Application Under Section 203(O) of The Pennsylvania Securities Act of 1972 is an application process that permits certain non-Pennsylvania broker-dealers to transact business in the state without registering or registering representatives in Pennsylvania. There are two types of applications under this section: the application for a temporary exemption and the application for a permanent exemption. The temporary exemption allows a non-Pennsylvania broker-dealer to transact business in the state for a period of up to 90 days. The broker-dealer must provide the Pennsylvania Securities Commission with proof of registration in their home state, as well as a description of the nature of the business they intend to conduct in the state. The permanent exemption allows a broker-dealer to conduct business in the state indefinitely. In order to obtain this exemption, the broker-dealer must provide the Pennsylvania Securities Commission with evidence of registration in their home state, demonstrate a satisfactory compliance history in their home state, and have maintained a place of business in the state for at least six months prior to the application. In order to apply for either type of exemption under Section 203(O) of the Pennsylvania Securities Act of 1972, the broker-dealer must submit an application to the Pennsylvania Securities Commission. The application must include a completed Form S-1, a copy of the broker-dealer's registration in their home state, and any additional information requested by the Commission. Upon approval, a certificate of exemption will be issued.

Application Under Section 203(O) of The Pennsylvania Securities Act of 1972

Description

How to fill out Application Under Section 203(O) Of The Pennsylvania Securities Act Of 1972?

If you’re searching for a way to properly prepare the Application Under Section 203(O) of The Pennsylvania Securities Act of 1972 without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of documentation you find on our online service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Follow these straightforward guidelines on how to obtain the ready-to-use Application Under Section 203(O) of The Pennsylvania Securities Act of 1972:

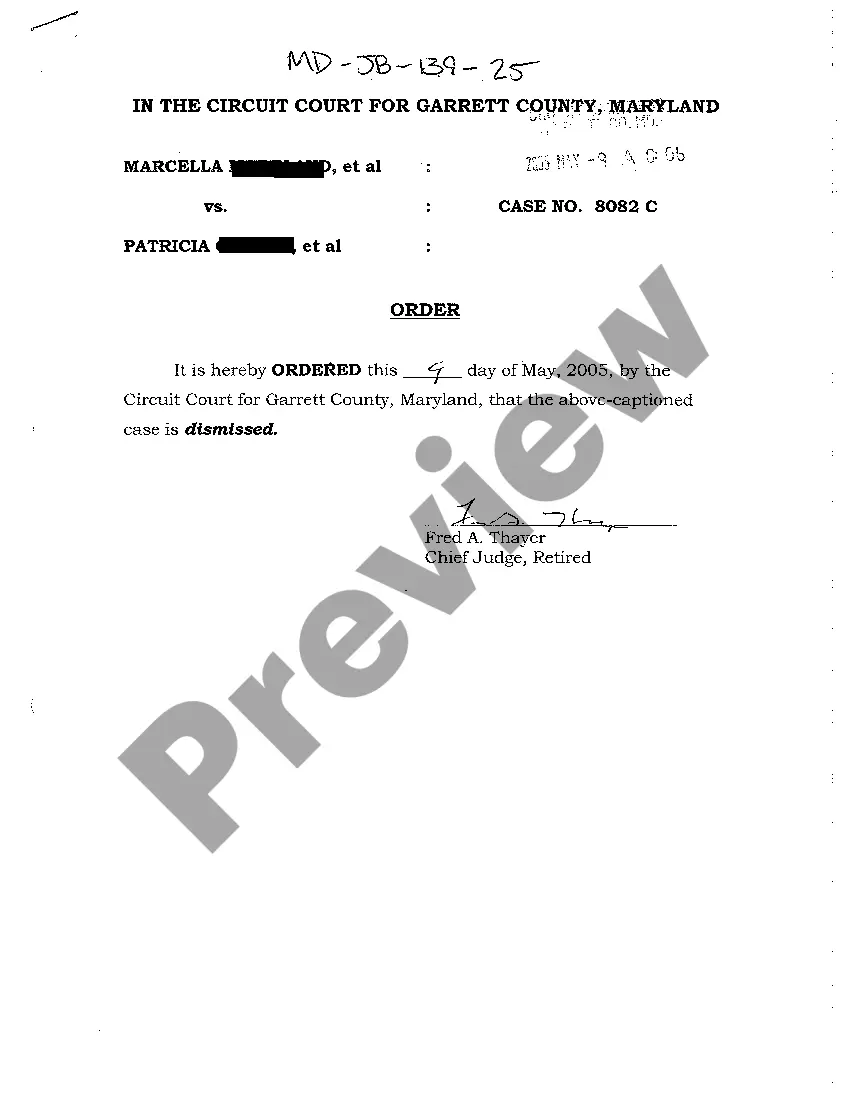

- Make sure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your Application Under Section 203(O) of The Pennsylvania Securities Act of 1972 and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A tax exempt charitable organization, corporation, limited liability corporation, or partnership with assets in excess of $5 million. a director, executive officer, or general partner of the company selling the securities, or any director, executive officer, or general partner of a general partner of that company.

Know SEC registration and exemption rules An issuance of securities to yourself, your immediate family members and a few other investors will usually be totally exempt form both federal and state securities laws. In this case, the exemption generally is ?self-executing??that is, the exemption is automatic.

PENNSYLVANIA SECURITIES ACT OF 1972. Relating to securities; prohibiting fraudulent practices in relation thereto; requiring the registration of broker-dealers, agents, investment advisers, and securities; and making uniform the law with reference thereto.

PENNSYLVANIA SECURITIES ACT OF 1972. Relating to securities; prohibiting fraudulent practices in relation thereto; requiring the registration of broker-dealers, agents, investment advisers, and securities; and making uniform the law with reference thereto.

The Securities Act of 1933 has two basic objectives: To require that investors receive financial and other significant information concerning securities being offered for public sale; and. To prohibit deceit, misrepresentations, and other fraud in the sale of securities.

Limited Offering Exemption (203(d)): Sales by an issuer to no more than 25 persons in Pennsylvania during a period of 12 consecutive months are exempt if the issuer obtains a written agreement from each purchaser not to re-sell the securities within a period of 12 months after the date of purchase; there is no public

De Minimis. An in-state IA is not required to register if it has fewer than 6 clients anywhere and does not hold itself out to the public as an IA. An out-of-state IA is not required to register if it has 5 or fewer clients in Pennsylvania.