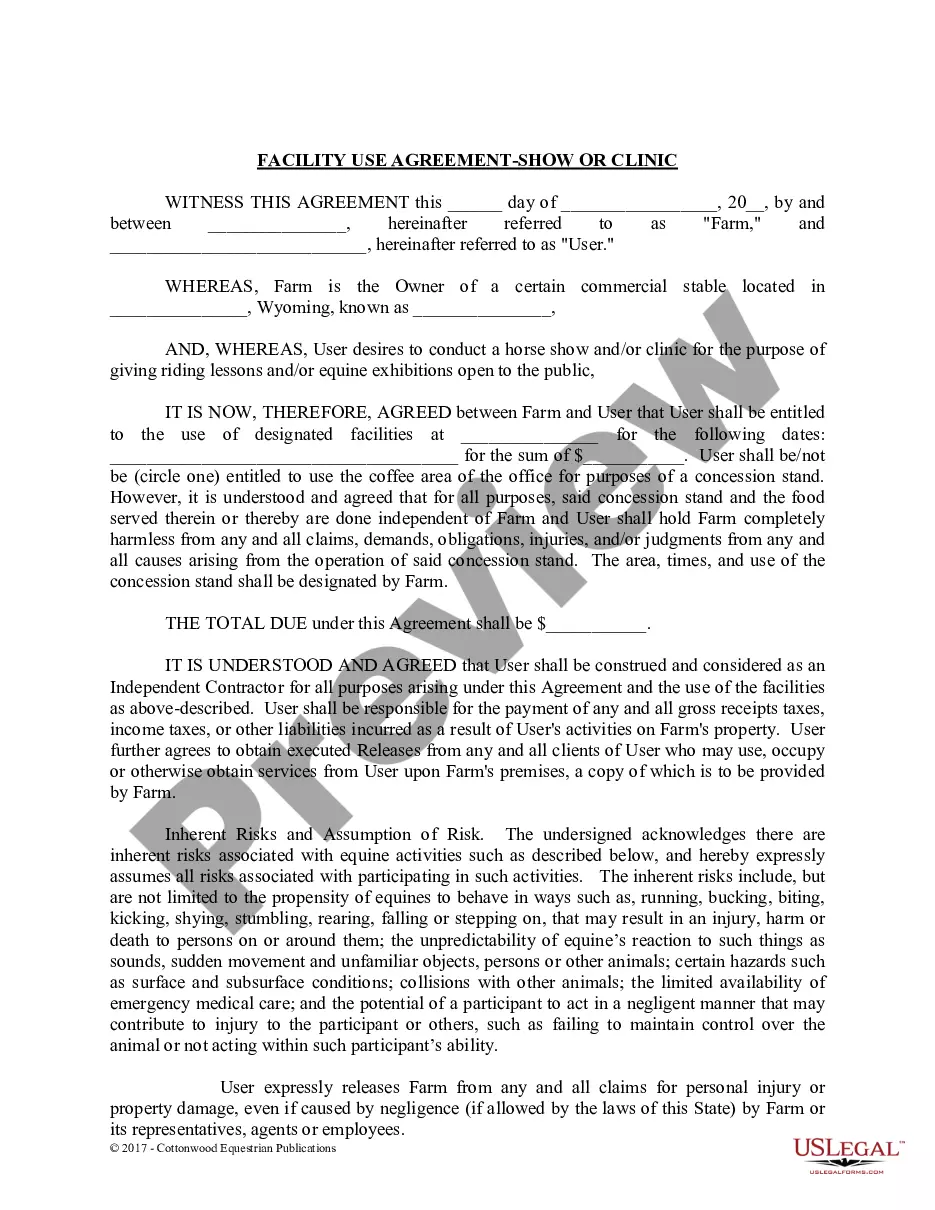

Pennsylvania Claim for Exemption from Wage Attachment

Description

How to fill out Pennsylvania Claim For Exemption From Wage Attachment?

How much time and resources do you typically spend on drafting official paperwork? There’s a greater opportunity to get such forms than hiring legal specialists or spending hours searching the web for an appropriate blank. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Pennsylvania CLAiM FOR EXEMPTION FROM WAGE ATTACHMENT.

To get and prepare a suitable Pennsylvania CLAiM FOR EXEMPTION FROM WAGE ATTACHMENT blank, follow these easy steps:

- Look through the form content to ensure it meets your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Pennsylvania CLAiM FOR EXEMPTION FROM WAGE ATTACHMENT. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Pennsylvania CLAiM FOR EXEMPTION FROM WAGE ATTACHMENT on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web solutions. Join us today!

Form popularity

FAQ

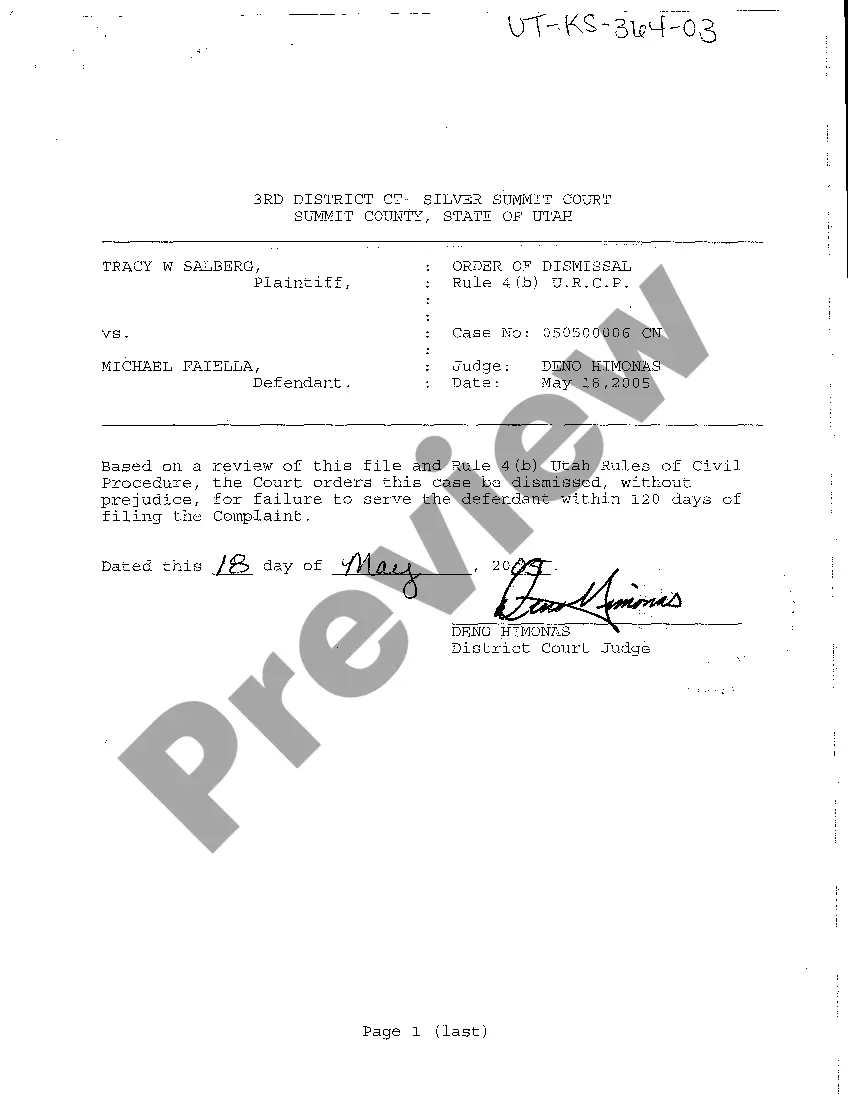

Pennsylvania judgments are valid for 5 years. Judgments can be revived every 5 years and should be revived if a creditor is attempting to actively collect on the debt. Judgments also act as a lien against real property for up to 20 years or longer if properly revived.

You can make a claim for exemption. If you file the claim within 30 days, the clerk will notify the creditor that you are exempt. If you wait until after your wages are garnished, then you'll have to go back to court and get a court order to stop the wage garnishment.

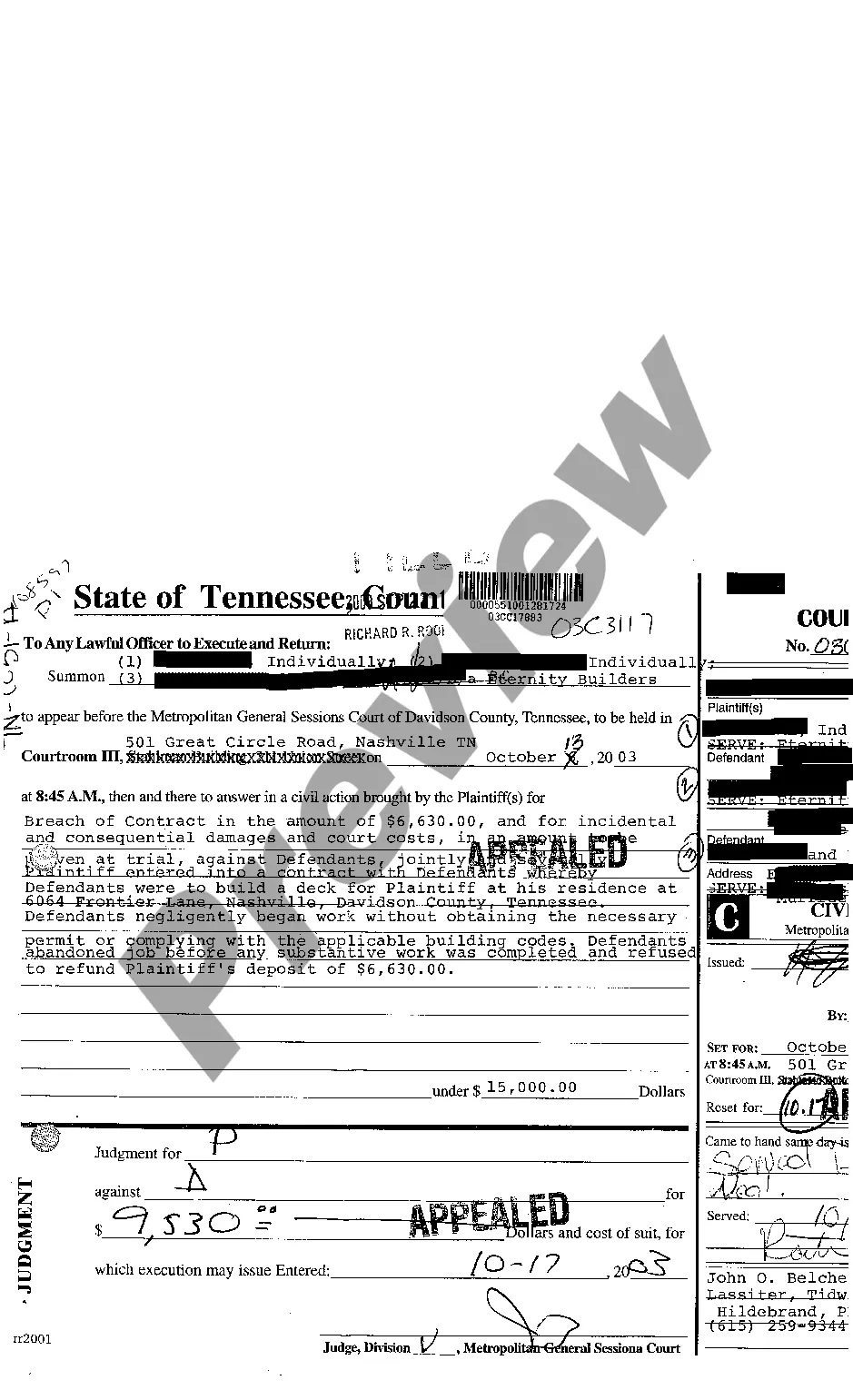

If you lose the lawsuit, a judgement is entered against you stating that you owe someone a certain amount of money. A copy will be given to you and the creditor. You usually have 30 days to appeal judgments. If you do not appeal, the creditor can pay a PA constable or sheriff money to try to collect the money from you.

(15 U.S.C. § 1673). Some states set a lower limit for how much of your wages are subject to garnishment. In Pennsylvania, garnishments aren't allowed except for certain situations, like for child or spousal support, back rent on a residential lease, and student loans.

Pennsylvania exempts from execution on judgment on a contract all wearing apparel of the debtor and his family, bibles and school books in use in the family, as well as $300 worth of any property owned or in pos- session of the debtor.

In addition to seizing bank accounts, you can also have the sheriff levy and sell personal assets of the debtor to collect a judgment in Pennsylvania. Personal assets can include furniture, tv's, jewelry, guns and firearms, other valuables or antiques.

The following items are exempt from execution by most creditors under Pennsylvania and Federal law: Most public benefits, Social Security benefits, money in retirement accounts (such as 401ks and pensions), and unemployment benefits. (SocialSecurity benefits are still exempt once they are in the bank.)

The Department of Revenue is authorized under Act 46 of 2003 to collect unpaid taxes by garnishing the wages of delinquent taxpayers. Under the act, the PA Department of Revenue can order an employer to withhold up to 10 percent of a taxpayer's gross wages and remit them to the department to pay delinquent state taxes.