Pennsylvania Warranty Deed for Husband and Wife to Two Individuals

Description

How to fill out Pennsylvania Warranty Deed For Husband And Wife To Two Individuals?

Among hundreds of paid and free samples which you find on the web, you can't be sure about their reliability. For example, who made them or if they’re qualified enough to deal with what you need these to. Keep relaxed and make use of US Legal Forms! Find Pennsylvania Warranty Deed for Husband and Wife to Two Individuals samples made by professional attorneys and avoid the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that paying them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access your previously saved documents in the My Forms menu.

If you are utilizing our website the very first time, follow the guidelines listed below to get your Pennsylvania Warranty Deed for Husband and Wife to Two Individuals quick:

- Make sure that the file you discover applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another template utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you’ve signed up and paid for your subscription, you can use your Pennsylvania Warranty Deed for Husband and Wife to Two Individuals as often as you need or for as long as it remains active in your state. Edit it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

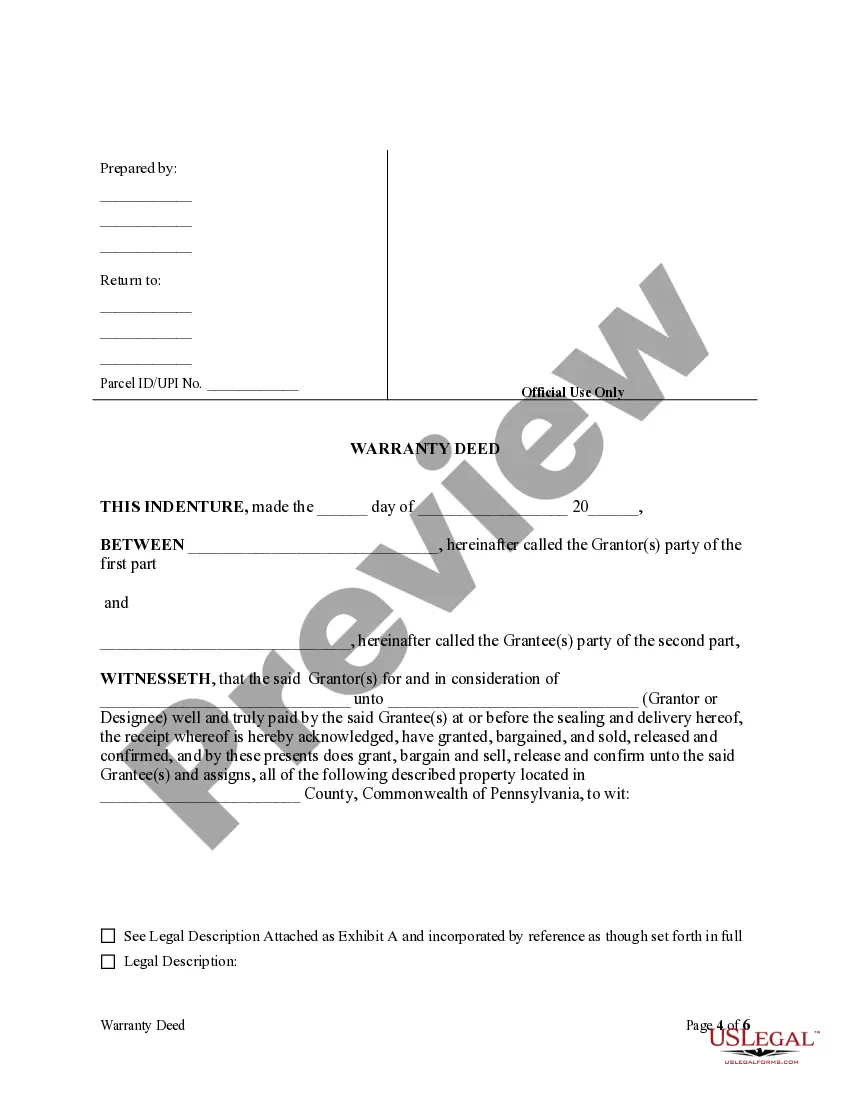

A: A "special warranty" deed is the type of deed used most frequently in Pennsylvania real estate sales. It essentially represents that the seller did nothing to weaken the status of title from the time that he/she received it.A "quit-claim" deed is a deed that contains no warranties at all.

To add a name to a house deed in Pennsylvania, a new deed is prepared. The owner can prepare his own deed or contact an attorney or document service to provide one. Using an attorney is the best route because the attorney ensures that the deed is prepared per the requirements of the state.

This can give you full confidence to buy because you know that should any claims against the property or liens arise, it can hold the seller legally liable.A special warranty deed only serves as a guarantee that there are no problems with the title outstanding from when the current seller owned the property.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.