Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan

Description

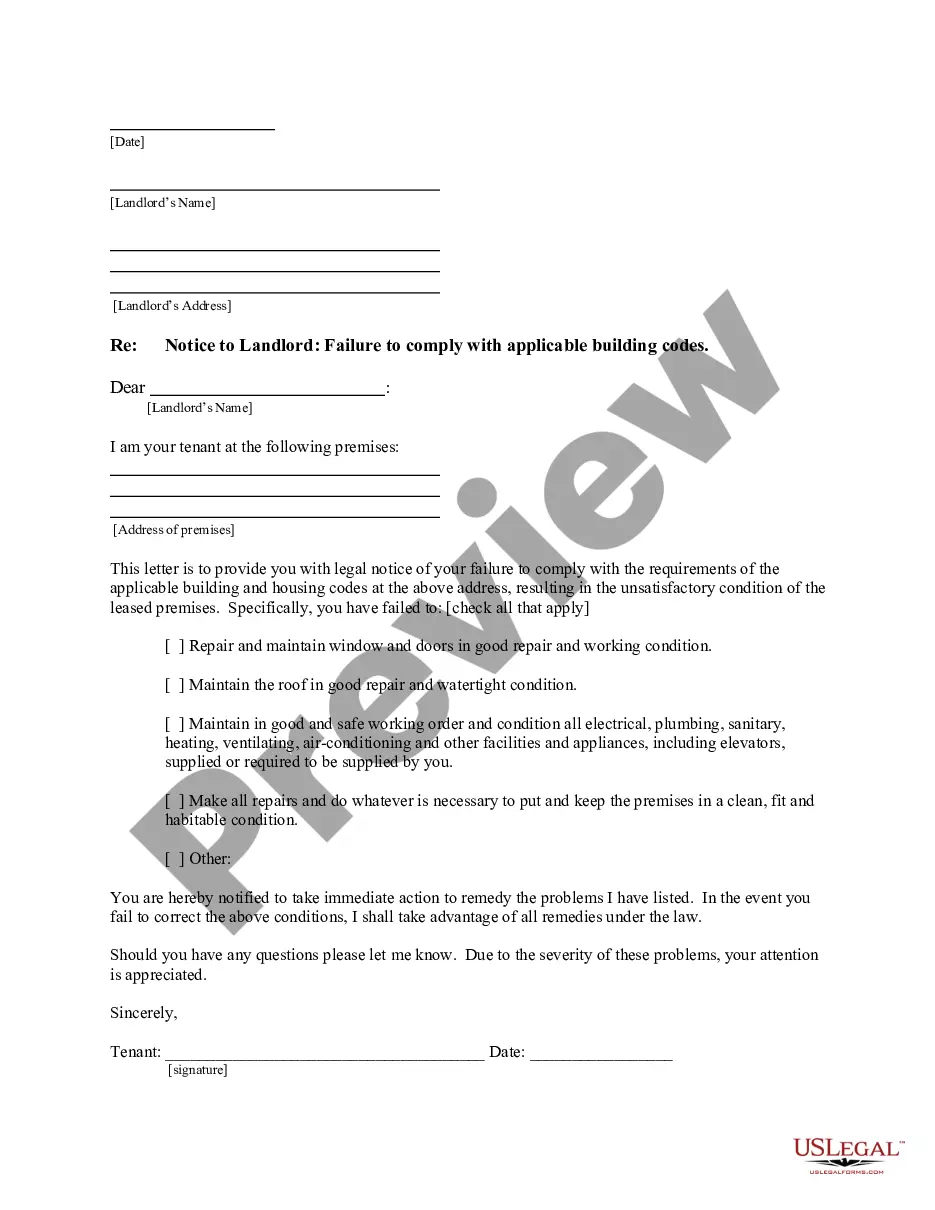

How to fill out Pennsylvania Landlord Agreement For Security Interest In Collateral For Loan?

Among numerous free and paid examples that you’re able to find on the internet, you can't be certain about their reliability. For example, who made them or if they are competent enough to take care of the thing you need these people to. Always keep calm and make use of US Legal Forms! Locate Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan samples developed by skilled lawyers and avoid the costly and time-consuming process of looking for an lawyer or attorney and after that paying them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all your earlier acquired samples in the My Forms menu.

If you are using our website the first time, follow the tips below to get your Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan easily:

- Make certain that the document you find applies where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another example using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you’ve signed up and purchased your subscription, you can utilize your Pennsylvania Landlord Agreement for Security Interest in Collateral for Loan as many times as you need or for as long as it continues to be active in your state. Change it in your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

The term collateral refers to an asset that a lender accepts as security for a loan.The collateral acts as a form of protection for the lender. That is, if the borrower defaults on their loan payments, the lender can seize the collateral and sell it to recoup some or all of its losses.

Also known as security documents. Collateral documents include any documents granting a security interest in collateral by the borrower, parent or subsidiary in favor of the lender and all other documents required to be executed or delivered pursuant to those documents.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

In the U.S. the term "security interest" is often used interchangeably with "lien". However, the term "lien" is more often associated with the collateral of real property than with of personal property. A security interest is typically granted by a "security agreement".

Security interests for most types of collateral are usually perfected by filing a document known simply as a financing statement.

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.In the event that the borrower defaults, the pledged collateral can be seized by the lender and sold.

To be valid, a secured transaction must contain an express agreement between the debtor and the secured party. The agreement must be in writing, must be signed by both parties, must describe the collateral, and must contain language indicating a grant of a security interest to the creditor.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the