Pennsylvania Post-Petition Payment History Note And Mortgage is a type of financial document used to track post-petition payments related to a Pennsylvania bankruptcy. These documents detail the payment history of a debtor’s mortgage and post-petition payments, including payments made to creditors, the trustee, and the court. The note includes the debtor’s name, loan number, payment amount, and payment date. Different types of Pennsylvania Post-Petition Payment History Note And Mortgage include: Chapter 7 Payment History Note, Chapter 11 Payment History Note, and Chapter 13 Payment History Note.

Pennsylvania Post-Petition Payment History Note And Mortgage

Description

How to fill out Pennsylvania Post-Petition Payment History Note And Mortgage?

US Legal Forms is the most simple and affordable way to locate suitable legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with national and local laws - just like your Pennsylvania Post-Petition Payment History Note And Mortgage.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Pennsylvania Post-Petition Payment History Note And Mortgage if you are using US Legal Forms for the first time:

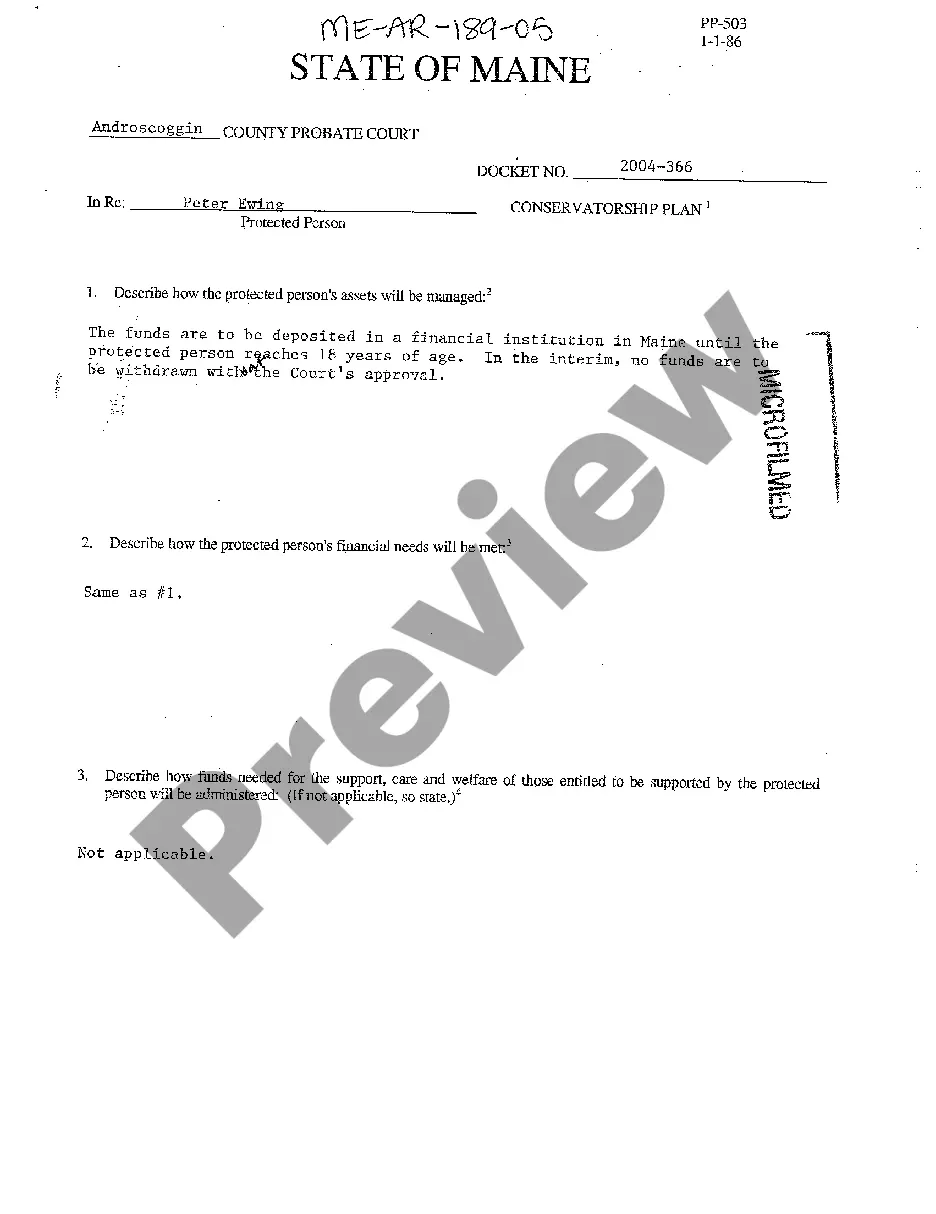

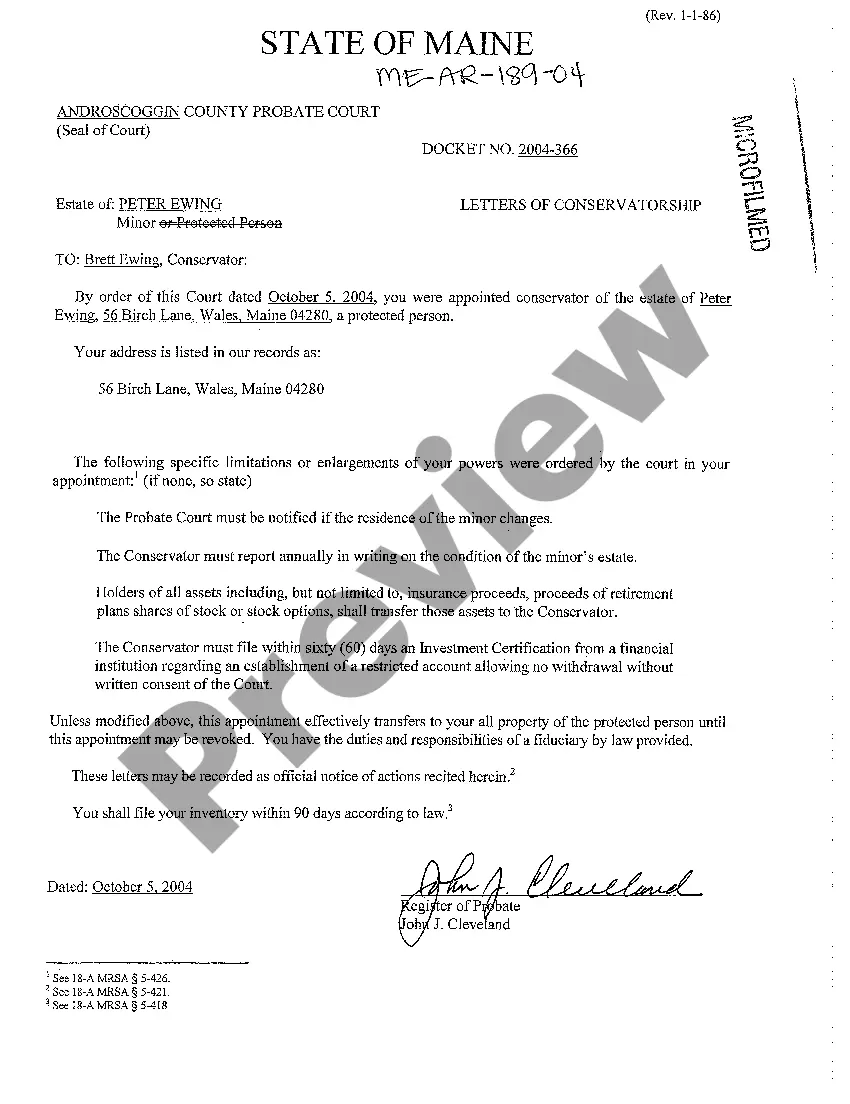

- Read the form description or preview the document to ensure you’ve found the one meeting your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Pennsylvania Post-Petition Payment History Note And Mortgage and save it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Try it out!

Form popularity

FAQ

When it comes to filing Chapter 7 bankruptcy, debts incurred before filing are called pre-petition debts, that debtors are discharged from, whereas debts incurred after a filing are post-petition payments, which debtors still must pay on.

Post-petition debt is a debt you obtain after filing your bankruptcy case. These debts are not part of your bankruptcy case and will not be discharged. Any debt you acquire after filing for bankruptcy (even if your case is still pending) is considered post-petition, and you are responsible for paying it.

If the trustee files a Notice of Final Cure Payment, the creditor should respond regardless of whether the debtor is current or if relief is obtained. If you fail to do this, it is at your own risk.

Official Form 410S2. Notice of Postpetition Mortgage Fees, Expenses, and Charges.

Prepetition: this term is often used to mean anything that occurred prior to your filing for bankruptcy protection. For example, the amount that may be behind on your house before you file bankruptcy would be called a pre-petition arrears.

Post-petition tax debts get special treatment in bankruptcy. The court always allows tax creditors to file claims for post-petition tax debts and then the claim gets priority in payment.

Post-petition refers to anything that occurs after you've filed for bankruptcy. Conversely, the term ?pre-petition? is used to refer to anything that happened before you filed for bankruptcy. Only ?pre-petition? debts are dischargeable in bankruptcy.

Reassessment of damages is accomplished through the filing of a post-judgment motion in which the plaintiff requests that the court modify the foreclosure judgment to incorporate certain charges incurred and interest accruing post-judgment.