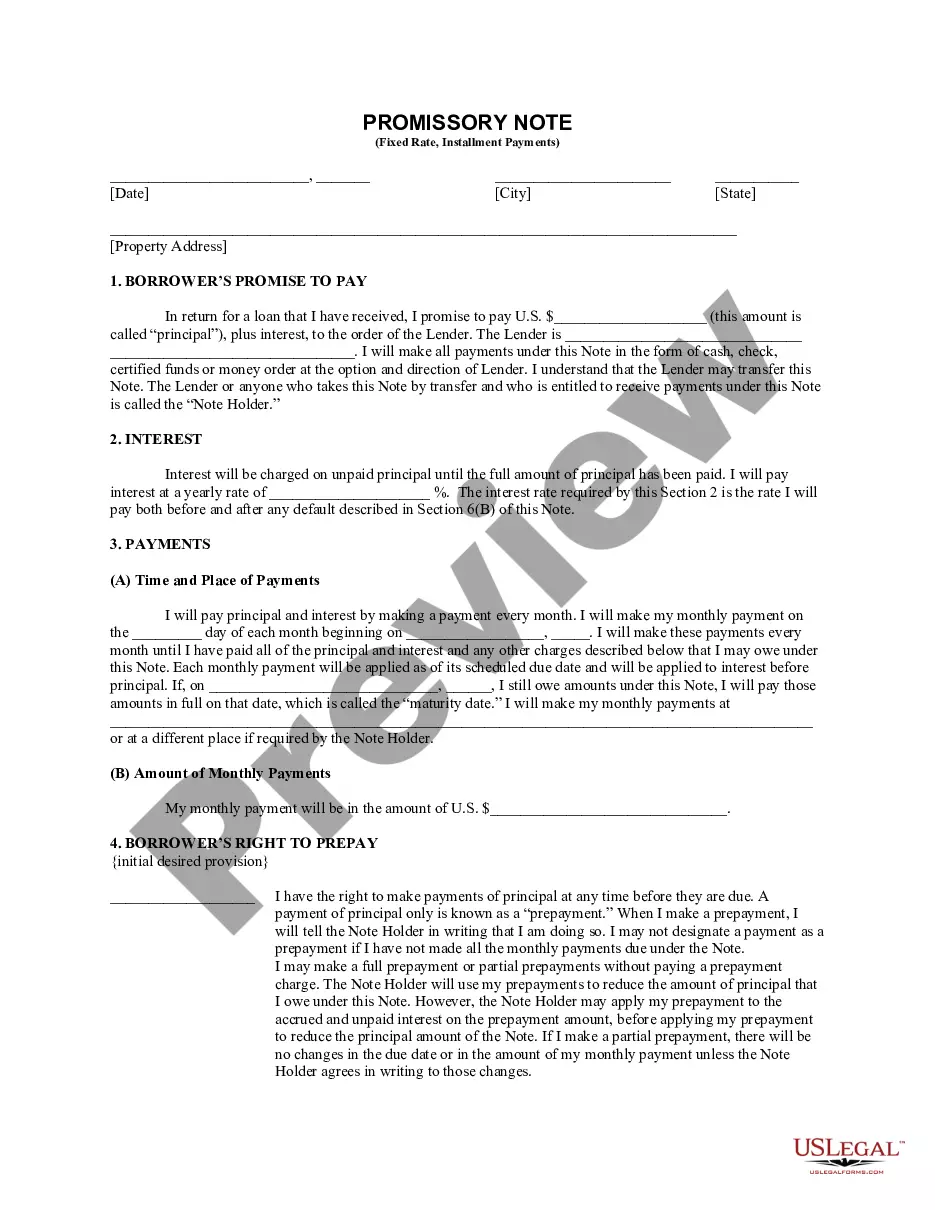

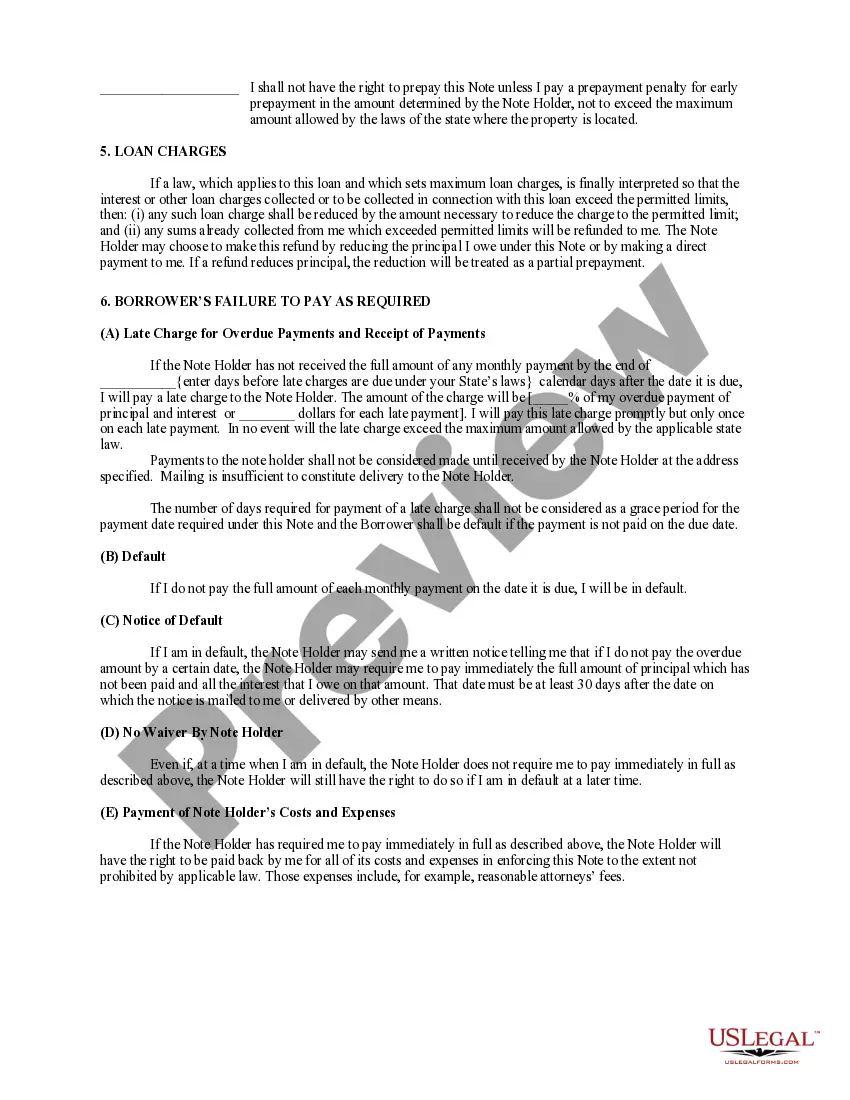

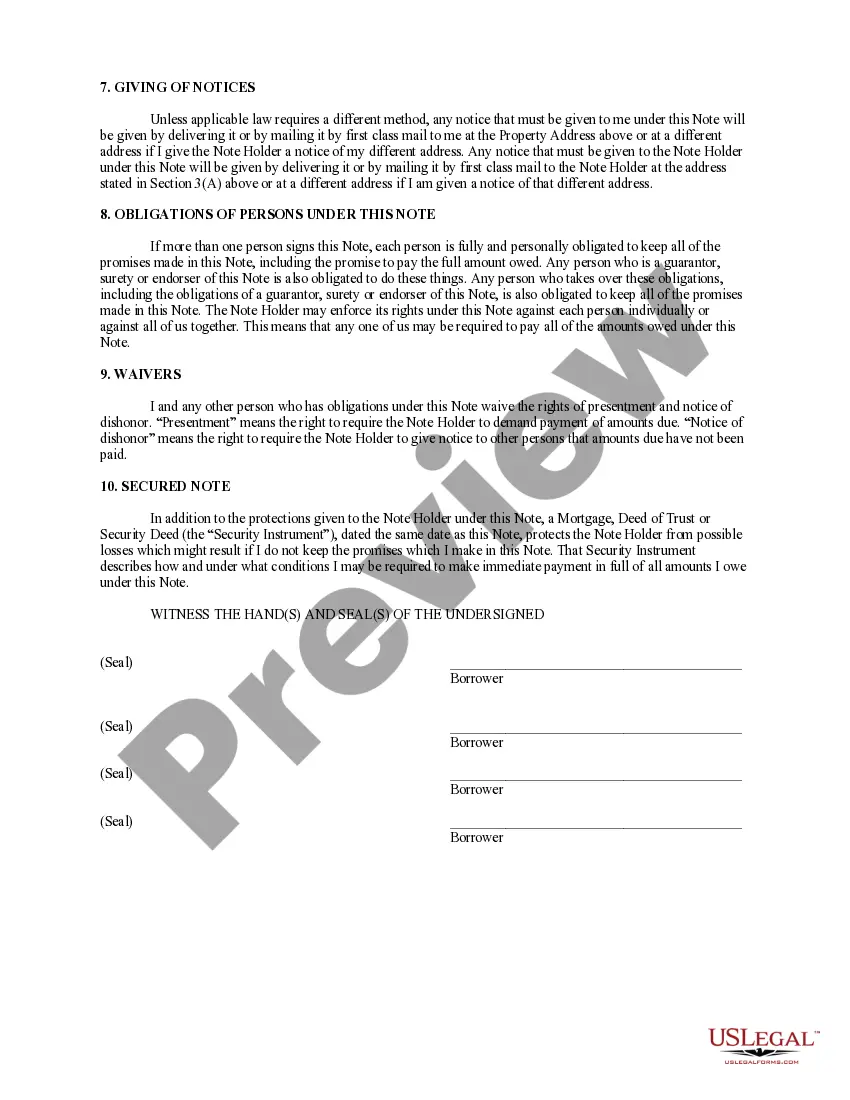

Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description Pennsylvania Promissory Note

How to fill out Pennsylvania Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

The work with documents isn't the most straightforward process, especially for those who rarely deal with legal papers. That's why we advise using correct Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate samples created by professional lawyers. It allows you to avoid troubles when in court or working with formal organizations. Find the files you require on our site for top-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the file page. Right after getting the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can easily create an account. Look at this brief step-by-step help guide to get the Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate:

- Ensure that file you found is eligible for use in the state it’s required in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this template is the thing you need or use the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after finishing these straightforward actions, you can fill out the form in an appropriate editor. Double-check filled in details and consider requesting a legal representative to review your Pennsylvania Installments Fixed Rate Promissory Note Secured by Residential Real Estate for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

Examples of tangible personal property are your household goods and motor vehicles.Examples of intangible personal property are stocks, bonds, mutual funds, and securities. In addition, if a person owes you money, you may have a promissory note which describes the loan and amount of money the individual owes you.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

A buyer wanted to use a promissory note for consideration on the purchase of a property. Can he do this? Yes, this is acceptable as long as the seller agrees.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.