Pennsylvania Chapter 13 Plan (Non-Fillable PDF) is a legal document that outlines the repayment plan of a debtor under Chapter 13 of the Bankruptcy Code. It outlines the debtor's repayment plan to creditors, including the amount of the monthly payment, the length of the repayment period, and the total amount to be paid to creditors. It also details the proposed distribution of funds to creditors, as well as the proposed treatment of secured and unsecured claims. The Pennsylvania Chapter 13 Plan (Non-Fillable PDF) must be filed with the Bankruptcy Court in the district in which the debtor resides. There are two types of Pennsylvania Chapter 13 Plan (Non-Fillable PDF): the joint plan and the individual plan. The joint plan is used when two or more debtors file a Chapter 13 bankruptcy case together. The individual plan is used when there is only one debtor filing the bankruptcy case.

Pennsylvania Chapter 13 Plan (Non-Fillable PDF)

Description

How to fill out Pennsylvania Chapter 13 Plan (Non-Fillable PDF)?

Dealing with legal paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Pennsylvania Chapter 13 Plan (Non-Fillable PDF) template from our library, you can be sure it complies with federal and state laws.

Working with our service is simple and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Pennsylvania Chapter 13 Plan (Non-Fillable PDF) within minutes:

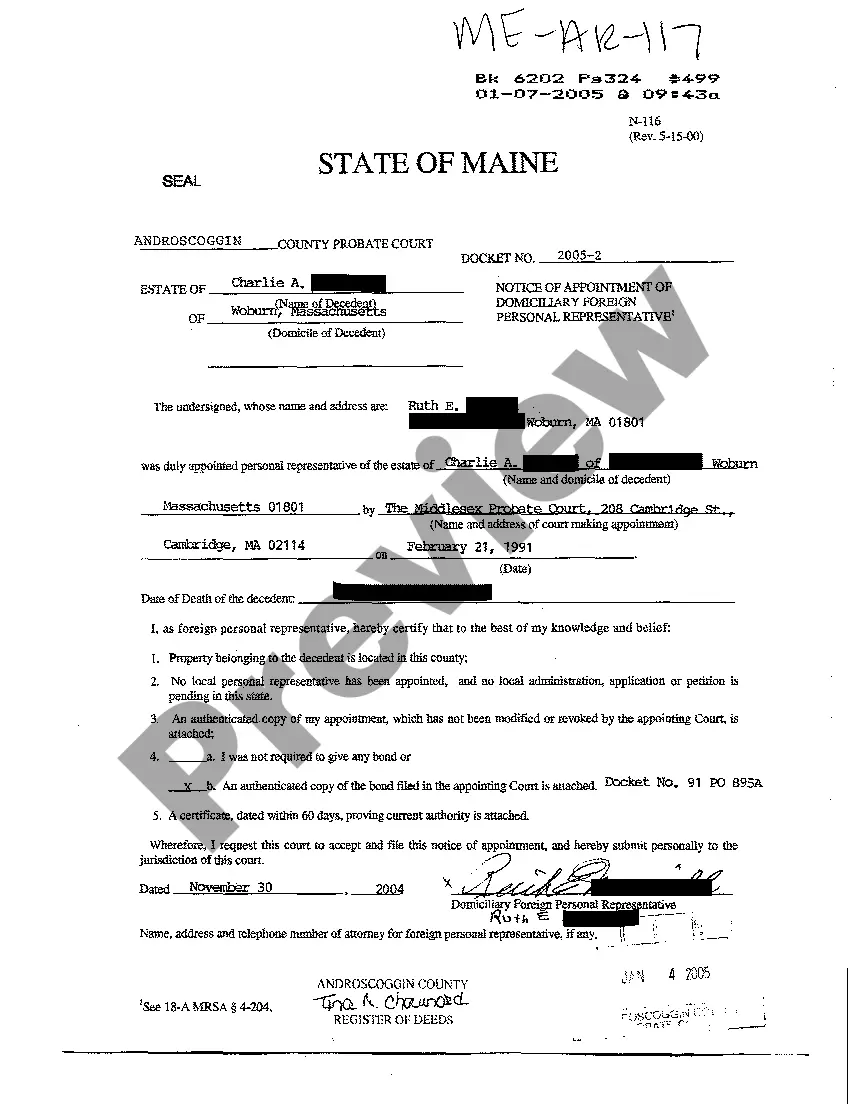

- Remember to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Pennsylvania Chapter 13 Plan (Non-Fillable PDF) in the format you need. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Pennsylvania Chapter 13 Plan (Non-Fillable PDF) you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Form 410. Form 410 is the form used by creditors to file a proof of claim. In some cases, a bankruptcy judge may accept an informal proof of claim. This must be a written document filed with the bankruptcy court, and it must make a demand against the debtor's bankruptcy estate.

Providing Supporting Documentation A Proof of Claim must include any pertinent documentation, such as promissory notes, purchase orders, contracts, invoices, delivery receipts or security agreements. Other documentation might include monthly statements, pay records and ledgers.

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

A written statement filed in a bankruptcy case setting forth a creditor's claim is called a proof of claim. A proof of claim should include a copy of any documentation giving rise to the claim as well as any evidence in support of the claim, such as evidence of secured status if the claim is secured.

What Is a Proof of Claim? A proof of claim is an essential element in the bankruptcy process. It documents your right as a creditor to repayment from the debtor. A debtor's chapter 11 bankruptcy filing may significantly impact a creditor and can jeopardize its ability to handle its own financial responsibilities.

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

Proof of Claim means a proof of Claim Filed against any of the Debtors in the Chapter 11 Cases. Proof of Interest means a proof of Interest Filed against any of the Debtors in the Chapter 11 Cases.