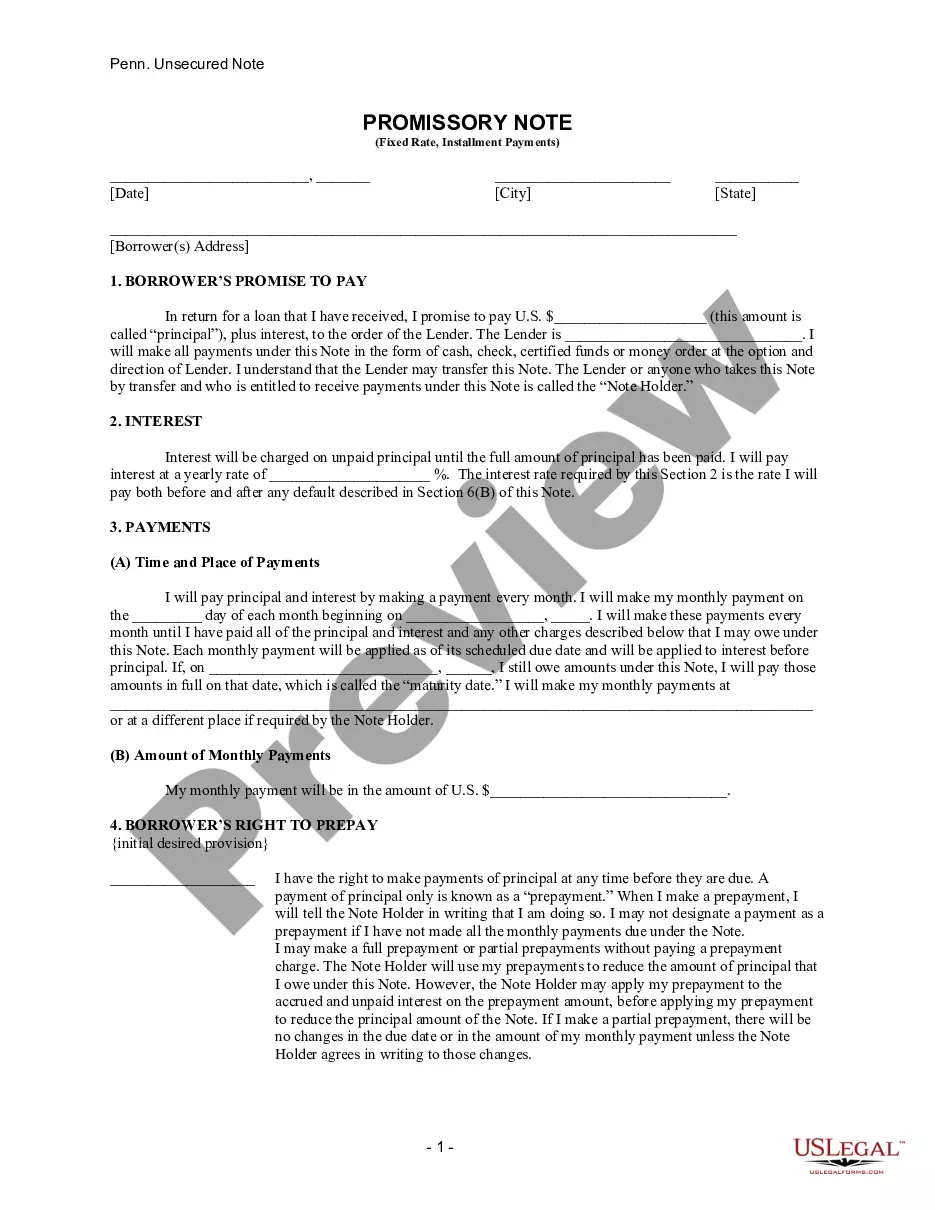

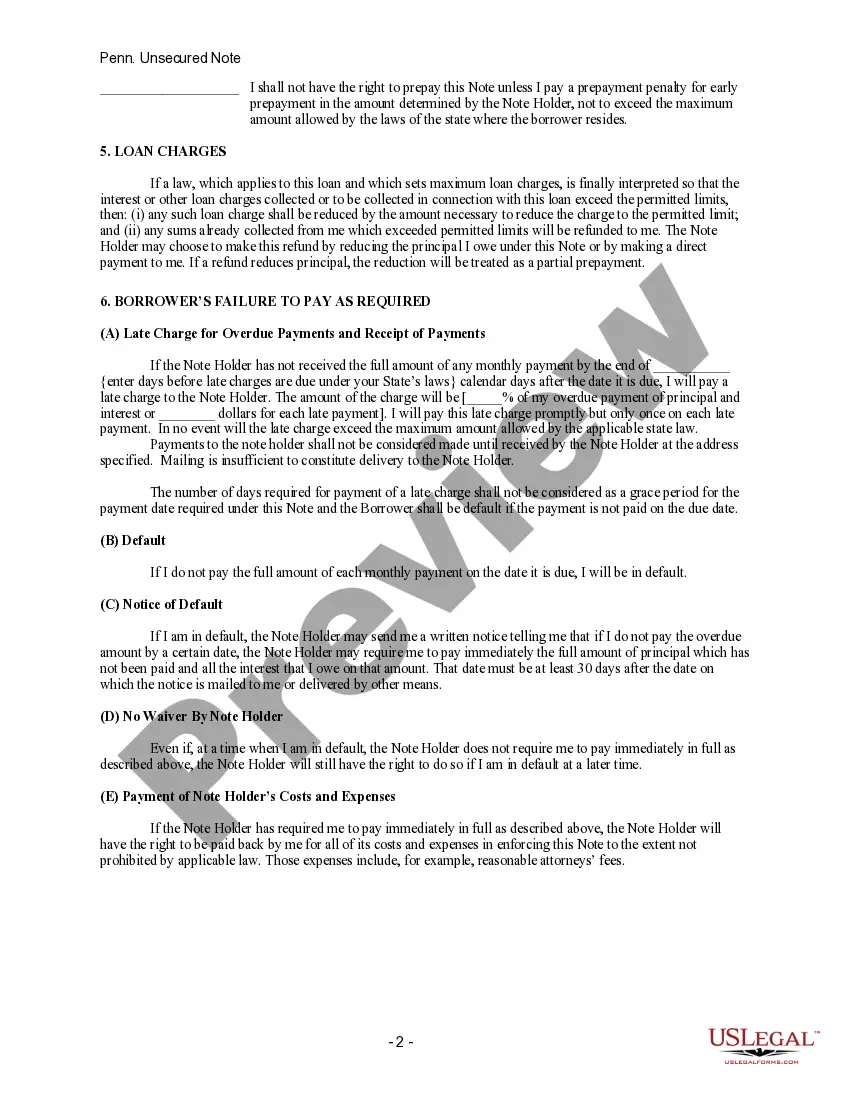

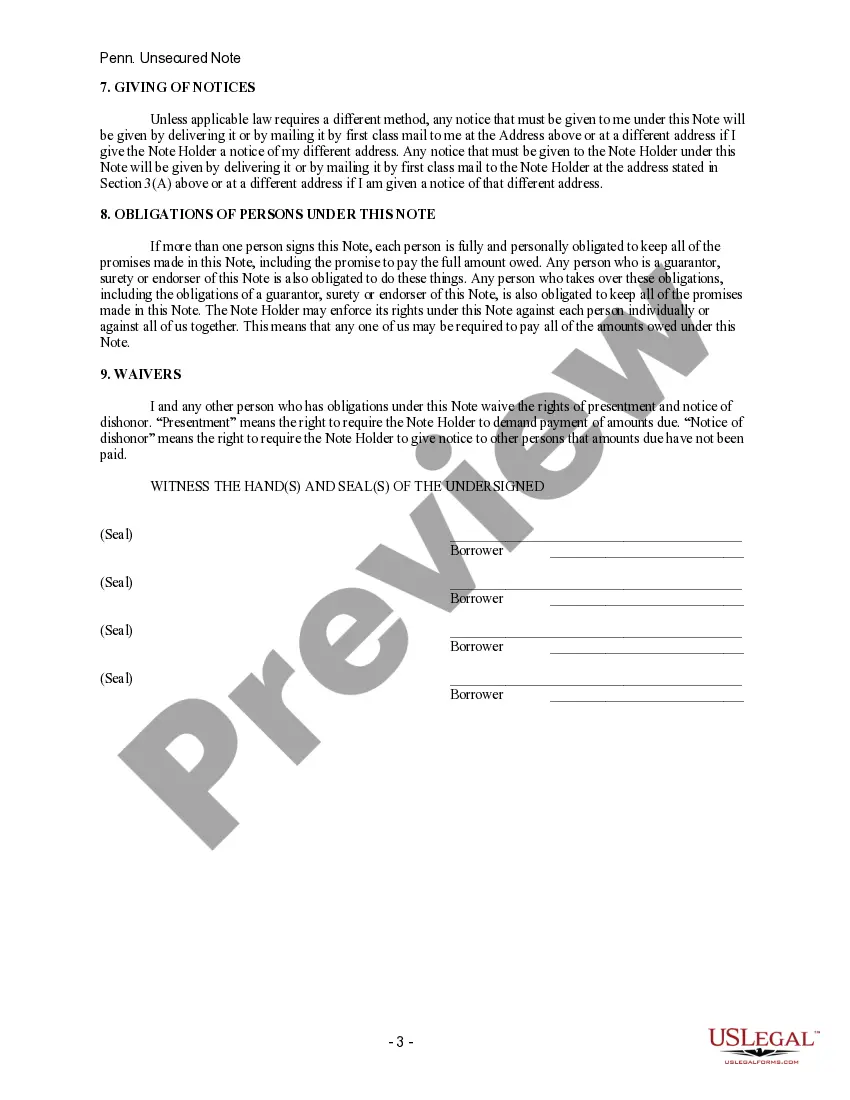

Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate

Description Promissory Note To Pay

How to fill out Pennsylvania Unsecured Installment Payment Promissory Note For Fixed Rate?

Creating documents isn't the most simple task, especially for people who rarely work with legal papers. That's why we advise using accurate Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate templates created by professional attorneys. It allows you to avoid difficulties when in court or handling formal organizations. Find the files you need on our website for high-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file webpage. After downloading the sample, it’ll be saved in the My Forms menu.

Customers with no an active subscription can easily get an account. Utilize this simple step-by-step help guide to get the Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate:

- Ensure that the form you found is eligible for use in the state it is required in.

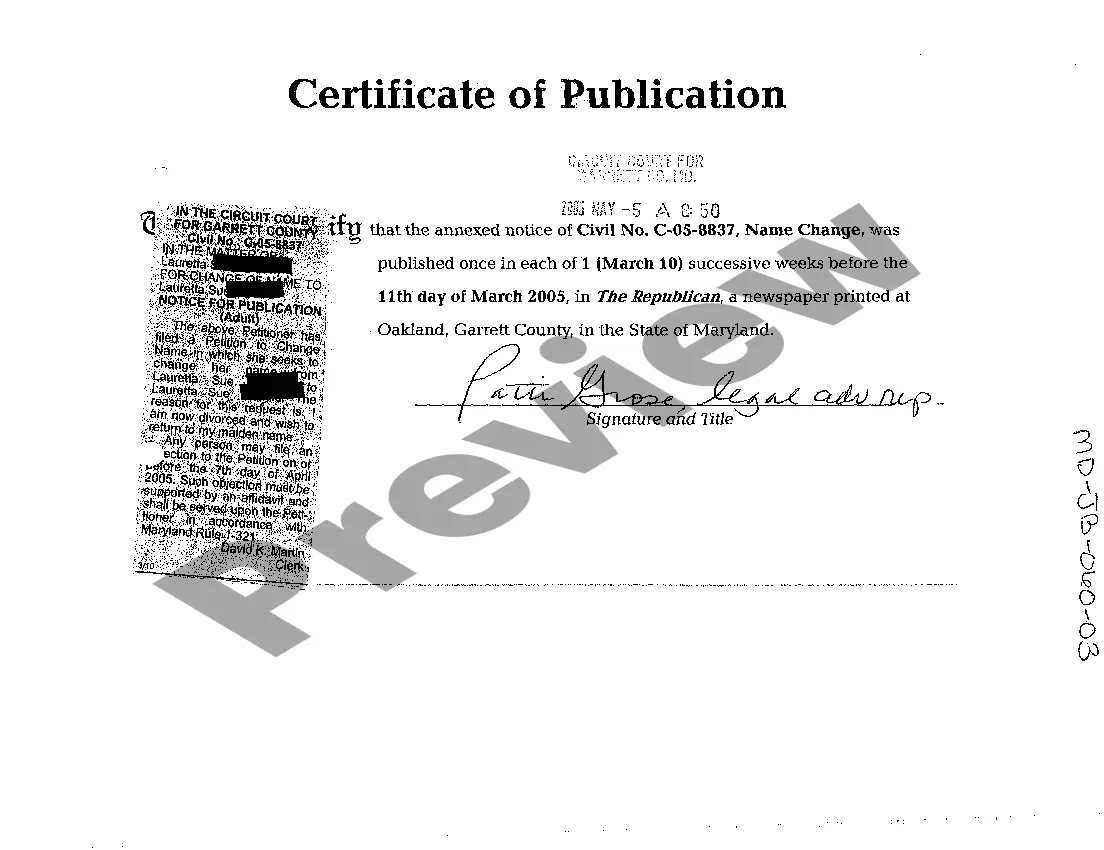

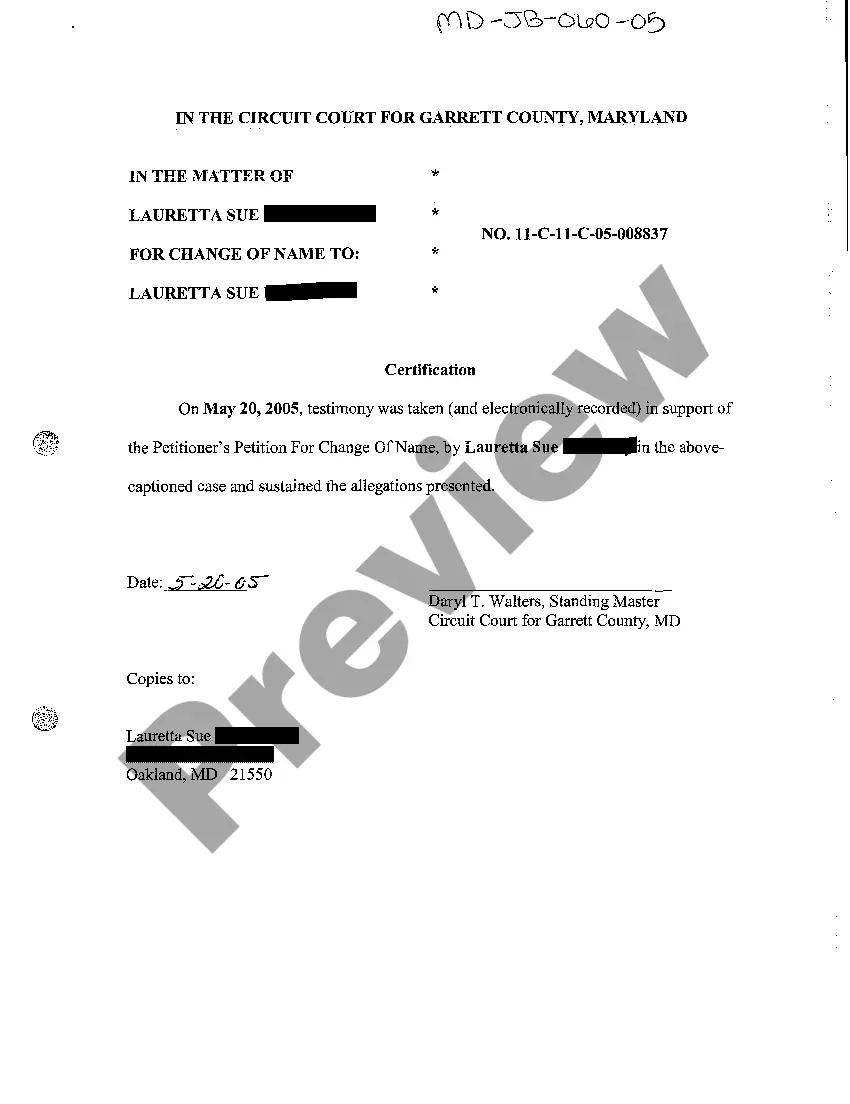

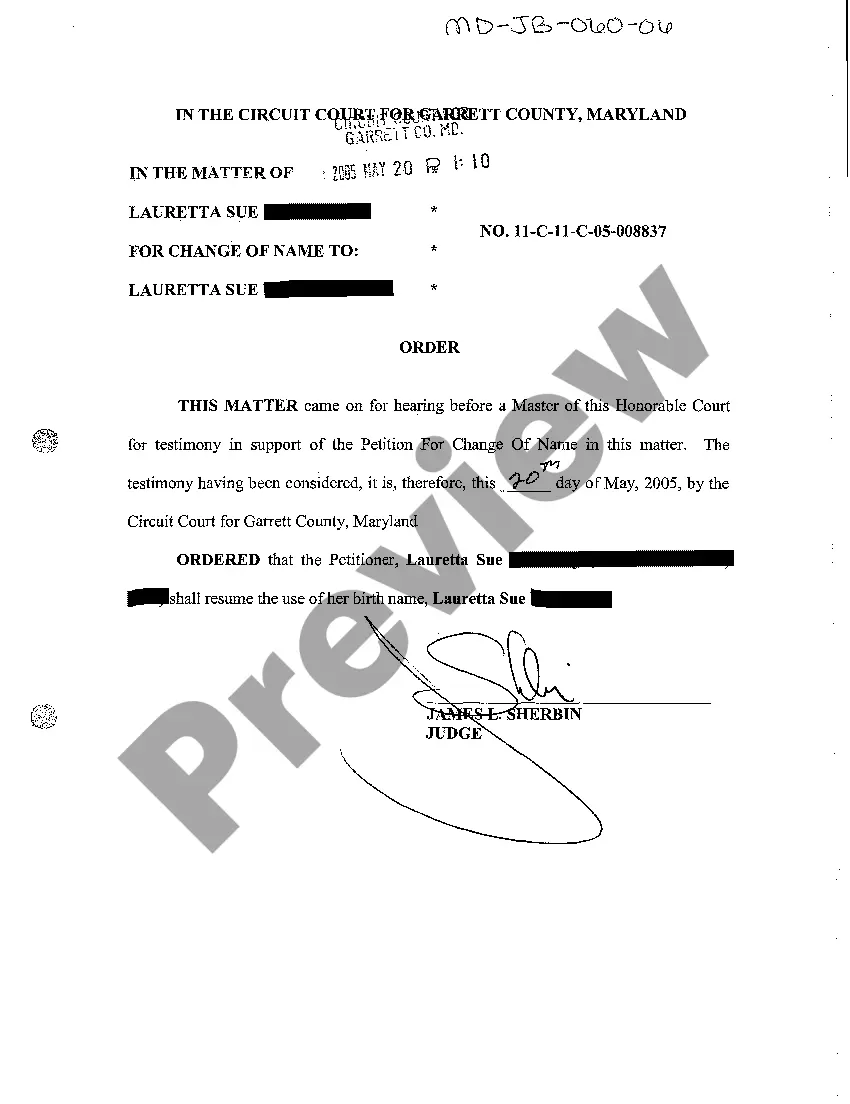

- Verify the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this file is what you need or go back to the Search field to find another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these easy actions, you are able to complete the sample in your favorite editor. Recheck completed information and consider requesting a legal representative to review your Pennsylvania Unsecured Installment Payment Promissory Note for Fixed Rate for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Unsecured Promissory Note Form popularity

FAQ

Pennsylvania only honors installment sales of real and tangible property and taxes 100% of the gain from intangibles at the time of the sale. Further, accrual basis taxpayers are never allowed to report the gain on installment sales over the collection period no matter what was sold.

Simple Promissory Note. Student Loan Promissory Note. Real Estate Promissory Note. Personal Loan Promissory Notes. Car Promissory Note. Commercial Promissory note. Investment Promissory Note.

How do I file estimated payments? 1-800-2PAYTAX (272-9829). To file estimated payments by mail, use Form PA-40ES for individuals and Form PA-40ES (F/C) for fiduciaries. My income consists of Social Security, a pension and some interest income.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A Promissory Note with Installment Payments specifies and documents the terms of a loan that will be paid back with consistent, equal, payments.You're a borrower and are agreeing to a loan with installments. You're in the business of loans or manage a loan company.

Electronic filing options are available through myPATH, the Department of Revenue's user-friendly online filing system. That includes the option to make a personal income tax payment.You can also pay by phone by calling, toll-free, 1-800-2PAYTAX (1-800-272-9829).

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note includes a specific promise to pay, and the steps required to do so (like the repayment schedule), while an IOU merely acknowledges that a debt exists, and the amount one party owes another.

To exclude the gain on the sale of your home from tax you must have owned and used the property as your principal residence for two of the five years immediately before the sale. The ownership and use need not be concurrent. You can generally claim the Section 121 tax exclusion only once every two years.