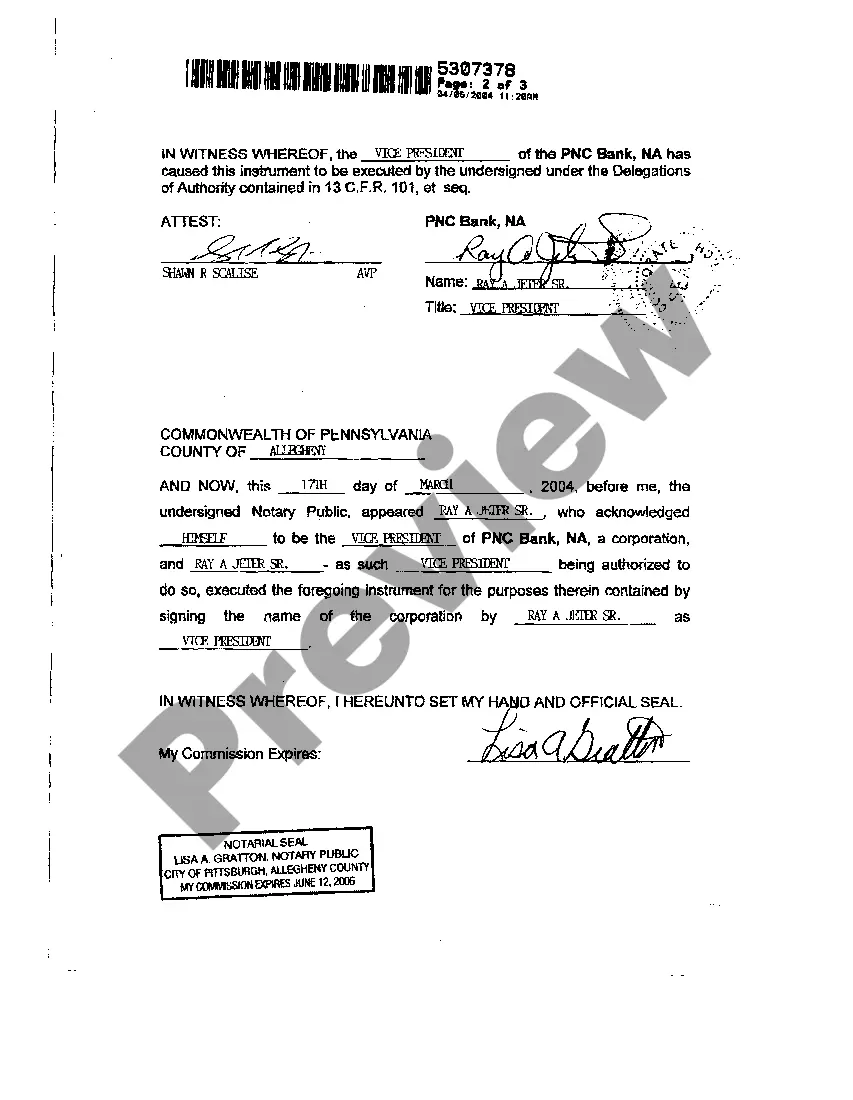

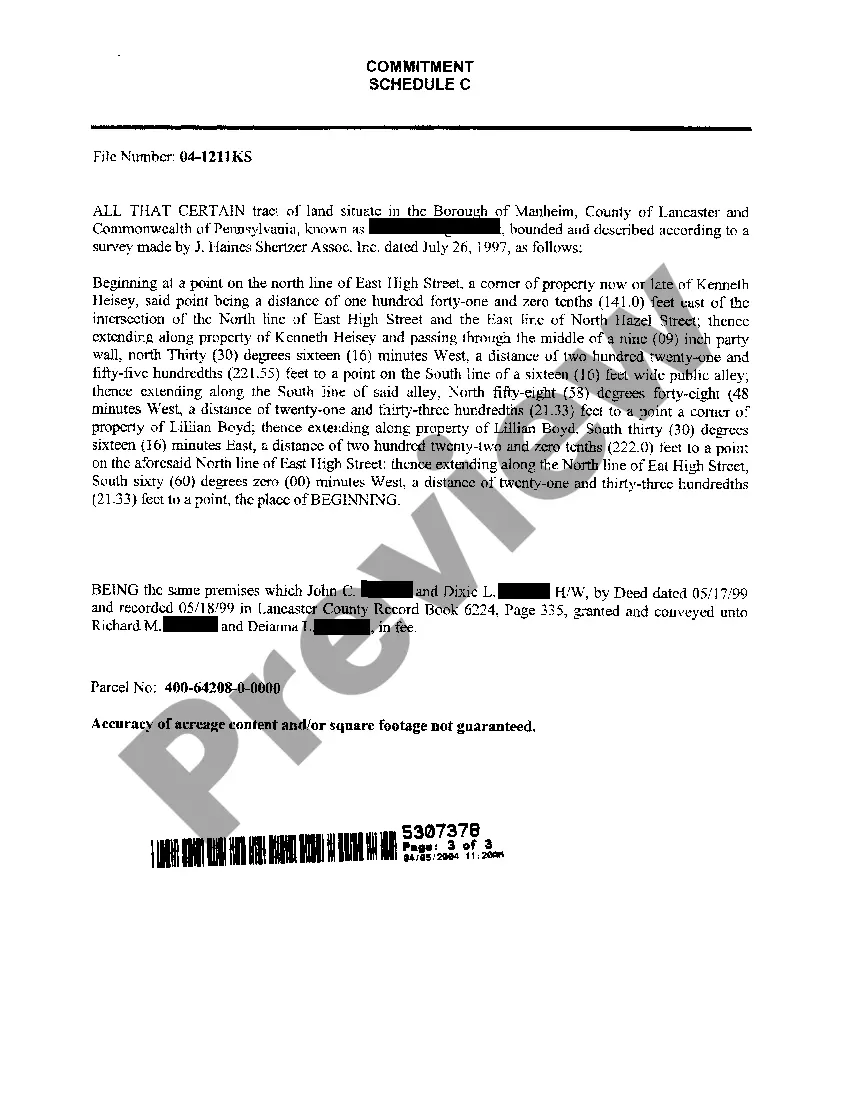

Pennsylvania Subordination Agreement of Mortgage

Description

How to fill out Pennsylvania Subordination Agreement Of Mortgage?

Among numerous free and paid examples that you can get on the web, you can't be sure about their accuracy. For example, who made them or if they’re competent enough to deal with what you need those to. Keep calm and use US Legal Forms! Discover Pennsylvania Subordination Agreement of Mortgage templates made by professional attorneys and avoid the expensive and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access your previously saved samples in the My Forms menu.

If you are using our service for the first time, follow the guidelines below to get your Pennsylvania Subordination Agreement of Mortgage fast:

- Ensure that the file you find is valid where you live.

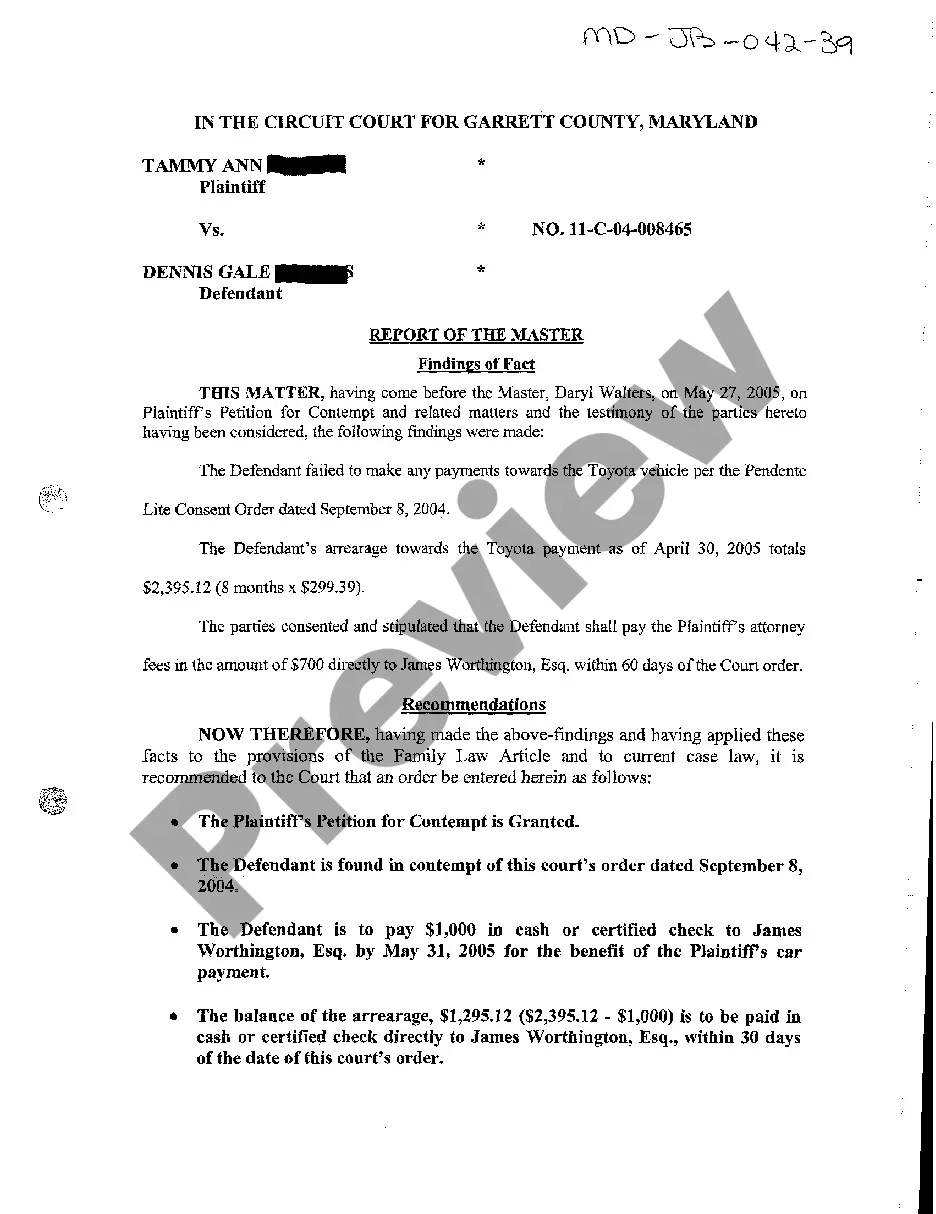

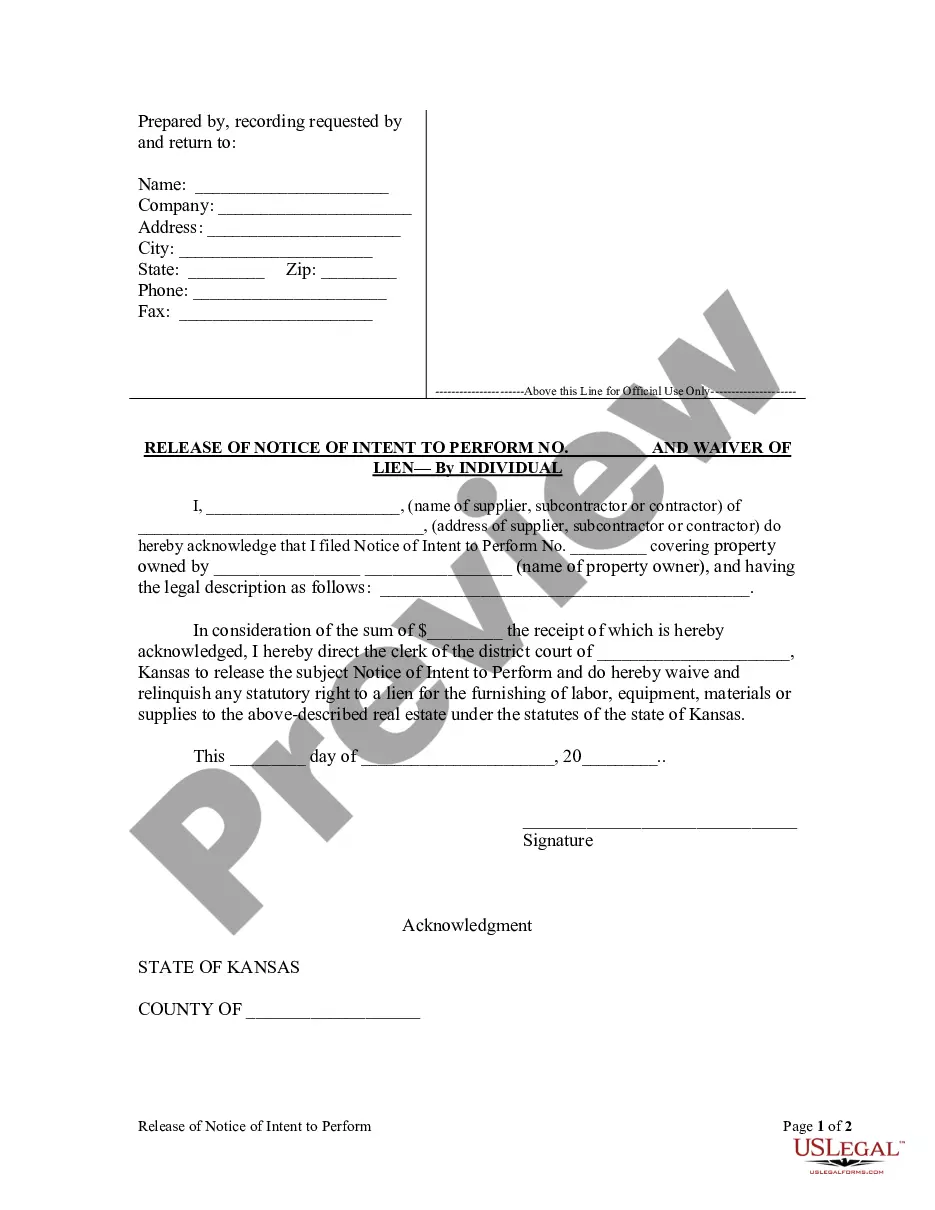

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you’ve signed up and paid for your subscription, you can utilize your Pennsylvania Subordination Agreement of Mortgage as often as you need or for as long as it remains valid where you live. Change it with your favored offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

: placement in a lower class, rank, or position : the act or process of subordinating someone or something or the state of being subordinated As a prescriptive text, moreover, the Bible has been interpreted as justifying the subordination of women to men.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance.Through subordination, lenders assign a lien position to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.