Pennsylvania Fiduciary Deed for Two Executors to an Individual

Description Deed Real Estate Document

How to fill out Fiduciary Deed Pa?

Among lots of free and paid examples that you find on the web, you can't be sure about their accuracy and reliability. For example, who created them or if they are competent enough to deal with what you require those to. Keep relaxed and make use of US Legal Forms! Get Pennsylvania Fiduciary Deed for Two Executors to an Individual templates developed by professional legal representatives and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and after that paying them to write a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access your earlier saved files in the My Forms menu.

If you’re utilizing our platform the first time, follow the guidelines listed below to get your Pennsylvania Fiduciary Deed for Two Executors to an Individual quickly:

- Make certain that the document you see is valid where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another example using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you have signed up and paid for your subscription, you can use your Pennsylvania Fiduciary Deed for Two Executors to an Individual as often as you need or for as long as it stays valid where you live. Revise it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Pennsylvania Fiduciary Deed 2 Executors Paper Form popularity

How To Transfer A Deed In Pa Other Form Names

Pa Deed Real FAQ

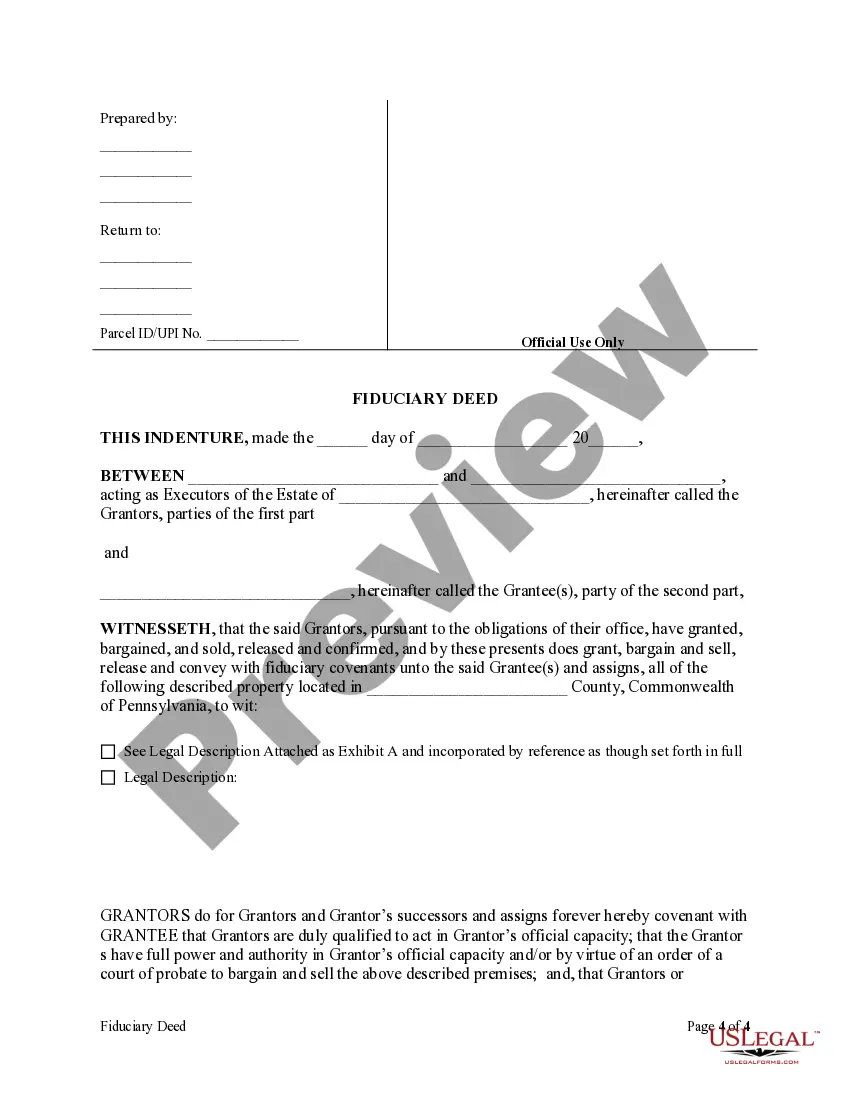

Both executors must sign the initial petition with the probate court. Typically, both executors will have to sign checks and other estate paperwork. Both executors may be responsible for filing tax returns. You have a duty to monitor the actions of the other executor and to report any unethical or illegal behavior.

In most situations, it's not a good idea to name co-executors. When you're making your will, a big decision is who you choose to be your executorthe person who will oversee the probate of your estate. Many people name their spouse or adult child. You can, however, name more than one person to serve as executor.

A joint Executor will not usually be able to act alone unless the other Executors formally agree to this.It is common for Will Writers to recommend a minimum of two Executors when someone is making a Will, but it's still a common occurrence for only one Executor to be been appointed.

The only circumstances in which jointly appointed Executors can act alone is if the other Executor(s) formally step down from their role. There are two ways in which they can do this.The other option is for the Executor who doesn't want to act to have Power Reserved to them.

If one of the co-executors does not agree, then the estate cannot take the action. So, each co executor should be working together with the other co executor to administer the estate.

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.

Can I start the estate process without them? Co-Executors in Pennsylvania must serve jointly.

If the will names multiple executors, but only one person wishes to take out a grant of probate, it is wise for at least one of the others to sign a power reserved letter, just in case the acting executor cannot complete the administration of the estate.

A sole Executor is usually able to act alone during Probate, although there are some important factors to consider. A joint Executor will not usually be able to act alone unless the other Executors formally agree to this.